sponsored

Cryptocurrency customers can face quite a lot of challenges discovering the fitting info wanted for reporting taxes. Koinly, a number one cryptocurrency tax calculator and portfolio tracker for merchants, has created the final word information to assist.

Koinly Presents The Final Bitcoin Tax Information for 2022

Crypto tax rules and legal guidelines might be complicated, leaving buyers with many questions on what crypto taxation appears like – how a lot tax to pay on Bitcoin and the tax fee? However don’t worry. Koinly brings an final crypto tax information to assist reply all of the questions associated to crypto taxes and extra.

Bitcoin, similar to every other cryptocurrency, is just not acknowledged as a fiat foreign money – like USD, GBP and AED, by virtually all international locations worldwide. For taxation functions, crypto is an asset & is taxed similar to every other asset – very similar to property, inventory, or shares. So sure, taxes are due on Bitcoin.

It doesn’t matter the place somebody lives, as most taxation departments worldwide are cracking down on crypto and taxing Bitcoin and different cryptocurrencies. Every nation has barely various views on crypto and its taxation. Koinly presents often up to date guides on many international locations, together with the US and Canada too.

Since Bitcoin is an asset for taxation functions, the proprietor should pay a Capital Beneficial properties Tax anytime an asset is liquidated and disposed of. In what eventualities are Bitcoin disposals taxed?

- When Bitcoin sells for Fiat foreign money

- When Bitcoin/crypto swaps for an additional cryptocurrency, together with stablecoins

- Items or providers purchased utilizing Bitcoin

- And in Eire, Australia and the UK, the tax is levied even when Bitcoin is presented

Except for Capital Beneficial properties Tax, there are situations the place Bitcoin might be taxed as a result of additionally it is transacted in different methods. Bitcoin transactions that may very well be taxed as earnings embrace:

- Getting paid in Bitcoin – like a wage.

- Mining Bitcoin – like earnings.

- Incomes Bitcoin by loaning – like incomes curiosity.

- Receiving new cash from a Bitcoin fork – a bonus.

In idea it’s simple to determine how a lot Bitcoin capital good points tax somebody must pay. You must know the truthful market worth of Bitcoin on the day it’s acquired, and on the day it’s disposed in fiat foreign money phrases – like USD or GBP. The distinction in worth will current both a revenue or a loss, and it’s a revenue that pulls capital good points tax. When a person’s Bitcoin is taxed as earnings, it will likely be taxed on the identical fee as their present Earnings Tax fee.

You will need to be aware that the Bitcoin somebody has paid Earnings Tax on will nonetheless be topic to Capital Beneficial properties Tax when it’s disposed of later. It might sound daunting at first, however due to Koinly, it’s not that troublesome to determine crypto tax.

Free Bitcoin Tax Calculator

It’s advisable to make use of a crypto-tax calculator like Koinly to remain tax-compliant as a result of the IRS, HMRC, the ATO, the CRA and extra, are cracking down exhausting on crypto daily. They’re working with large crypto exchanges to realize prospects’ info and ship letters to buyers who must pay Bitcoin tax. Koinly makes it easy and simple to calculate tax and put together studies to the tax workplace. Whereas there are different crypto-tax calculators, Koinly is a free Bitcoin tax calculator, supporting Bitcoin and different main cryptocurrencies, making it simpler for customers to calculate crypto tax. Koinly can be including assist for a number of new tokens and cash on a regular basis; additionally maintaining with the continually evolving and altering crypto tax laws and legal guidelines.

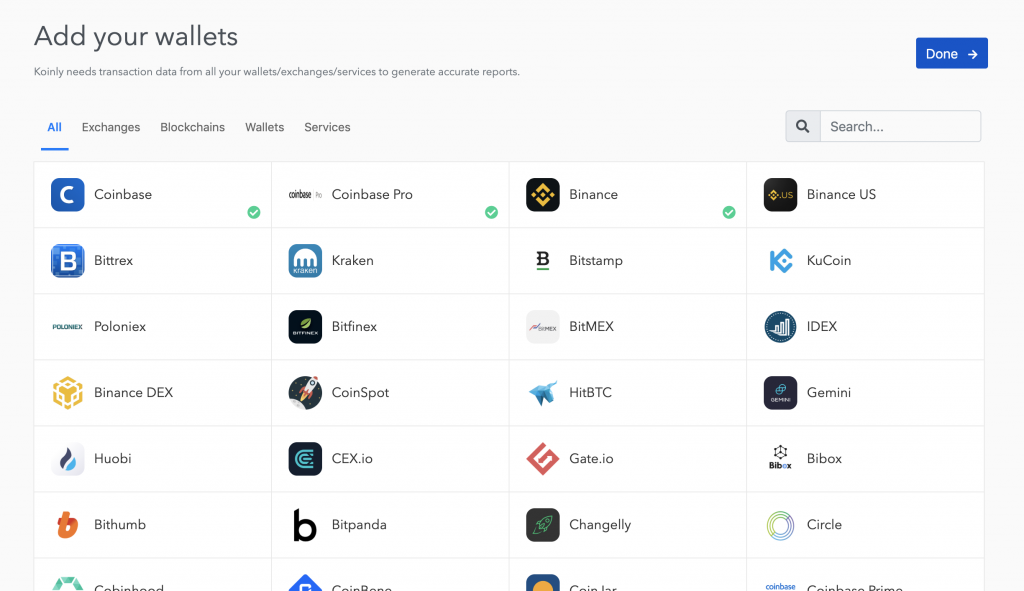

It’s so simple to enroll for an account on Koinly. As soon as a consumer has signed up for an account, they’ll use Koinly’s in depth performance to sync all of the crypto wallets, exchanges, or blockchains they use, with Koinly, through API or CSV file add. As a substitute of manually calculating tax charges and formulation to determine tax, let Koinly calculate the taxes for you. It shortly calculates good points and losses and Bitcoin earnings and bills inside minutes.

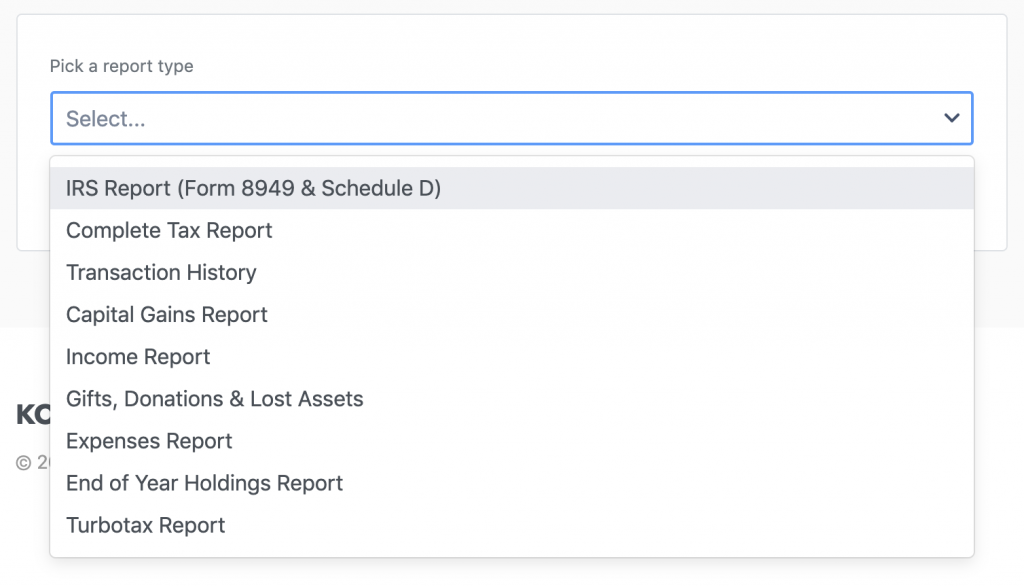

The consumer can even head to the tax studies web page in Koinly to see a abstract of their Bitcoin taxes. Scrolling down on the web page will assist the consumer discover the kind of tax report they want. They will obtain a selected kind of tax report based mostly on their nation – just like the IRS Kind 8949 and Schedule D for reporting Bitcoin good points for American buyers or the HMRC Capital Beneficial properties Abstract Kind for reporting Bitcoin good points for UK buyers. Koinly may even generate tax studies for tax apps like TurboTax and TaxAct.

To study extra about crypto taxes in 2022 try Koinly immediately.

This can be a sponsored submit. Discover ways to attain our viewers right here. Learn disclaimer under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.