Up to date on June twenty seventh, 2022 by Nikolaos Sismanis

Alkeon Capital Administration is a privately-owned registered funding adviser out of New York. The corporate was fashioned in 2002 as a spin-off from CIBC Oppenheimer.

Two key people govern the agency: Takis Sparaggis, President and CIO, and Alex Tahsili, who performs the Managing Director position.

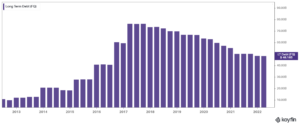

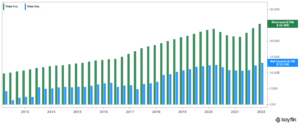

They each oversee Alkeon Capital Administration’s portfolio, at present valued at roughly $49.9 billion, of which round $24.3 billion is allotted in public equities.

Traders following the corporate’s 13F filings over the past 3 years (from mid-Could 2019 by way of mid-Could 2022) would have generated annualized whole returns of 4.8%. For comparability, the S&P 500 ETF (SPY) generated annualized whole returns of 16.1% over the identical time interval.

Notice: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Alkeon Capital Administration’s present 13F fairness holdings under:

Hold studying this text to study extra about Alkeon Capital Administration.

Desk Of Contents

Alkeon’s Strategy To Investing

Alkeon has stayed away from the highlight for many years, publishing restricted info relating to its operations and funding philosophy. An interview with administration from its early days, nevertheless, reveals important data which appears to carry up within the current day.

Its analysis course of is a 100% bottom-up, fundamentally-driven, research-concentrated process to investing. Their flagship technique entails figuring out important potential returns in Know-how, Media, Telecom (“TMT”) within the broadest of scope. Making use of a bottom-up technique implies that Alkeon focuses on particular person securities somewhat than on the general actions within the securities market.

Mr. Sparaggis, who holds the ultimate phrase for any funding, goals for a 12 to 24-month time horizon for Alkeon’s holdings and discourages short-term buying and selling. Alkeon avoids timing the route of the market and goals to generate alpha primarily based on its distinctive stock-picking expertise. It additionally has an elaborate community of trade contacts, with whom it’s in steady talks with a view to determine trade developments earlier than they develop into obvious to Wall Avenue.

Alkeon is primarily targeted on investing in shares with spectacular progress charges. Many traders hesitate to spend money on this kind of inventory resulting from their extreme price-to-earnings ratios however Alkeon has proved competent in figuring out high-growth shares that produce outsized returns. Notably, the common price-to-earnings ratio of the inventory portfolio of Alkeon at present stands at 57.43.

When it comes to threat administration, the corporate’s in-house threat supervisor is accountable for periodic checks to make sure diversification amongst particular person securities and sectors, liquidity, and total fund exposures.

Lastly, Alkeon manages its purchasers on a pari passu foundation. In different phrases, purchasers are handled in an equal-footing method, managed with out choice. By comparability, some hedge funds might differentiate amongst a number of lessons of purchasers, primarily based on their out there capital and status.

Alkeon’s Portfolio & High Holdings

Round 1/3 of Alkeon’s portfolio consists of public equities, whereas the remaining embodies a number of choices, as hedge funds typically do to alleviate their threat profile. The picks replicate administration’s tech and client discretionary-oriented technique. These two sectors occupy round 62% of Alkeon’s portfolio collectively.

Supply: 13F filings, Writer

Out of Alkeon’s 114 particular person shares, the highest 10 holdings account for round 31.2% of its public-equities a part of the portfolio. That determine reaches about 48.5% in relation to its 20 bigger picks, which signifies a comparatively concentrated allocation of funds.

Nonetheless, no holding accounts for greater than 5.6% of the whole portfolio, which is kind of distinctive among the many numerous funds we’ve coated. That being stated, the fund’s sector diversification could also be a bit weak because of the nearly unique focus of Alkeon on tech and client discretionary shares.

Through the interval masking Alkeon’s newest 13F submitting, the fund initiated and bought the next noteworthy securities:

New Buys:

- Tesla Inc (TSLA)

- Workday Inc (WDAY)

- Adobe Methods, Inc. (ADBE)

- American Specific Co (AXP)

- DocuSign Inc (DOCU)

- Salesforce.com Inc. (CRM)

New Sells:

- Costco Co. (COST)

- ANSYS, Inc. (ANSS)

- Aspen Know-how Inc (AZPN)

- Journey.com Group Ltd (TCOM)

- TAL Training Group American Depositary ADR (TAL)

As of the fund’s newest 13F submitting, the next are the highest 10 holdings of Alkeon:

Supply: 13F filings, Writer

Meta Platforms, Inc. (META)

Meta Platforms has had a spot in Alkeon’s portfolio since Q3-2014 and is now the fund’s largest holding.

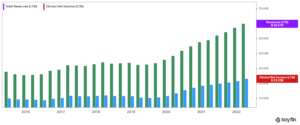

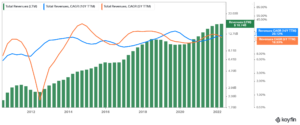

Meta is an amazing money cow, however with an issue. With sturdy financials, a wholesome steadiness sheet, and one of the best social media platform for advertisers, Meta has been dominating the social media trade. The corporate reported an all-time excessive backside line of $19.37 billion in FY2021, amid nice consumer progress, however now decelerating to the only digits.

For these causes, it could not be an entire shock if Meta paid a dividend sooner or later sooner or later.

However, the inventory has failed to draw a better a number of, because the steep scrutiny it has confronted over the previous few years have had an impression on the valuation. Hypothesis over the corporate’s large spending towards “The Metaverse” has additionally spurred uncertainty. The inventory is just buying and selling at round 16.0 occasions its underlying earnings, regardless of its constant profitability and future progress prospects.

With its ARPU (common income per consumer) nonetheless very sturdy, Meta’s financials are greater than more likely to proceed increasing quickly. Meta’s funding case right now doesn’t solely embody the potential for a big upside but in addition comes with an ideal margin of security.

If such a valuation enlargement by no means seems, and Meta continues to commerce at a ahead P/E of round 16.0, at an EPS progress price of 10%-15% within the medium time period (which the present consumer and APRU progress trajectory and ongoing inventory repurchases might moderately maintain), traders ought to obtain equally passable returns with a relentless valuation a number of.

Meta Platforms inventory at present accounts for five.6% of the fund’s whole holdings.

Alphabet (GOOGL)(GOOG)

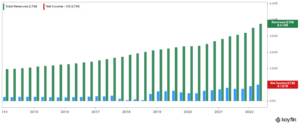

Alphabet provides a number of well-known merchandise, resembling Google, Android, Chrome, Google Cloud, Google Maps, Google Play, YouTube, in addition to technical infrastructure. Whereas the corporate’s enlargement has lasted for greater than a decade and a half, it’s nonetheless a high-growth inventory.

Income progress has re-accelerated, with the corporate posting progress of over 41% final 12 months, regardless of the deceleration triggered throughout the first couple of quarters throughout the preliminary pandemic outbreak. The corporate is among the most attractively priced shares within the sector as nicely, buying and selling at round 19.1 occasions its ahead earnings, regardless of its constant progress, huge moat, and powerful steadiness sheet.

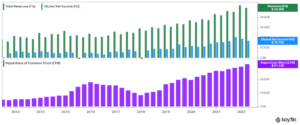

With its strong profitability, Alphabet has accrued a money and equivalents place of $133.9 billion. Because of this, the corporate can comfortably afford to spend money on its long-term bets resembling Waymo, and within the meantime return money to its shareholders by way of buybacks. Alphabet has repurchased $52.18 billion value of inventory over the previous 4 quarters, retiring shares at an all-time excessive price.

Alkeon trimmed its place by 13% throughout the quarter. The inventory accounts for round 5.1% of its portfolio and is the fund’s second-largest holding.

QUALCOMM Integrated (QCOM)

QUALCOMM is a comparatively new place in Alkeon’s portfolio. The fund initiated a place in This autumn 2021, but QUALCOMM rapidly ascended amongst the fund’s prime holdings.

“High quality Communications” was began in the lounge of Dr. Irwin Jacobs in 1985. The corporate’s first product and repair was a satellite tv for pc utilized by long-haul trucking corporations that might find and message drivers. Qualcomm, as it’s recognized right now, develops and sells built-in circuits to be used in voice and information communications. The chip maker receives royalty funds for its patents utilized in gadgets which are on 4G and 5G networks.

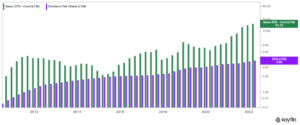

The corporate has grown earnings-per-share at a price of 6.6% per 12 months over the past decade. Its agreements with Apple and Huawei, a declining share depend, and management in 5G ought to permit the corporate to develop within the coming years. We additionally imagine that demand for 3G/4G/5G headsets will enhance following a restoration from the COVID-19 pandemic.

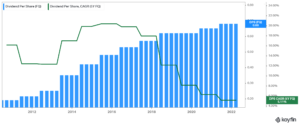

QUALCOMM additionally numbers 20 years of consecutive annual dividend will increase, that includes a 5-year dividend-per-share CAGR of 5.11%.

QUALCOMM is Alkeon’s third-largest holding, making up 4.0% of its portfolio. The fund boosted its place by 10.2% in comparison with the earlier quarter.

Synopsys develops digital design automation software program merchandise used to compose and check built-in circuits. Each the corporate’s prime & backside traces have expanded quickly over the previous few years, as Synopsys benefited vastly from the rising world demand for chips.

Analysts are at present anticipating annualized earnings progress within the double-digits over the medium time period. Nonetheless, buying and selling at a ahead P/E of over 37.6 whereas nonetheless not paying a dividend, present traders face a really skinny margin of security.

The place was trimmed by 9% throughout Alkeon’s newest quarter. It’s the fund’s fourth-largest place.

Cadence Design Methods, Inc. (CDNS)

Cadence Design Methods provides software program, {hardware}, companies, and reusable built-in circuit design blocks internationally. The corporate’s purposeful verification companies, comprising of emulation and prototyping {hardware}, permit its purchasers to carry out chip verification.

The corporate’s revenues and web revenue have been increasing at a really constant and fast tempo over the previous decade. A dividend has but to be initiated, nonetheless.

Cadence has had a spot in Alkeon’s portfolio since late 2014. The fund trimmed its place by 2% throughout the quarter, however nonetheless owns round 1.51% of the corporate’s excellent shares. It’s now the fund’s fourth-largest holding.

Microsoft (MSFT):

Discovered amongst the highest holdings of the vast majority of the funds we’ve coated, Microsoft is Alkeon’s sixth-largest holding, occupying 2.5% of its portfolio. The fund trimmed its place by 22% throughout the quarter.

Microsoft is a mega-cap inventory with a market capitalization of $1.85 trillion.

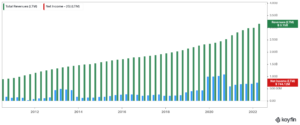

Supported by the corporate’s sturdy profitability, administration has been persistently elevating buybacks over the previous decade to additional reward its shareholders. The quantity allotted to inventory repurchases has reached new all-time highs over the previous 4 quarters, at practically $31.1 billion.

Income progress stays within the double-digits, so it’s more likely to see capital returns accelerating shifting ahead. The corporate can also be rising the dividend at a double-digit price, although on the present yield, which stands under 1%, traders ought to anticipate the vast majority of their future returns within the type of capital positive aspects.

Regardless of that, Microsoft’s money place has been rising regularly, with the corporate at present sitting on prime of a large $104.6 billion money pile.

Additional, whereas many corporations had chosen to make the most of the ultra-low rate of interest surroundings over the previous a number of years to boost low cost debt and purchase again inventory, Microsoft’s remained prudent and considerate. Not solely are present earnings extensively masking buybacks (~60% buyback “payout ratio”), however long-term debt has been considerably lowered from $76 billion in mid-2017 to round $48.1 billion as of its final report.

It’s spectacular {that a} inventory with a market capitalization of $1.85 trillion nonetheless has such a powerful progress momentum. Shares are additionally buying and selling at a ahead P/E ratio of round 23.3, which might sign a chance towards the corporate’s sturdy progress velocity, particularly from Azure. As a result of Microsoft’s strong progress and financials, it’s seemingly that traders gained’t let shares commerce at a lot of a reduction going ahead, regardless of the underlying shaky macroeconomic surroundings.

KLA Company (KLAC)

KLA Company is a provider to the semiconductor trade. The corporate provides course of management and yield administration techniques for semiconductor producers resembling TSMC, Samsung, and Micron. KLA was created in 1997, by way of a merger between KLA Devices and Tencor Devices, and has grown by way of a spread of acquisitions since then.

KLA Company’s earnings-per-share progress has traditionally come from a mixture of income progress, margin enhancements, and share repurchases. The income progress outlook stays sturdy, as KLA has been capable of develop its gross sales significantly over the last couple of quarters. Nearly all of KLA’s revenues come from product gross sales, however service revenues have gotten more and more necessary. This can be a constructive in the long term, as a better price of recurring service revenues ought to assist KLA’s prime line develop into much less cyclical.

The corporate has additionally grown its dividend per share for 12 consecutive years now, that includes a 5-year DPS CAGR of 14.22%.

KLA has had a spot in Alkeon’s portfolio since Q2-2017. The fund trimmed its place within the firm by 4% throughout the earlier quarter. KLA is now Alkoen’s seventh-largest place, comprising 2.4% of its portfolio.

Taiwan Semiconductor Manufacturing Firm Restricted (TSM):

Taiwan Semiconductor Manufacturing is the world’s largest devoted foundry for semiconductor parts. The corporate is headquartered in Hsinchu, Taiwan. American traders can provoke an possession stake in Taiwan Semiconductor by way of American Depository Receipts on the New York Inventory Change, the place they commerce below the ticker TSM with a market capitalization of US$440.7 billion.

Because the chief within the semiconductor manufacturing trade, it’s unsurprising that Taiwan Semiconductor has generated super progress over the past decade. Certainly, the corporate has compounded its adjusted earnings-per-share by 16.0% per 12 months over this time interval. The corporate displays a remarkably sturdy steadiness sheet as nicely. Since only a few corporations are debt-free, the distinctive steadiness sheet of the semiconductor producer is a testomony to the energy of its enterprise mannequin, which doesn’t require debt to gasoline progress and generates ample free money flows.

Taiwan Semiconductor is Alkeon’s eighth-largest holding. The place was left comparatively unchanged in comparison with the earlier quarter.

Lam Analysis Corp. (LRCX)

Lam Analysis Company was based in 1980 and headquartered in Fermont, California. The corporate designs, manufactures, markets, refurbishes, and companies semiconductor processing gear used to manufacture built-in circuits worldwide. Lam is a serious provider of wafer fabrication gear and companies to the semiconductor trade.

Lam Analysis has grown its income by a powerful 20.12% progress price over the previous ten years and 18.33% over the previous 5 years. Earnings per share have elevated by over 32.4% over the previous 5 years.

The corporate has additionally had a pleasant dividend progress file over the previous three years, with a mean of 10.9%. The corporate’s most up-to-date dividend enhance was 15.4%, introduced on August 26, 2021.

The corporate has additionally had a pleasant dividend progress file over the previous three years, with a mean of 10.9%. The corporate’s most up-to-date dividend enhance was 15.4%, introduced on August 26, 2021.

Alkeon elevated its place within the inventory by 19% over the last quarter. The inventory now accounts for two.0% of Alkeon’s holdings and is the fund’s ninth-largest place.

Visa (V)

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The inventory went public in 2008, and its IPO has confirmed to be one of the vital profitable in U.S. historical past. The corporate’s world processing community supplies safe and dependable funds world wide and is able to dealing with greater than 65,000 transactions a second. Within the fiscal 12 months 2021, the corporate generated practically $12.3 billion in revenue.

On April twenty sixth, 2022, Visa reported Q2 fiscal 12 months 2022 outcomes for the interval ending March thirty first, 2022. (Visa’s fiscal 12 months ends September thirtieth.) For the quarter, Visa generated income of $7.2 billion, adjusted web revenue of $3.8 billion, and adjusted earnings-per-share of $1.79, marking will increase of 25%, 27%, and 30%, respectively.

These outcomes have been pushed by a 17% achieve in Funds Quantity, a 47% achieve in Cross-Border Quantity, and a 19% achieve in Processed Transactions. On account of financial sanctions imposed on Russia by the U.S., European Union, United Kingdom, and others, Visa introduced in March 2022 that they have been suspending operations in Russia and since they’re now not producing income from actions associated to Russia. Russia accounted for roughly 4% of whole web revenues for the primary half of fiscal 2022 and the total 12 months of fiscal 2021.

Through the quarter, Visa returned $3.7 billion to shareholders by way of dividends and share repurchases.

Visa is Alkeon’s tenth-largest place. The fund boosted its place by 54% throughout the newest quarter, leading to Visa accounting for 1.9% of its whole holdings.

Ultimate Ideas

Regardless of Alkeon’s low profile and choice to not appeal to media consideration, the corporate is a silent achiever. Its efficiency has lagged currently on account of the continuing sell-off that has primarily occurred in know-how and progress equities. Nonetheless, up to now Alkeon has delivered market-beating efficiency by unlocking the alpha potential on a number of shares, offering its purchasers with wonderful funding returns.

You’ll be able to obtain an Excel spreadsheet with metrics that matter of Alkeon Capital Administration present 13F fairness holdings under:

Further Sources

See the articles under for evaluation on different main funding companies/asset managers:

In case you are involved in discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases might be helpful:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].