maybefalse/iStock Unreleased through Getty Photographs

A Relook One 12 months On

A yr in the past in 2021, I posted two in-depth evaluation on Alibaba Group Holding Restricted (NYSE:BABA), documenting the sturdy fundamentals, development prospects, and engaging valuation of the corporate. Most of the factors raised nonetheless stay very legitimate in the present day, as Alibaba has continued to pose wonderful monetary and person metrics development of their vital cloud and computing segments. For reference and comparability of theses, you may view my previous articles right here.

- Alibaba: A Worth And Progress Inventory At Present Costs

- Alibaba: A Basically Robust Firm Unfairly Crushed Down By The Market

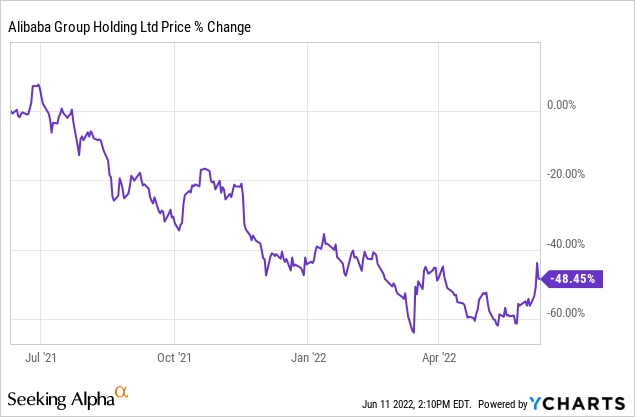

A yr on, Alibaba’s share value has dipped by virtually 50%, and this has been largely triggered by regulatory and macro-environmental considerations. Via all of it, Alibaba’s sturdy fundamentals stay unshaken and I’m extra bullish on Alibaba in the present day than ever earlier than. On this article, I’ll re-assess a few of my earlier pointers following FY22’s outcomes and up to date regulatory developments, in addition to put forth three new theses on why I imagine Alibaba in the present day is extraordinarily nicely positioned for long run outperformance.

Since Alibaba is a extensively lined firm, I can be specializing in lesser touched on features and views of the companies therefore if you want a fuller evaluation on the totally different enterprise segments, be at liberty to learn my two earlier articles.

Thesis 1: New Retail Section Is An Underneath-Appreciated Driver Of Progress

A lot of the bull/bear discussions surrounding Alibaba have been relating to the corporate’s regularly falling e-commerce market share with the rise of opponents equivalent to JD.com (JD) and Pinduoduo (PDD). Moreover, some analysts have voiced considerations that Alibaba’s e-commerce income development will inadvertently gradual for the reason that trade is nearing maturity in China. Therefore, my major thesis on this article can be too deep-dive Alibaba’s new retail phase which appears to have been neglected by many as a long run development driver..

New Retail Section Continues To Pose The Highest Progress Charges Regardless of A Extra Risky Enterprise Atmosphere In FY22

As a recap, new retail refers back to the mixing of on-line and offline commerce by offering shoppers a seamless change between each platforms. I discussed final yr that new retail would function new avenues of income development for Alibaba, and I imagine that outcomes and growth over the previous yr proceed to solidify this thesis.

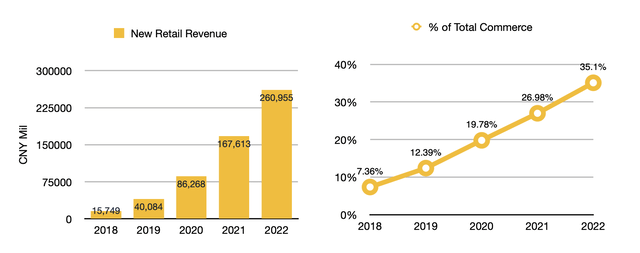

Alibaba’s New Retail Income Progress (Creator’s compilations from Alibaba’s 10-Ks)

To determine new retail income, I’ve taken the figures from Alibaba’s “Direct Gross sales & Others” income line which the corporate has described as income from Solar Artwork, Freshippo and Tmall Grocery store — all of that are a part of the brand new retail technique. Therefore, whereas the precise new retail income would possibly differ from these quantities, I imagine that it’s a ok proxy for evaluation.

For FY22, we will see that new retail income has continued to develop by 55% y-o-y, with a 4Y CAGR of over 101%! New retail now makes up 35% of whole commerce income, and is now a major income driver for Alibaba.

That is big for Alibaba, as we’re at present solely 5 years into the projected twelve years projected timeframe for brand spanking new retail to reached a extra “developed” section, a timeline set by founder Jack Ma again when this idea was launched. Regardless of its relative dimension, new retail remains to be Alibaba’s quickest rising phase, over cloud and worldwide retail at 24% y-o-y. On condition that Alibaba is already posing stellar outcomes for brand spanking new retail, I imagine this phase will proceed to be a future income and development driver for each the native commerce phase and firm on the whole.

Consolidation Of Solar Artwork Coupled With Freshippo Vastly Strengthens Alibaba’s Omni-Channel Grocery store Enterprise

Now, I’ll flip to the extra qualitative features of the phase to clarify why Alibaba’s new retail companies are nicely positioned for development. On the coronary heart of Alibaba’s new retail technique are hypermarkets and supermarkets. It’s because there are lots of dimensions to the buyer expertise on this space, and quite a few alternatives for innovation, as famous by Alibaba’s President Michael Evans.

One key piece of the technique is Solar Artwork Retail, a number one grocery store in China which Alibaba purchased an preliminary 36% minority stake again in 2017 to kickstart its new retail roadmap. In 2020, Alibaba acquired a majority stake within the retailer, giving it full management and entry to its shops, stock and networks. With out Solar Artwork, Alibaba’s solely bodily grocery store chain was its self-developed Freshippo “smart-supermarkets”, commanding solely 320 storefronts as of 2Q22. Therefore, the consolidation of Solar Artwork provides over 500 bodily shops, greater than doubling Alibaba’s bodily footprint and distribution community for supermarkets.

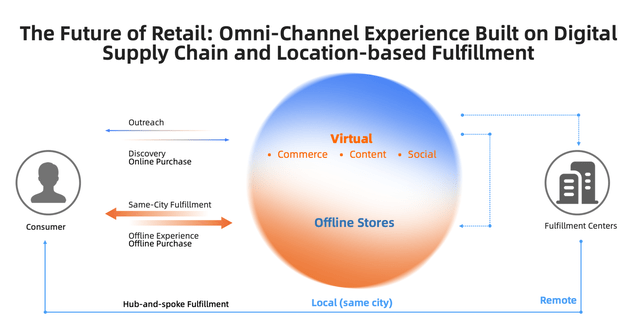

Alibaba’s New Retail Technique & Ecosystem (Alibaba Investor Day 2021)

With this, Alibaba’s focus is on integrating all their new retail manufacturers, Solar Artwork, Freshippo, Tmall Grocery store (grocery arm of the Tmall e-commerce app), by digitalizing the brick-and-mortar manufacturers and connecting stock, supply and distribution networks to value-add the e-commerce platforms. Which means stock for a Tmall grocery store product might be saved at a Freshippo retailer closest to a shopper, and this can enable identical day supply both via Freshippo’s supply fleet or Alibaba’s personal Cainiao logistics community.

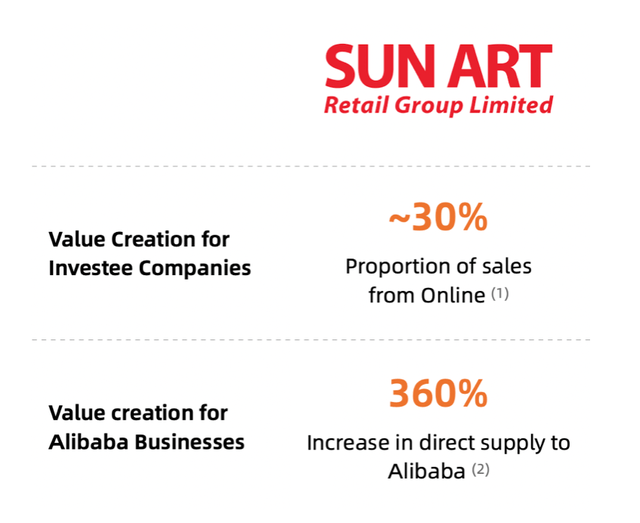

To offer concrete examples, Solar Artwork had already begun to combine its stock with Tmall again in 2019. In FY22, a full yr after consolidation, Alibaba has additionally reported sturdy synergies between Solar Artwork and Alibaba’s e-commerce arm, with Solar Artwork’s e-commerce gross sales rising to 30% as Alibaba used its e-commerce experience to develop Solar Artwork’s on-line platforms. Then again, there was a 360% improve in stock provide to Alibaba and this additional strengthens the corporate’s omni-channel grocery store technique as they’ve larger management over their items. At the moment, Solar Artwork is piloting a “warehouse-based” storefront just like Freshippo, which means that half the shop can be a ahead distribution level for Alibaba’s logistics community e.g. stock, packing and supply level.

Solar Artwork & Alibaba’s Synergies (Alibaba Investor Day 2021)

Alibaba Is Now Even Higher Positioned To Scale And Seize Progress In New Retail Markets

With a completely consolidated Solar Artwork to enhance Freshippo and Tmall grocery store, Alibaba can now begin to scale their omni-channel grocery store phase as integration processes develop into extra full. When taking a look at opponents, JD.com can be the obvious rival on this market, as they’re the one different e-commerce participant with an in depth community of bodily shops and well-developed logistics supply ecosystem.

With the consolidation of Solar Artwork, Alibaba’s MAUs for its grocery store apps now exceed 30 million, at an analogous stage as JD Daojia, JD’s O2O grocery arm. Nevertheless, Alibaba’s figures solely embrace these of Solar Artwork and Freshippo and excludes Tmall Grocery store MAUs as this quantity just isn’t disclosed. I’d count on the mixed determine to be a lot bigger since Alibaba’s Tmall MAU exceeds 800 million. Turning to bodily storefronts, Alibaba now has a commanding lead over JD on owned grocery store areas, with JD solely opening its personal sensible grocery store retailer 7Fresh final yr. The chain now has 48 areas with 12 extra anticipated to open by finish 2022.

Nevertheless, the place JD differs is in its enterprise mannequin. As an alternative of proudly owning supermarkets, JD engages in energetic partnership with retail chains such Yonghui Superstores, in addition to native mother and pop shops, totaling over 150,000 storefronts from companions. Additionally it is reported that JD is opening over 1000 new small comfort shops per day via franchising agreements, and these shops function supply outpost for JD Daojia.

Alibaba | JD | |

Grocery store App MAUs | 30m+ from Solar Artwork & Freshippo, excluding Tmall Grocery store | 30m from JD Daojia |

Essential App AACs | 939m | 580m |

Bodily Community Of Supermarkets | 800+ (Owned) | 150,000 (Companions) |

As each corporations are working totally different enterprise fashions, Alibaba specializing in warehouse fashion whereas JD goes for attain, it will be tough for me to determine who can be the winner. Nevertheless as historical past has proven, there’s all the time room for a couple of participant within the Chinese language market and I totally imagine that Alibaba is now in a stronger place to rival JD within the omni-channel grocer realm.

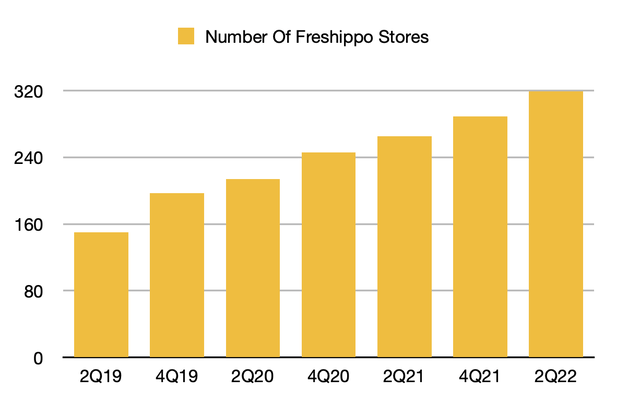

Past Solar Artwork’s consolidation, Alibaba can quickly scale its bodily footprint and even broaden via smaller-sized shops to extend their attain. For instance, Freshippo’s shops have grown by a 41% CAGR from 1Q19 to 2Q22 and are nonetheless primarily concentrated in Tier 1 cities. On condition that China’s grocery store focus is somewhat low and lots of prime chains have over 1000 shops, which means room for retailer growth is aplenty on this market. With shops concentrated in Tier 1 cities, growth into decrease tier cities is also facilitated by the sturdy momentum of Taobao Offers which was launched final yr to focus on value delicate, decrease tier shoppers.

Retailer Rely Progress Of Alibaba’s Freshippo (Statista)

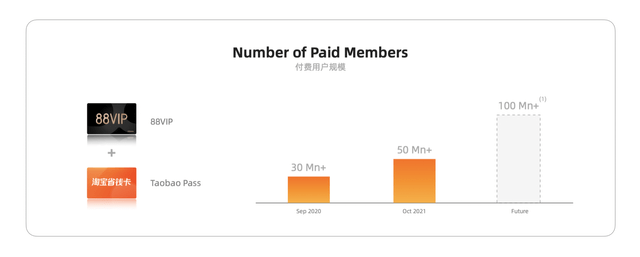

Lastly, new retail may develop by leveraging on Alibaba’s community results. As proven earlier, Alibaba has virtually double the person base of JD, which may work of their favor as they upsell shoppers and promote grocery store functionalities. Moreover, Alibaba at present has over 50 million paid members of their Taobao app, a significantly massive pool of loyal shoppers whom they will additional goal their new retail methods at.

Quantity Of Alibaba’s Paid Members (Alibaba Investor Day 2021)

In all, I imagine that new retail via omni-channel grocery is a large market and income driver that appears to have been neglected by many. Given Alibaba’s sturdy monetary efficiency over the previous 5 years, coupled with its sturdy O2O integrations, development potential and attainable community results, I imagine this phase can be a core development driver for the corporate in the long term.

Thesis 2: Profitability And Scalability Of Cloud Will Enhance Margins And Alibaba Can Now Pivot To Abroad Growth With Their Robust Choices

Subsequent, cloud is a extensively watched enterprise phase for Alibaba. In 2021, I famous that Alibaba would doubtless flip a non-GAAP revenue for this phase in FY22 and this may be worth accretive as cloud will not drain money stream from the corporate. Quick ahead to in the present day, Alibaba has certainly posed constructive cloud EBITA for FY22, and the thesis has performed out.

Alibaba Cloud Stays Prime In Capabilities & Market Share In China To Seize Progress In The House Market

At present, I can be reinforcing the cloud thesis for the long term as I imagine that regardless of some unfavorable developments over the previous yr e.g. Alibaba Cloud shedding an enormous buyer, Chinese language authorities encouraging the general public sector to make use of state owned cloud, Alibaba nonetheless instructions a robust place in its residence market.

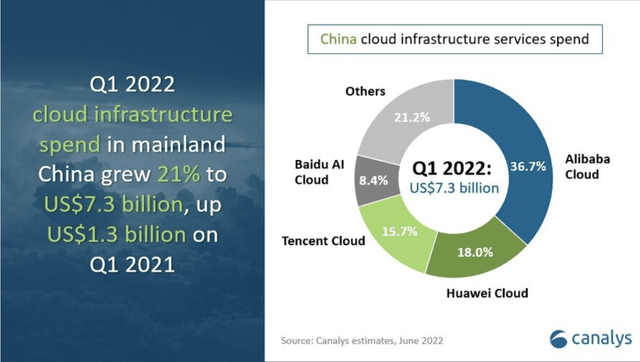

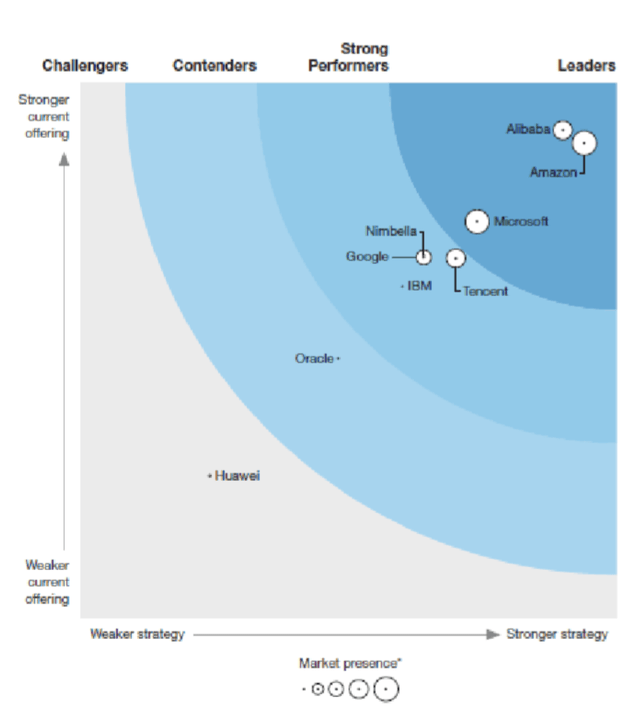

In Q1 this yr, Alibaba commanded 36.7% market share in China, barely down from 39% a yr in the past. Such a drop is anticipated given Alibaba’s big lead, as they proceed to have a commanding market place lead over their closest rivals. Equally, Alibaba can be nicely forward of its rivals per Forrester Wave when it comes to cloud providers and capabilities.

Cloud Computing Market Share In China 1Q2022 (Canalys)

Whilst tech corporations and public cloud are coming below larger scrutiny and rules, the Chinese language cloud market remains to be anticipated to develop at a CAGR of 33.3% via 2025, reaching $87 billion. That is catalyzed by the nation’s poorer enterprise software program sector which signifies that public cloud infrastructure will dominate development within the years to come back as there are not any good options. With Alibaba remaining because the best choice, they may have the ability to proceed to reap this development within the years to come back.

Alibaba Cloud Can Viably Increase Into Friendlier Abroad Markets Given Its Robust Suite Of Choices Relative To Worldwide Friends

Alternatively, ought to development within the home cloud market gradual resulting from unexpected causes, Alibaba has stronger draw back safety as in comparison with its Chinese language friends, as they’ve the biggest cloud infrastructure abroad and a bundle that may rival international cloud suppliers like Amazon (AMZN) and Microsoft (MSFT).

One key marketplace for Alibaba can be Southeast Asia, because the area remains to be comparatively undeveloped when it comes to know-how and knowledge storage infrastructure therefore Alibaba Cloud offers a robust worth proposition within the area. SEA can be the quickest rising adopter of cloud computing by area, with an estimated market dimension of $40 billion by 2025, half that of China!

In SEA, Alibaba already has over 100 knowledge facilities in Malaysia, Singapore, Indonesia and the Philippines amongst others, making it the biggest cloud supplier in Asia Pacific. By way of market share and total capabilities, Alibaba nonetheless ranks behind Amazon and Microsoft, however is the one Chinese language cloud firm to be ranked by Forrester Wave. Moreover, Alibaba Cloud does have its area of interest promoting factors as the identical examine additionally revealed that Alibaba Cloud tops all international friends in two forms of providers: Container-as-a-Service (CaaS) and Operate-as-a-Service (FaaS).

Forrester Wave’s FaaS Rankings (Forrester Wave)

In addition to offering Alibaba Cloud with a USP, its management in serverless cloud via FaaS and CaaS can be engaging to customers in SEA as they’re on the decrease finish of the pricing spectrum when in comparison with the opposite suite of cloud providers equivalent to IaaS. Since SEA has decrease spending energy than Europe and even China, this may be a tailwind for Alibaba’s cloud growth within the area.

Moreover, as FaaS and CaaS surrenders extra use instances to be managed by the cloud serviced supplier, this creates a sticker shopper base as switching prices are elevated.

To again the sturdy high quality of Alibaba Cloud, development in SEA has been stellar, with income development at 60% y-o-y and an growing market share from 3.7% in 2016 to 9.5% in 2020. With the sturdy product line up on supply, I count on this development to steadily proceed.

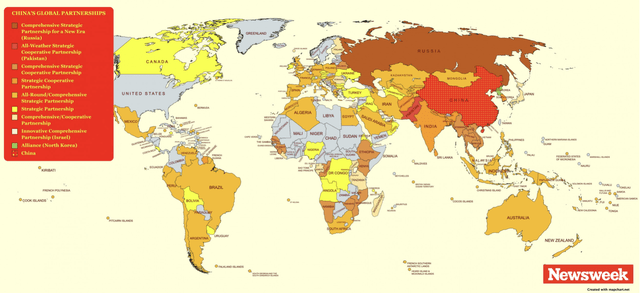

Lastly, not like in Europe the place Alibaba would possibly face pressures over knowledge safety resulting from its Chinese language origins, SEA is a way more friendlier area to Chinese language tech as China has a robust diplomatic presence within the area and has invested closely into many creating nations. The map under ranks the world by their diplomatic agreements with China and SEA might be seen in darkish brown which represented one of many stronger forms of ties.

China’s World Partnerships (Newsweek)

One other area of growth can be Africa & the Center East which additionally has nearer ties with China. To enter these area, strategic partnerships are vital and Alibaba has proven to be prudent of their resolution marking. For instance, they are going to be opening 2 new knowledge facilities in Saudi Arabia, with a $500 million funding dedication over the subsequent 5 years. This JV consists of the Saudi Firm for Synthetic Intelligence (SCAI), which is wholly owned by the nation’s Public Funding Fund (PIF), signaling governmental help for his or her entrance.

Therefore, because the cloud phase turns worthwhile, I imagine that it’s going to nonetheless stay a robust income development driver each domestically and internationally for Alibaba — and as all this growth additional provides to its scale, margin enhancements will certainly be useful to shareholders.

Thesis 3: Alibaba Is Properly Positioned To Profit From An Bettering Regulatory Outlook And Economic system

Lastly, this may be a comparatively shorter thesis as I want to shortly tackle the regulatory developments in China. Many people ought to know that in current weeks, the Chinese language regulators have expressed that the tech-clampdown in China can be coming to an finish. On Tuesday, the State Anti-Monopoly Bureau acknowledged that it had achieved sturdy outcomes in controlling monopolistic practices and are actually give attention to restoring market confidence. Prime CCP officers had additionally met with massive tech leaders again in Might to reaffirm help for the wholesome growth of the platform economic system and to reassure that new rules can be predictable transferring ahead.

That is extraordinarily vital for Alibaba as they’re arguably the agency worst hit by the anti-monopolistic clampdown over the previous two years, paying the majority of antitrust fines. With an ending tech-clampdown and governmental help for financial development, we may see Alibaba with the ability to proceed to develop and innovate in areas which have been placed on maintain through the clampdown equivalent to Ant Monetary. As talked about in my earlier article, financial stimulus would additionally profit Alibaba drastically as they’re a primarily consumption primarily based firm, in an economic system that’s pushed by consumption. Therefore, as China goals to spice up its economic system put up pandemic via lifting digital platforms and stimulus, Alibaba can be one of many biggest benefactors of each. To learn extra on why Alibaba can be on the forefront of the regulatory and macro-environmental restoration of China, you may learn my earlier article: Alibaba And Baidu: At The Forefront Of Chinese language Shares Restoration

Valuation

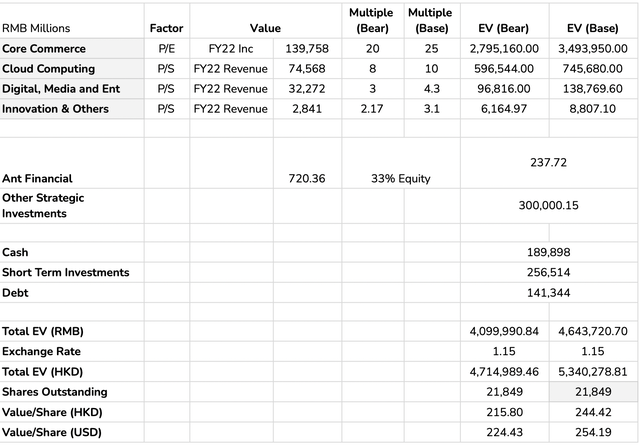

Lastly, I’ve up to date by SOTP valuation for Alibaba with FY22 figures. Assumptions for my multiples, change charges and particular person valuations stay fixed with my earlier articles and are nonetheless on a extra conservative finish.

Alibaba Updates SOTP June 2022 (Creator’s calculations)

I get hold of a good worth vary of $224 to $254, which is a 105-130% upside from a closing value of $110.

Conclusion

In all, my stance on Alibaba stays the identical as one yr in the past – the corporate stays a powerful purchase, each from a basic and valuation standpoint. The truth is, Alibaba in the present day is in a a lot stronger place than earlier than contemplating that regulatory clampdowns are ending and that the corporate has began to show a revenue of their cloud division. Lastly, past e-commerce development in China & Southeast Asia, Alibaba additionally has an below appreciated development driver in new retail which can be worth accretive for the corporate and shareholders in the long term. It’s now an excellent time to purchase a essentially sturdy firm nonetheless buying and selling at a steep low cost as share value restoration is correct on the horizon.