Jack Ma when asked where Alibaba stock price was going Andrew Burton

On our previous coverage of Alibaba Group Holding Limited (NYSE:BABA), we emphasized that the stock was in value territory but unlikely to produce big returns. That stemmed from prioritizing macro over the micro and disregarding the potential spin-off benefit.

We think that this “six degrees of separation” idea of spinning off all these units by BABA might reduce regulatory risk but will substantially increase overhead costs. It will also decrease pricing power further. We rate the stock a hold and think that those bullish should play it using covered calls.

Source: Six Degrees Of Separation

That idea was an outlier and it was interesting to see BABA drop sharply on its earnings release as it announced that it will no longer spin-off the Cloud Intelligence Group. Let’s look the results, the valuation and update why we believe investors can make some dough here.

A Step Back

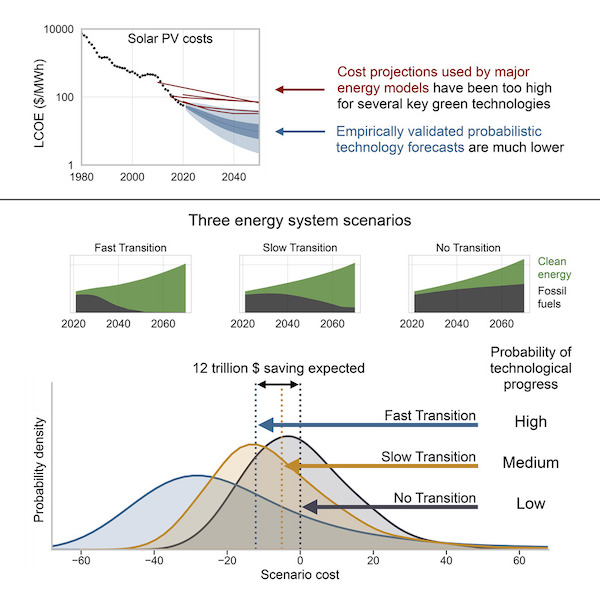

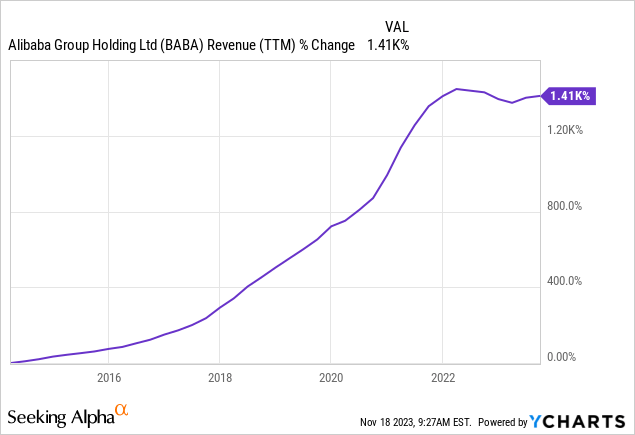

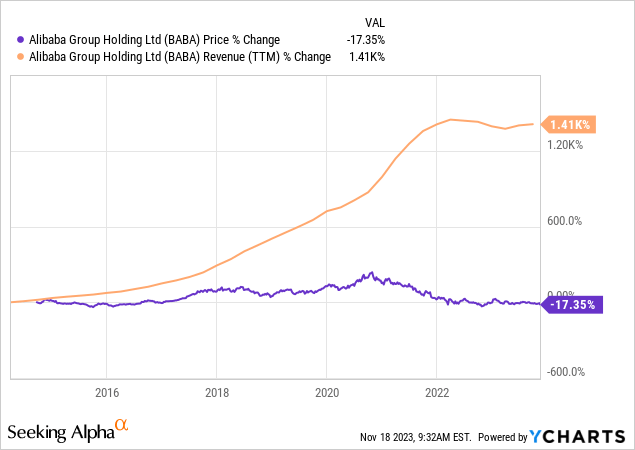

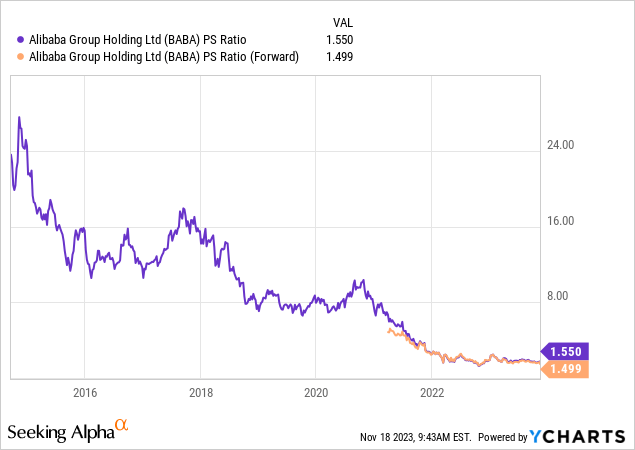

Before we get to those results, it is helpful to see just how much valuation compression or expansion can play a role in returns. Imagine on the day of the US listing someone told you that BABA’s revenues will be up 1400% within a decade and they nudge you to venture your total returns.

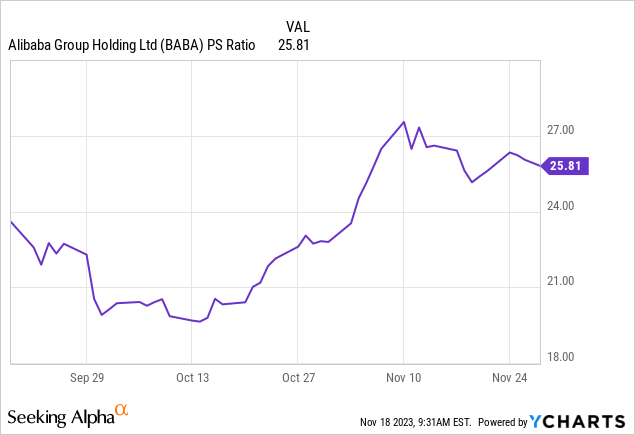

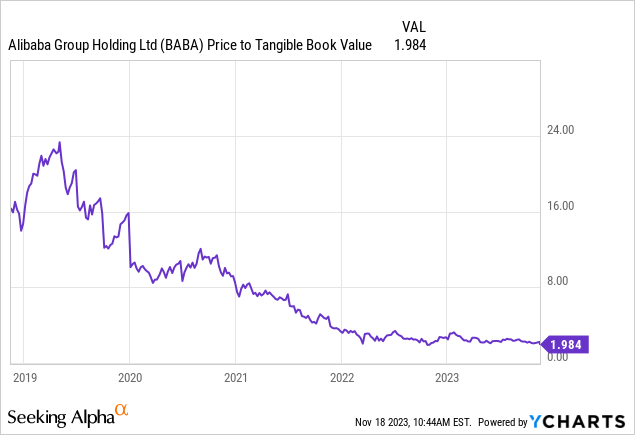

Most novice investors would venture that you would likely see close to the same level of total returns. Intelligent investors as in those that have lived through a couple of bear markets and know what valuation metrics are important, if asked the same the same thing would be more conservative. They would note the extraordinarily expensive nature of the listing (price to sales of 24X), and would perhaps go with a 200%-300% total return prospect.

But no one saw this.

That starting price to sales multiple has really compressed.

This is one of the key (although least mentioned) reasons for diversification. Even when you get the basic thesis perfectly correct, you cannot force the market to give it the correct multiple. So if you bet your retirement on few stocks like these, well, you won’t be retiring.

Quarterly Results

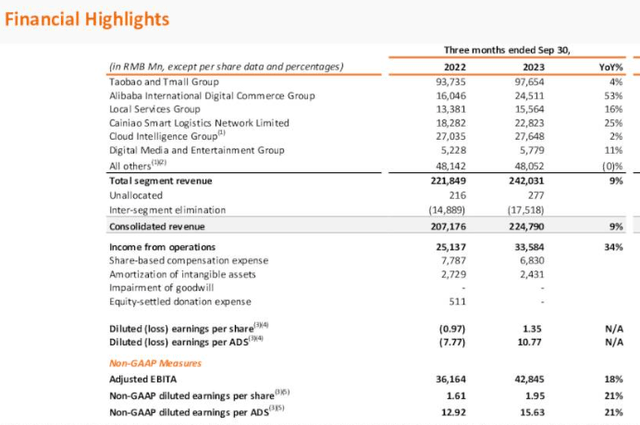

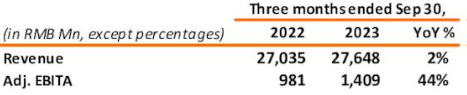

BABA delivered a solid quarter, relative to expectations and revenues expanded at a nice 9% clip.

BABA Presentation

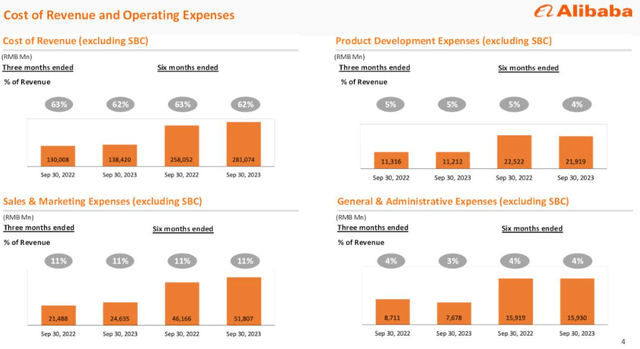

Income from operations non-GAAP earnings moved up even faster at brisk double digit pace. BABA’s cost control was in full display here and it remains the most profitable amongst the Chinese online retailers.

BABA Presentation

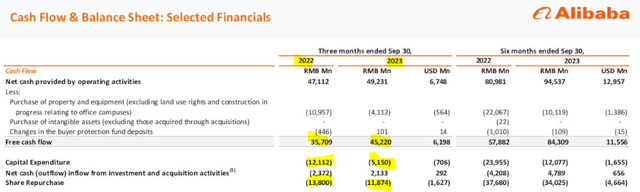

The cash deployed towards share repurchases was a tad small for most bulls and came in lower than what we saw last year.

BABA Presentation

The plus to this restraint is that at least BABA remains in a better position than companies like PayPal (PYPL) that blew cash away buying back stock at multiples of the current price. The focus of the news was the cloud unit and its sales looked quite weak.

BABA Presentation

But more importantly, BABA decided to call off the IPO.

First, we announced in our earnings release that Alibaba will not pursue a full spin-off of Cloud Intelligence Group in light of uncertainties created by recent U.S. export restrictions on advanced computing chips. Instead, we will focus on developing a sustainable growth model based on emerging AI-driven demand for networked and highly scaled cloud computing services.

Second, in August, Cainiao Smart Logistics filed its prospectus and application for an IPO on the Hong Kong Stock Exchange. While the success of an IPO transaction is subject to market conditions and relevant approvals, we are confident of the business fundamentals of our logistics unit.

Source: BABA Conference Call Transcript

Outlook

Investors were hoping for a cloud unit listing to save them and it won’t be happening any time soon. We do want to stress here that the revenue growth of BABA’s cloud unit is remarkably weak and we doubt it would be gamechanger. Still it is strange that the spin-off was stopped for the reasons suggested. Management mentioned the recent export ban to China led to the halt of the cloud segment spin-off. Certainly the US is cracking down harder on this and we just got news on Applied Materials, Inc. (AMAT) the other day being in the crosshairs. Still, there has been an export ban of sorts in place for quite some time. In fact the major developments took place more than a year ago.

BIS

So BABA knew this was on the table and had announced the IPO idea anyway. A more logical reason, and one we think BABA did not get into, was probably that the unit is unlikely to garner the kind of multiple that the street expects. It will also require very heavy capex to keep it competitive and both those argue for keeping it within the BABA fold.

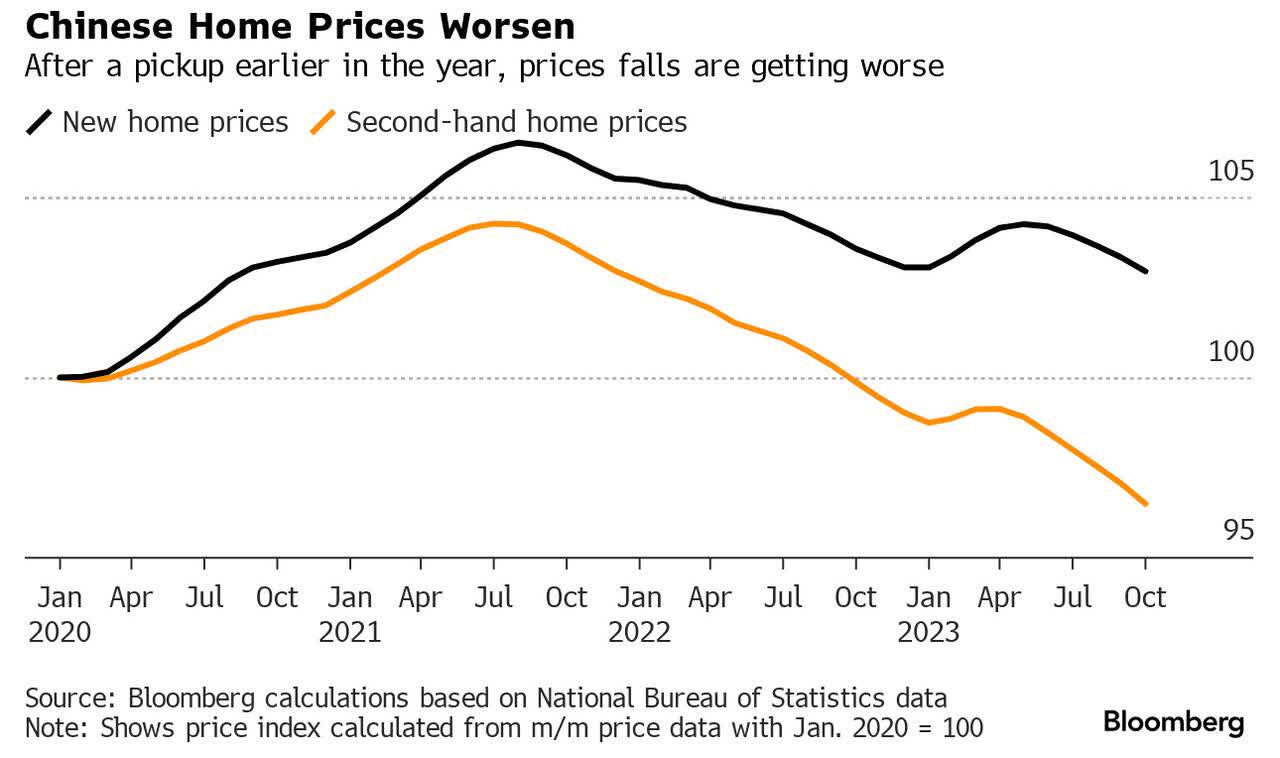

The bigger issue for BABA, and one we have harped on endlessly, continues to be the housing bubble fallout.

While third-quarter gross domestic product figures released Wednesday surpassed expectations on strong consumer spending, the data points to difficult months ahead for the world’s second-largest economy as efforts by President Xi Jinping’s government to stabilize the property sector and avert deflation have shown little effect.

Housing market challenges were evident in price data for September, which showed new home prices in major cities falling by the most in nearly a year even as measures to encourage home purchases came into effect. The vast real estate sector contracted 2.7% in the third quarter, the biggest quarterly drop this year, according to China’s statistics bureau.

Source: BNN Bloomberg

We have to stress here that while the pic below shows the drop, we are still in the second or third innings of this fallout.

Bloomberg

The official stats are also underestimating the magnitude of the decline, possibly consciously, to prevent a full scale panic.

Home-price data in many countries are based on total market transactions, yet China uses selective samples,” said Chin, the head of research for Asia Pacific at CBRE Group Inc. “When a market goes down, the true market condition is hard to be reflected in such data.”

In Hangzhou, close to where Alibaba is headquartered, home prices in some neighborhoods are down 25% to 28% from a peak around October 2021, agents said. In Lianyang, a downtown area popular with expats and financiers in Shanghai, residential prices have slid 15% to 20% from record highs in mid-2021, they said.

Top cities, once considered resilient against a housing downturn, aren’t immune. Prices of existing homes in at least five popular districts of Shenzhen have slumped 15% in the past three years, according to a July report by property research institute Leyoujia. The southern hub is the country’s least affordable housing market.

All data sources in China, be it government or private ones, face “significant challenges” for compiling a portfolio that’s relatively stable for tracking home prices, Goldman Sachs China economists led by Wang Lisheng wrote in the July report. In their assessment of China home price measures, they said there is “no perfect” gauge.

Source: Fortune

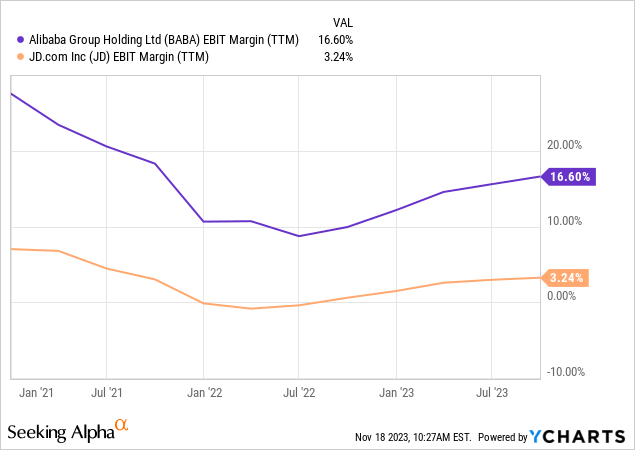

We think this being the largest bubble known to man, the fallout will span at least a decade as assets get repriced to consumer income. Retail sales remain vulnerable in such an environment. BABA maintains consistent profitability and high margins, relative to other online retailers like JD.com (JD).

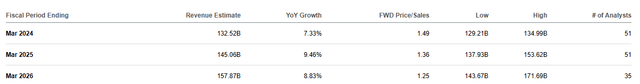

But that might be a problem in a weak economy as people turn price conscious. BABA’s estimates here still look optimistic for what we see ahead.

Seeking Alpha

More disappointments are in store for 2024.

Verdict

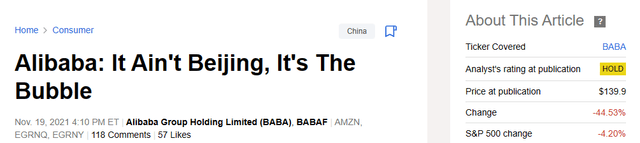

BABA was “cheap” when we first wrote on it.

Seeking Alpha

It is of course, even cheaper now. We showed the price to sales multiple earlier in the article and now we are showing the price to tangible book multiple.

This has compressed as BABA has accumulated tons of cash and investments on its balance sheet. This adds another buffer to the bull case here and BABA remains poised to deploy extraordinary amounts of cash flow towards shareholder returns relative to its market capitalization. The recently announced inaugural dividend was another step in the right direction. The stock has long term potential here, despite some big headwinds. It has become a value play, from a growth stock extraordinaire. Nothing says it won’t become an even bigger value play as tax-loss harvesting takes hold. We continue to believe that covered calls will outperform the common equity long and hence rate this as a Hold.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.