Updated on September 7th, 2022 by Bob Ciura

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of all 147 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions. As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

This article will discuss large cap stocks, and an analysis of our top 7 Dividend Champions, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million. These added requirements preclude many companies that possess a sufficient track record of annual dividend increases, but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats. Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns.

Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

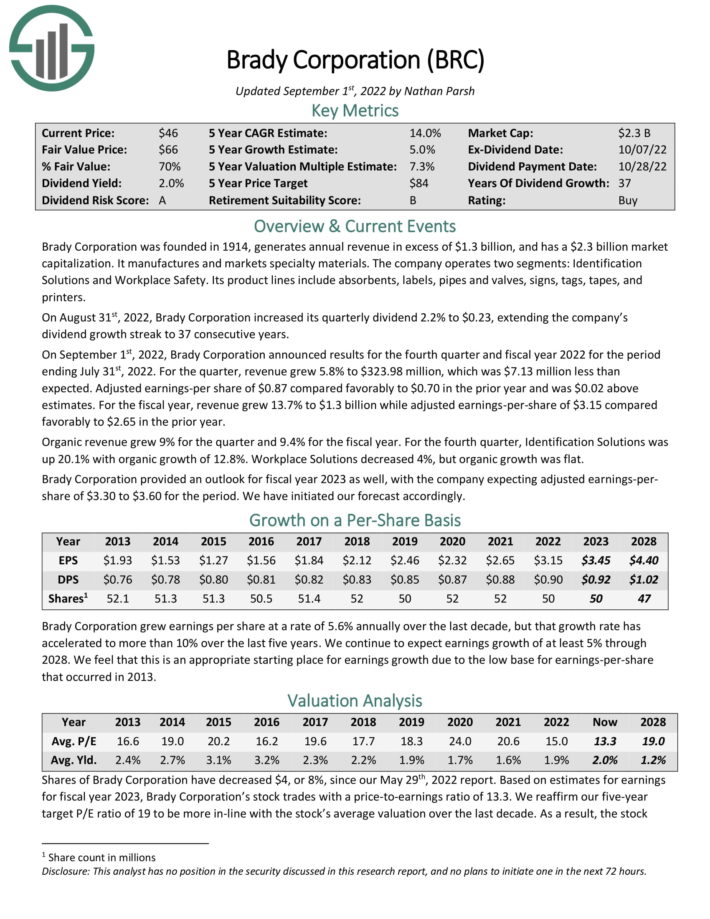

Top Dividend Champion #7: Brady Corporation (BRC)

- 5-year expected returns: 15.7%

Brady Corporation was founded in 1914, and now generates annual revenue in excess of $1.3 billion. It manufactures and markets specialty materials. The company operates two segments: Identification Solutions and Workplace Safety. Its product lines include absorbents, labels, pipes and valves, signs, tags, tapes, and printers.

Source: Investor Presentation

On August 31st, 2022, Brady Corporation increased its quarterly dividend 2.2% to $0.23, extending the company’s dividend growth streak to 37 consecutive years.

On September 1st, 2022, Brady Corporation announced results for the fourth quarter and fiscal year 2022 for the period ending July 31st, 2022. For the quarter, revenue grew 5.8% to $323.98 million, which was $7.13 million less than expected. Adjusted earnings-per share of $0.87 compared favorably to $0.70 in the prior year and was $0.02 above estimates.

For the fiscal year, revenue grew 13.7% to $1.3 billion while adjusted earnings-per-share of $3.15 compared favorably to $2.65 in the prior year. Organic revenue grew 9% for the quarter and 9.4% for the fiscal year. For the fourth quarter, Identification Solutions was up 20.1% with organic growth of 12.8%. Workplace Solutions decreased 4%, but organic growth was flat.

Brady Corporation provided an outlook for fiscal year 2023 as well, with the company expecting adjusted earnings-per-share of $3.30-$3.60 for the full year.

The stock has a 2.8% dividend yield, and we expect 8% annual EPS growth. With an ~8.0% annual boost from an expanding P/E multiple, total returns are expected to reach 18.8% per year.

Click here to download our most recent Sure Analysis report on BRC (preview of page 1 of 3 shown below):

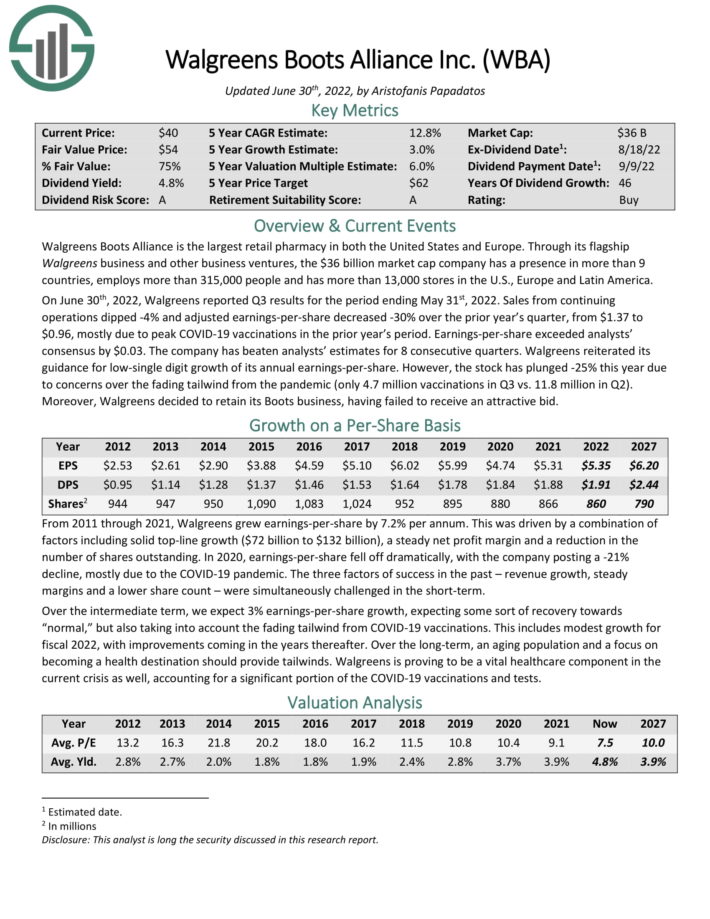

Top Dividend Champion #6: Walgreens Boots Alliance (WBA)

- 5-year expected returns: 15.9%

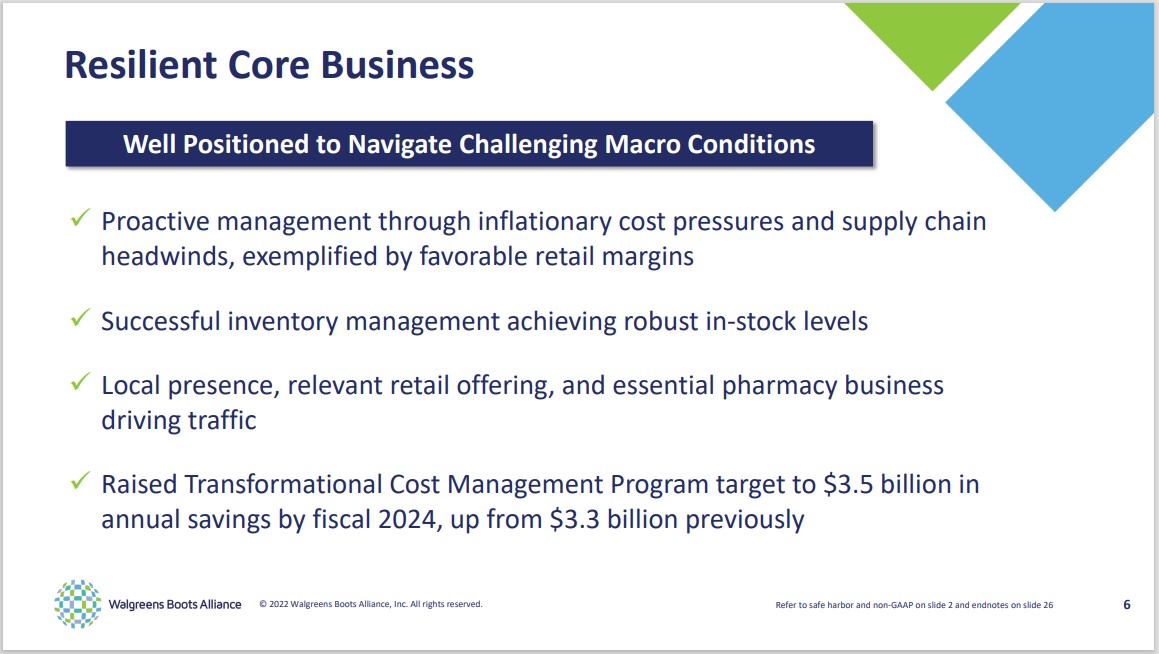

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the company employs more than 325,000 people and has more than 13,000 stores.

On June 30th, 2022, Walgreens reported Q3 results for the period ending May 31st, 2022. Sales from continuing operations dipped -4% and adjusted earnings-per-share decreased -30% over the prior year’s quarter, from $1.37 to $0.96, mostly due to peak COVID-19 vaccinations in the prior year’s period.

Source: Investor Presentation

Earnings-per-share exceeded analysts’ consensus by $0.03. The company has beaten analysts’ estimates for 8 consecutive quarters.

Walgreens reiterated its guidance for low-single digit growth of its annual earnings-per-share.

We expect 3% annual EPS growth over the next five years. In addition, the stock has a 5.4% dividend yield. We also view the stock as undervalued, leading to total expected returns of nearly 16% per year.

Click here to download our most recent Sure Analysis report on Walgreens (preview of page 1 of 3 shown below):

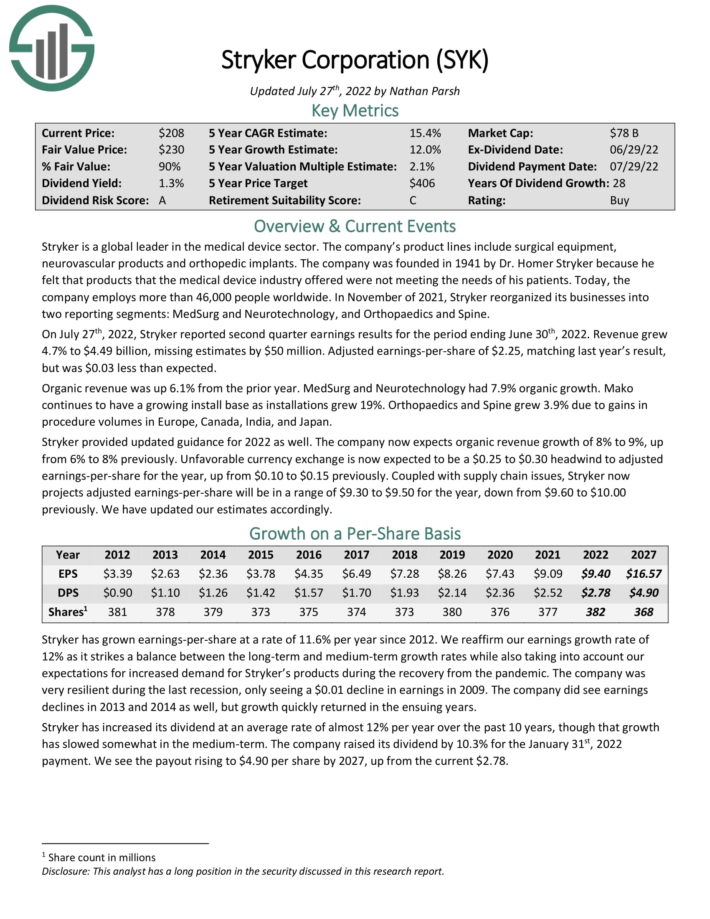

Top Dividend Champion #5: Stryker Corporation (SYK)

- 5-year expected returns: 16.0%

Stryker is a global leader in the medical device sector. The company’s product lines include surgical equipment, neurovascular products and orthopedic implants.

On July 27th, 2022, Stryker reported second quarter earnings results for the period ending June 30th, 2022. Revenue grew 4.7% to $4.49 billion, missing estimates by $50 million. Adjusted earnings-per-share of $2.25, matching last year’s result, but was $0.03 less than expected.

Organic revenue was up 6.1% from the prior year. MedSurg and Neurotechnology had 7.9% organic growth. Mako continues to have a growing install base as installations grew 19%. Orthopaedics and Spine grew 3.9% due to gains in procedure volumes in Europe, Canada, India, and Japan.

Stryker provided updated guidance for 2022 as well. The company now expects organic revenue growth of 8% to 9%, up from 6% to 8% previously. Unfavorable currency exchange is now expected to be a $0.25 to $0.30 headwind to adjusted earnings-per-share for the year, up from $0.10 to $0.15 previously. Coupled with supply chain issues, Stryker now projects adjusted earnings-per-share will be in a range of $9.30 to $9.50 for the year, down from $9.60 to $10.00 previously.

Click here to download our most recent Sure Analysis report on Stryker (preview of page 1 of 3 shown below):

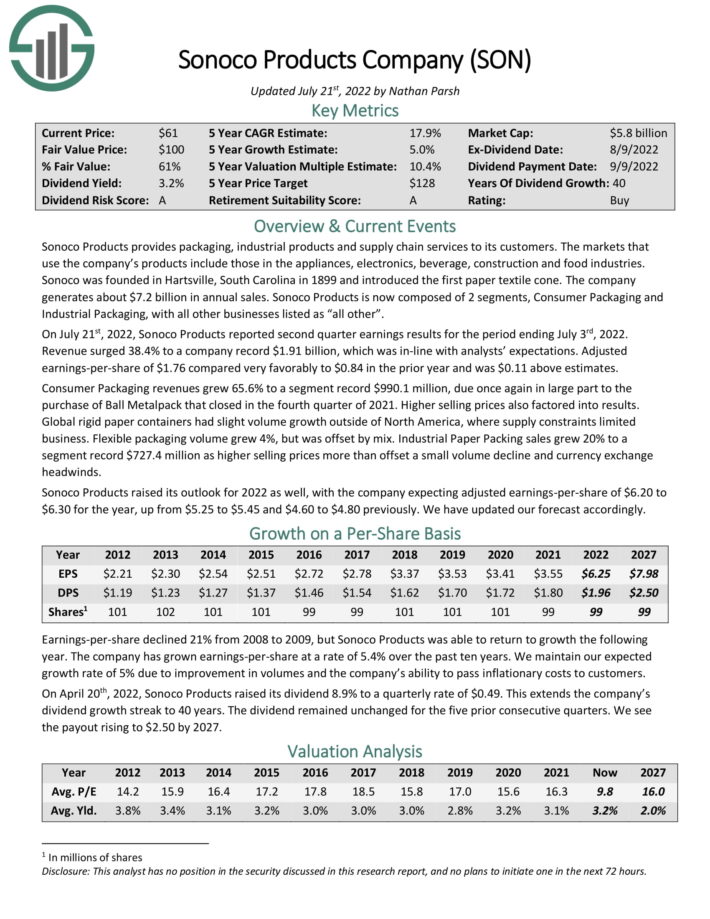

Top Dividend Champion #4: Sonoco Products Company (SON)

- 5-year expected returns: 17.3%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries. The company generates about $7.2 billion in annual sales. Sonoco Products is now composed of 2 segments, Consumer Packaging and Industrial Packaging, with all other businesses listed as “all other”.

Source: Investor Presentation

On July 21st, 2022, Sonoco Products reported second quarter earnings results for the period ending July 3rd, 2022. Revenue surged 38.4% to a company record $1.91 billion, which was in-line with analysts’ expectations. Adjusted earnings-per-share of $1.76 compared very favorably to $0.84 in the prior year and was $0.11 above estimates.

Consumer Packaging revenues grew 65.6% to a segment record $990.1 million, due once again in large part to the purchase of Ball Metalpack that closed in the fourth quarter of 2021. Higher selling prices also factored into results. Global rigid paper containers had slight volume growth outside of North America, where supply constraints limited business. Flexible packaging volume grew 4%, but was offset by mix.

Industrial Paper Packing sales grew 20% to a segment record $727.4 million as higher selling prices more than offset a small volume decline and currency exchange headwinds. Sonoco Products raised its outlook for 2022 as well, with the company expecting adjusted earnings-per-share of $6.20 to $6.30 for the year, up from $5.25 to $5.45 and $4.60 to $4.80 previously.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

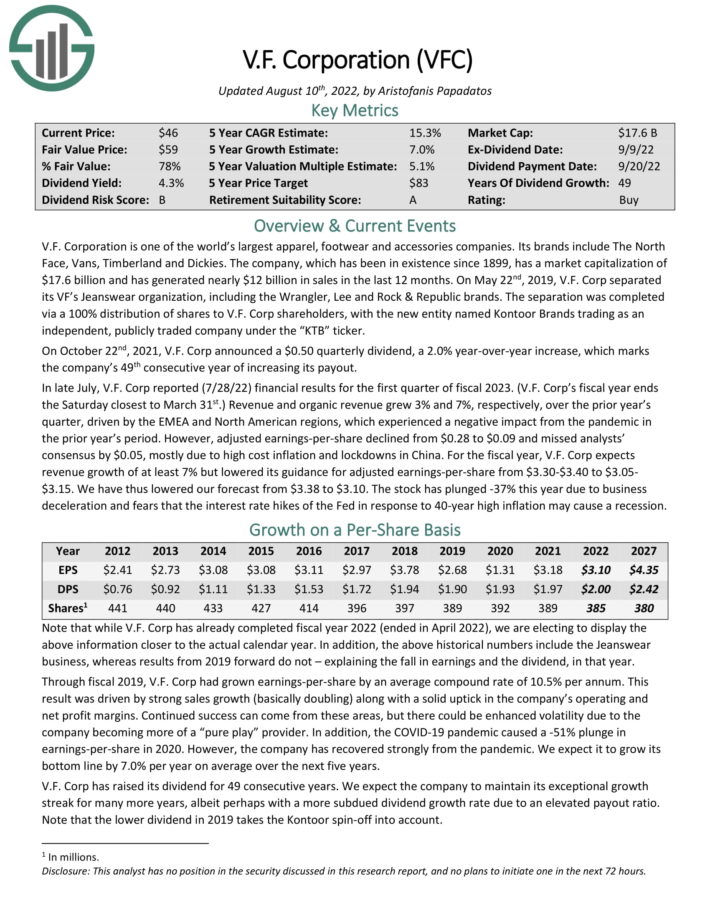

Top Dividend Champion #3: V.F. Corp. (VFC)

- 5-year expected returns: 18.5%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

In late July, V.F. Corp reported (7/28/22) financial results for the fiscal 2023 first quarter. Revenue of $2.26 billion rose 3.2% year over year and beat analyst estimates by $20 million. The North Face brand led the way with 37% currency-neutral revenue growth in the quarter.

However, inflation took its toll on margins and profits. Gross margin of 53.9% for the quarter declined 260 basis points, while operating margin of 2.8% declined 640 basis points. As a result, adjusted EPS declined 68% to $0.09 per share.

Adjusted earnings-per-share grew 67%, from $0.27 to $0.45, but missed analysts’ consensus by $0.02. For the new fiscal year, V.F. Corp expects revenue growth of at least 7% and adjusted earnings-per-share of $3.30 to $3.40.

We expect 7% annual EPS growth over the next five years. VFC stock also has a dividend yield of 4.8%. Annual returns from an expanding P/E multiple are estimated at ~6.7%, equaling total expected annual returns of 18.5% through 2027.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

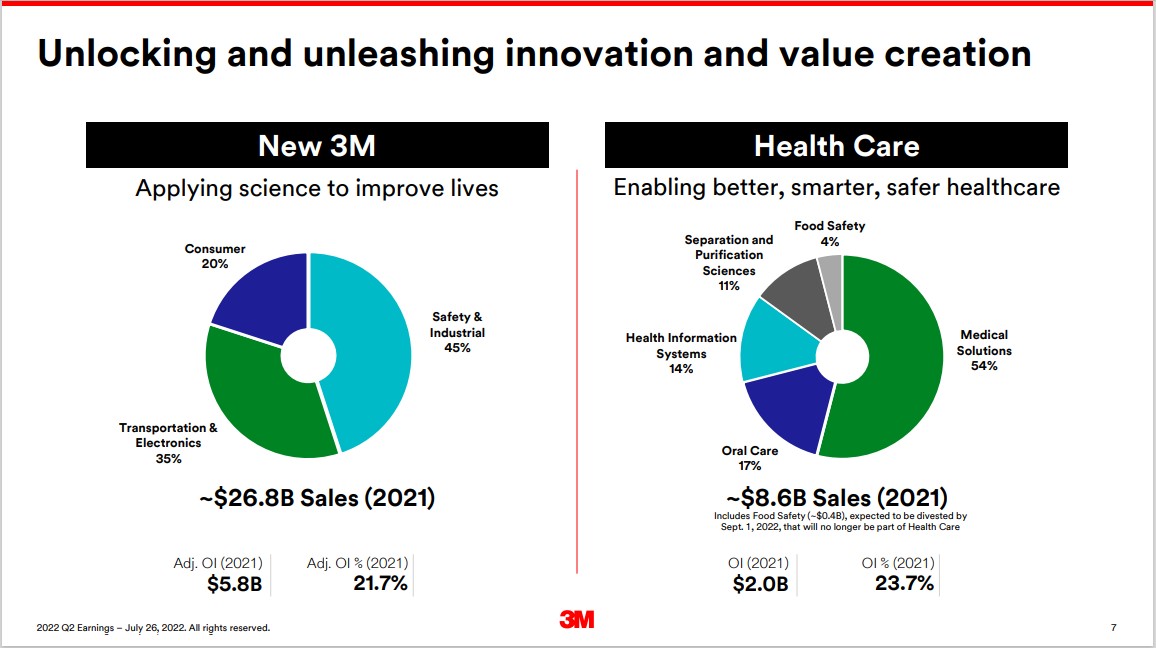

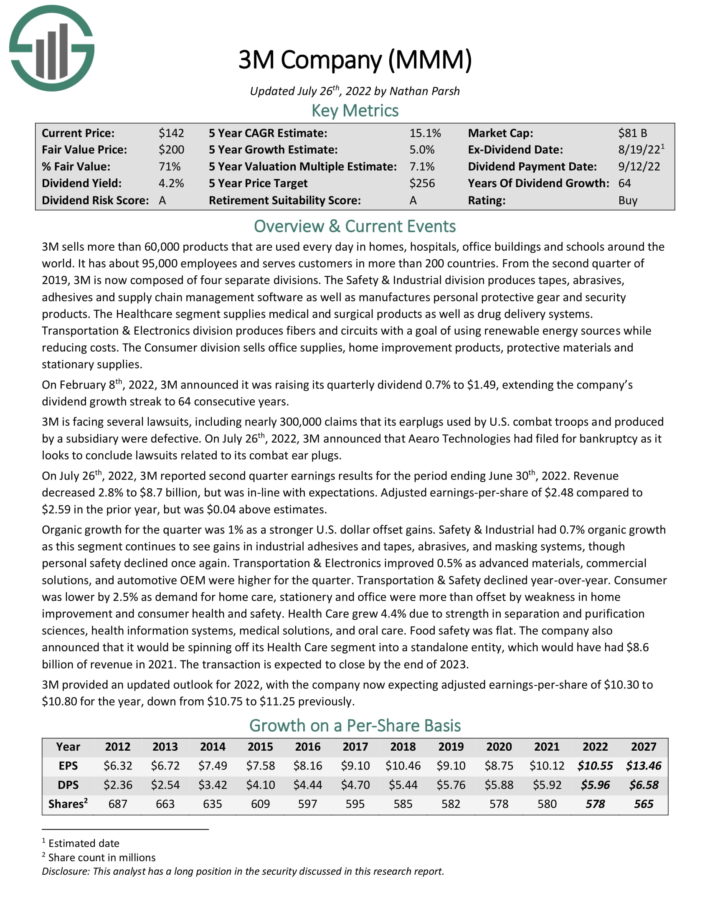

Top Dividend Champion #2: 3M Company (MMM)

- 5-year expected returns: 19.7%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries.

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs.

The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

Source: Investor Presentation

On July 26th, 2022, 3M reported second quarter earnings results for the period ending June 30th, 2022. Revenue decreased 2.8% to $8.7 billion, but was in-line with expectations. Adjusted earnings-per-share of $2.48 compared to $2.59 in the prior year, but was $0.04 above estimates. Organic growth for the quarter was 1% as a stronger U.S. dollar weighed.

The company also announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

3M provided an updated outlook for 2022, with the company now expecting adjusted earnings-per-share of $10.30 to $10.80 for the year, down from $10.75 to $11.25 previously.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

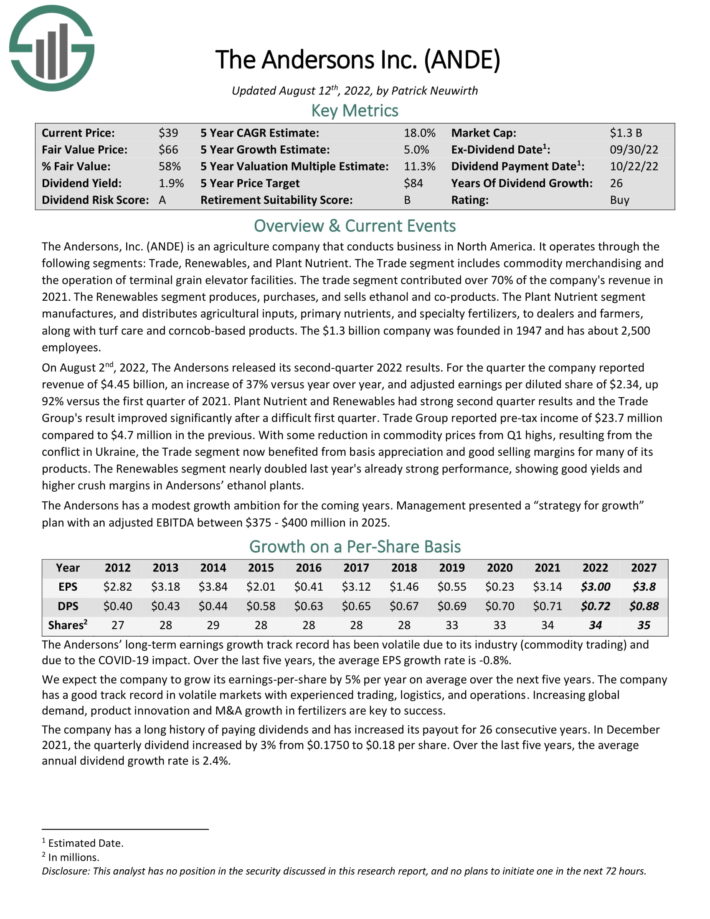

Top Dividend Champion #1: The Andersons Inc. (ANDE)

- 5-year expected returns: 20.2%

The Andersons, Inc. is an agriculture company that conducts business in North America. It operates through the following segments: Trade, Renewables, and Plant Nutrient. The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021.

On August 2nd, 2022, The Andersons released its second-quarter 2022 results. For the quarter the company reported revenue of $4.45 billion, an increase of 37% versus year over year, and adjusted earnings per diluted share of $2.34, up 92% versus the first quarter of 2021. Plant Nutrient and Renewables had strong second quarter results and the Trade Group’s result improved significantly after a difficult first quarter. Trade Group reported pre-tax income of $23.7 million compared to $4.7 million in the previous.

With some reduction in commodity prices from Q1 highs, resulting from the conflict in Ukraine, the Trade segment now benefited from basis appreciation and good selling margins for many of its products. The Renewables segment nearly doubled last year’s already strong performance, showing good yields and higher crush margins in Andersons’ ethanol plants.

The Andersons has a modest growth ambition for the coming years. Management presented a “strategy for growth” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. Shares currently yield 2.1%. Total returns are estimated at 20.9% per year.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].