spooh/iStock Unreleased via Getty Images

The AMD Investment Thesis

Seeking Alpha Rating History

Since my last article on Advanced Micro Devices, Inc. (NASDAQ:AMD), in which I said that the company was underestimated, the stock has performed well. And the basic assumptions still hold: Nvidia Corporation (NVDA) and AMD are far ahead of the competition, and the high barriers to entry in terms of knowledge and capacity at Taiwan Semiconductor Manufacturing Company Limited (TSM) aka TSMC protect them from competition.

And the fact that Nvidia is now using chiplets in its Blackwell series shows that AMD’s decision to focus on this technology and gain experience with it a long time ago was the right one. It also shows that AMD continues to lead in double precision and Nvidia has a clear lead in low precision when comparing the AMD MI300X accelerator to Nvidia’s B100, B200, and GB200 models.

On the software side, however, AMD still has some catching up to do, which is currently Nvidia’s competitive advantage. However, if AMD can catch up in the future, it would likely improve the outlook even more.

AMD’s ROCm Vs Nvidia’s CUDA

If we just look at the GPU market, and AMD is much more than just GPUs, which many tend to forget, then the battle between CUDA and ROCm is probably something that is very important to get a good picture of.

Now that prices have normalized a bit and availability is good, except for very popular models, most used models are back below list price or the new ones are available at list price. However, the demand for Nvidia’s RTX 4090 is still very high, and it is still very difficult to get them at list price and with a good delivery time. But with all the other GPUs from Nvidia and AMD in plentiful supply, demand can be met and the shortages of the past few years are over.

Therefore, not much has changed in the consumer graphics card market. AMD remains the choice for customers who want a little more bang for their buck, and Nvidia is for customers who need maximum performance.

However, the situation is different for Nvidia’s h-models and AMD’s MI-models. These are in high demand, and AMD has the advantage that the MI’s have better availability, which is often cited as a reason why customers choose AMD’s product.

But now we come to the interesting part, which is Nvidia’s current platform competitive advantage called CUDA and AMD’s attempt to attack it. CUDA, which has been around since 2007, was unsuccessfully challenged by AMD in 2008 with Close to Metal, and then with HSA. Since 2016, they are trying to challenge CUDA with ROCm and HIP, which should make it easier to port CUDA code. So HIP is a kind of imitation layer, but of course you could argue that there is more and better code for CUDA now, and so an imitation layer is used to make as much of that code available to users of other ecosystems.

Another translation layer called ZLUDA has been banned, as you can see from the new EULA in the CUDA documentation. Also, as we can see, this is a competition in which several participants are aware of the importance of being the dominant player in the software/ecosystem space and are trying to maintain their competitive advantage. In addition, customers are divided on whether they prefer an open source solution or are happy with the status quo, as Nvidia was the first to support the machine learning community when others ignored it.

The main advantage of CUDA is that it performs better in benchmarks and is relatively easy to get up and running, even for home users. However, it should be noted that AMD’s focus with ROCm has really been on supercomputers, so it looks like the consumer cards are being treated as an afterthought, although they do get support. It is often said that Nvidia offers longer support, but old AMD cards usually work with newer drivers, even if they are no longer in the test pool.

But CUDA retains the biggest competitive advantage for now. AMD has already said that ROCm will be a focus for 2024, so it remains interesting. And especially with supercomputers like Frontier and EL Capitan running on ROCm, there have been no reports of bad experiences, which means that AMD has definitely gotten stronger in the supercomputer space, which is sometimes not communicated.

And I think there is room for improvement, for AMD to focus a little bit more on communication, on how ROCm is used and how it is used by supercomputers and how successful it is there, because I think the software is better than it is sometimes perceived. For example, one of Nvidia’s great strengths is that CEO Jensen Huang is an excellent salesperson and communicator.

Impact On Other Industries

In my opinion, it is always interesting to see the impact on other industries, as this can sometimes indicate what might be interesting to invest in. That Intel Corporation (INTC), AMD, Nvidia, or even Apple (AAPL) are competing for TSMC’s capacity should be clear to most, but the demand for high-bandwidth memory is also going to grow strongly, and this market is dominated by Samsung (OTCPK:SSNLF) and SK Hynix, with Micron Technology (MU) also having a small share. HBM3E will be very popular in the future, as will chiplets due to the new Blackwell GPUs.

I also believe that liquid cooling for data centers and the provision of low-cost energy will benefit greatly from the AI trend. AI chips for smartphones and AI PCs are also likely to see strong growth.

Plus, the AI chip startups like SambaNova Systems, Cerebras Systems and Groq could also be interesting. Some of them focus on training and inference as a service, where they have shown impressive results in demos. And what makes Groq special is that they do not need HBM, nor are they dependent on TSMC’s capacity.

State Of The Chinese Microprocessor Market

Much has been said in recent days about China banning the use of Intel and AMD chips in government computers. And that AMD could lose hundreds of millions in revenue as a result. But the fact that AMD CEO Lisa Su met with the Chinese Minister of Commerce, Wang Wentao, has received relatively little attention. And that could be a sign that AMD’s sales in China could surprise to the upside as the year progresses.

In general, I think AMD and Intel microprocessors are the best right now, so even if the government stops using them, it will not have a big impact on the China business because the Chinese customers also want to use the best technology.

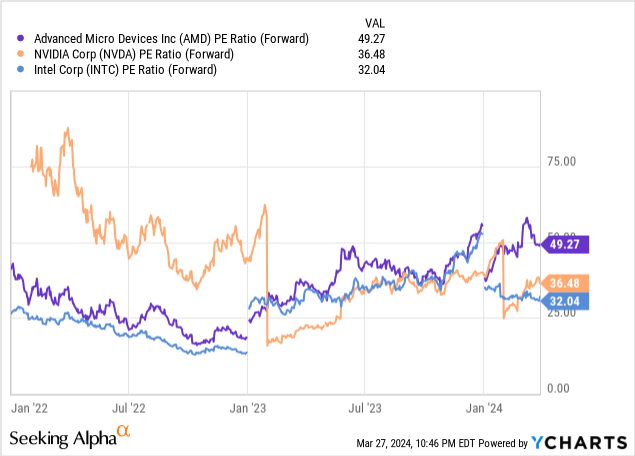

Valuation

On a forward P/E basis, AMD is the most expensive company in the peer group, although the growth opportunities are sufficient to justify a 49x multiple. Also, I think the estimated earnings are probably on the low side because I think the magnitude of the impact of the MI300X is rather conservative and AMD is likely to surprise with higher than expected earnings later this year.

Therefore, I believe that the market still underestimates AMD when it comes to how much revenue or earnings they will make.

What Could EPS Look Like In 2 Years?

Seeking Alpha Earnings Estimates

For FY25, 38 analysts have EPS estimates ranging from $3.52 to $9.05, with an average estimate of $5.48. The current TTM EPS is $0.53, so analysts see a lot of upside potential.

And I think the estimates tend to be conservative, and the new products from AMD will probably cause those estimates to be revised up later in the year. An EPS of $7.5 at a multiple of 30x to 35x seems realistic to me for December 2025, which would translate into a share price of $225 to $262.

Furthermore, AMD’s debt position remains comfortable with $5.3 billion in cash and short-term investments and only $1.7 billion in long-term debt, which protects the downside. So, I think AMD continues to be well positioned for the future.

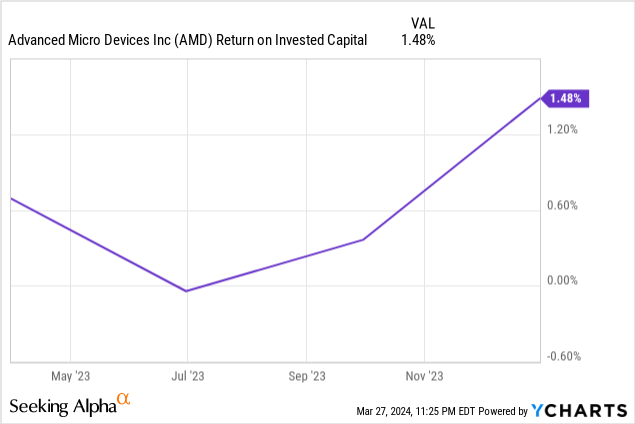

AMD’s ROIC

AMD’s returns on capital continue to rise, and the company should soon return to the high double-digit returns of the past as its investments bear fruit. In any case, I would not be surprised to see them rise sharply in the coming quarters.

Conclusion

AMD’s dominant position in two of the most important industries of the future, the CPU and GPU markets, combined with a healthy balance sheet, should position the company well for the future. And if they couple that with improvements on the software side and a little better communication, the future looks even brighter.

As a result, AMD is likely to remain a top pick for the near future given its potential and continued growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.