Lemon_tm

Back in September, I discussed the disappointing equity offering from AMC Entertainment (NYSE:AMC). The theater chain raised more than $325 million to help fix its extremely strained balance sheet, but the dilution required was a lot more than originally expected. This week, management celebrated the company’s strong Q3 results, only to dash investors’ optimism the next morning with another large equity offering.

After the close on Wednesday, AMC published its Q3 shareholder letter. Revenues of more than $1.4 billion surged 45% over the prior year period, as the theater business continues to recover from its pandemic blues. This number handily beat street estimates by $150 million, and was even higher than the final Q3 period in 2019 before the coronavirus hit. Results were helped significantly by the success of films like Barbie and Oppenheimer. The company was also able to squeak out a small profit for the quarter, also beating street estimates quite nicely.

If you read through the shareholder letter or read some of the conference call transcript, you would have thought the company was in a great spot right now. Management talked about record Q3 revenue and adjusted EBITDA, along with a strong cash balance of $730 million. Of course, this cash position only rose because of the equity sales program in Q3 that diluted investors by 40 million shares, or more than 20%. As a reminder, that offering came after the reverse split sent shares plunging, and the original plan was to sell 25 million shares.

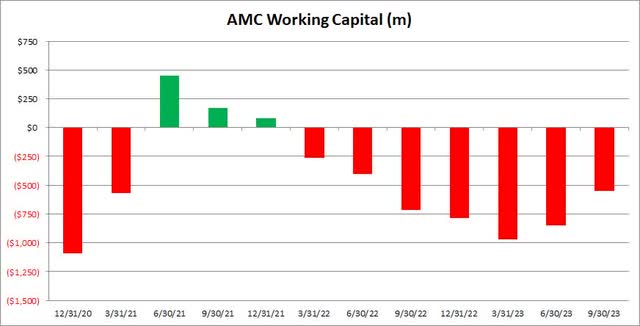

AMC finished Q3 with nearly 200 million Class A shares outstanding. On a split-adjusted basis, this was a name with only about 5.2 million Class A shares before the pandemic hit. The company has had to massively dilute investors just to stay afloat, and it still finished Q3 in a net debt position of more than $4 billion while reporting negative equity on the balance sheet over $2 billion. The company reported free cash flow of $8.4 million in the quarter, but that’s just a drop in the bucket for what it needs to truly survive. Even with all of that good news that management talked about, plus the completed Q3 equity offering, working capital remained highly negative as seen below.

AMC Working Capital (Company Earnings Releases)

AMC shares were flat to slightly down in the after-hours trading session on Wednesday, but that completely changed on Thursday morning. The company issued a press release that it would be offering another $350 million worth of shares. The morning’s low just over $8 was only about a dollar from the recent low, with shares losing almost all of their value from meme-stock frenzy peak from a few years back of well over $300. A further update on the situation reported that 30 million shares were priced at $10 each, but that’s at least 15% additional dilution and the program would still have $50 million to go.

While raising more funds obviously will help the balance sheet, the latest round still isn’t projected to get working capital back to the green. The Q3 raise of more than $325 million only resulted in a $298 million improvement in the working capital balance during the quarter. This newly announced equity sales plan would get the company’s working capital hole down to about $200 million, but that still implies more funds will be needed in the short term. Don’t forget, AMC has been using a lot of cash to pay back long term debt, so working capital could stay quite negative for some time, resulting in more equity sales in the future.

Given the additional round of dilution won’t get the working capital balance into plus territory, I am continuing to rate AMC shares a sell today. While the theater business is back from its pandemic lows, the company is still not generating the kind of results needed for long term sustainability. I would expect at least one more equity sales program in the next couple of quarters, and each one gets more dilutive with the stock near its all-time lows. I would only consider raising my rating to a hold if we get another equity sales round after this plus see another quarter or two of decent results.

In the end, AMC shares tumbled on Thursday after the company announced another major equity raise. While management pounded its chest a lot a day earlier regarding Q3 results, any enthusiasm there was quickly wiped away by the $350 million offering. While the company is making small steps to improve its balance sheet, the latest 20% plus round of dilution won’t even get the working capital balance back to positive territory, which likely means more equity sales down the road. As a result, it would not surprise me to see AMC shares continue to struggle.