Boarding1Now/iStock Editorial via Getty Images

Dear readers/followers,

When looking at Alstom (OTCPK:ALSMY), we want to look at “high level” value – because this company is as high-level infrastructure business as it gets. Even more than Siemens (OTCPK:SIEGY), which I, by the way, also own. Even though the company is dropping in today’s market action, the company has actually still outperformed since my last article.

Seeking Alpha Alstom Performance (Seeking Alpha)

Again, if you follow my stances on Alstom, you still would’ve done fairly well for yourself, even in this volatile market. The company is a cyclical industrial with a spotty history – but it’s been shaping up over the past few years, and as things currently stand and if you look beyond the current noise we’re in the middle of, I believe you can make a decent amount of returns for yourself.

Let’s see why I still believe you should own Alstom, and overlook any uncertainties you may have about investing in French stocks.

Alstom – The company has advantages and is likely to outperform even now

So, I’ve been covering Alstom for about a year at this point, and researching the company for far longer than that. I believe this is one of those global transport companies you really want to end up owning at some point – the fields of transportation, signaling, and locomotives aren’t going anywhere, and this company is a market leader here.

I know that the availability of anything but commercial transportation of goods on railways is outside of the norm in the USA (and especially considering all the recent derailings with Norfolk (NSC) and others and all of NA, but that is not the case in the global context, where on-rails transport is the norm.

Most of our European infrastructure network for the transport of goods is railway – and many nations have an extensively-built and maintained railway system for the transportation of people as well. Sweden is definitely among them – so going by the US case here, which would imply not caring much about Alstom, would be wrong.

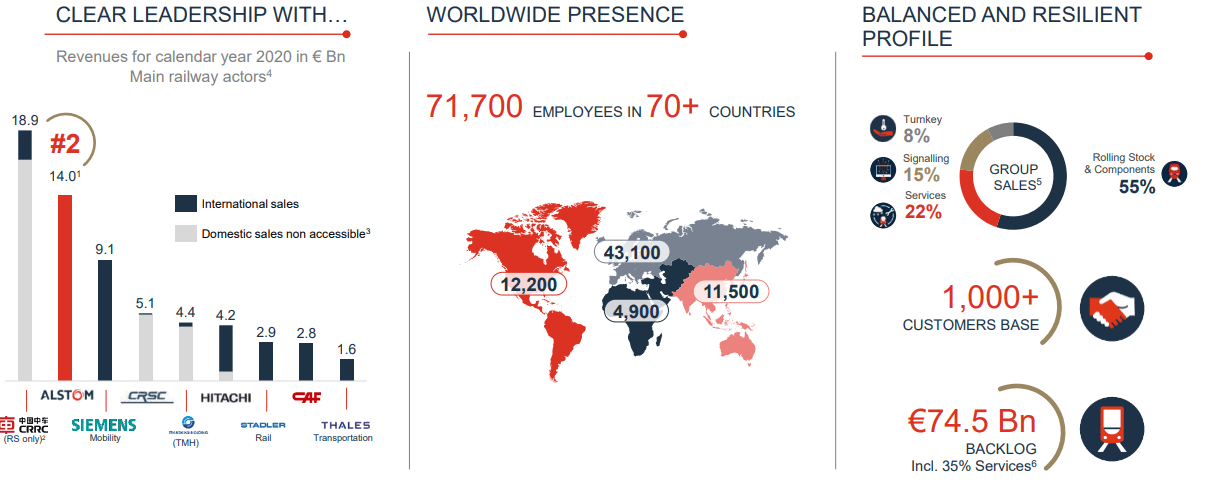

Some leadership here…

Alstom IR (Alstom IR)

…and given what the company has accomplished, it should be enough to make you overlook, including the massive backlog inclusive of services, its doubtful history and volatile trading going back around 20-30 years. Its history back then isn’t as rosy, and includes both mismanagement and bailouts.

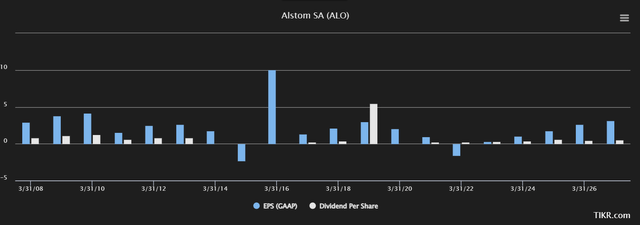

But that’s the Alstom of the past – new management, a far-simplified division setup, and proof of concept over the past 10+ years, that with the exception of COVID-19 and 2022 due to some effects, has seen the company become impressively profitable, going onto being even more profitable in the future, while also being a good dividend payor.

Alstom EPS/Dividend (TIKR.com)

The company doesn’t always post its quarterlies, instead focusing on half-year results and sales figures aside from results. This may become more of the norm as well, so keep that in mind looking at Alstom.

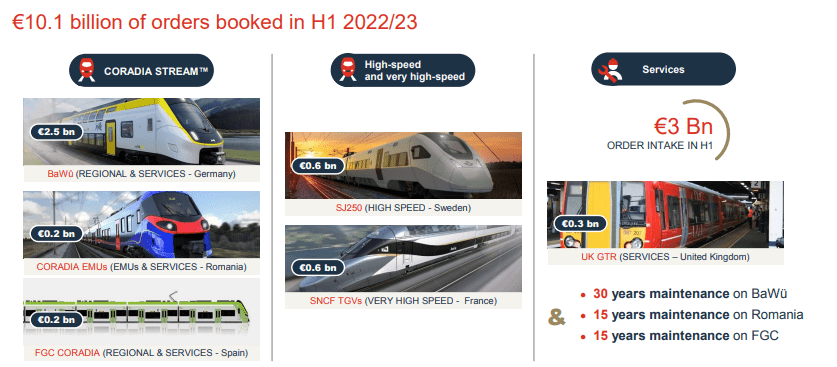

9M sales numbers including order intake and commercial momentum is solid. 3Q22 is what we have here, and the backlog as of December 2022 stood at €84.6B, which provides superb sales visibility in terms of how much demand is incoming. The company’s sales increased by 8% YoY, which is in line with the company’s targeted growth rate for the top line.

New frame agreements were entered into in Spain, Ireland, and Kazakhstan, with strong service performance, the UK above all.

Despite a chaotic macro, the company’s customers, typically governments, are confirming their investments across the boards. Alstom’s focus, therefore, is on increasing sales and focusing on the resilience of the business so that the company aside from generating top-line sales, also generates bottom-line profits at impressive levels to go along with it.

The group’s flows remain heavily EU-focused. So if you invest in Alstom, know that you’re getting a European business.

On a regional level, Europe accounted for the majority of the orders, i.e. 55% of the Group total. Alstom was awarded a contract worth nearly €370 million to supply 49 additional Coradia Stream high-capacity trains to Renfe in Spain. These trains supplement the 152 trains already ordered in March 2021. The two orders are totalling a value of €1.8 billion for 201 trains.

(Source: Alstom IR)

The company completed the Elizabeth Line in London during 3Q, and with the acceptance of the final trains, the company has completely re-aligned its order intake from there with the 2014 contract with Transport for London, and this is a 32-year contractual concession period until 2046, with a service order value of no less than €1.1B in a single quarter.

That is the sort of contracts, orders, and trends the company works with, and that’s what you need to understand. The company’s top line is chugging along like a….well, like a train. That goes for every segment – rolling stock, signaling, systems, and services, with particular strength from systems which grew almost 30% due to a massive ramp-up of sales in Egypt, Canada, and Saudi Arabia.

The book to bill for Alstom is 1.2x here.

The company’s projects, despite its heavy EU focus, are global. The Cairo line, the Athens Metro, and the full PHX Sky train turnkey solution are recent examples of this.

The company’s targets remain clear – book-to-bill above 1x, sales growth of over 5-7%, EBIT margin within the 5-5.3% range, which sounds small – but again, remember what the company does and where it works, and being able to generate FCF of €100-€300M overall.

Do not underestimate the company’s order book, or its projects…

Alstom IR (Alstom IR)

…and do not underestimate the whip-saw movement a stock like that could make. Alstom is BBB-equivalent rated, pays a decent dividend for the native that’s likely to increase going forward, and is entering a period of high growth.

What we want to keep an eye on as investors, and what I intend to keep an eye on as an analyst, is the company’s specific trends in overall costs, in inflation, in wages, and in other bottom-line-influencing trends. I have no doubt the company will remain a solid investment in terms of sales and trends – my question is what sort of bottom-line development we’ll be able to see, because that’s where our profits and dividends come from.

But essentially, what we look at here is how the future few quarters work out, and how Alstom deals with these impacts of what we’re currently seeing in the financial macro.

That will dictate the bottom line, and what we can value Alstom at. For now though, these indications are downright positive, as I see them.

Why are they so positive?

Alstom – Set to grow by quite a bit, and here’s the valuation

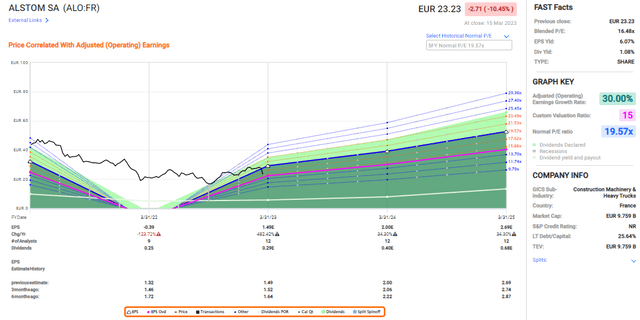

Because Alstom is set to improve its earnings, GAAP, and adjusted, by massive amounts as we move into this order/contract cycle. The company has a more than 30% average annual EPS growth rate over the next few years, following the decline in 2022. I believe this growth will result in substantially increased share price levels.

Alstom Upside (F.A.S.T graphs)

That being said, I always mention that anyone valuing Alstom, which I’ve seen some analysts do, should be clear about the fact that Alstom valuation has some problems. This is because the company does not share segment-specific margin or breakdown data.

This means most of our forecasts are based on guesswork, even “best” sort of guesses here. I still believe it is fair to say, based on the Backlog and current management guidance that we can forecast, on a DCF basis, for Alstom to grow faster than the global industry average – despite the current macro. The current forecasts from both S&P Global and FactSet also confirm this.

The upside, to give you an idea based on what you see above in a visual representation, implies that if we value Alstom at 15-18x P/E, we get an upside range of no less than 32.72% on the low, 15x P/E side, and 50.71% on the high side. Or in different terms, we might be able to go as high as 131% RoR from here in less than 3 full years. That’s something to be excited about, even if there’s risk in the investment.

I expect considerable continued margin pressure until after 2022 relating to Bombardier Transport, but not after 2023, after which I model for a margin increase. However, I’ve also impaired this margin increase somewhat, because inflation, wage, and interest rate costs are like as not to make this improvement somewhat strained. In fact, if this macro had happened during the last 2-3 years, I have no doubt we’d see Alstom trading closer to single digits here, because I doubt the company, under its legacy Bombardier contracts, could have posted any sort of profit.

Along with this, I guide for a 4% EBITDA and sales growth (down from up to 5% from my last article), with a top-end 5.2% EBITDA growth range, down 0.3% from 5.5% and an increase in CapEx to 5.8%, (up from 5.5%) starting to wind down in 2023-2025.

The company has a WACC of around ~9.9% with a cost of debt of around 2.45%, with the cost of debt static due to the very low-interest rates for the company’s actual debt. However, this is also set to change going forward. The ECB changed the interest rates today, as I am writing this article. So there are a few things to consider here, and costs and debt are two of them.

S&P Global’s PTs remain at similar levels to when I last reviewed the company. 19 analysts follow the stock, and they work with a range from €14 on the low side to €38 on the high side, with 14 out of 19 analysts at a “BUY” or equivalent rating here. My own PT, combining these aforementioned perspectives, came to €36/share in my last article. I don’t see a significant or relevant reason to change my price target here. I’ve impaired some of the fundamental forecasts to some degree, but due to these being relatively minor, I view it as in the realm of possibility that the company could still reach this price target.

If I was being nitpicky, I would lower the PT to around €35.75, but I try not to work with euro cents or dollar cents unless it makes sense. For now, I’m sticking to my PT for Alstom and reiterating my strong like for this French infrastructure business.

Thesis

- Based on long-term positive business fundamentals from a combined rolling stock/service/turnkey business and added to by urbanization in the emerging markets, the future trends for Alstom are likely to be positive. Pushes for green services and marketing are likely to enhance this even further.

- The company’s focus on improving portfolio margins and moving to higher-margin segments such as signals/services is likely to benefit the company in the long term.

- I view the company as a “Buy” with a PT of €36/share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized):

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills every single one of my requirements and therefore warrants a “Buy”. I still maintain that despite the recent surge, the company is actually cheap for what it offers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.