An Amazon supply truck driver on their route.

400tmax/iStock Unreleased through Getty Photographs

Though I am principally a dividend development investor, I am not against proudly owning qualitative development shares, both. As I’ve recounted up to now, it is because I presumably have time on my aspect at 27 years of age.

To be certain, qualitative is a subjective time period. My definition is a enterprise that persistently grows its internet gross sales/EPS/working money move over time. A solidly investment-grade stability sheet additionally encompasses my definition. Ideally, this enterprise must also be a transparent trade chief.

On the expansion aspect of the equation, I am in search of corporations with observable development tailwinds on their aspect. That is as a result of such parts can hold pushing internet gross sales/EPS/working money move increased, which might drive outsized complete returns. That is particularly the case when the underlying inventory of a enterprise is a cut price.

This brings me to the main focus of right now’s article, Amazon (NASDAQ:AMZN). Once I final coated the inventory with a robust purchase ranking in July, I appreciated its quite a few development catalysts. I additionally favored the advance in free money move and the strengthening stability sheet. Lastly, shares seemed to be deeply discounted.

After Amazon’s second quarter outcomes on Aug. 1st, I am sustaining my robust purchase ranking. Although the corporate’s outcomes have been combined, it nonetheless carried out fairly nicely. Amazon additionally has ample room for future development. The corporate’s free money move and internet money/marketable securities place improved once more. My barely increased truthful worth estimate coupled with a decrease share value means shares stay fairly undervalued.

No Finish In Sight To Amazon’s Sturdy Development

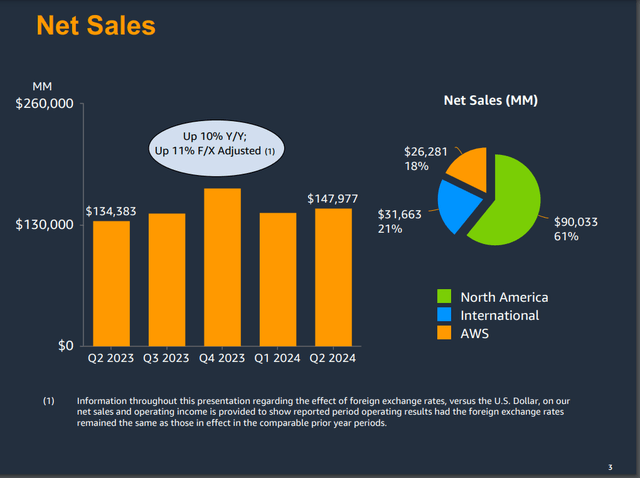

Amazon Q2 2024 Earnings Presentation

After 5 straight quarters of posting double-beats, Amazon fell simply quick on internet gross sales for the second quarter. The corporate’s internet gross sales jumped by 10.1% year-over-year to $148 billion within the quarter. Adjusting for unfavorable international foreign money translation, fixed foreign money internet gross sales have been up 11% throughout the quarter. For context, this was $780 million lower than In search of Alpha’s analyst consensus for the quarter.

Nonetheless, Amazon is a enterprise that is executing exceptionally nicely. Every facet of the corporate recorded wholesome development within the second quarter.

Unsurprisingly, the vast majority of Amazon’s topline development was pushed by its North America section throughout the second quarter. Phase income rose by 9.1% over the year-ago interval to high $90 billion for the quarter. Amazon’s give attention to offering the very best value, choice, and comfort for purchasers continued to pay dividends. That pushed unit gross sales, promoting gross sales, and subscription providers gross sales increased within the quarter.

Adjusting for the 100 foundation level advantage of Leap Day throughout the first quarter, internet gross sales development did reasonably decelerate sequentially from roughly 11%. CEO Andy Jassy famous in his opening remarks throughout the Q2 2024 Earnings Name that Amazon’s increased ticket objects are rising sooner than the trade common. Nonetheless, development is slower than is often noticed in a extra strong financial system, per Jassy.

Amazon’s AWS section was the subsequent largest development contributor for the corporate for the second quarter. The section posted $26.3 billion in internet gross sales, which was an 18.7% year-over-year development price. That represented an acceleration sequentially versus the 17.2% development price logged in Q1.

Better buyer utilization throughout each generative AI and non-generative AI workloads greater than offset pricing expenses through long-term buyer contracts. In keeping with Jassy, this was fueled by corporations turning their consideration to newer initiatives and restarting/accelerating present migrations from on-premises to the cloud.

Lastly, Worldwide section gross sales elevated by 6.7% over the year-ago interval to $31.7 billion within the second quarter. Just like the North America section, the Worldwide section skilled a moderation in internet gross sales development from 9.7% in Q1. A extra cautious world client setting partially offset the corporate’s value-creation efforts.

Transferring to the underside line, Amazon’s diluted EPS surged 93.8% increased throughout the second quarter to $1.26. This got here in $0.24 higher than In search of Alpha’s analyst consensus for the quarter.

Due to disciplined price administration, Amazon’s complete working bills elevated by simply 5.2% to $133.3 billion within the second quarter. That prompted a 410 foundation level enlargement within the internet revenue margin to 9.1%. That is how diluted EPS development simply exceeded internet gross sales development throughout the quarter.

Within the years forward, Amazon’s outlook for maybe its single most necessary metric is encouraging: Working money move per share.

The fruits of the corporate’s capital spending in previous years lead the FAST Graphs analyst consensus to foretell 38.7% development to $11.23 in 2024. For 2025, one other 18.5% enhance to $13.31 is anticipated. In 2026, a further 25.5% rise to $16.70 is anticipated.

Amazon’s customer-centric method to enterprise is spectacular sufficient. However what makes its future even brighter is the rising share of complete world e-commerce gross sales to complete world retail shares. In 2023, e-commerce made up 19% of worldwide retail gross sales. By 2027, it will broaden additional to almost 1 / 4 of worldwide retail gross sales per Statista.

The long-term outlook for AWS is simply as encouraging. Simply as I outlined in my earlier article, the overwhelming majority of worldwide IT spending remains to be on-premises. As the worldwide lead in cloud computing, AWS is the obvious beneficiary of this ongoing pattern. Throw in that Jassy believes generative AI remains to be within the very early days and the longer term is upbeat on this facet, too (except in any other case sourced or hyperlinked, all particulars on this subhead have been in accordance with Amazon’s Q2 2024 Earnings Press Launch, Amazon’s Q2 2024 Earnings Presentation, and Amazon’s Q2 2024 10-Q Submitting).

The Already Superb Stability Sheet Will get Higher Every Quarter

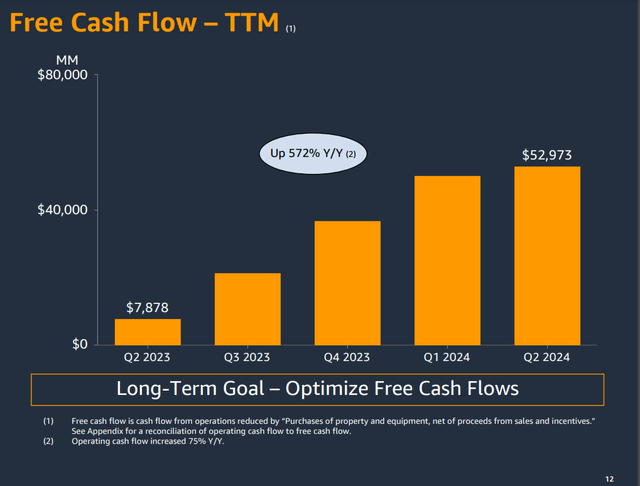

Amazon Q2 2024 Earnings Presentation

Amazon’s unbelievable uptick in its working money move from its earlier capex cycle helps to push free money move increased. The corporate’s working money move jumped by 74.6% year-over-year to $108 billion for the second quarter.

Together with comparatively regular capex spending, this resulted in a staggering 572.4% development price in free money move to $53 billion within the second quarter.

That can also be how the corporate’s internet money and money equivalents/marketable securities stability improved to $34.2 billion throughout the quarter. On account of this internet money place, it is also not a shock to be taught that Amazon generated $940 million in internet curiosity revenue via the primary half of 2024.

The Dividend Kings’ Zen Analysis Terminal

That is why Amazon enjoys an AA credit standing from S&P on a steady outlook per The Dividend Kings’ Zen Analysis Terminal. That vigorous company credit standing implies only a half p.c likelihood of the corporate submitting for chapter within the subsequent 30 years.

100%+ Upside Might Be Justified By means of 2026

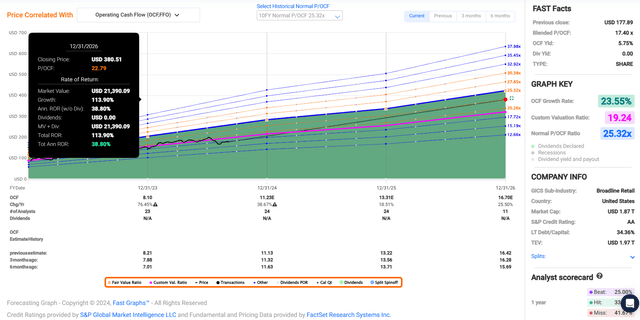

FAST Graphs, FactSet

Backed up by the basics, a have a look at Amazon’s FAST Graphs chart reveals that its valuation is sort of attention-grabbing right here. The corporate’s current-year P/OCF ratio is 15.4, which is nicely beneath the 10-year common P/OCF ratio of 25.3.

That is although Amazon’s 23.6% annual ahead OCF per share development outlook is similar to its 10-year common compound annual development price of 29.5%. That kind of development could be formidable for even a a lot smaller firm, which is what makes it so marvelous.

That is why I proceed to imagine {that a} affordable P/OCF a number of stays one normal deviation underneath the 10-year common. That’s equal to a 22.8 P/OCF ratio.

As issues stand, the present calendar yr is about 69% full. This implies that one other 31% of 2024 and 69% of 2025 is but to return within the subsequent 12 months. Thus, I arrive at a ahead 12-month OCF per share enter of $12.68.

Utilizing my truthful worth a number of, I compute a good worth of $289 a share. In comparison with the $173 share value (as of September sixth, 2024), this can be a 40% low cost to truthful worth.

If Amazon matches the expansion consensus and reverts to my truthful worth P/OCF a number of, it might have a blistering 114% upside forward by the top of 2026. Put one other approach, Amazon might compound at 39% yearly via 2026, and it might be 100% supported by the basics.

Dangers To Contemplate

Amazon is a world-beating enterprise of the utmost high quality. Nonetheless, it nonetheless has dangers to the funding thesis that must be watched over time.

Amazon continues to ship for its purchasers and that is serving to it to retain a 30%+ share of the worldwide cloud market every quarter. Within the second quarter, the corporate’s market share got here in at an estimated 32%, per CRN.

The long-term danger is that AWS might fail to take care of its super worth proposition over time. If this occurred in as aggressive of an trade setting as world cloud computing, rivals might swipe share away from Amazon. That would lead to a deterioration of the corporate’s development prospects.

Moreover, as I highlighted in my prior article, Amazon arguably has probably the most buyer information of any firm on the planet. This positions it because the enterprise maybe most focused by would-be cyber hackers.

If any main cyber breaches materialized, this might jeopardize the safety of its huge databases. That would undermine buyer belief in Amazon and lead to sizable authorized settlements in opposition to the corporate.

Stock danger is one further danger that the enterprise faces because the world’s largest e-commerce retailer. If Amazon cannot preserve applicable stock ranges, this might weigh on the corporate’s working outcomes. Understocking objects might additionally damage Amazon’s model repute amongst shoppers.

Abstract: Shopping for And Holding My Amazon Place For The Lengthy Haul

Amazon is a top-notch firm. It has catalyst after catalyst working in its favor. The corporate can also be executing and possesses an admirable development trajectory. Amazon’s AA-rated stability sheet is without doubt one of the finest on this planet, and it is solely getting stronger each quarter. The icing on the robust purchase case cake is that shares look to be 40% undervalued. This might translate into shares doubling within the subsequent two and a half years.

That is why I maintain a 2.5% stake in Amazon, and will realistically see this weight double within the subsequent yr or two. That journey to a 4% to five% weighting on Amazon will start with a 20% bump in my stake with further capital deployment on my finish inside the subsequent few weeks.