HJBC

Amazon (NASDAQ:AMZN) announced its earnings with its share price bouncing around some, as the company largely beat top-of-the-line expectations. The company is one that we’ve continuously recommended against, and as we’ll see throughout this article, despite some bright spots in its portfolio, we expect it to underperform.

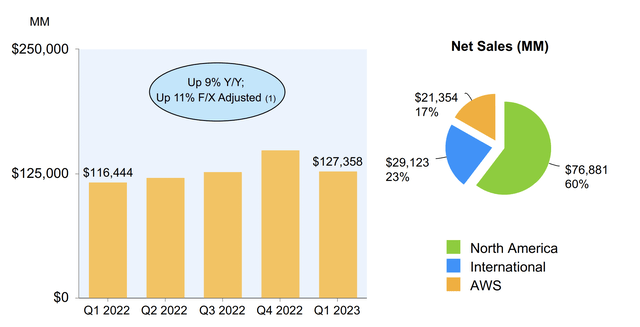

Amazon Net Sales

The company’s net sales growth has slowed down dramatically.

Amazon Investor Presentation

The company had $127.4 billion in sales for the quarter, up a respectable 9.5% YoY, but much lower in real terms. North American continues to dominate the company’s businesses, as the company has struggled to expand internationally. Given the company’s much slower growth versus 3Q 2022, we expect its growth to remain lower for longer.

Those weak net sales highlight a changing environment for the company.

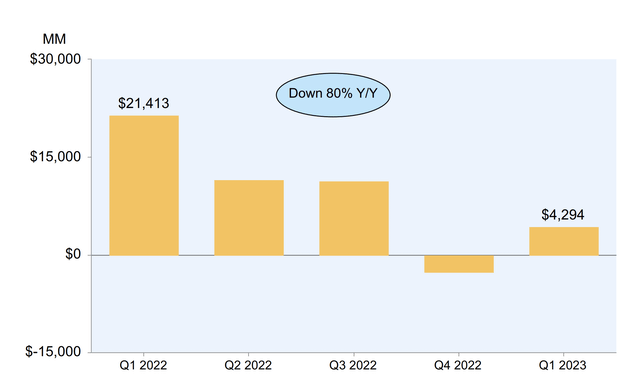

Amazon Financial Performance

The company’s earnings dropped substantially, even when accounting that its earnings would be closer to $10 billion without the impact of Rivian.

Amazon Investor Presentation

The company earned a mere $4.3 billion for the TTM, or $8.5 billion without the impact of its Rivian investment. That gives the company an annualized P/E of roughly 150x. That is a level that expects incredibly strong future growth. That’s concerning to see given the company’s continued earnings weakness and struggle to grow sales.

Another way to look at it is Amazon’s valuation is ~$1.1 trillion means long-term to justify its valuation it needs close to $100 billion in annualized earnings. That’s 20% of the company’s revenue, an incredibly high margin, that’s only sustainable with continued growth.

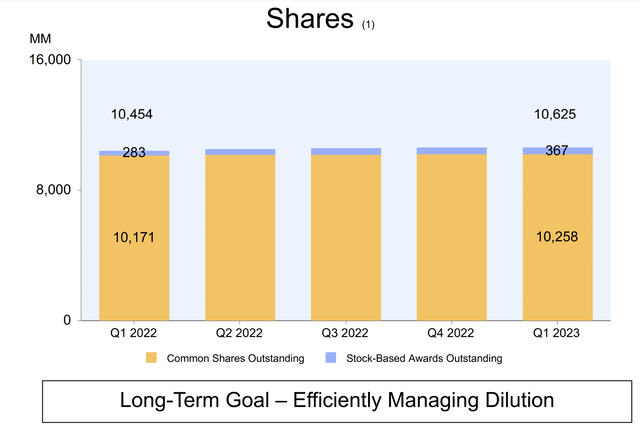

Amazon Share Dilution

More importantly, the company’s earnings don’t account for continued shareholder dilution.

Amazon Investor Presentation

Over the past year, the company’s outstanding shares increased by 171 million shares. At just under $110/share, that means that the company added almost $19 billion in dilution. The company still has hundreds of millions of stock-based awards outstanding, and that number as increased YoY, so we expect dilution to continue.

Unfortunately for the company, dilution is a real compensation cost. One that was more than double the company’s earnings. That means the company’s profits are actually negative and we expect them to remain that way.

Amazon’s AWS Is No Longer The Golden Child

Unfortunately, the company’s AWS business, once the golden child in revenue and profits is no longer the golden child.

Amazon Investor Presentation

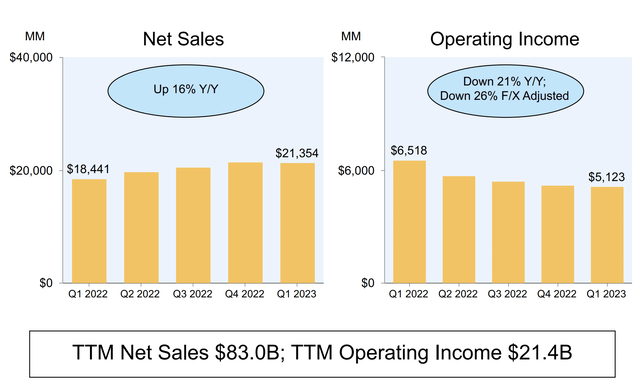

Amazon’s AWS business has seen its sales growth slow down dramatically. Net sales increased 16% YoY but QoQ it’s clear that the pace slowed down. Operating income dropped much faster, down 21% YoY, or 26% accounting for currency fluctuations. The business is still profitable (TTM operating income of $21.4 billion).

However, Google and Microsoft have ramped up their offerings substantially. Google reported a quarterly profit for the first time. Google and Microsoft designing their own processors can also push down margins. As a result, we think the peak for AWS has passed, and we expect it to make up a less sizable part of the company’s profits and margins going forward.

Amazon Advertising

The one bright spot in the company’s portfolio is its advertising business.

Amazon Investor Presentation

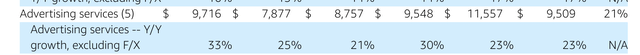

The company’s TTM advertising revenue was ~$38 billion. That’s a massive almost 10% of the company’s market capitalization, growing in the double-digits. For the company, this is all incredibly high margin revenue. Similar to the $10s of billions that Apple earnings from advertising with Google to make Google the default search engine.

We see advertising as a bright spot in the company’s portfolio, but not enough to justify its valuation.

Thesis Risk

The largest risk to our thesis is the company’s ability to drive additional shareholder returns as it decides to invest less in its business. The company is profitable at the current time, and its profits could ramp up. That combined with some portfolio bright spots could enable increased shareholder returns that justify its valuation.

Conclusion

Amazon is overvalued. The company’s volatile earnings showed a bright-spot with the company’s high-margin advertising business. We expect that bright-spot to continue, but unfortunately it’s not a “company maker”. The company’s earnings have dropped and we expect them to remain weak as prior high-margin businesses like AWS are pressured.

The company is facing competition across the board with all of its key businesses. Incredibly deep pocketed competitors such and Google and Apple are stealing the company’s lunch. With a $1.1 trillion market cap, the company needs substantial profits to justify its valuation, and we don’t see a path for it to accomplish those, making it a poor investment.