A Decentralised Autonomous Organisation (DAO) is like ‘an Web-based group with a shared checking account’. You possibly can consider it as a mutual fund the place as an alternative of a central supervisor, the individuals determine on the funding and different selections. DAOs exist solely on a blockchain and their guidelines are coded in ‘sensible contracts’. Since DAOs run on public blockchains, anybody can verify and confirm all of the monetary transactions made by the DAO.

Members of a DAO do not need to belief one another – they need to belief the code.

My favourite DAOs are:

- Aave

- Compound

- Decred

- Maker

- Uniswap

The DAO Hack

DAOs didn’t begin off too nicely. The primary-ever DAO was ‘hacked’ and in the end led to the unique Ethereum community splitting into two.

Shocked? Let’s return to 2016.

The primary DAO raised about $150 million value of Ether (ETH) by means of a token sale. However a hacker exploited a bug within the “sensible contract” and siphoned out all the cash!

Now, logically nothing ought to have been performed about this. Blockchains are ‘immutable’ and ‘censorship-resistant’ proper? However a ‘laborious fork’ was carried out. This rolled again Ethereum’s historical past to earlier than the hack.

This reallocated the hacked ETH to a special ‘sensible contract’ and allowed buyers to withdraw their funds. The ‘purists’ hated this and that is what led to Ethereum splitting into 2 blockchains: Ethereum and Ethereum Basic.

![]() 1. AAVE

1. AAVE

Governance Token: AAVE

Max provide: 16 million

The Aave protocol permits the lending and borrowing of crypto. Lenders deposit digital belongings into liquidity swimming pools. Debtors put up crypto collateral and take ‘flash loans’ utilizing the liquidity swimming pools.

As a token, it offers holders discounted charges and likewise serves as a governance token by giving holders a vote within the protocol’s improvement.

Customers can take part within the mission’s governance course of by holding AAVE tokens and /or stkAAVE (staked AAVE).

![]()

2. Compound

Governance Token: COMP

Max provide: 10 million

Compound is a Decentralised Finance (DeFi) lending protocol that allows depositors to earn curiosity on their cryptos. It additionally permits debtors to take secured loans by depositing collateral.

The protocol distributes 2,312 COMP each day as rewards to energetic lenders and debtors. In essence, customers are likely to accrue COMP tokens as they take part within the lending and borrowing economic system of the Compound ecosystem.

Anybody can autonomously create proposals by locking 100 COMP in an handle. The proposal can relate to adjustments in:

- The belongings’ collateral issue

- Rate of interest fashions

- Addition or elimination of markets

- Different parameters utilized by the Compound protocol

A proposal is taken into account for voting if the proposer’s handle is delegated 65,000 COMP. After a three-day voting course of, proposals with at the very least 400,000 optimistic votes are queued for 2 days earlier than being carried out.

![]()

3. Decred

Governance Token: DCR

Max provide: 21 million

Decred is a blockchain that makes use of a hybrid consensus mechanism. To vote, customers ‘timelock’ their DCR to buy tickets which can be utilized each for on-chain and off-chain voting.

For on-chain voting, the protocol randomly selects 5 tickets to evaluation the newest block created by the miners. A block is finalised if at the very least 3 of the 5 tickets vote that the block is legitimate. After the voting, the DCR is unlocked and returned together with the reward.

Off-chain voting is completed on the Politeia platform. This may relate to spending the platform’s treasury funds and adjustments to the constitutions and insurance policies. The data, proposals, and actions are periodically anchored to the Decred blockchain.

![]()

4. MakerDAO

Governance Token: MKR

Max provide: Limitless

MakerDAO is a decentralised organisation whereas Maker Protocol is a software program platform, that permits customers to difficulty and handle the DAI stablecoin. Maker (MKR) is the governance token of the MakerDAO and Maker Protocol.

MKR is minted & burnt relying on the debt standing of MakerDAO. If the monetary assets of the protocol can not cowl its debt, new tokens are minted. If there’s a surplus, tokens are burned.

To vote on proposals customers have to personal MKR, or have it delegated to themselves. Then that you must create a voting contract and lock MKR tokens in it.

![]() 5. Uniswap

5. Uniswap

Governance Token: UNI

Max provide: 1 billion

Uniswap is a extremely popular decentralised buying and selling protocol for Ethereum tokens. It’s an automatic market maker and UNI is its governance token.

UNI holders collectively management:

- Uniswap governance

- UNI group treasury

- The protocol payment swap

- Uniswap.eth ENS identify

- Uniswap Default Listing (tokens.uniswap.eth)

- SOCKS liquidity tokens

Future DAO Index

A crypto index is a mathematical technique for monitoring the efficiency of a bunch of crypto belongings. Refined buyers use Indexes to make higher selections.

The Future DAO Index is a market capitalisation index primarily based on:

1. Aave (AAVE)

2. Compound (COMP)

3. Curve DAO Token (CRV)

4. Sprint (DASH)

5. Decred (DCR)

6. Maker (MKR)

7. SushiSwap (SUSHI)

8. Uniswap (UNI)

The bottom date of the Future DAO Index was Thursday, twenty fourth February 2022.

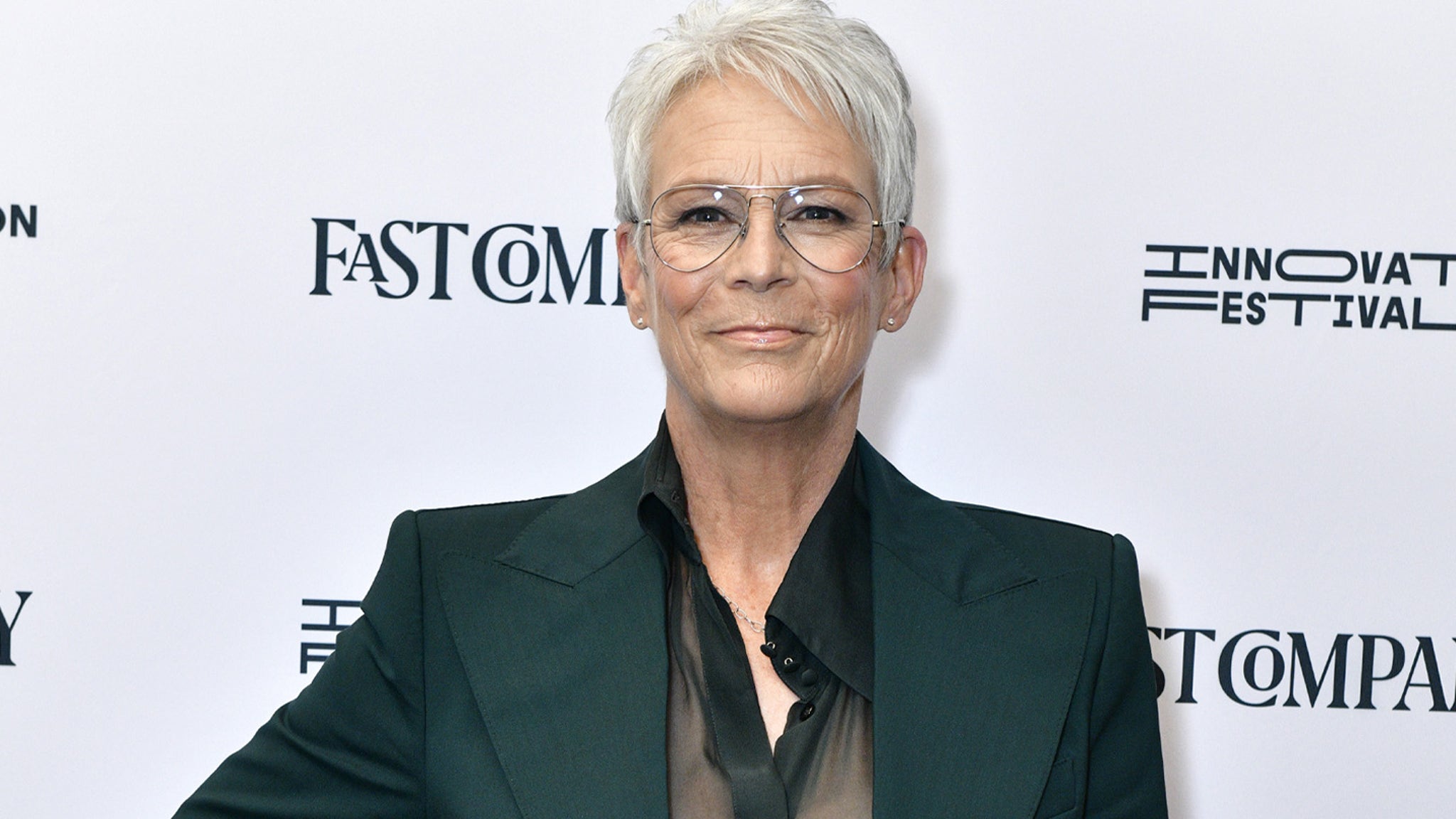

Rohas Nagpal is the creator of the Future Cash Playbook and Chief Blockchain Architect on the Wrapped Asset Venture. He’s additionally an newbie boxer and a retired hacker. You possibly can comply with him on LinkedIn.

Cryptocurrency is an unregulated digital foreign money, not a authorized tender and topic to market dangers. The data supplied within the article isn’t meant to be and doesn’t represent monetary recommendation, buying and selling recommendation or another recommendation or suggestion of any type supplied or endorsed by NDTV. NDTV shall not be liable for any loss arising from any funding primarily based on any perceived suggestion, forecast or another info contained within the article.