Updated on March 24th, 2023 by Bob Ciura

To invest in great businesses, you have to find them first. Carl Icahn is an expert at this, with an equity investment portfolio worth more than $22 billion, as of the end of the 2022 fourth quarter.

Carl Icahn’s portfolio is filled with quality stocks. You can ‘cheat’ from Carl Icahn stocks to find picks for your portfolio. That’s because institutional investors are required to periodically show their holdings in a 13F filing.

You can see all 15 Carl Icahn stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Notes: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

This article analyzes Carl Icahn’s 15 stocks based on information disclosed in his Q4 2022 13F filing.

Table of Contents

You can skip to a specific section with the table of contents below. Stocks are listed by percentage of the total portfolio, from highest to lowest.

Carl Icahn & Dividend Stocks

Carl Icahn has grown his wealth by investing in and acquiring businesses with strong competitive advantages trading at fair or better prices.

Most investors know Carl Icahn looks for attractive stocks, but few know the degree to which he invests in dividend stocks:

- 11 out of the 15 Carl Icahn stocks pay dividends

- His top 5 holdings have an average dividend yield of 5.3% (and make up 91% of his portfolio)

- His investment firm, Icahn Enterprises, is structured as an MLP and pays its own investors a double-digit yield.

Keep reading this article to see Carl Icahn’s 15 stock selections analyzed in greater detail.

#1: Icahn Enterprises L.P. (IEP)

Dividend Yield: 10.5%

Percent of Carl Icahn’s Portfolio: 71.9%

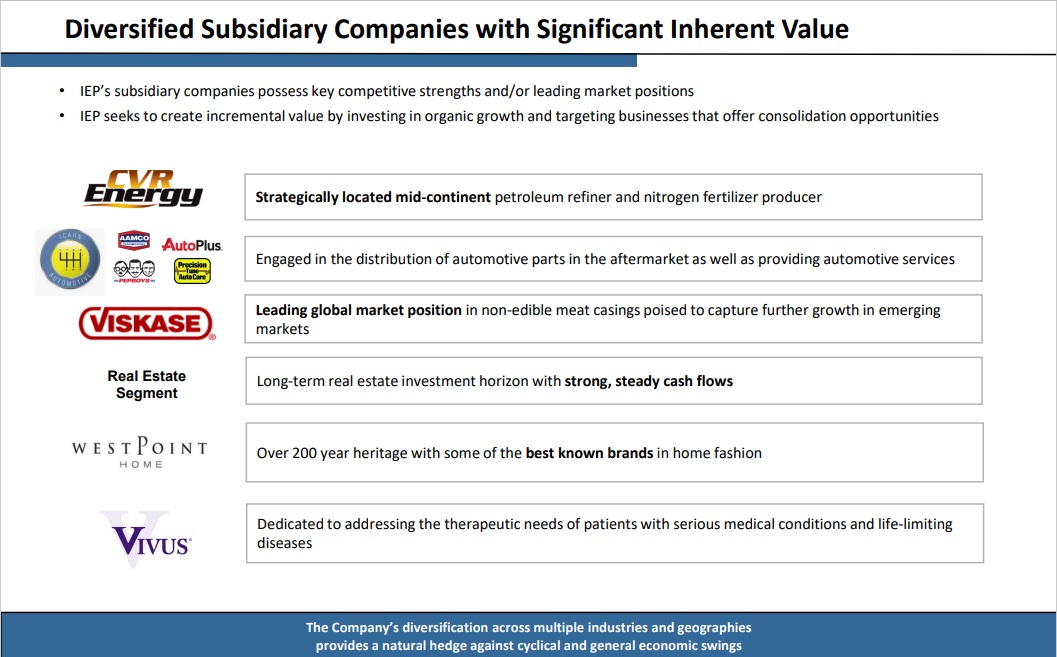

Icahn Enterprises L.P. operates in investment, energy, automotive, food packaging, metals, real estate and home fashion businesses in the United States and Internationally. The company’s Investment segment focuses on finding undervalued companies to allocate capital through its various private investment funds.

Source: Investor Presentation

Carl Icahn owns 100% of Icahn Enterprises GP, the general partner of Icahn Enterprises and Icahn Enterprises Holdings, and approximately 87% of Icahn Enterprises’ outstanding shares.

On February 24th, 2022, Icahn Enterprises reported its Q4-2022 and full-year results for the period ending December 31st, 2022. For the quarter, revenues came in at $3.1 billion, 34.2% higher year-over-year, while the loss per unit was $0.74, versus the loss per unit of 1.72 in Q4-2021. Improved revenue results were due to Icahn’s investments recording better results compared to last year. For FY2022, the company posted a GAAP net income per unit of $0.57.

Click here to download our most recent Sure Analysis report on IEP (preview of page 1 of 3 shown below):

#2: CVR Energy Inc. (CVI)

Dividend Yield: 4.9%

Percent of Carl Icahn’s Portfolio: 10.7%

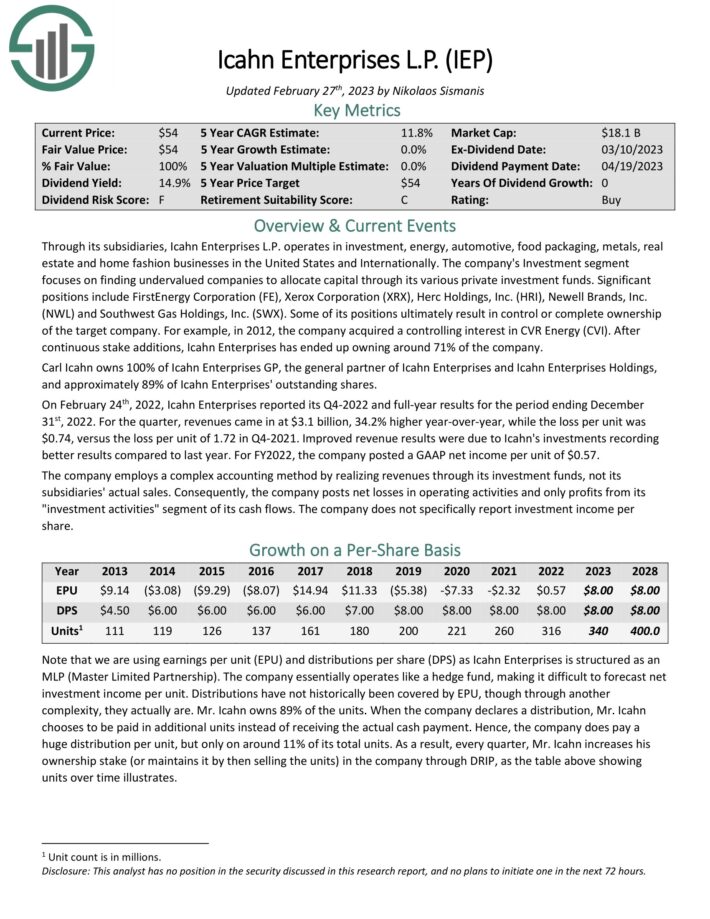

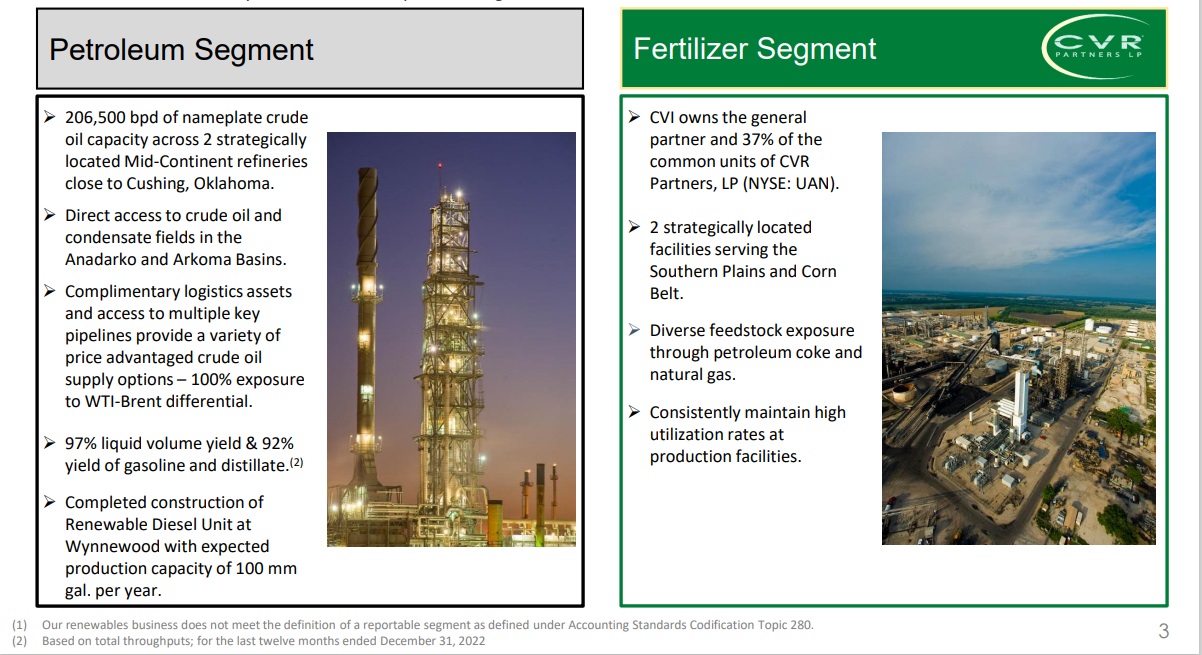

CVR Energy is a diversified holding company primarily engaged in the renewable fuels and petroleum refining and marketing businesses, as well as in the nitrogen fertilizer manufacturing business through its interest in CVR Partners, LP. CVR Energy subsidiaries serve as the general partner and own 37% of the common units of CVR Partners.

Source: Investor Presentation

For full-year 2022, the company reported net income of $463 million, or $4.60 per diluted share, on net sales of $10.9 billion, compared to net income for full-year 2021 of $25 million, or 25 cents per diluted share, on net sales of $7.2 billion. Adjusted earnings for full-year 2022 was $6.04 per diluted share compared to an adjusted loss of 93 cents per diluted share in full-year 2021, primarily driven by improved crack spreads.

It also increased quarterly cash dividend to 50 cents for the fourth quarter 2022, bringing the cumulative cash dividends declared for 2022 to $5.30 per share, including special dividends.

#3: Firstenergy Corp. (FE)

Dividend Yield: 3.9%

Percent of Carl Icahn’s Portfolio: 3.4%

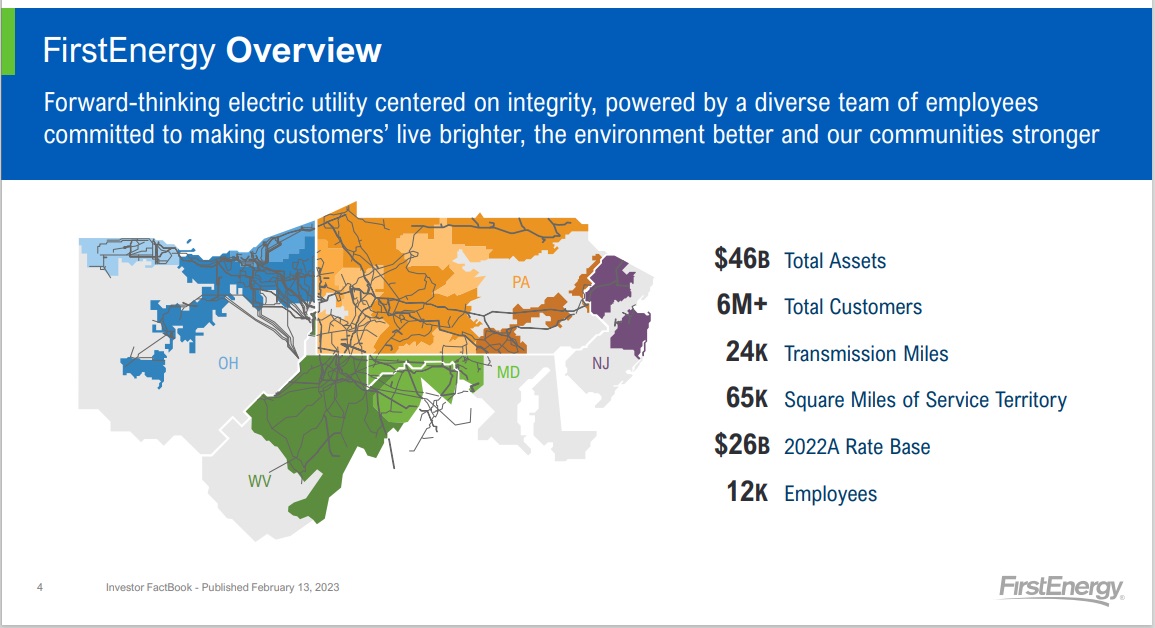

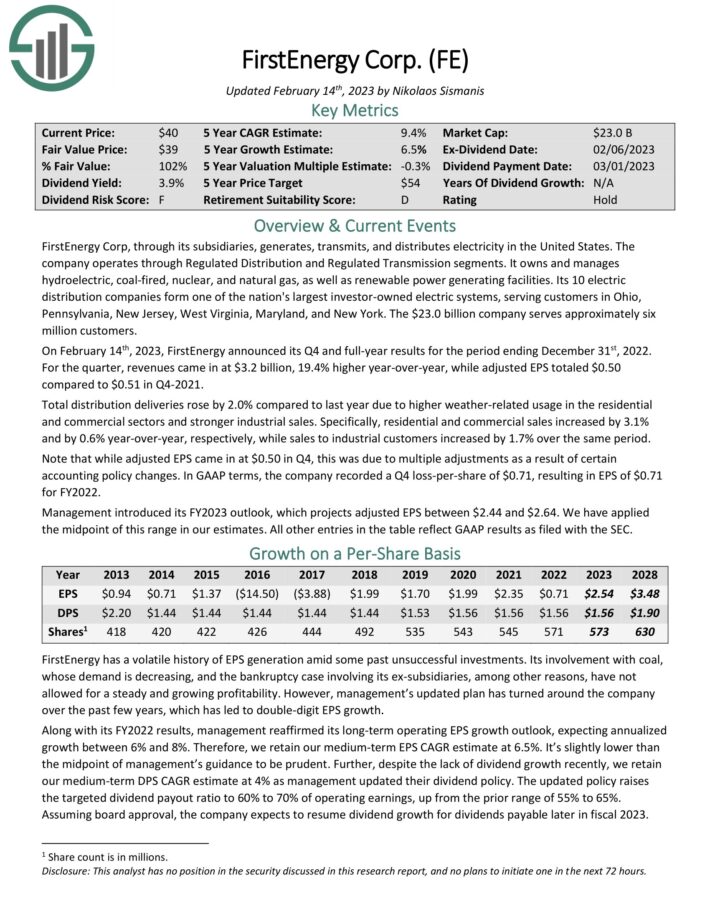

FirstEnergy Corp, through its subsidiaries, generates, transmits, and distributes electricity in the United States. The company operates through Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and natural gas, as well as renewable power generating facilities.

Its 10 electric distribution companies form one of the nation’s largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The $23.0 billion company serves approximately six million customers.

Source: Investor Presentation

On February 14th, 2023, FirstEnergy announced its Q4 and full-year results for the period ending December 31st, 2022. For the quarter, revenues came in at $3.2 billion, 19.4% higher year-over-year, while adjusted EPS totaled $0.50

compared to $0.51 in Q4-2021. Total distribution deliveries rose by 2.0% compared to last year due to higher weather-related usage in the residential and commercial sectors and stronger industrial sales.

Specifically, residential and commercial sales increased by 3.1% and by 0.6% year-over-year, respectively, while sales to industrial customers increased by 1.7% over the same period. Note that while adjusted EPS came in at $0.50 in Q4, this was due to multiple adjustments as a result of certain accounting policy changes.

In GAAP terms, the company recorded a Q4 loss-per-share of $0.71, resulting in EPS of $0.71 for FY 2022. Management introduced its FY2023 outlook, which projects adjusted EPS between $2.44 and $2.64.

Click here to download our most recent Sure Analysis report on FE (preview of page 1 of 3 shown below):

#4: Xerox Holdings (XRX)

Dividend Yield: 5.8%

Percent of Carl Icahn’s Portfolio: 2.6%

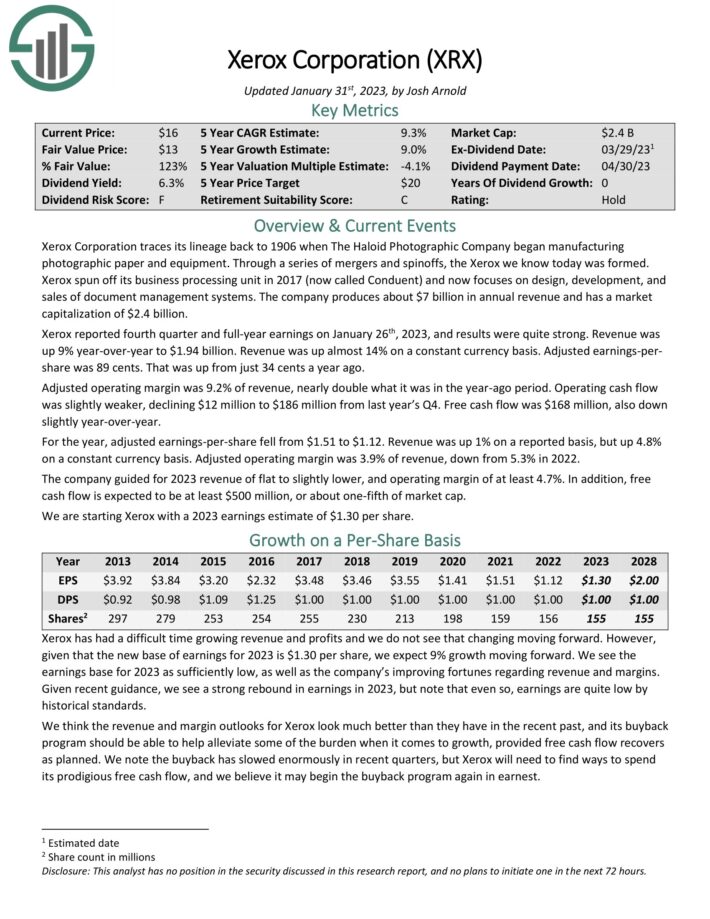

Xerox Corporation traces its lineage back to 1906 when The Haloid Photographic Company began manufacturing photographic paper and equipment. Through a series of mergers and spinoffs, the Xerox we know today was formed.

Xerox spun off its business processing unit in 2017 (now called Conduent) and now focuses on design, development, and sales of document management systems. The company produces about $7 billion in annual revenue.

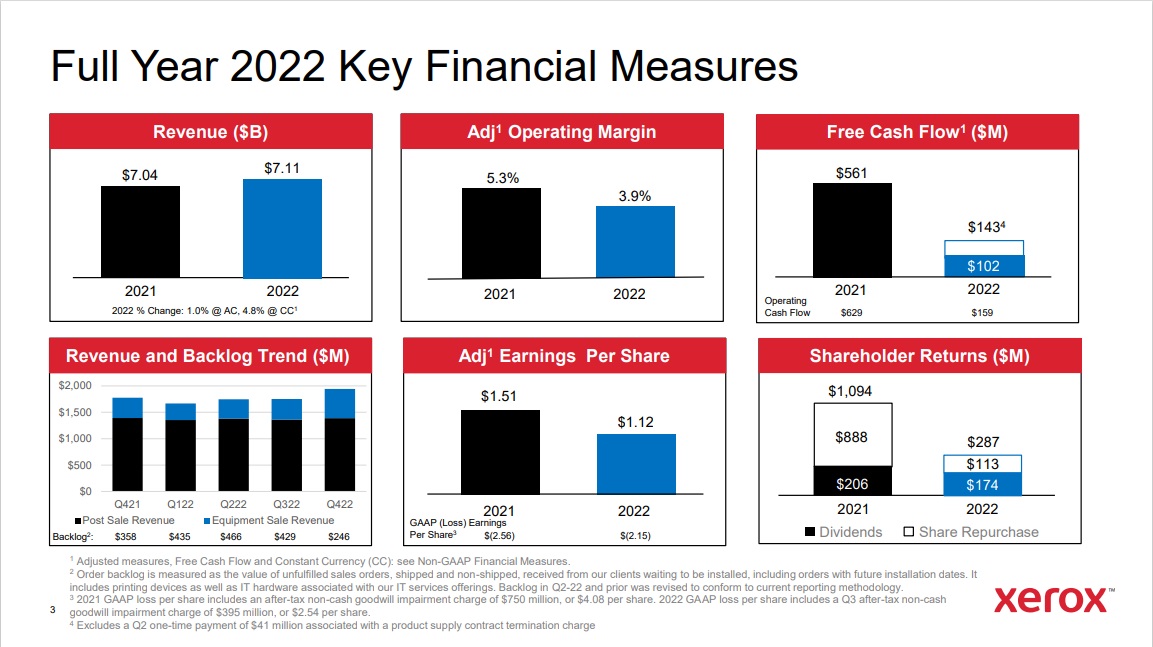

Xerox reported fourth quarter and full-year earnings on January 26th, 2023, and results were quite strong. Revenue was up 9% year-over-year to $1.94 billion. Revenue was up almost 14% on a constant currency basis. Adjusted earnings-pershare was 89 cents. That was up from just 34 cents a year ago.

Source: Investor Presentation

Adjusted operating margin was 9.2% of revenue, nearly double what it was in the year-ago period. Operating cash flow was slightly weaker, declining $12 million to $186 million from last year’s Q4. Free cash flow was $168 million, also down slightly year-over-year.

For the year, adjusted earnings-per-share fell from $1.51 to $1.12. Revenue was up 1% on a reported basis, but up 4.8% on a constant currency basis. Adjusted operating margin was 3.9% of revenue, down from 5.3% in 2022. The company guided for 2023 revenue of flat to slightly lower, and operating margin of at least 4.7%. In addition, free cash flow is expected to be at least $500 million.

Click here to download our most recent Sure Analysis report on Xerox Holdings (preview of page 1 of 3 shown below):

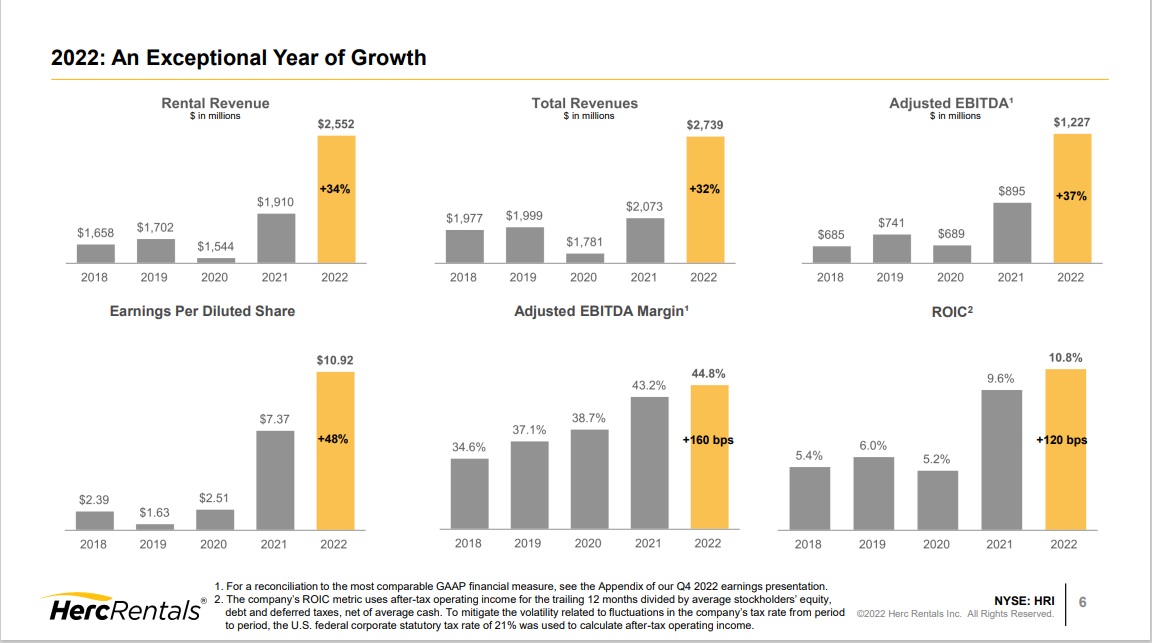

#5: Herc Holdings (HRI)

Dividend Yield: 1.6%

Percent of Carl Icahn’s Portfolio: 2.3%

Herc Holdings is an equipment rental supplier in the United States and internationally. It rents aerial, earth-moving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment.

You can see an overview of the company’s financial performance in 2022 below:

Source: Investor Presentation

The company also provides ProSolutions providing services including power generation, climate control, remediation and restoration, pump, trench shoring, and studio and production equipment. It also offers ProContractor professional grade tools.

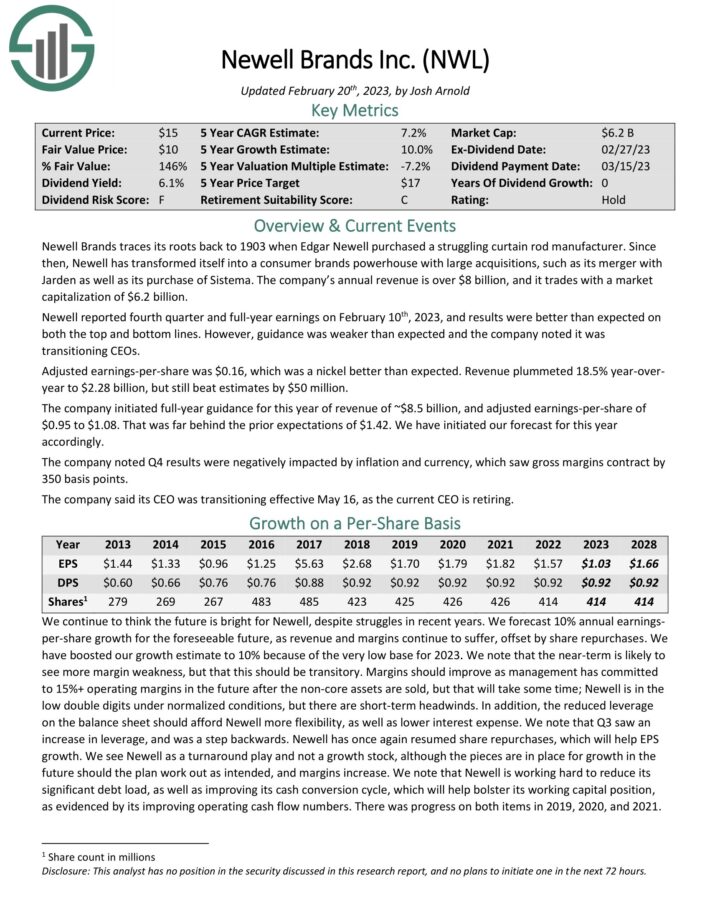

#6: Newell Brands (NWL)

Dividend Yield: 6.2%

Percent of Carl Icahn’s Portfolio: 2.2%

Newell has transformed itself into a consumer brands powerhouse with large acquisitions, such as its merger with

Jarden as well as its purchase of Sistema. The company’s annual revenue is over $8 billion and it has a diversified product portfolio.

Source: Investor Presentation

Newell reported fourth quarter and full-year earnings on February 10th, 2023, and results were better than expected on both the top and bottom lines. However, guidance was weaker than expected and the company noted it was transitioning CEOs.

Adjusted earnings-per-share was $0.16, which was a nickel better than expected. Revenue plummeted 18.5% year-over year to $2.28 billion, but still beat estimates by $50 million.

The company initiated full-year guidance for this year of revenue of ~$8.5 billion, and adjusted earnings-per-share of $0.95 to $1.08. That was far behind the prior expectations of $1.42. The company noted Q4 results were negatively impacted by inflation and currency, which saw gross margins contract by 350 basis points.

Click here to download our most recent Sure Analysis report on Newell (preview of page 1 of 3 shown below):

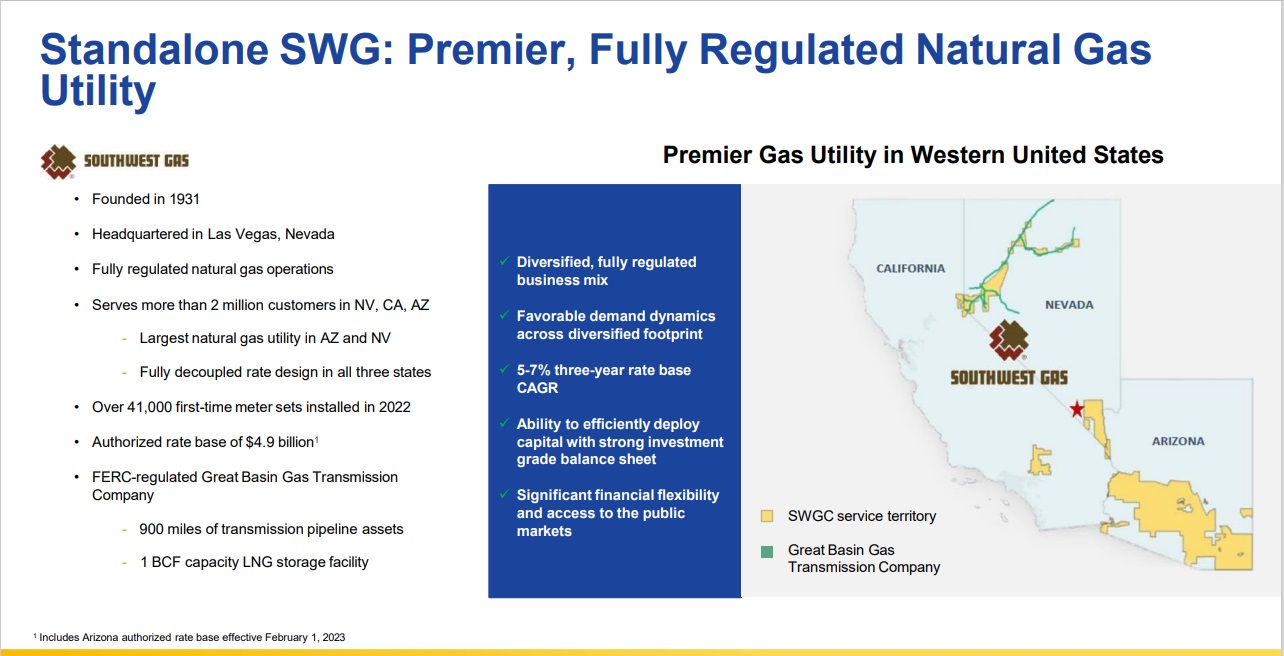

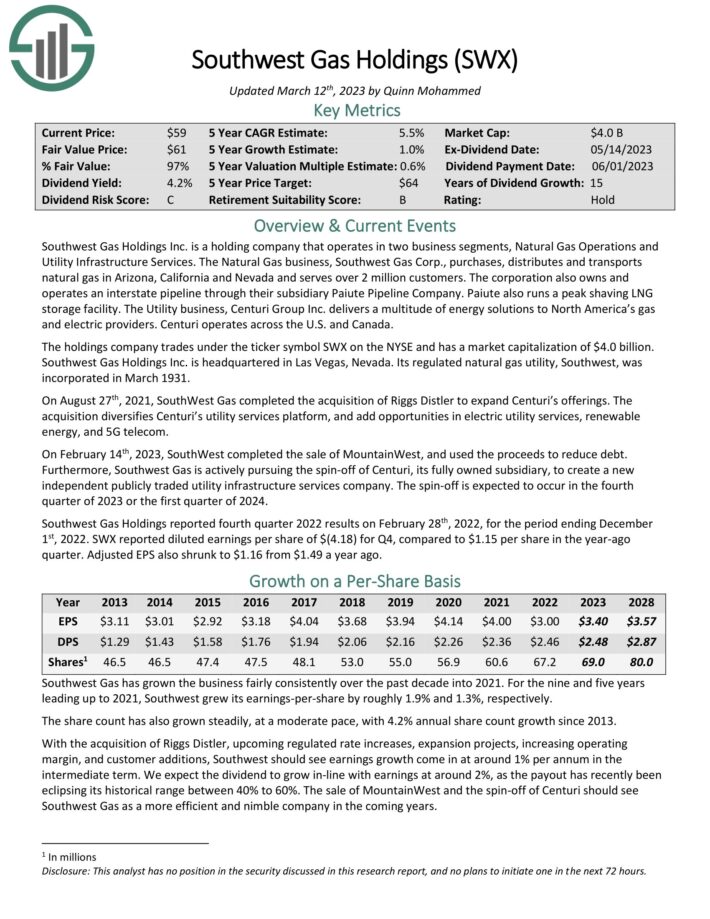

#7: Southwest Gas Holdings (SWX)

Dividend Yield: 4.1%

Percent of Carl Icahn’s Portfolio: 1.9%

Southwest Gas Holdings Inc. is a holding company that operates in two business segments, Natural Gas Operations and Utility Infrastructure Services. The Natural Gas business, Southwest Gas Corp., purchases, distributes and transports natural gas in Arizona, California and Nevada and serves over 2 million customers.

The corporation also owns and operates an interstate pipeline through their subsidiary Paiute Pipeline Company. Paiute also runs a peak shaving LNG storage facility. The Utility business, Centuri Group Inc. delivers a multitude of energy solutions to North America’s gas and electric providers. Centuri operates across the U.S. and Canada.

Source: Investor Presentation

On February 14th, 2023, SouthWest completed the sale of MountainWest, and used the proceeds to reduce debt. Furthermore, Southwest Gas is actively pursuing the spin-off of Centuri, its fully owned subsidiary, to create a new independent publicly traded utility infrastructure services company. The spin-off is expected to occur in the fourth quarter of 2023 or the first quarter of 2024.

Southwest Gas Holdings reported fourth quarter 2022 results on February 28th, 2022, for the period ending December 1st, 2022. SWX reported diluted earnings per share of $(4.18) for Q4, compared to $1.15 per share in the year-ago quarter. Adjusted EPS also shrunk to $1.16 from $1.49 a year ago.

Click here to download our most recent Sure Analysis report on SWX (preview of page 1 of 3 shown below):

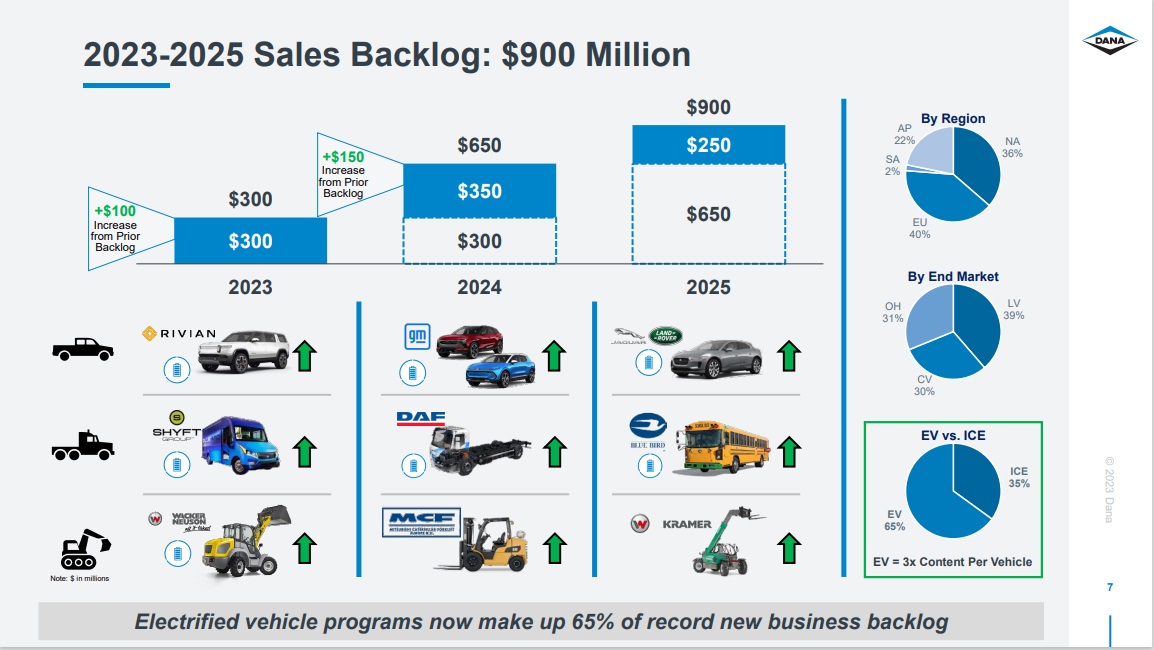

#8: Dana Inc. (DAN)

Dividend Yield: 2.4%

Percent of Carl Icahn’s Portfolio: 1.2%

Dana Incorporated provides power-conveyance and energy-management solutions for vehicles and machinery in North America, Europe, South America, and the Asia Pacific. It operates in four segments: Light Vehicle Drive Systems, Commercial Vehicle Drive and Motion Systems, Off-Highway Drive and Motion Systems, and Power Technologies.

Sales for 2022 were $10.2 billion, compared with $8.9 billion in 2021. The increase of $1.2 billion resulted from improved overall market demand and conversion of the sales backlog combined with pricing actions, including material commodity price and inflationary cost recoveries.

Source: Investor Presentation

Adjusted EBITDA for 2022 was $700 million, compared with $795 million in 2021. Lower profit was driven primarily by non-material inflation, as well as production inefficiencies driven by volatile customer demand schedules, continued supply-chain challenges, higher launch costs, and accelerated spending on development for electric-vehicle products.

The net loss attributable to Dana for 2022 was $242 million or $1.69 per share, compared with net income of $197 million or $1.35 per share in 2021. The loss resulted from a one-time non-cash goodwill impairment charge of $191 million due to increasing interest rates and lower market capitalization, and from $157 million of additional non-cash tax valuation allowances.

#9: Bausch Health Companies (BHC)

Dividend Yield: N/A (Bausch Health does not currently pay a quarterly dividend)

Percent of Carl Icahn’s Portfolio: 1.2%

Bausch Health Companies was formerly known as Valeant Pharmaceuticals and changed its name to Bausch Health Companies Inc. in July 2018. Bausch Health manufactures and markets a range of pharmaceutical, medical device, and over-the-counter (OTC) products primarily in the therapeutic areas of eye health, gastroenterology, and dermatology.

The company operates through five segments: Salix, International, Solta Medical, Diversified Products, and Bausch + Lomb. The Salix segment provides gastroenterology products in the U.S., while the International segment offers Solta products, branded and generic pharmaceutical products, OTC products, and medical device products, and Bausch + Lomb products in Canada, Europe, Asia, Latin America, Africa, and the Middle East.

The Solta Medical segment offers medical devices. The Diversified Products segment offers pharmaceutical products in the areas of neurology and other therapeutic classes, as well as generic, dermatological, and dentistry products in the United States.

Lastly, the Bausch + Lomb segment offers products with a focus on the vision care, surgical, and ophthalmic pharmaceuticals products.

#10: Conduent Inc. (CNDT)

Dividend Yield: N/A (Conduent does not currently pay a quarterly dividend)

Percent of Carl Icahn’s Portfolio: 0.7%

Conduent delivers technology-led business process solutions for businesses and governments globally. Conduent’s solutions and services digitally transform its clients’ operations including delivering 43% of nutrition assistance payments in the U.S., enabling 1.3 billion customer service interactions annually.

For 2022, revenue of $3.8 billion declined 6.8% year-over-year, primarily driven by significant, non-recurring stimulus payments volume in its Government Services business in the prior year, recessionary-related volume reductions in the Commercial business, as well as unfavorable foreign exchange impact.

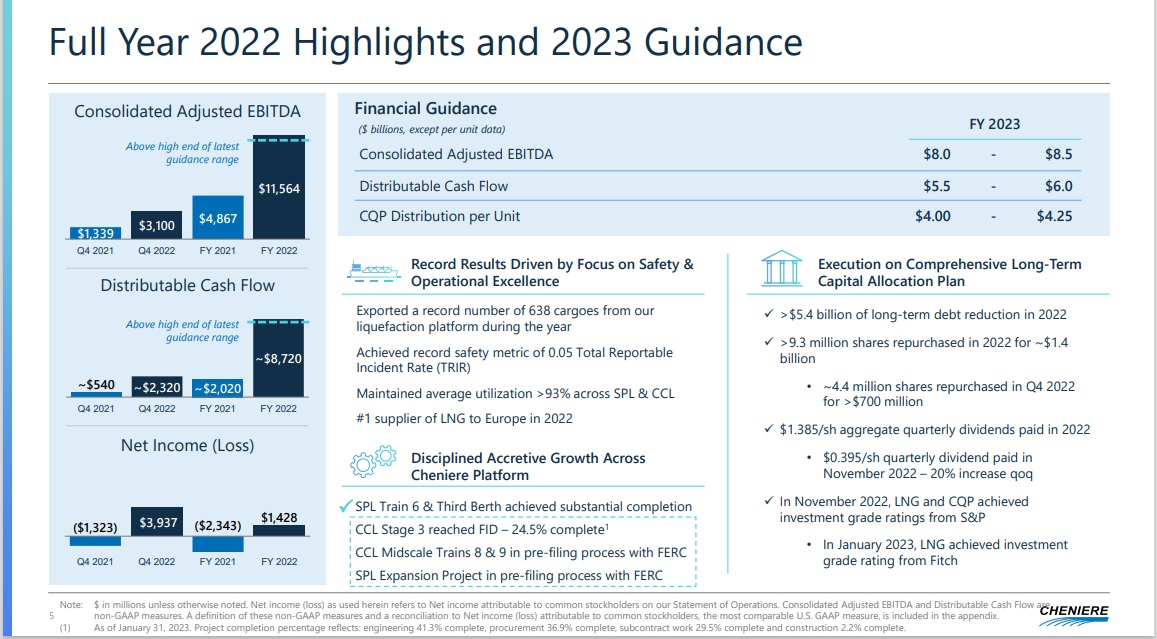

#11: Cheniere Energy (LNG)

Dividend Yield: 1.0%

Percent of Carl Icahn’s Portfolio: 0.7%

Cheniere Energy is an energy company engaged in liquefied natural gas related businesses. It owns and operates the Sabine Pass LNG terminal in Cameron Parish, Louisiana; and the Corpus Christi LNG terminal near Corpus Christi, Texas.

The company also owns Creole Trail pipeline, a 94-mile pipeline interconnecting the Sabine Pass LNG terminal with various interstate pipelines; and operates Corpus Christi pipeline, a 21.5-mile natural gas supply pipeline.

You can see an overview of the company’s 2022 financial performance in the image below:

Source: Investor Presentation

#12: Crown Holdings, Inc. (CCK)

Dividend Yield: 1.0%

Percent of Carl Icahn’s Portfolio: 0.4%

Crown Holdings, Inc., together with its subsidiaries, supplies rigid packaging products in Pennsylvania and internationally. It operates through Americas Beverage, European Beverage, Asia Pacific, and Transit Packaging segments.

Net sales in the fourth quarter were $3,012 million compared to $3,054 million in the fourth quarter of 2021 reflecting higher prices and increased beverage sales unit volumes, offset by lower volumes in the Transit Packaging businesses and unfavorable foreign currency translation of $92 million.

Income from operations was $229 million in the fourth quarter compared to $303 million in the fourth quarter of 2021. Segment income in the fourth quarter of 2022 was $292 million compared to $357 million in the prior-year fourth quarter due to higher costs and higher energy prices.

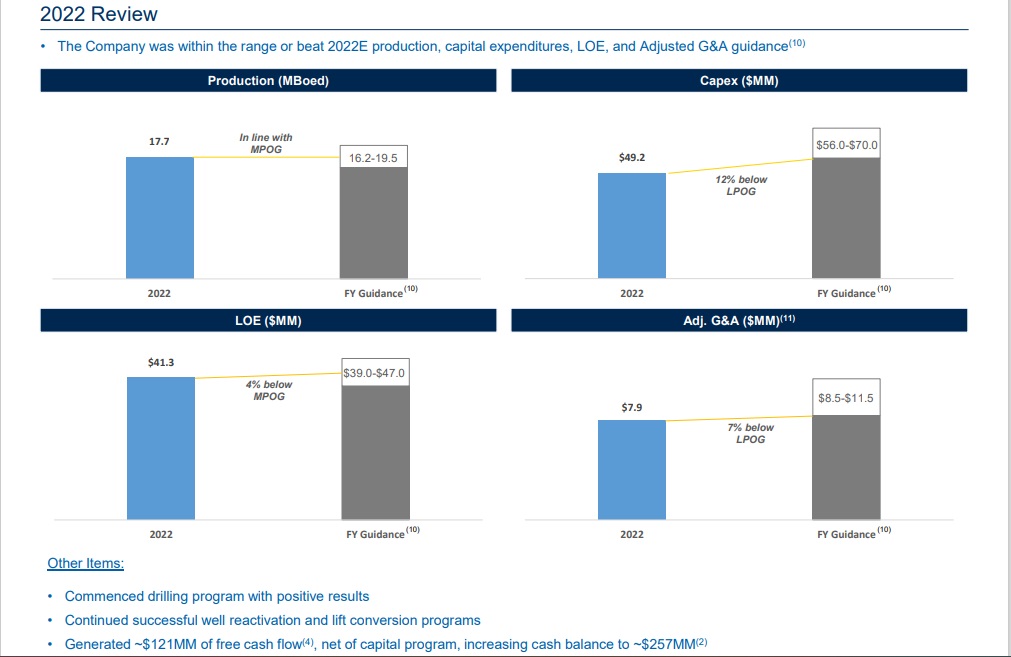

#13: Sandridge Energy Inc. (SD)

Dividend Yield: N/A

Percent of Carl Icahn’s Portfolio: 0.3%

SandRidge Energy, Inc. engages in the acquisition, development, and production of oil and natural gas primarily in the United States Mid-Continent. As of December 31, 2022, it had an interest in 1,471 gross producing wells.

For 2022, the company generated net income of $242.2 million, or $6.59 per basic share in 2022. Adjusted net income was $171.5 million, or $4.67 per basic share. Adjusted EBITDA of $191.2 million in 2022 compared to $113.5 million in 2021.

Source: Investor Presentation

Sandridge generated approximately $120.6 million of free cash flow in 2022, which represents a conversion rate of approximately 63% relative to adjusted EBITDA. Production averaged 17.7 MBoed in 2022.

The company drilled eight and completed six new wells in 2022. In 2023, the company currently plans to drill two and complete four new wells. It also returned 50 wells to production in 2022 that were previously curtailed.

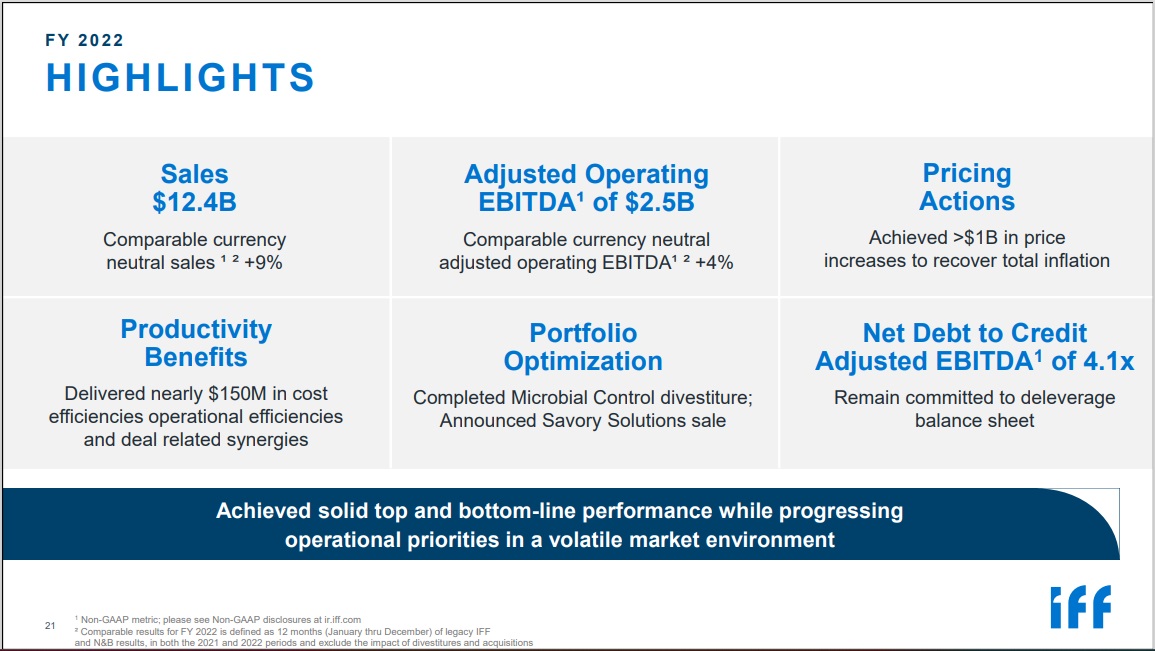

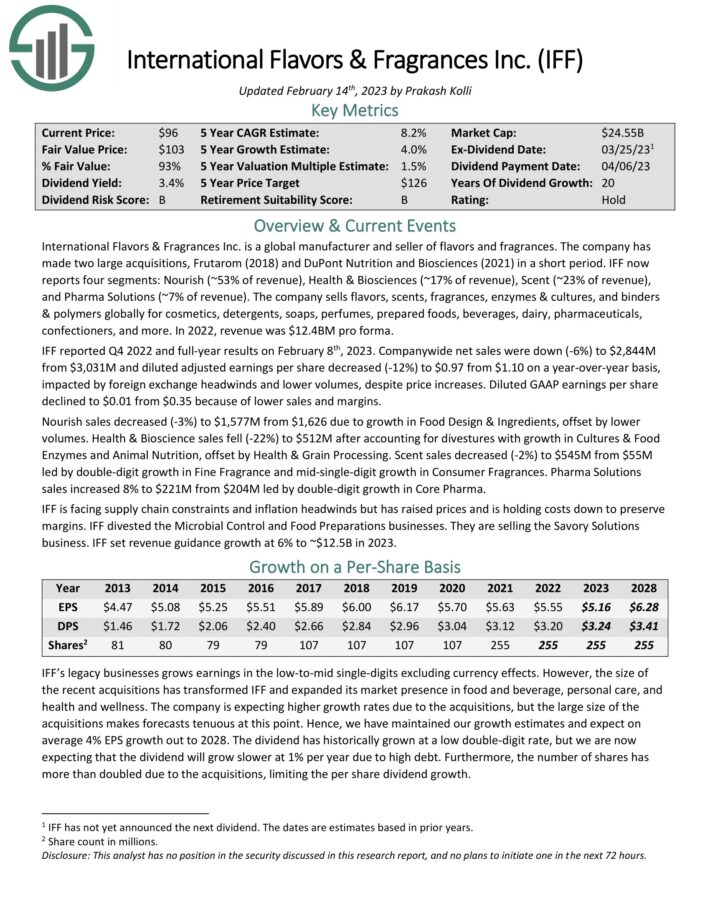

#14: International Flavors & Fragrances (IFF)

Dividend Yield: 3.4%

Percent of Carl Icahn’s Portfolio: 0.3%

International Flavors & Fragrances Inc. is a global manufacturer and seller of flavors and fragrances. The company has made two large acquisitions, Frutarom (2018) and DuPont Nutrition and Biosciences (2021) in a short period. IFF now reports four segments: Nourish (~53% of revenue), Health & Biosciences (~17% of revenue), Scent (~23% of revenue), and Pharma Solutions (~7% of revenue).

The company sells flavors, scents, fragrances, enzymes & cultures, and binders & polymers globally for cosmetics, detergents, soaps, perfumes, prepared foods, beverages, dairy, pharmaceuticals, confectioners, and more. In 2022, revenue was $12.4BM pro forma.

Source: Investor Presentation

IFF reported Q4 2022 and full-year results on February 8th, 2023. Companywide net sales were down (-6%) to $2,844M from $3,031M and diluted adjusted earnings per share decreased (-12%) to $0.97 from $1.10 on a year-over-year basis, impacted by foreign exchange headwinds and lower volumes, despite price increases. Diluted GAAP earnings per share declined to $0.01 from $0.35 because of lower sales and margins.

Nourish sales decreased (-3%) to $1,577M from $1,626 due to growth in Food Design & Ingredients, offset by lower volumes. Health & Bioscience sales fell (-22%) to $512M after accounting for divestitures with growth in Cultures & Food Enzymes and Animal Nutrition, offset by Health & Grain Processing. Scent sales decreased (-2%) to $545M from $55M led by double-digit growth in Fine Fragrance and mid-single-digit growth in Consumer Fragrances. Pharma Solutions sales increased 8% to $221M from $204M led by double-digit growth in Core Pharma..

Click here to download our most recent Sure Analysis report on IFF (preview of page 1 of 3 shown below):

#15: Bausch & Lomb Corporation (BLCO)

Dividend Yield: N/A

Percent of Carl Icahn’s Portfolio: 0.3%

Bausch + Lomb Corporation operates as an eye health company worldwide. It operates through three segments: Vision Care, Ophthalmic Pharmaceuticals, and Surgical. The Vision Care segment provides contact lenses and contact lens care products.

The Ophthalmic Pharmaceuticals segment offers proprietary and generic pharmaceutical products for post-operative treatments, as well as for the treatment of eye conditions such as glaucoma and retinal diseases.

The Surgical segment provides medical device equipment, consumables, and technologies. Bausch + Lomb Corporation was spun off from Bausch Health Companies.

Final Thoughts

You can see more high-quality dividend stocks in the following Sure Dividend databases:

Alternatively, another great place to look for high-quality business is inside the portfolios of other highly successful investors.

To that end, Sure Dividend has created the following stock databases:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following two lists provide useful information on high dividend stocks and stocks that pay monthly dividends:

Lastly, you can see the articles below for analysis on other major investment firms/asset managers:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].