Spreadsheet information up to date every day

Up to date on April 18th, 2022 by Bob Ciura

Particular person merchandise, companies, and even whole industries (newspapers, typewriters, horse and buggy) exit of favor and change into out of date.

Maybe greater than every other business, agriculture is right here to remain. Agriculture began round 14,000 years in the past. It’s a protected wager we will probably be training agriculture far into the longer term.

And, the expansion of the worldwide inhabitants is tied to rising agricultural effectivity. The agricultural revolution allowed larger inhabitants progress (and led to the economic revolution).

As the worldwide inhabitants grows, so does the necessity for improved agricultural manufacturing. This creates a long-term demand driver for agriculture shares.

You’ll be able to obtain the whole checklist of all 43 agriculture shares (together with vital monetary metrics similar to price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the hyperlink under:

The agriculture shares checklist was derived from two main exchange-traded funds. These are the AgTech & Meals Innovation ETF (KROP) and the iShares International Agriculture Index ETF (COW).

Investing in farm and agriculture shares means investing in an business that:

- Has steady long-term demand

- Has withstood the take a look at of time, and is extraordinarily more likely to be round far into the longer term

- Advantages from advancing know-how

This text analyzes 7 of the very best agriculture shares intimately. You’ll be able to rapidly navigate the article utilizing the desk of contents under.

Desk of Contents

We have now ranked our 7 favourite agriculture shares under. The shares are ranked based on anticipated returns over the subsequent 5 years, so as of lowest to highest.

Even higher, all 7 agriculture shares pay dividends to shareholders, making them enticing for revenue traders. traders ought to view this as a beginning off level to extra analysis.

Agriculture Inventory #7: Tractor Provide Firm (TSCO)

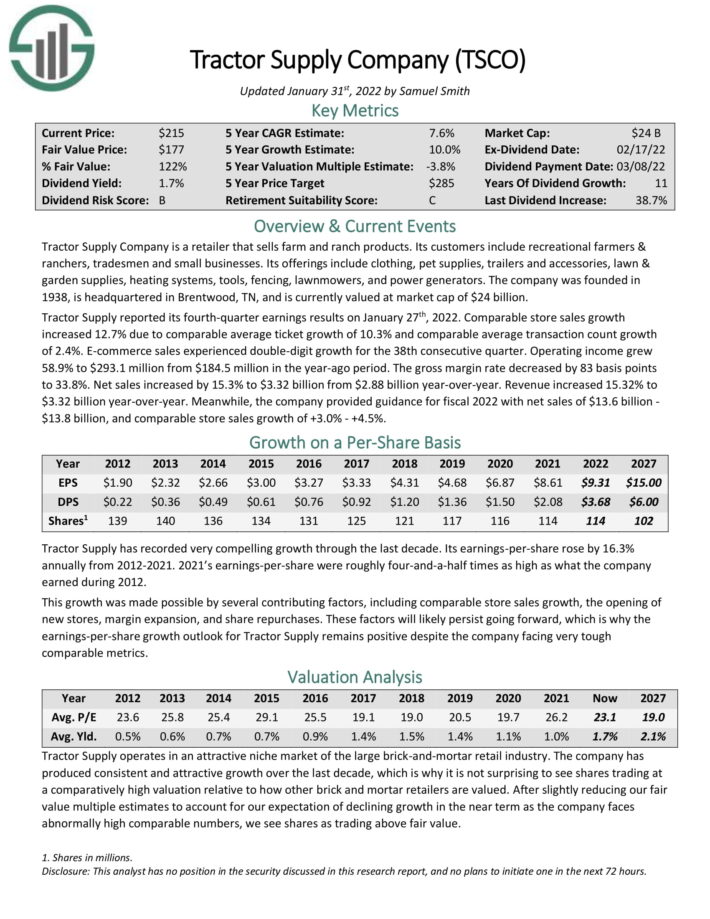

Tractor Provide Firm is a retailer that sells farm and ranch merchandise. Its prospects embrace leisure farmers & ranchers, tradesmen and small companies. Its choices embrace clothes, pet provides, trailers and equipment, garden & backyard provides, heating programs, instruments, fencing, lawnmowers, and energy mills.

Tractor Provide reported its fourth-quarter earnings outcomes on January twenty seventh, 2022. Comparable retailer gross sales progress elevated 12.7% because of comparable common ticket progress of 10.3% and comparable common transaction depend progress of two.4%. E-commerce gross sales skilled double-digit progress for the thirty eighth consecutive quarter. Working revenue grew 58.9% to $293.1 million from $184.5 million within the year-ago interval.

Supply: Investor Presentation

Internet gross sales elevated by 15.3% to $3.32 billion from $2.88 billion year-over-year. Income elevated 15.32% to $3.32 billion year-over-year. In the meantime, the corporate supplied steerage for fiscal 2022 with internet gross sales of $13.6 billion to $13.8 billion, and comparable retailer gross sales progress of three.0% to 4.5%.

We anticipate annual returns of 6.3% per yr, because of 10% anticipated EPS progress, the 1.6% dividend yield, and a -5.3% annual discount from a declining P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Tractor Provide (preview of web page 1 of three proven under):

Agriculture Inventory #6: Federal Agricultural Mortgage Firm (AGM)

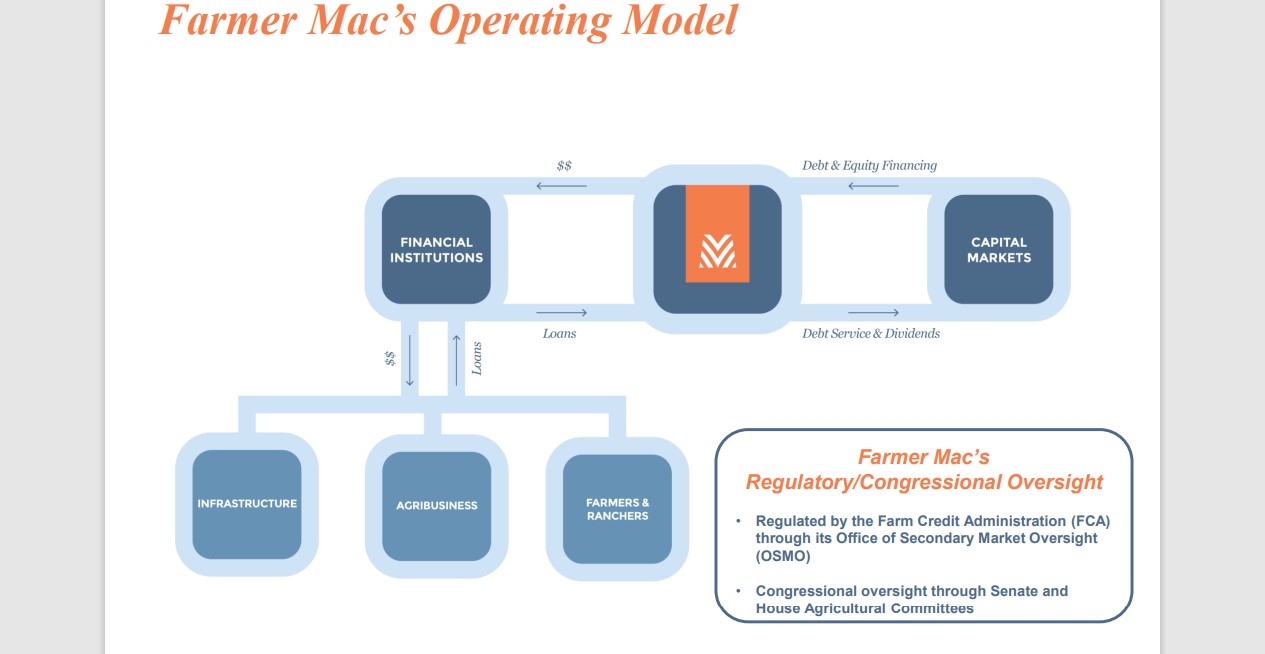

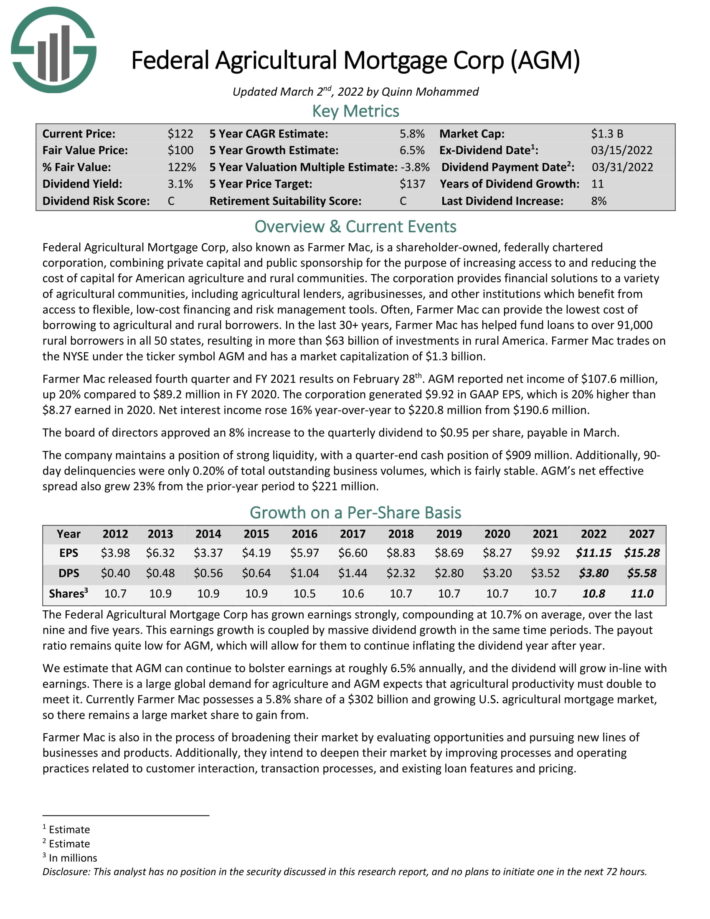

Federal Agricultural Mortgage Corp, also referred to as Farmer Mac, is a shareholder-owned, federally chartered company, combining personal capital and public sponsorship for the aim of accelerating entry to and lowering the price of capital for American agriculture and rural communities.

Supply: Investor Presentation

The company offers monetary options to a wide range of agricultural communities, together with agricultural lenders, agribusinesses, and different establishments which profit from entry to versatile, low-cost financing and danger administration instruments.

Usually, Farmer Mac can present the bottom value of borrowing to agricultural and rural debtors. Within the final 30+ years, Farmer Mac has helped fund loans to over 91,000 rural debtors in all 50 states, leading to greater than $63 billion of investments in rural America.

Farmer Mac launched fourth quarter and FY 2021 outcomes on February twenty eighth. AGM reported internet revenue of $107.6 million, up 20% in comparison with $89.2 million in FY 2020. The company generated $9.92 in GAAP EPS, which is 20% increased than $8.27 earned in 2020. Internet curiosity revenue rose 16% year-over-year to $220.8 million from $190.6 million.

We anticipate annual returns of 8.0% per yr, consisting of 6.5% anticipated EPS progress, the three.5% dividend yield, and a -2% discount because of a declining P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGM (preview of web page 1 of three proven under):

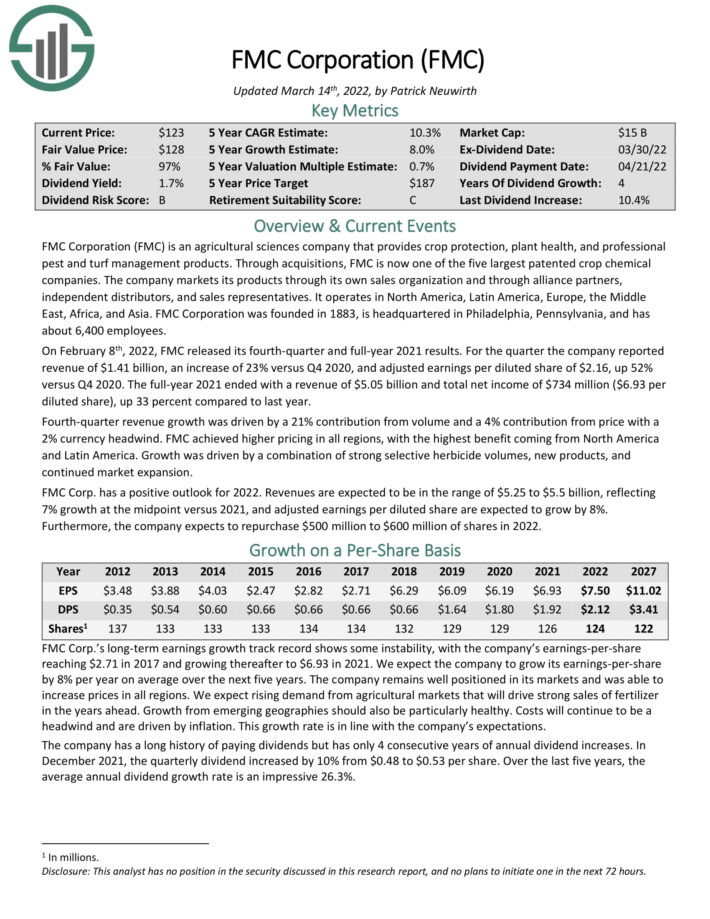

Agriculture Inventory #5: FMC Company (FMC)

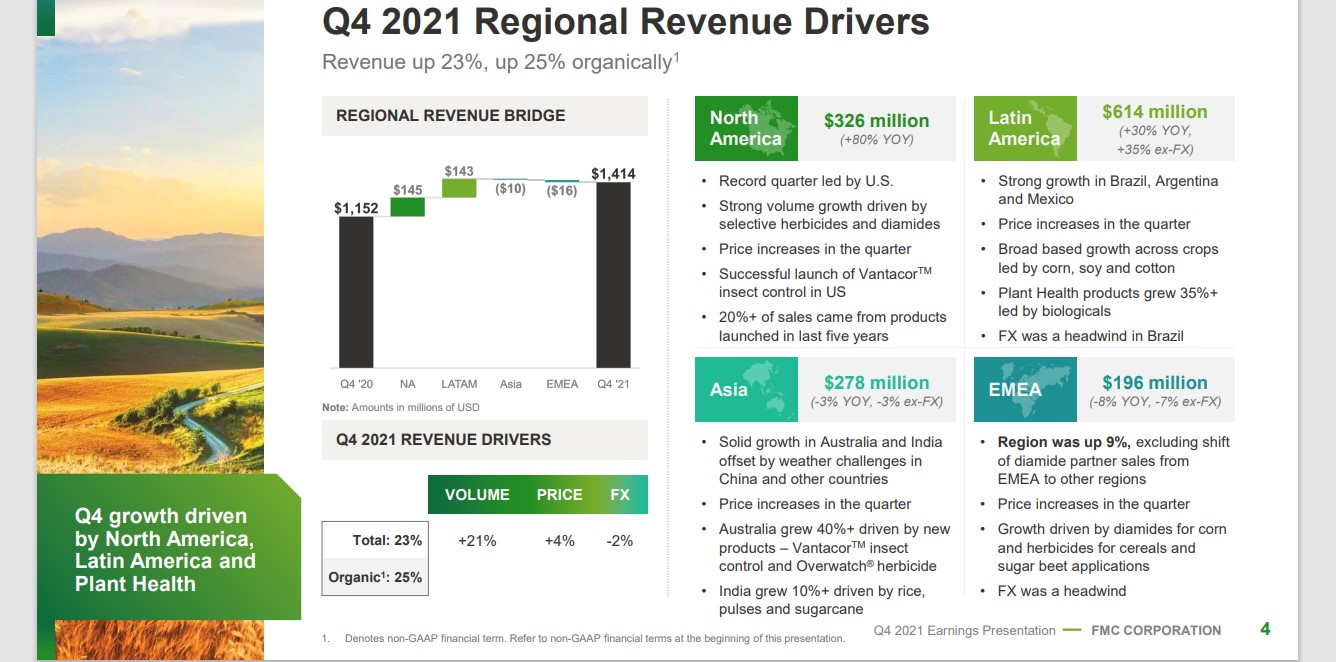

FMC Company is an agricultural sciences firm that gives crop safety, plant well being, {and professional} pest and turf administration merchandise. By way of acquisitions, FMC is now one of many 5 largest patented crop chemical corporations.

The corporate markets its merchandise by way of its personal gross sales group and thru alliance companions, impartial distributors, and gross sales representatives. It operates in North America, Latin America, Europe, the Center East, Africa, and Asia.

On February eighth, 2022, FMC launched its fourth-quarter and full-year 2021 outcomes.

Supply: Investor Presentation

For the quarter the corporate reported income of $1.41 billion, a rise of 23% versus This autumn 2020, and adjusted earnings per diluted share of $2.16, up 52% versus This autumn 2020. The total-year 2021 ended with a income of $5.05 billion and whole internet revenue of $734 million ($6.93 per diluted share), up 33 % in comparison with final yr.

We anticipate annual returns of 8.1% per yr, pushed nearly solely by 8% anticipated EPS progress. Dividends are anticipated to be offset by a declining P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMC (preview of web page 1 of three proven under):

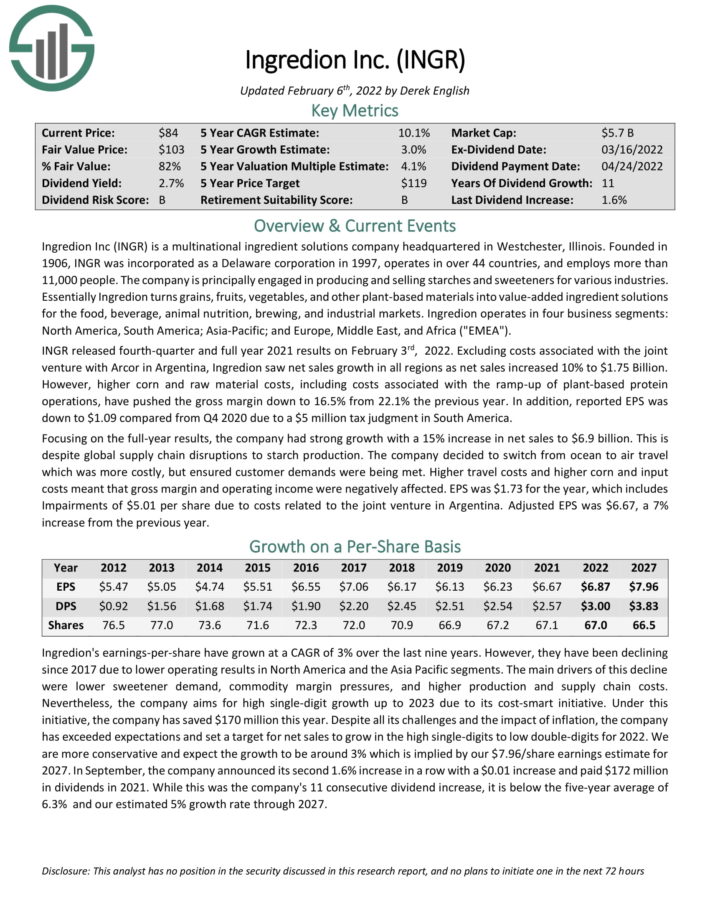

Agriculture Inventory #4: Ingredion Inc. (INGR)

Ingredion is a multinational ingredient options firm headquartered in Westchester, Illinois. Based in 1906, INGR was integrated as a Delaware company in 1997, operates in over 44 nations, and employs greater than 11,000 individuals. The corporate is principally engaged in producing and promoting starches and sweeteners for numerous industries.

Supply: Investor Presentation

Basically Ingredion turns grains, fruits, greens, and different plant-based supplies into value-added ingredient options for the meals, beverage, animal diet, brewing, and industrial markets. Ingredion operates in 4 enterprise segments: North America, South America; Asia-Pacific; and Europe, Center East, and Africa (“EMEA”).

INGR launched fourth-quarter and full yr 2021 outcomes on February third, 2022. Excluding prices related to the three way partnership with Arcor in Argentina, Ingredion noticed internet gross sales progress in all areas as internet gross sales elevated 10% to $1.75 Billion.

Nonetheless, increased corn and uncooked materials prices, together with prices related to the ramp-up of plant-based protein operations, have pushed the gross margin right down to 16.5% from 22.1% the earlier yr. As well as, reported EPS was right down to $1.09 in contrast from This autumn 2020 because of a $5 million tax judgment in South America.

Complete returns are estimated at 8.9% per yr, pushed by 3% anticipated EPS progress, the two.9% dividend yield, and a 3% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ingredion (preview of web page 1 of three proven under):

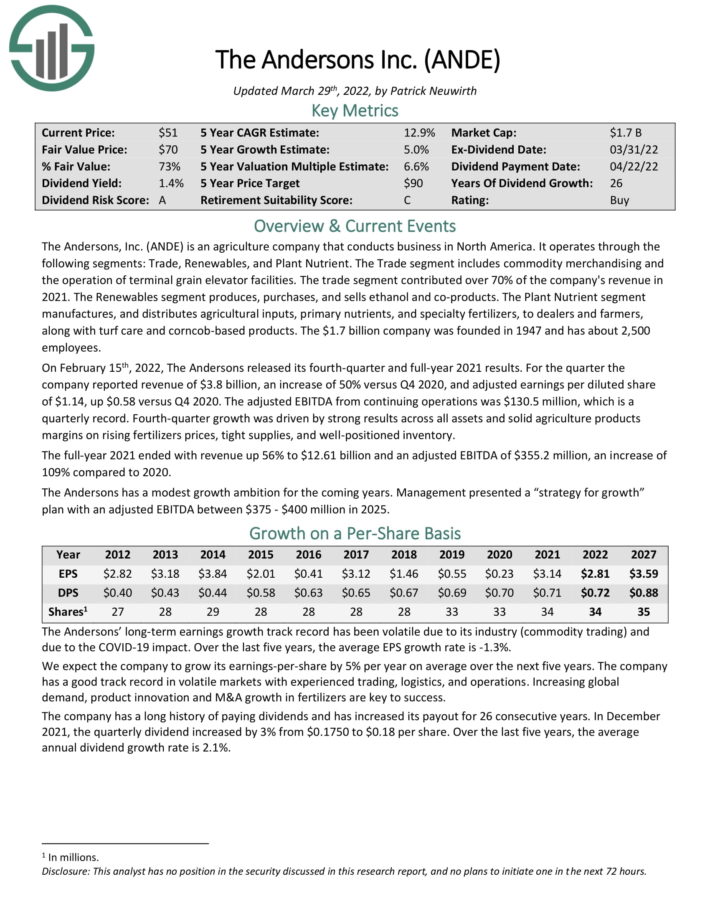

Agriculture Inventory #3: The Andersons Inc. (ANDE)

The Andersons, Inc. is an agriculture firm that conducts enterprise in North America. It operates by way of the next segments: Commerce, Renewables, and Plant Nutrient. The Commerce phase contains commodity merchandising and the operation of terminal grain elevator services. The commerce phase contributed over 70% of the corporate’s income in 2021.

In the newest quarter, income of $3.8 billion elevated 50% versus This autumn 2020, and adjusted earnings per diluted share of $1.14, up $0.58 versus This autumn 2020. Development was pushed by sturdy outcomes throughout all property and strong agriculture merchandise margins on rising fertilizers costs and tight provide.

The corporate has an extended historical past of paying dividends and has elevated its payout for 26 consecutive years. Shares at the moment yield 1.5%. Complete returns are estimated at 9.9% per yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on ANDE (preview of web page 1 of three proven under):

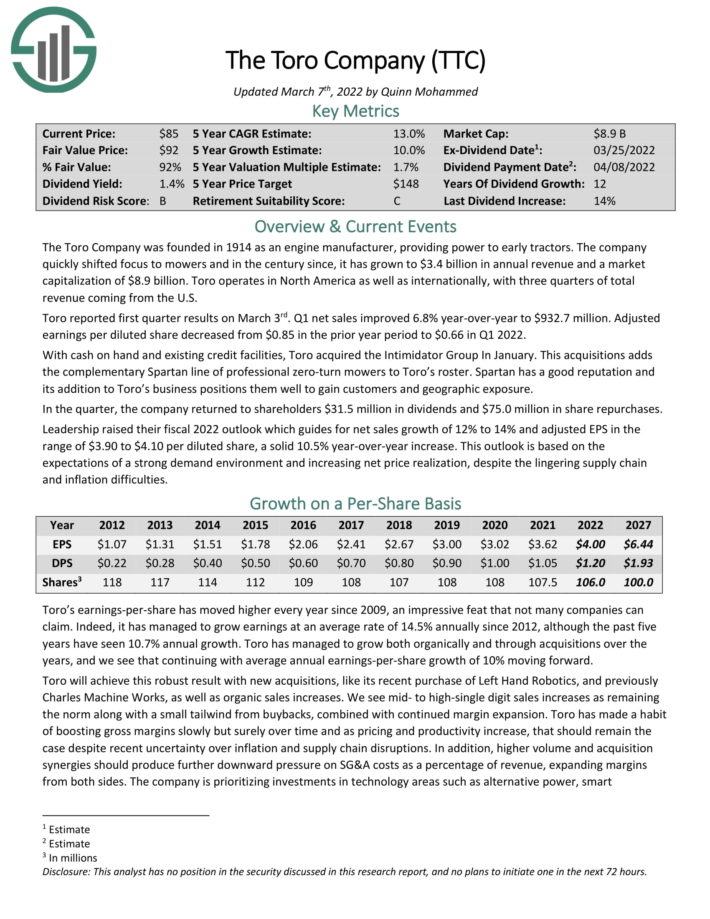

Agriculture Inventory #2: The Toro Firm (TTC)

The Toro Firm was based in 1914 as an engine producer, offering energy to early tractors. The corporate rapidly shifted focus to mowers and within the century since, it has grown to $3.4 billion in annual income. Toro operates in North America in addition to internationally, with three quarters of whole income coming from the U.S.

Toro reported first quarter outcomes on March third. Q1 internet gross sales improved 6.8% year-over-year to $932.7 million. Adjusted earnings per diluted share decreased from $0.85 within the prior yr interval to $0.66 in Q1 2022. With money available and present credit score services, Toro acquired the Intimidator Group in January.

This acquisitions provides the complementary Spartan line {of professional} zero-turn mowers to Toro’s roster. Spartan has repute and its addition to Toro’s enterprise positions them nicely to realize prospects and geographic publicity.

We anticipate annual returns of 13.4% per yr over the subsequent 5 years, pushed by 10% EPS progress, the 1.4% dividend yield, and a 2% annual increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on The Toro Firm (preview of web page 1 of three proven under):

Agriculture Inventory #1: Scotts Miracle-Gro (SMG)

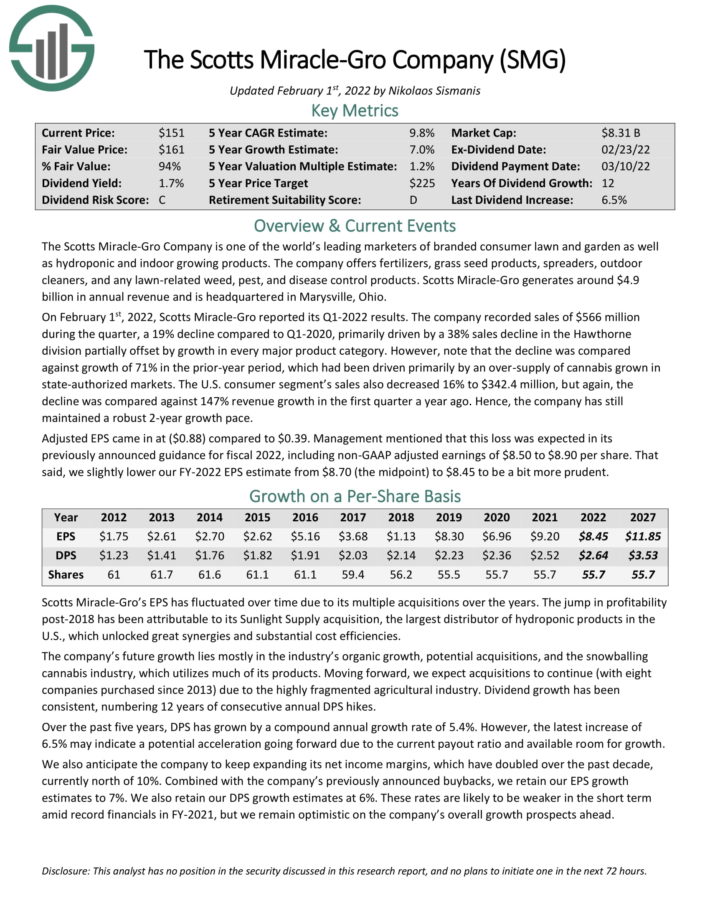

The Scotts Miracle-Gro Firm is likely one of the world’s main entrepreneurs of branded shopper garden and backyard in addition to hydroponic and indoor rising merchandise. The corporate gives fertilizers, grass seed merchandise, spreaders, out of doors cleaners, and any lawn-related weed, pest, and illness management merchandise. Scotts Miracle-Gro generates round $4.9 billion in annual income and is headquartered in Marysville, Ohio.

Supply: Investor Presentation

On February 1st, 2022, Scotts Miracle-Gro reported its Q1-2022 outcomes. The corporate recorded gross sales of $566 million in the course of the quarter, a 19% decline in comparison with Q1-2020, primarily pushed by a 38% gross sales decline within the Hawthorne division partially offset by progress in each main product class.

Nonetheless, observe that the decline was in contrast towards progress of 71% within the prior-year interval, which had been pushed primarily by an over-supply of hashish grown in state-authorized markets. The U.S. shopper phase’s gross sales additionally decreased 16% to $342.4 million, however once more, the decline was in contrast towards 147% income progress within the first quarter a yr in the past.

We anticipate annual returns of 16.2% per yr, pushed by anticipated EPS progress of seven%, the two.3% dividend yield and a large increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Scotts Miracle-Gro (preview of web page 1 of three proven under):

Ultimate Ideas

Agriculture shares are a compelling place to search for long-term inventory investments. That’s as a result of the demand drivers of the business make it extraordinarily more likely to be round far into the longer term.

We imagine the 7 agriculture shares examined on this article are the very best throughout the business.

Of those, Scotts Miracle-Gro, Toro, and The Andersons stand above the remaining from a top quality perspective due to their sturdy enterprise fashions, enticing dividend yields, and long-term dividend progress potential.

At Certain Dividend, we regularly advocate for investing in corporations with a excessive likelihood of accelerating their dividends each yr.

If that technique appeals to you, it might be helpful to flick thru the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].