marrio31/iStock via Getty Images

Successful investing is tough – really tough, in fact. It takes perseverance, patience, discipline, time, and a thirst for knowledge (a little luck doesn’t hurt, either). Long-term investing is vital to building lasting wealth, as many veteran stockholders know. I’ve often kicked myself after growing impatient and ditching a high-conviction stock only to see it soar months later.

The most important quality for an investor is temperament, not intellect. -Warren Buffett.

What does this have to do with Amazon (NASDAQ:AMZN) stock and investors as we barrel toward Q1 earnings on April 27th? Everything!

Amazon shareholder letter 2023

Amazon CEO Andy Jassy’s 2023 shareholder letter cemented the company’s focus on lasting success, likely at the expense of short-term results.

The phrase “long-term” was mentioned more than ten times in the 7-page letter (13 iterations to be exact), often followed by words like investment, opportunity, and decision.

Amazon Web Services (AWS) is a terrific example of this thinking in a couple of ways. First, as a historical example. When this segment started back in 2006, many questioned the wisdom of pouring money into it. After all, Amazon was the king of online retail; why not stick with that?

Fast forward to today, and AWS generates $85 billion in annual revenue and $23 billion in operating profit last year as Amazon’s only profitable segment.

Second, AWS is also an excellent example of Amazon’s directive today. Management has hinted on recent earnings calls, and more bluntly in the shareholder letter, that they are laser-focused on building enduring relationships with customers even though that means sacrificing profits and margins now.

AWS’s scalability means customers can reduce their data usage or switch to lower-cost options to save money. Amazon is helping them do that.

Here is an excerpt from Jassy’s letter:

While some companies might obsess over how they could extract as much money from customers as possible in these tight times, it’s neither what customers want nor best for customers in the long term, so we’re taking a different tack.

And here is CFO Brian Olsavsky on the Q4 earnings call (emphasis mine):

Our customers are looking for ways to save money, and we spend a lot of our time trying to help them do so. This customer focus is in our DNA and informs how we think about our customer relationships and how we will partner with them for the long term.

…we expect these optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters.

This was plain to see in Q4 2022 as AWS’s operating margin fell to 24% – a far cry from the fantastic 35% operating margin in Q1 2022.

As investors, we should take this to heart and take heart in it. A quick fix isn’t forthcoming – and that’s okay. A company that is willing to sacrifice the future for short-term praise is not worthy of investment dollars.

This quarter’s results aren’t likely to be spectacular. The recovery of profits and cash flow is going to take time.

Important steps in the right direction

The focus on the long pull doesn’t mean that Amazon shouldn’t also focus on efficiencies now or that upcoming results aren’t important.

To this end, Jassy mentioned cutting costs in low-conviction operations and shuttering others, such as telehealth initiative Amazon Care. The company has announced 27,000 layoffs (a little less than 2% of the workforce). This is an unfortunate reality for many tech employees now. And while rightsizing should improve margins eventually, it will hurt profits immediately because of one-time charges like severances.

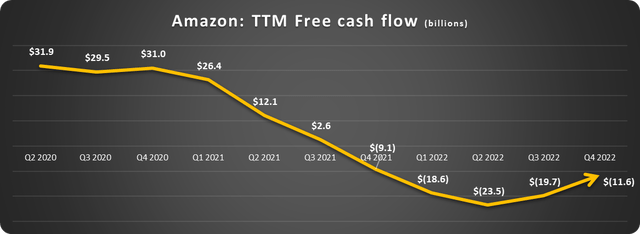

However, there is one urgent point of emphasis. Amazon must generate positive free cash flow before it becomes a glaring problem.

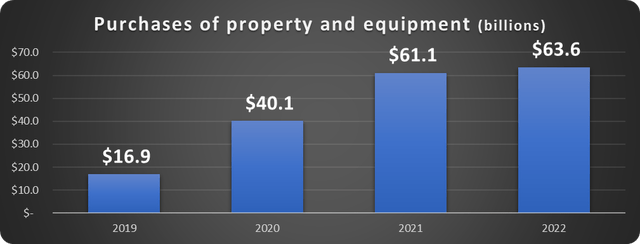

Amazon’s purchases of fixed assets (CapEx) ballooned more than 350% from 2019 to 2022, as shown below.

Data source: Amazon. Chart by author.

Spending $160 billion over three years is further evidence of a focus on the future, but it has also crushed free cash flow and weakened the balance sheet.

It’s time to right the ship.

Amazon should accomplish this since inflation is declining and other recent complications, like the strong US dollar, are easing.

Free cash flow is already trending in the right direction, as shown below.

Data source: Amazon. Chart by author.

Now Jassy and company need to finish the job.

What does Amazon’s future look like?

As I’ve discussed recently, the bulk of Amazon’s future profits will come from selling higher-margin services (rather than low-margin retail).

The massive CapEx built up digital and logistical infrastructure. Now, Amazon is poised to capitalize, especially when the economy recovers.

Current revenue lines that will propel future profits are:

- Digital advertising: Revenue +91% since 2020 to $38 billion in 2022;

- Subscription services (Prime): Sales +40% since 2020 to $35 billion;

- AWS: +77% over two years to $80 billion 2022 revenue; and

- let’s not forget the new initiative Buy with Prime, which allows retailers to utilize Amazon as a third-party logistics service. This will put those capital investments to work. More on this here.

Is Amazon stock a buy?

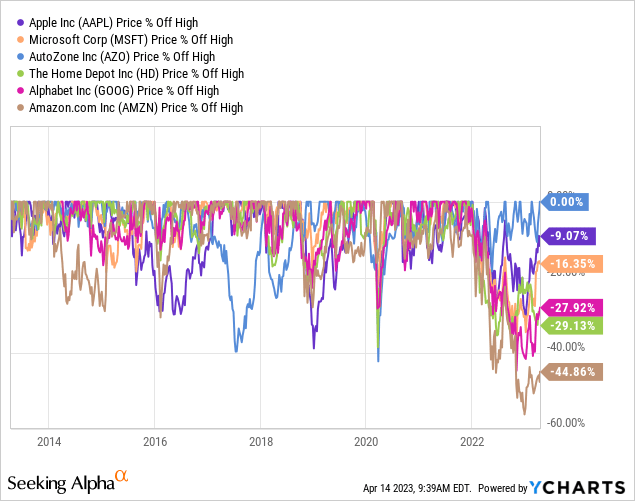

All iconic companies go through difficult periods, usually several times over their lifecycles.

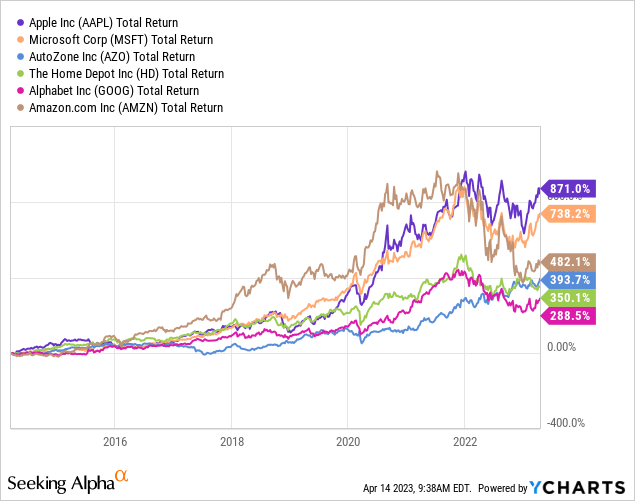

Here are a few examples. The dips in the graph represent the pullback from highs for the stocks.

However, it looks a lot different if we view the same graph by total return.

Investing in high-quality companies pays handsomely over time. The question for investors is whether they believe Amazon is one.

The recovery will take time, but the stock can rally on a dime and unexpectedly. As always, it’s wise to dollar-cost average, keep some cash around, and diversify.

Investors’ patience will be tested as Amazon restores its success. However, Jassy’s focus on investing for the future, building lasting customer relationships, and service revenue is the correct path for the company and its shareholders in my view.