Pavel Byrkin/iStock Editorial by way of Getty Pictures

The funding thesis

This text analyzes Superior Micro Gadgets (NASDAQ:AMD) from the attitude of its product portfolio and profitability and execution in current quarters. The outcomes present that AMD enjoys a powerful product portfolio and the revenue margins are quickly increasing. Admittedly, there are nonetheless rooms for the margins to additional enhance. However regardless of the enterprise lags in revenue margin, it greater than makes it up in robust execution and product innovation.

Trying ahead, we see the next catalysts to reinforce its profitability and assist its inventory value:

- Its robust product portfolio will solely get stronger. AMD presently options one of the best product portfolio arguably within the business. And the portfolio is getting even stronger contemplating its Ryzen processors with 3D V Cache™ expertise and differentiated options for heterogeneous compute enabled by the Xilinx acquisition. The latter will assist AMD to faucet into the rising computing demand throughout information facilities, communications, and embedded markets.

- Increasing margin. AMD has already been having fun with quickly increasing margins in current quarters and we see the enlargement to proceed and even speed up with the Xilinx acquisition. The acquisition will add diversified income streams throughout a number of, high-margin companies. It’s anticipated to be accretive to non-GAAP margins, non-GAAP EPS, and free money stream (“FCF”) within the first 12 months.

- Significantly, we expect the market underestimates the potential of its FCF margin. It earned a document FCF of $3.2 billion in 2021 on document income of $16.4 billion, leading to an FCF margin of 19.5%. With the accreditation of Xilinx and higher-margin merchandise, we expect no less than 150 foundation factors FCF margin enlargement in 2022, from 21% to 22%.

- Lastly, valuation. Many potential buyers are (or have been) involved about its excessive valuation. The current correction has introduced its valuation to about 28x FW PE, a really cheap stage when adjusted for its high quality and progress.

Cause 1 – AMD’s robust product portfolio

AMD presently options one of the best product portfolio not solely in its personal historical past but additionally arguably within the business. The product portfolio incorporates a wealthy mixture of merchandise, starting from high-end Ryzen™, to Radeon™, and to EPYC™ processors. This robust product line addresses vital high-growth market sectors, together with desktop and cellular computing, PC and gaming, GPU, information heart, et al. Notably, due to its technological lead, many ADM chips now are attaining one of the best of each worlds in computing – management efficiency and decrease energy consumption (which ends up in superior battery life) on the similar time.

Trying ahead, we see the product combine to additional strengthen. Its not too long ago introduced Ryzen processors with 3D V Cache expertise is anticipated to energy unimaginable gaming experiences, a excessive market. The Xilinx (XLNX) acquisition to additional strengthens AMD’s strategic place. It considerably augmented its customization means and is anticipated to be instantly accretive to the underside line. The XLNX acquisition added the number-one supplier of adaptive computing options to AMD’s enterprise. This acquisition, coupled with natural progress, has administration focusing on annual revenues of about $21.5 billion this 12 months, a greater than 30% enhance from the 2021 stage.

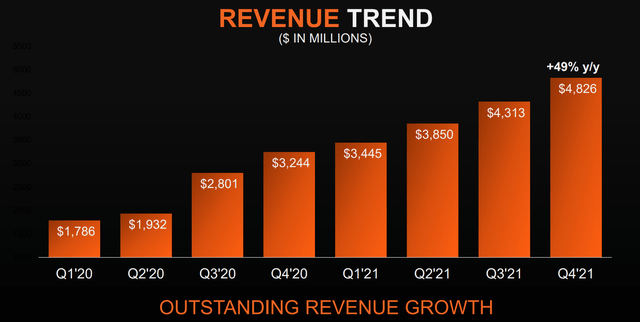

Supply: AMD 2021 This autumn earnings launch

Cause 2 – quickly increasing margin

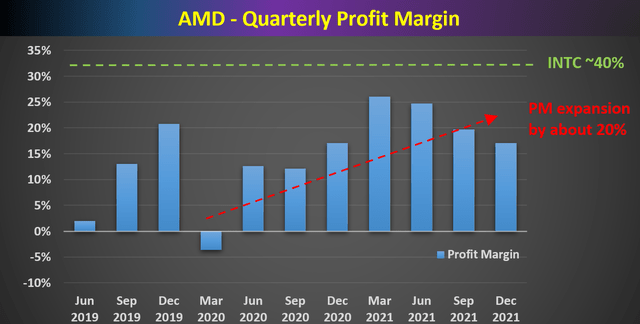

As will be seen from the following chart, the revenue margin (I used operation money stream margin right here) has first stabilized for AMD since 2018~2019 after which actually began to quickly develop since Mar 2020. Since Mar 2020, it has improved from the destructive to ~20% on the present stage. Key drivers for such increasing margins are the upper Common Promoting Costs (ASP). Particularly, the shopper processor ASP noticed robust progress pushed by a richer mixture of Ryzen desktop and pocket book processor gross sales, and the GPU ASP, pushed by high-end graphics merchandise, together with information heart GPU gross sales.

Admittedly, there are nonetheless rooms for the margins to additional enhance. As proven within the determine under, the revenue margin for Intel (INTC) is about 40% presently, exceeding that of AMD by a big hole. Nevertheless, the 25% margin is nothing too shabby by itself. On common, the revenue margin for the general economic system fluctuates round 8% and barely goes above 10%. After all, that is a median throughout all enterprise sectors. Nonetheless, as a rule of thumb, 10% is a really wholesome revenue margin and 20% is a really excessive margin. So AMD’s present 25% is among the many very excessive finish in comparison with the general economic system.

Trying ahead, we see the Xilinx acquisition so as to add diversified income streams throughout a number of segments. It permits differentiated options for heterogeneous computing to deal with a rising demand throughout information facilities, communications, and embedded markets. We anticipate these alternatives to additional develop margins throughout the board (starting from non-GAAP margins, non-GAAP EPS, and FCF margins).

And moreover, no matter AMD lags in revenue margin, it greater than makes it up by product innovation as talked about above and likewise by robust execution, as mentioned under.

Supply: creator and Looking for Alpha information

Cause 3 – robust execution and robust progress

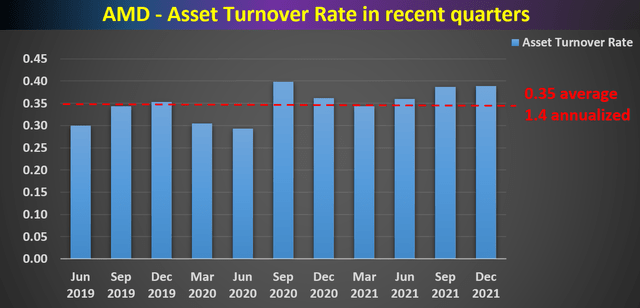

The following chart exhibits the asset turnover fee (“ATR”) for AMD in current quarterly. The ATR measures how effectively an organization makes use of its property to generate income. The upper the ATR, the higher the corporate is performing, since increased ratios suggest that the corporate is producing extra income per greenback of property. As seen, AMD’s ATR has been fairly steady round a median of 0.35 on a quarterly foundation, and therefore about 1.4 when annualized. ATR is a knob that administration can constantly tweak to swimsuit its operations, and AMD has been turning this knob very successfully in comparison with tech corporations. To place issues into perspective, the ATR of Apple (AAPL) is presently at about 0.9 below Tim Cook dinner’s management, a CEO recognized for his great experiences and insights for streamlining operations. And the ATR for INTC is just about 0.7 lately.

In the long run, the ultimate profitability of enterprise in the end will depend on revenue margin and asset turnover fee, assuming related leverages (which is an efficient assumption as a result of massive mature companies comparable to AMD, INTC, and AAPL all have related ranges of leverage). So AMD’s present lag in revenue margin (25% vs 40%) has been greater than made up by its ATR.

And moreover, AMD additionally has a powerful progress on its aspect with its robust product line as talked about. The income has nearly doubled up to now 12 months as seen. And administration’s outlook for subsequent 12 months’s progress is ~30%.

Supply: creator and Looking for Alpha information Supply: AMD 2021 This autumn earnings launch

Cause 4 – very cheap valuation after current correction

Many potential buyers are (or have been) involved about AMD’s excessive valuation. Certainly, even a couple of months in the past, again in Nov~Dec 2021, AMD was buying and selling at about 42x PE. Nevertheless, AMD’s present valuation is definitely fairly cheap after the massive value correction YTD and likewise its Xilinx acquisition. The present FW PE is about 28x, a really cheap stage particularly when you think about its high quality and progress potential.

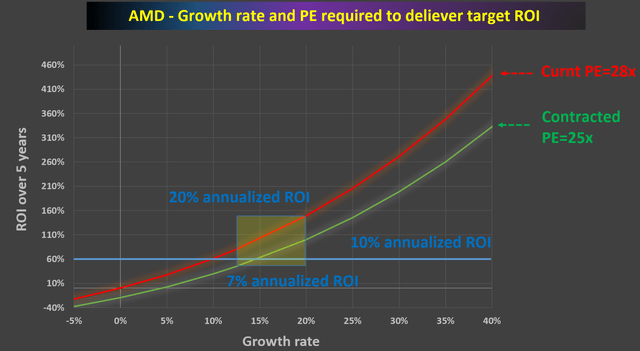

To judge the valuation threat, what I at all times love to do is a straightforward actuality examine as proven within the chart under. It’s primarily a again of envelope calculation to estimate what’s the progress fee and valuation required to ship a goal ROI within the subsequent few years, say 5 years. And see if such progress fee and valuation can cross a commonsense take a look at.

For instance to offer a tutorial to learn this chart, if we require a ten% annual ROI, represented by the pink line (10% annual return interprets to 60% whole return in 5 years as a result of 1.1^5=160%), the expansion fee must be about precisely 10% if the PE ratio doesn’t change from its present stage – one thing everyone knows already. And if the PE contracts to 25x (primarily the typical market valuation) as proven by the inexperienced line, the expansion fee must be about 16% to ship the required 10% ROI.

With the above background, we are able to see that the present valuation simply passes the truth examine. To place issues into perspective, AMD nearly doubled its revenues from 2020 to 2021 (from $9.7B to about $16.4B). And administration’s outlook for the following 12 months’s income is $21.5B, reflecting a progress fee of greater than 30%. It’s seemingly that administration is being conservative with this outlook. It helps them after they set a conservative goal, after which report precise numbers that exceed the goal – like what has occurred up to now quarter. However even the expansion truly turns to be what the present outlook is, it already far exceeds what is required to justify the present valuation as seen – even when the valuation compresses considerably – and nonetheless ship a wholesome return. Really, even when progress slows to about 12.5% AND valuation contracts to 25x PE (as proven by the decrease sure of the yellow field), the funding would nonetheless not loss and make an honest revenue.

Supply: creator and Looking for Alpha information

Conclusion and Dangers

This text analyzes AMD each as a enterprise and an funding. As a enterprise, AMD enjoys a powerful product portfolio, quickly increasing margins, robust execution – all resulting in robust progress. And as an funding, it incorporates a very cheap valuation when adjusted for its high quality and progress. Extra particularly,

- AMD presently options one of the best product portfolio not solely in its personal historical past but additionally arguably within the business. And the portfolio is getting even stronger with its product lineups and the Xilinx acquisition.

- The revenue margin has turned a nook in Mar 2020 and has expanded quickly to the present stage of ~20%. Admittedly, 25% remains to be behind different mature companies comparable to INTC, whose revenue margins are across the 40% stage. Nevertheless, we see loads of room and catalysts for its margins to additional develop. And regardless of the enterprise lags in revenue margin, it greater than makes it up in robust execution and product innovation.

- AMD’s execution effectivity, as measured by the asset turnover fee, is about 1.4 on an annual foundation. It’s increased than AAPL by about 55% (and keep in mind AAPL is headed by a CEO recognized for his great experiences for streamlining operations), and about 2x of that of INTC.

- Lastly, the present valuation simply passes the truth examine. The present progress outlook far exceeds what is required to justify the present valuation – even when the valuation compresses considerably – and nonetheless ship a wholesome return.

The dangers embrace:

- Macroeconomic dangers. The continued interruptions of the worldwide provide chain create a significant macroeconomic threat. The availability chain shock remains to be unfolding and will develop in lots of doable instructions, particularly with the brand new COVID variant showing, China restarting lockdown mode in key cities, and the Ukraine/Russian scenario nonetheless ongoing.

- Valuation. Even after the current correction, AMD remains to be buying and selling at a major premium in opposition to its friends. For instance, each INTC and QCOM are traded at about 13~14x FW PE. Such a valuation premium, mixed with the macroeconomic dangers, may result in short-term massive value volatility dangers.

- Competitors. Firms within the semiconductor business are in a continuing race to construct smaller, sooner, and cheaper chips. AMD competes immediately with Intel, NVIDIA (NVDA), QUALCOMM, et al. The competitors will not be solely restricted to chip design but additionally extends to different areas comparable to manufacturing. AMD, for instance, has a threat of dropping its console enterprise if Intel’s Foundry Providers turns into on-line and profitable as a result of the associated fee is a vital issue within the consoles enterprise.