bagi1998

It has been a few months since I wrote my initiation article on Alphamin Resources (OTCPK:AFMJF) (TSXV:AFM:CA). I rated Alphamin a buy in my initiation as I liked the company’s tin exposure as well as its cheap valuation. Since my article, the company has gained 7%, roughly in line with the market (Figure 1).

Figure 1 – Alphamin has gained 7% since June (Seeking Alpha)

As we head into year-end, I thought it would be timely to check-in on the Alphamin’s operations as well as development plans at Mpama South, the company’s flagship expansion project.

(Author’s note, financial figures are in U.S. dollars unless otherwise stated)

Brief Company Overview

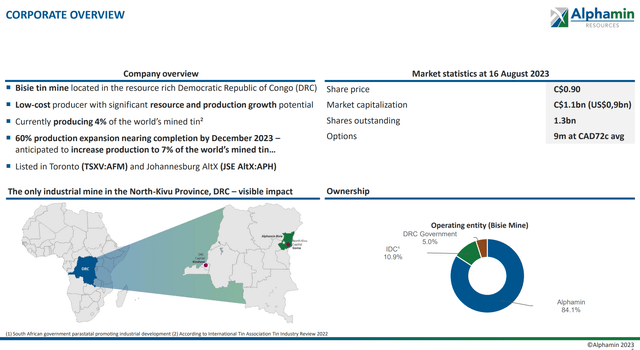

Alphamin Resources is a low-cost tin producer based in the Democratic Republic of Congo (“DRC”). Its flagship mine is the Bisie Tin Mine (“Bisie”) which has the highest known tin grade of any operating mine (Figure 2). From this mine alone, Alphamin is currently producing ~4% of the world’s tin supply. Once the Mpama South expansion is completed in early 2024, Alphamin is expected to increase production to ~7% of the world’s tin supply.

Figure 2 – Alphamin overview (Company investor presentation)

Tin Is The ‘Glue’ To A Connected World

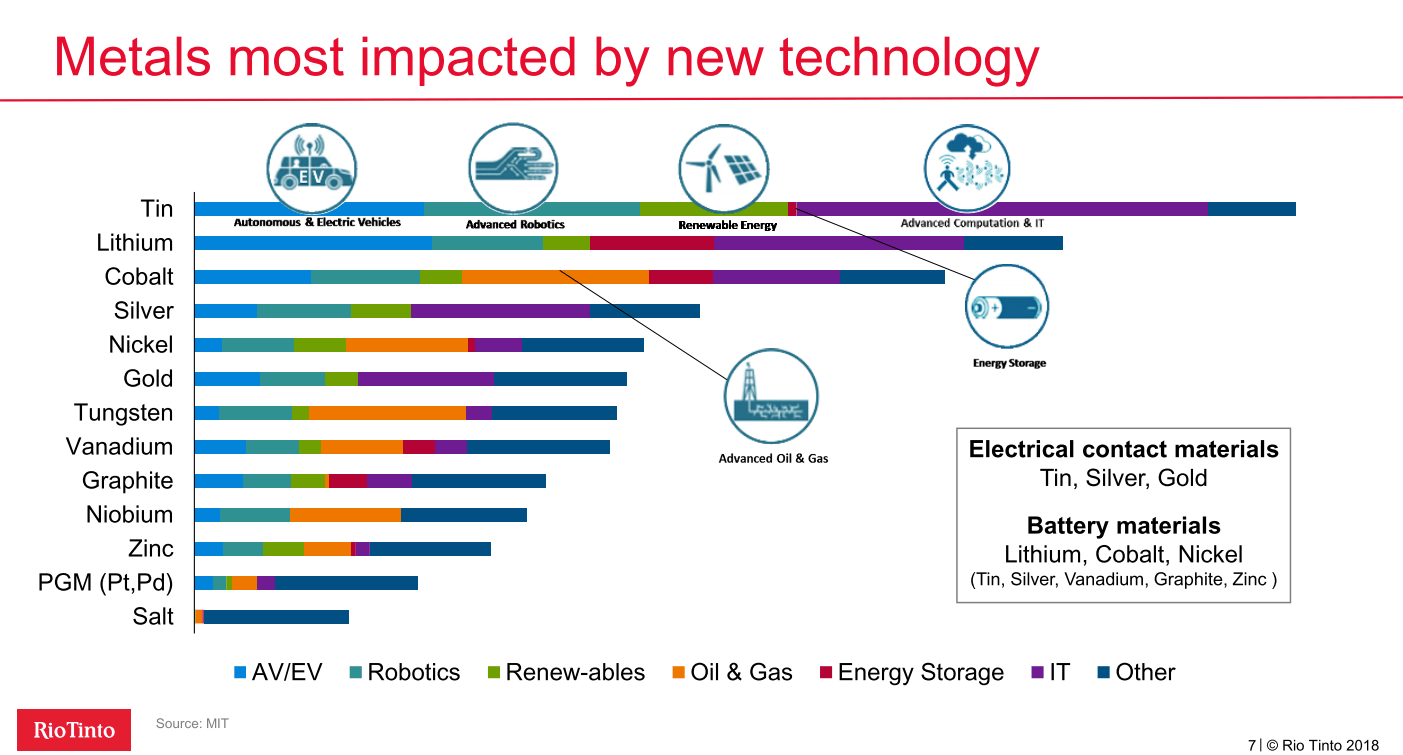

While many investors commonly look to lithium, nickel and cobalt as critical metals in the energy transition, they often overlook lowly tin, the literal ‘glue’ (solder) that holds electrical components together.

According to a 2018 MIT study commissioned by Rio Tinto, tin may be the metal most impacted by new technologies as it is involved in electric vehicles, robotics, renewable energy, and advanced computers (Figure 3).

Figure 3 – Tin may be the critical metal most impacted by new technologies (Rio Tinto investor presentation)

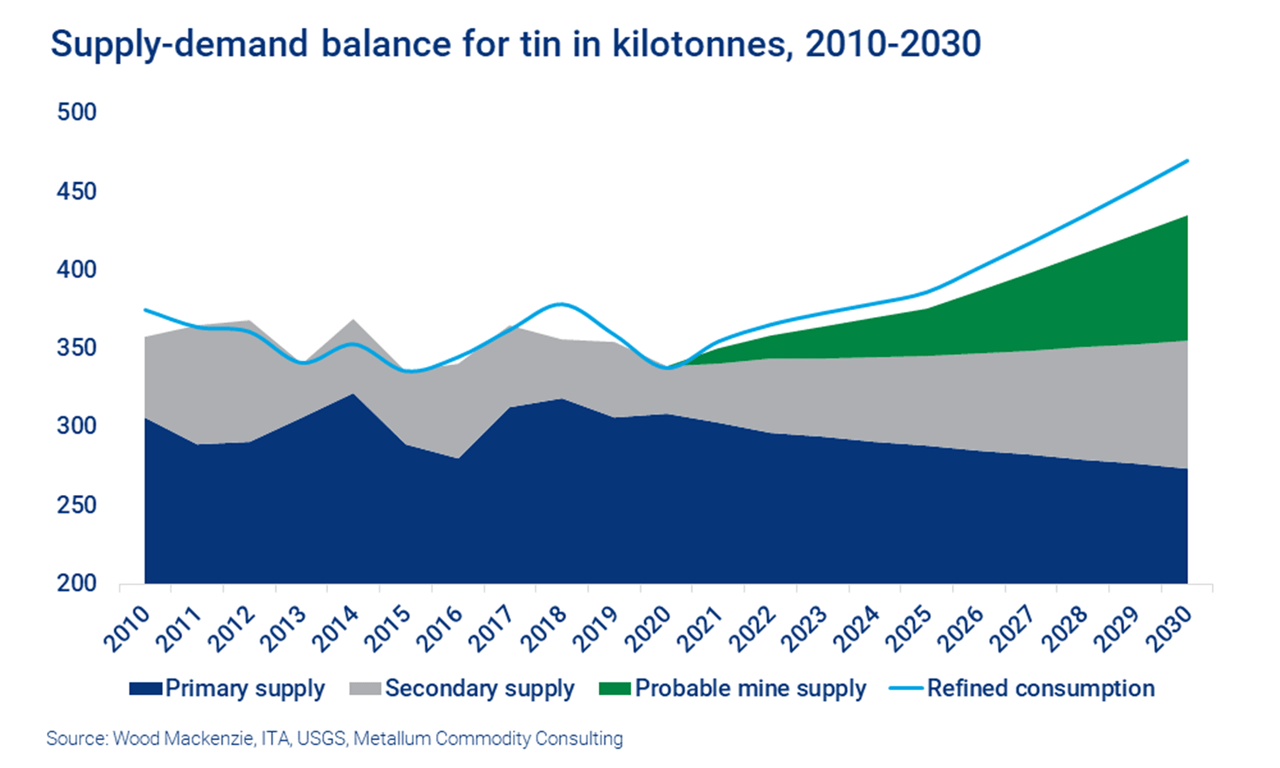

Solder accounts for roughly half of global tin demand and with an ever increasing number of microchips and electronics in our everyday lives, tin is expected to be in structural deficits for the foreseeable future as existing supplies deplete and probable mines fail to keep up with increasing demand (Figure 4).

Figure 4 – Tin is expected to be in structural deficits (Wood Mackenzie)

Tin Price Has Halved On Reduced Semiconductor Demand…

Although tin prices have roughly halved in the past year, that is really because supply disruptions pushed prices to unsustainable levels of over $45,000 / ton in early 2022 (Figure 5). However, compared to 5 years ago, tin prices are still very healthy, recently trading ~$25,000.

Figure 5 – Tin prices have been volatile (tradingeconomics.com)

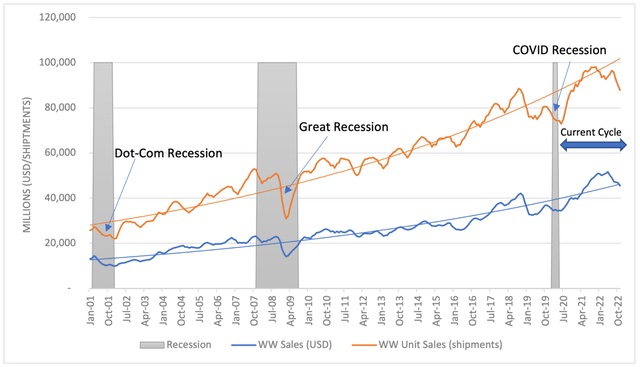

Part of the reason for the decline in tin prices in the past year has been due to a cyclical slowdown in semiconductor sales, as many end-users had double- and triple- ordered in the months following the COVID pandemic and were sitting on large inventories (Figure 6). There were also concerns with slowing global growth, causing companies to reduce their inventories of microchips and semiconductors.

Figure 6 – Semiconductors have suffered through a cyclical slowdown (Semiconductor Industry Association)

…But Long-Term Picture Remains Robust

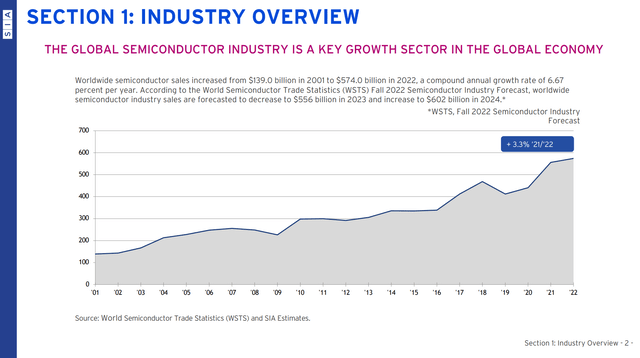

However, looking past the current cyclical slowdown, demand for semiconductors has grown at a 6.7% CAGR for the past 2 decades and there are no signs this pace will slowdown in the near-term (Figure 7). In fact, with introduction of AI applications like ChatGPT, demand for computing power is expected to grow exponentially in the years to come.

Figure 7 – But long-term, semiconductor demand has grown at 6.7% CAGR (Semiconductor Industry Association)

Recently, we may be seeing signs that the cyclical semiconductor slump is nearing an end as TSMC, the largest contract semiconductor fab in the world, noted in its Q3 earnings call that they are “observing some early signs of demand stabilization in the PC and smartphone market”.

Furthermore, Myanmar, one of the world’s largest suppliers of tin, recently banned the production and export of tin, fanning supply shortage fears.

The combination of improving demand and restricted supply has some analysts calling for prices to rise in the coming months.

Alphamin Delivers Another Solid Quarter Of Operations

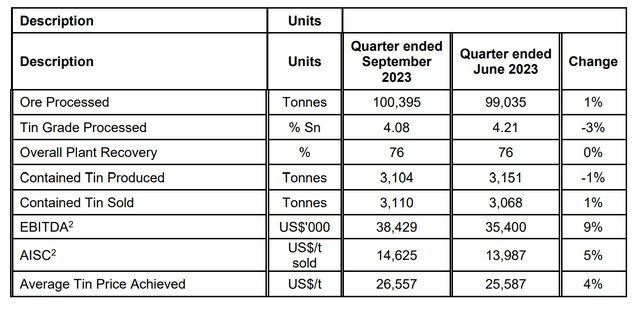

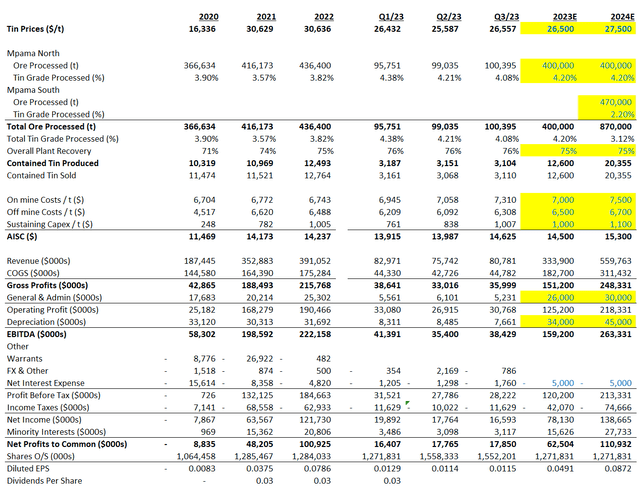

Switching gears to Alphamin, the Bisie mine has been performing well, with the company recently reporting financial results for the third quarter. Tin produced was 3,104 tons, in line with the previous quarter, while EBITDA was $38.4 million, an 8% increase QoQ on slightly higher tin prices (Figure 8).

Figure 8 – Alphamin Q3/2023 financial summary (Alphamin Q3/2023 Report)

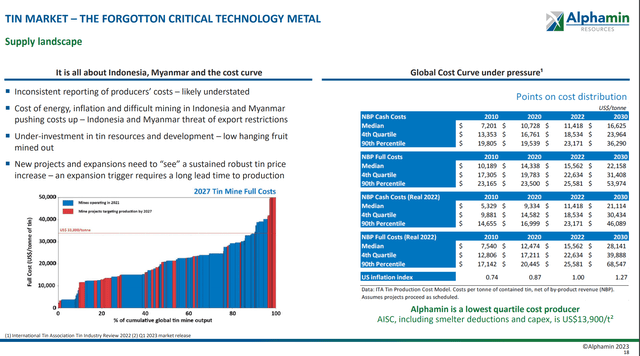

Bisie’s all-in sustaining cost (“AISC”) of $14,625 in the quarter was 5% higher than last quarter, but still places Alphamin in the first quartile of global production costs (Figure 9). Approximately half of the AISC increase was due to the timing of sustaining capex, while the rest was due to higher G&A and fuel expenses.

Figure 9 – Tin cost curve (Company investor presentation)

Mpama South Development On Schedule And On Budget

With respect to the Mpama South expansion, development remains on schedule and on budget. A total of 2,448m of underground development has been completed to date, with 988m achieved in the latest quarter. The Mpama South development rate increased in the third quarter as additional equipment arrived on site, and an additional ~1,200m of development is required in the upcoming quarter in order for Alphamin to achieve targeted tin production in FY2024. Once completed, Alphamin’s annual production will increase from ~12,000 tons to ~20,000 tons.

The construction of the processing plant is also progressing well with commissioning expected in January/February 2024, a slight delay compared to initial estimates due to poor road conditions and a damaged bridge causing delays in deliveries of some key materials. Ore is expected to be fed to the plant beginning in late February.

Financially, Alphamin has spent $99 million to date on the Mpama South project, and the project is expected to be substantially completed within the original budget of $116 million. However, Alphamin did amend and restate its credit agreement to raise an additional $10 million in senior debt financing as a precaution. In addition, Alphamin’s short-term facility in the DRC has been increased by $15 million to $55 million in anticipation of paying the previously reported high final and provisional DRC taxes during 2023 that is not expected to repeat in 2024.

Valuation Trading At Half Of Peers

Once Mpama South achieves commercial production, Alphamin’s production is expected to reach 20,000 tons of tin per annum. This should translate into ~$260 million in EBITDA at $27,500 / t tin price (Figure 10).

Figure 10 – Alphamin financial model (Author created)

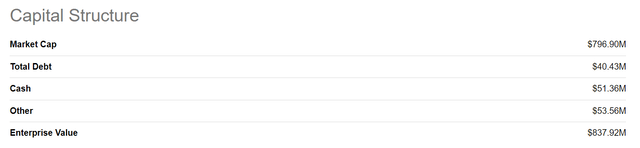

At a current enterprise value of $840 million, Alphamin is trading at only 3.2x Fwd EV/EBITDA, assuming the Mpama South expansion is completed (Figure 11).

Figure 11 – Alphamin valuation (Seeking Alpha)

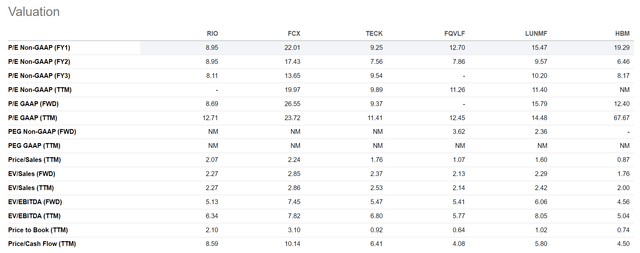

In comparison, base metal mining companies like Rio Tinto and Freeport trade at 5-7x Fwd EV/EBITDA (Figure 12). This suggests there is significant upside in Alphamin’s share price.

Figure 12 – Base metal miner comparable valuations (Seeking Alpha)

Risks To Alphamin

There are two key risks with Alphamin. First, Alphamin is a single commodity producer, so it is very exposed to tin prices. However, luckily, Alphamin has first quartile production costs, so the company should remain profitable in most pricing scenarios.

A second risk to Alphamin is Bisie’s location in the DRC. The DRC is one of the toughest jurisdictions to operate mining assets as the country is politically unstable and corruption is rife. However, to date, Alphamin has not experienced any challenges with the local authorities.

Conclusion

Alphamin’s operations have performed well so far in 2023, with the company on pace to achieve the annual 12,000 tons of tin production at ~$14,500 AISC. This places Alphamin squarely in the first quartile of production costs.

Development on the Mpama South expansion is progressing with commissioning expected in early 2024. Once commissioned, Alphamin’s production is expected to rise to 20,000 tons per annum. At $27,500 / ton, this could translate into over $260 million in EBITDA.

Alphamin’s valuation remains compelling, as it is trading at only 3.2x Fwd EV/EBITDA assuming a 20,000 tpa production run rate, roughly half of peer valuations.

I remain comfortable holding onto my Alphamin shares and expect investors will be richly rewarded in the coming years as production expands and tin prices rise.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.