All is quiet on the American entrance because the week involves a detailed, at the same time as Korea JoongAng Every day studies {that a} high-ranking Chinese language commerce official from the Ministry of Finance was noticed on the U.S. Treasury Division headquarters in Washington, D.C. earlier at present. The assembly between Chinese language and U.S. officers comes on the eve of a commerce conflict shock now ripping throughout the Pacific, with the Port of Los Angeles set to be the primary hit. Excessive-frequency knowledge suggests the influence will start sooner or later subsequent week and intensify with every passing week.

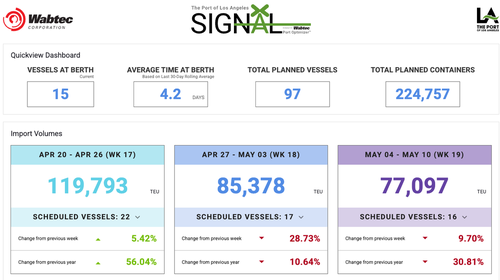

On the eve of a commerce conflict shock, knowledge from Port Optimizer—a monitoring system utilized by vessel operators—exhibits that scheduled import volumes into the Port of Los Angeles are set to start plunging subsequent week and will collapse by mid-month.

Goldman analyst Jacob Malmstrom has just a few charts for us to finish the week:

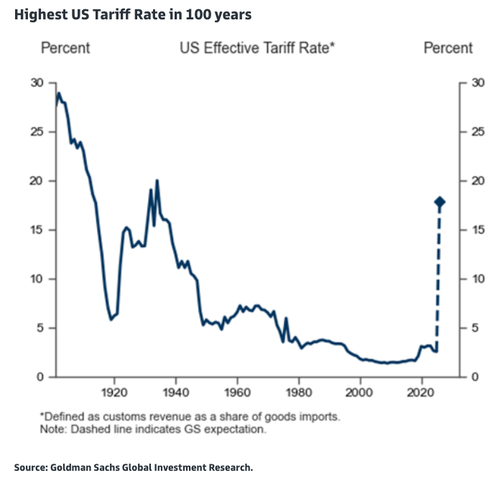

Geopolitical tensions easing main markets increased for the week however the place the efficient tariff price presently is the best it has been in 100 years.

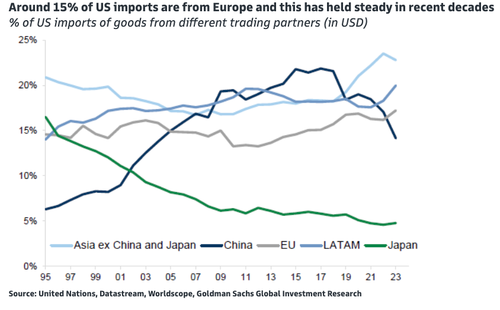

With globalisation the commerce development has grown considerably within the final 60 yr however present U.S. imports from Europe they’ve hovered round 15% in current many years.

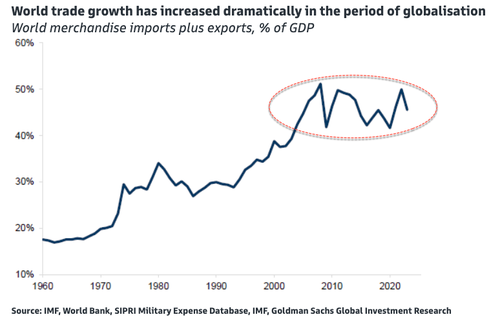

World commerce development has elevated dramatically within the interval of globalisation

In markets, Malmstrom warned:

Tough to provide you with a basic bull-case from right here long term. Nonetheless must see any of those 4 situations met for a sustainable restoration: 1) Enticing valuations ,2) Excessive positioning easing, 3) Coverage Assist, 4) Sense that the second spinoff of development is bettering. When valuations within the U.S. they give the impression of being extra justified when evaluating to ROE. Banks sold-off at first of the yr however has rebounded whereas Mega-cap tech has continued its decline. Lastly earnings to this point has been in-line with the historic common.

Our protection particulars the occasions which have unfolded this month in set off the commerce conflict shock—one which’s already hitting China and is now set to scrub ashore momentarily within the U.S.:

Excessive-frequency knowledge from the Port of Los Angeles suggests a considerable influence on Chinese language exports to the U.S. will start subsequent week, primarily because of the lag between manufacturing unit shutdowns or halted shipments in China—triggered by the 145% tariffs—and the time it takes for containerized freight to cross the Pacific on huge cargo ships.

The bulleted record above outlines what would possibly come subsequent: downward stress throughout the trucking trade in Southern California and the Empire Inland warehouse district. As Goldman famous earlier, inventories for a lot of firms are within the 2–3 month vary however might be depleted rapidly if panic shopping for units in as soon as customers turn into conscious of Port of Los Angeles disruptions. There may even be a short-term spike in inflation this summer season, although it will doubtless show transitory.