A_Carina

By David Brady

Getting straight to it, we may have seen the lows in gold, silver, and the miners, but I seriously doubt it. Gold remains relatively bullish. There’s a gap below at 28 on the daily chart for GDX that may need to be closed.

The Bullion Banks remain significantly net short gold, and we’re heading into the liquidity-light July 4th week. The euro looks sick as the Fed’s Powell pounds the table for two more rate hikes, resuscitating the DXY.

That said, the risk-reward beyond the very short term is heavily skewed to the upside in metals and miners. In the meantime, I’m expecting the gold price to have an 18 handle next week.

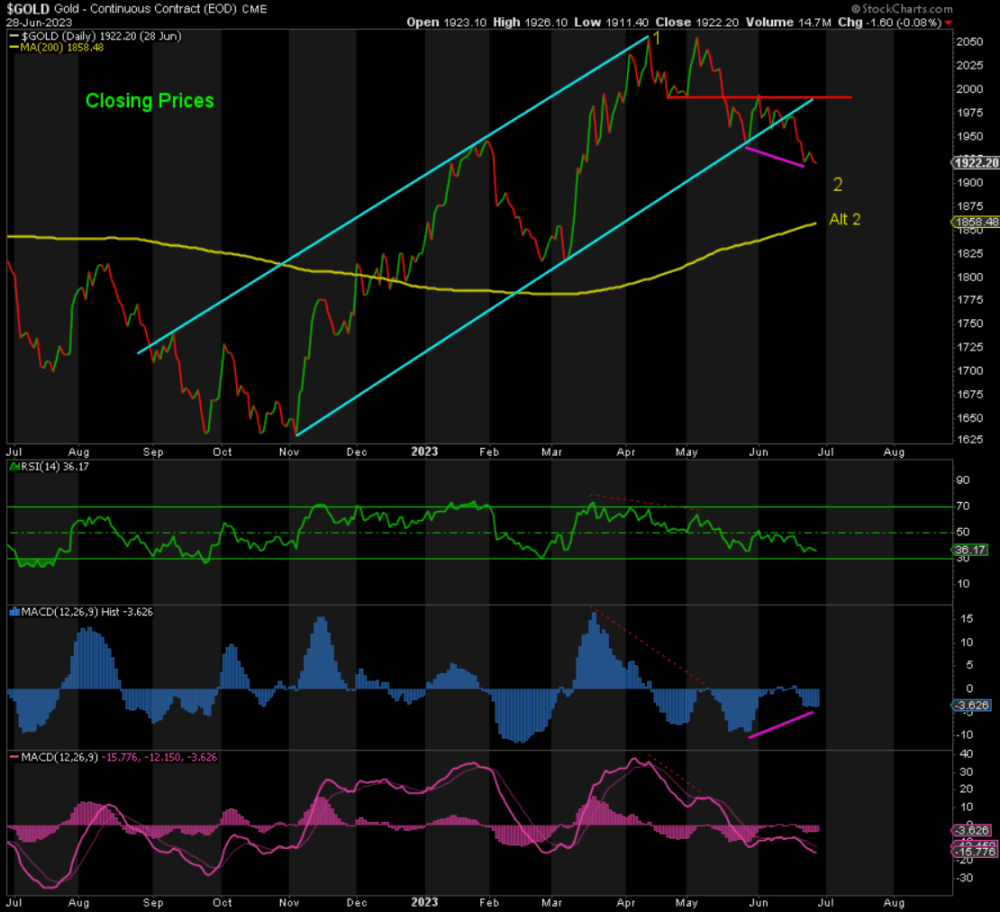

Gold

As we can see, Gold has broken the bearish channel to the downside and has reached my primary target at 1900 this Thursday morning. It is now bouncing from that level.

But I still see the risk of a test of the 200-day moving average at ~1860 before we’re done on the downside, for all of the aforementioned reasons. This may come as early as tomorrow or, more likely, next week.

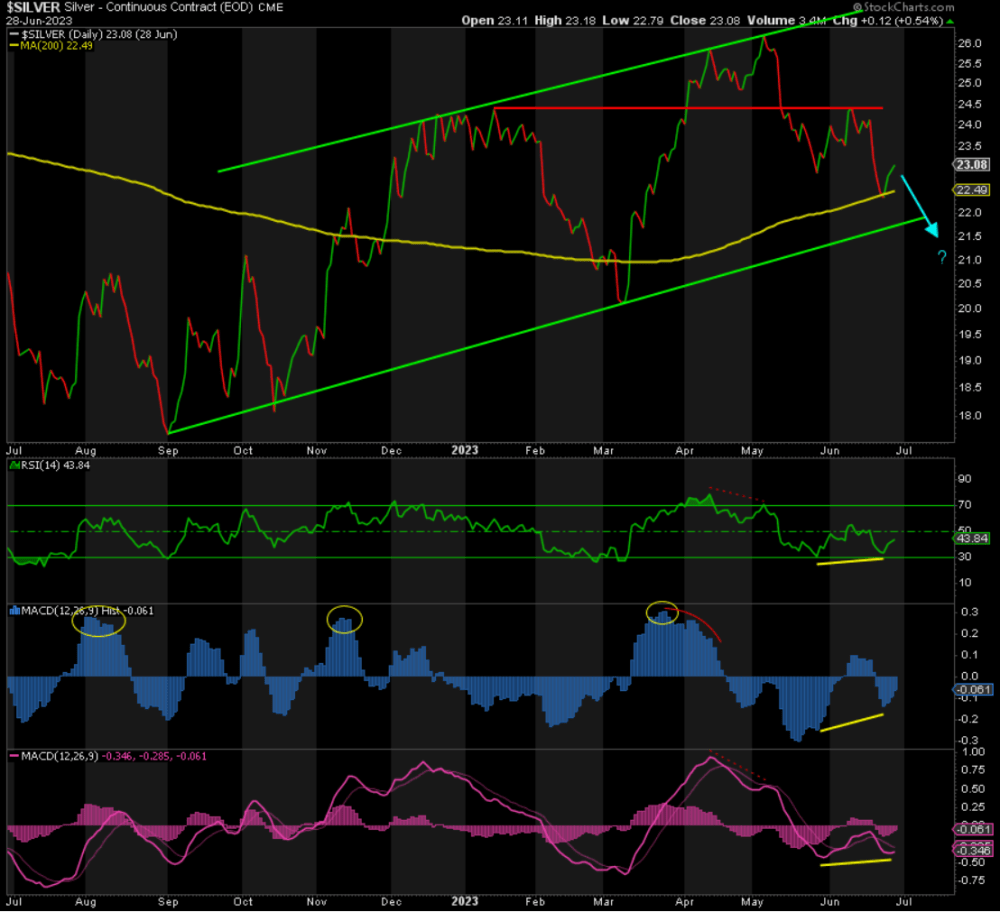

Silver

Although silver is positively divergent and far more bearish than gold – and therefore closer to a bottom – it will be difficult for silver to move up if gold heads south.

It has held above the 200-day moving average so far, but the risk is that it breaks below there and possibly the trendline support also, towards 21, while clearing out all of the stops before heading higher again.

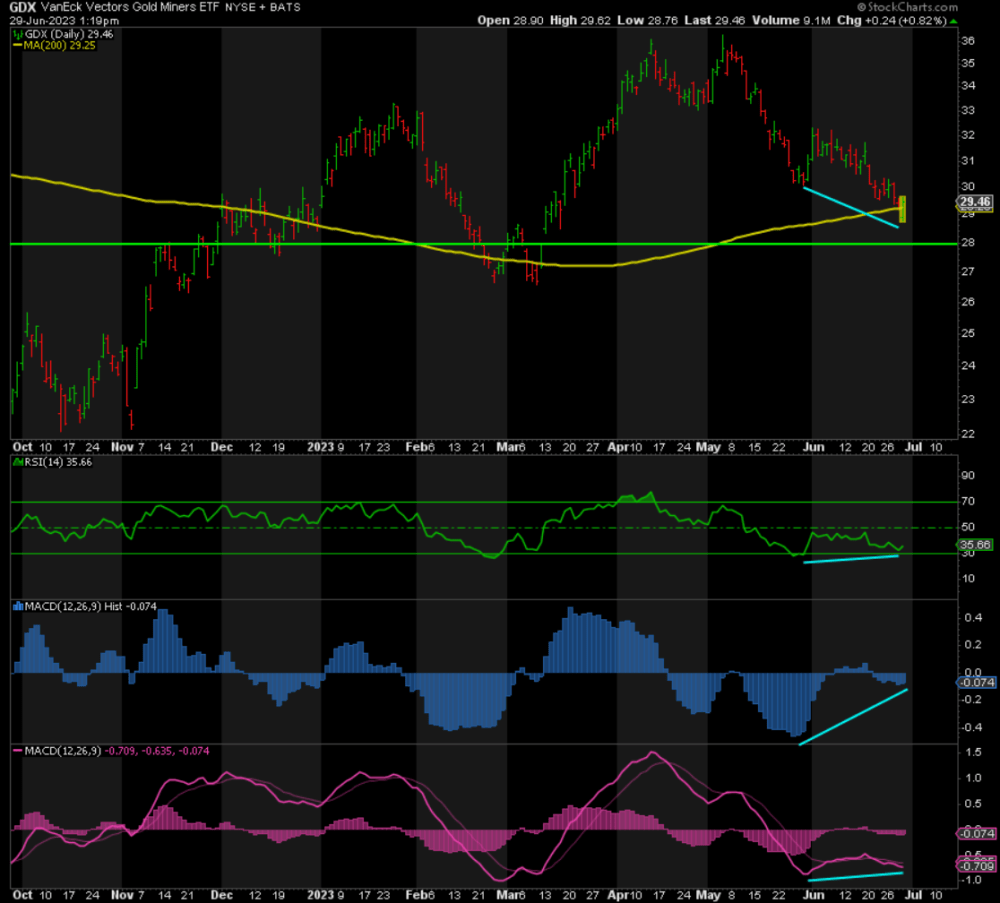

GDX

Much of the comments on silver apply to GDX also. The big difference is the gap left behind on the daily chart at 28 (27.95 to be exact) on March 10. More often than not, such gaps are closed first before an asset can resume its trend to the upside. I am looking for a drop to just below 28 to close that gap and provide the fuel for the next rally to 36 or above.

Conclusion

While I am not ready to say the bottom is in, we are close. I believe the next lower low is the final one and coming soon. That said, if you consider the risk-reward here, it’s dramatically skewed to the upside going forward.

Even if gold fell to 1750, that’s $150 lower. Whereas the upside is minimum 2600, i.e., $700 higher, perhaps as high as 3000, $1100 higher. That’s a minimum 4.66:1 or max 7.33:1 risk-reward ratio. The gains for silver and the miners would be even greater!

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.