maybefalse/iStock Unreleased via Getty Images

Article Thesis

Alibaba Group Holding Limited (NYSE:BABA) is about to become a very different company due to the spin-offs it plans. Breaking up the company will unlock value that has, so far, not been realized. Alibaba has now taken the first step to break up the company, as its logistics unit is preparing for an IPO that will help the company raise at least $1 billion. The valuation is very low, growth has recently been strong, and with the breakup proceeding, I believe that there is a catalyst for compelling returns in the foreseeable future.

What Happened?

Alibaba Group has, earlier this year, come to the conclusion that the combined value of the company’s many different business units is worth more than what the market is giving the company credit for. In order to unlock this value, Alibaba plans to spin off several of its businesses. This will allow investors to pick the businesses they are most comfortable with — or the ones they deem most appealing — for investment, which should make the “conglomerate discount” vanish.

While this strategic shift has been announced months ago, Alibaba has now taken the next step. According to recent reports, Alibaba’s logistics unit, which is called Cainiao Network Technology, is preparing for an initial public offering. An IPO filing could happen as early as next week, according to these reports. Also, Cainiao Network Technology is seeking to raise at least $1 billion. We don’t know yet about the valuation, but despite the fact that Cainiao is not the most valuable franchise for Alibaba, it should easily be worth several billions of dollars. While the IPO itself is not overly material for Alibaba and its investors, it is still very good news that things are progressing, and that Alibaba is following through on its plans to split up the company into a total of six different companies.

Alibaba’s Performance

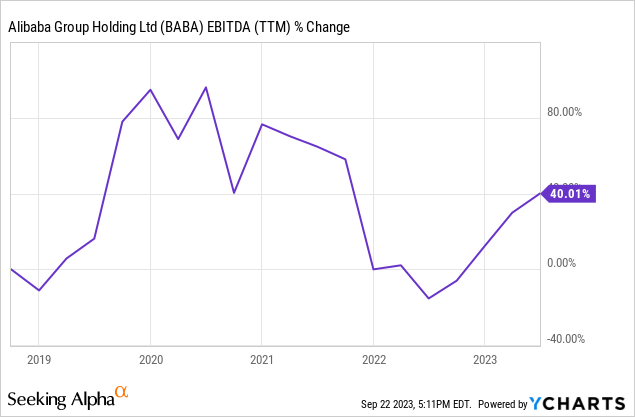

In China, which remains Alibaba Group’s most important geographic market by far, economic growth has been somewhat uneven in recent years. Lockdowns, a real estate crisis, trade tensions, and so on have weighed on economic growth, which has also had an impact on Alibaba’s growth performance in recent years:

Alibaba’s trailing twelve months EBITDA has peaked in early 2020, meaning the Q3 2019 to Q2 2020 period was the best from a profitability perspective. In 2022, results were weaker, but things have improved meaningfully in the very recent past.

During the most recent quarter, Alibaba’s fiscal Q1, the company showcased revenue growth of 14%, which was above the recent trend, and which beat estimates easily. It looks like the end of lockdown measures has been positive for Alibaba, likely due to consumer sentiment in China improving, which is positive for discretionary spending.

Even better, however, was Alibaba’s profit performance. The company was able to turn a 14% revenue growth rate into a 32% EBITA growth rate — profit growth was more than twice as high as the company’s sales growth rate. That was a meaningful improvement compared to previous quarters when Alibaba was facing margin headwinds due to factors such as increasing regulation, growth investments, and so on. But with Alibaba’s management now more focused on creating value for shareholders, including via the split-up of the company, it is not surprising that management is also putting more and more focus on improving profits. While sales growth and operating leverage played a role in improving profits, a focus on making the company more efficient played a role as well. This includes, for example, headcount reductions in the company’s cloud unit — naturally, a lower headcount helps improve the expense side of BABA’s operations.

Operating income growth was even better than the company’s EBITA growth rate during the period, as adjusted operating profit soared 43% on a year-over-year basis. Net income growth was even more outstanding, with a 48% increase compared to the previous year’s quarter. That was comparable to the earnings per share growth rate over the same time frame, which was a bit of a disappointment — despite strong absolute growth, BABA was not able to grow its earnings per share faster than its net income. Since Alibaba has been spending billions on buybacks over the last year, one could have expected that earnings per share growth would be even better than the already very strong net income growth rate that the company recorded over the last year.

Business growth during the most recent quarter was broad-based, as Alibaba Group saw encouraging results in different business units. Taobao, which will be combined with Tmall in one company, saw a nice 7% daily active user increase. For a business that already has very strong market penetration in its home country, a user growth rate like this is very appealing, I believe.

Alibaba’s Local Services Group, which combines businesses such as Ele.me (a delivery platform) and Amap (a navigation app), saw very strong sales growth of 30% during the quarter. While that group makes up less than 10% of BABA’s company-wide revenues, the unit should rise in importance if growth can be maintained at the current level.

Cainiao Smart Logistics Network, the unit that will likely IPO in Hong Kong soon, also showed very nice growth, with a revenue gain of 34%. That was driven by international expansion. Cainiao continues to open up new sorting centers in its international business, thus I believe that there is a good chance that the business will continue to generate appealing sales growth in the coming quarters as well.

BABA: Trading At A Low Valuation

During the first quarter, Alibaba Group earned $2.40 per share. If the company were to generate similar profits in the coming three quarters, earnings per share for the current year would total $9.60. Today, Alibaba Group’s shares are trading at $88, which would pencil out to an earnings multiple of just above 9.

Of course, there is no guarantee that the company will be equally profitable during the coming three quarters, relative to the first quarter. But even based on current earnings per share estimates by Wall Street analysts, the earnings multiple for the current year is just 9.4. And since Alibaba Group was able to beat the consensus earnings per share estimate for the first quarter easily, I believe that there is a good chance that Q2-Q4 will come with positive surprises as well.

Other valuation metrics also suggest that Alibaba is pretty cheap today. The enterprise value to EBITDA multiple, based on current estimates, is just 6.5, for example. Oftentimes, EV/EBITDA ratios of less than 10 are considered low — and BABA trades well below that level today.

While cheap stocks can remain cheap if there is no catalyst for higher valuations and prices, investing in cheap stocks still has advantages. First, the downside potential is much more limited when one buys a company trading at a single-digit earnings multiple, compared to buying shares of a company that trades at a way higher valuation. Second, once there is a catalyst for a higher valuation, shares can rally quite a lot, even without becoming overly expensive. If BABA’s valuation were to expand to a high-teens earnings multiple, for example, shares could double — and that would still not represent a very high valuation.

With BABA splitting up its operations, I believe that a catalyst for a higher valuation could indeed materialize over the coming quarters. And even if the valuation stays low, BABA’s shares could still climb as long as profits continue to grow in the coming quarters.

Takeaway

Alibaba Group has been trading at a pretty low valuation for quite some time. The break-up of the company should help unlock value, thus it is great to see that things are progressing on that front. Add appealing business growth, and BABA could be well-positioned for attractive returns over the next year or so. I remain long and I am looking forward to seeing how the business split-up will play out.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.