Andrew Burton

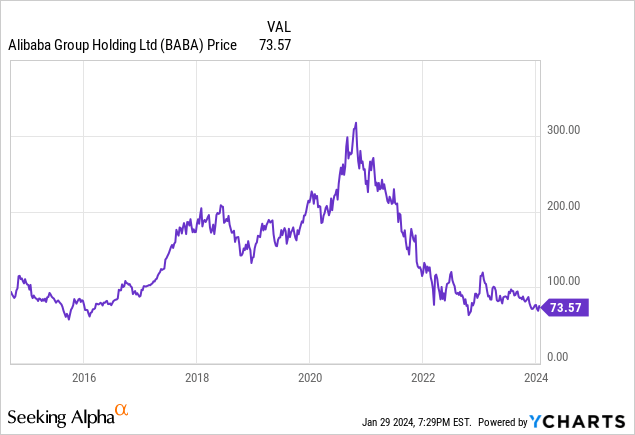

Alibaba Group Holding Limited (NYSE:BABA) has seen very volatile trading as of late. With the Chinese property market appearing as dicey as ever, investors have grown cautious on Chinese equities, with BABA trading down to below its IPO price.

But the stock has seen some life recently on account of significant insider buying from co-founder Jack Ma as well as CEO Joe Tsai. The stock remains extraordinarily cheap at least on the surface, backed by lots of net cash and a significant equity investment portfolio.

However, I have grown disillusioned by management’s inability to deliver on plans to separate out its business units through spinoffs and IPOs. With the most obvious catalyst now appearing unlikely, I cannot avoid turning my attention to the Chinese macro environment. I am selling my stock and do not intend to revisit the name until there is tangible progress on business spinoffs or a resolution of the Chinese property crisis.

BABA Stock Price

Pessimism is high for Chinese equities, but is it high enough? BABA briefly traded below its 2014 IPO price, but has recently seen signs of life due disclosure that both Ma and Tsai had purchased a combined $200 million of stock in the company. Whereas Ma’s $50 million purchase was of the Hong Kong-listed securities, it is notable that Tsai’s $150 million purchase was of the American depository receipts.

I last covered BABA in October, where I stood by my bullish rating on account of the strong balance sheet and catalysts in motion. While it may seem abrupt, I am now pulling my bullish rating due to management being unable to execute on the planned spinoffs, in spite of having already attempted to spin off both the grocery and cloud divisions.

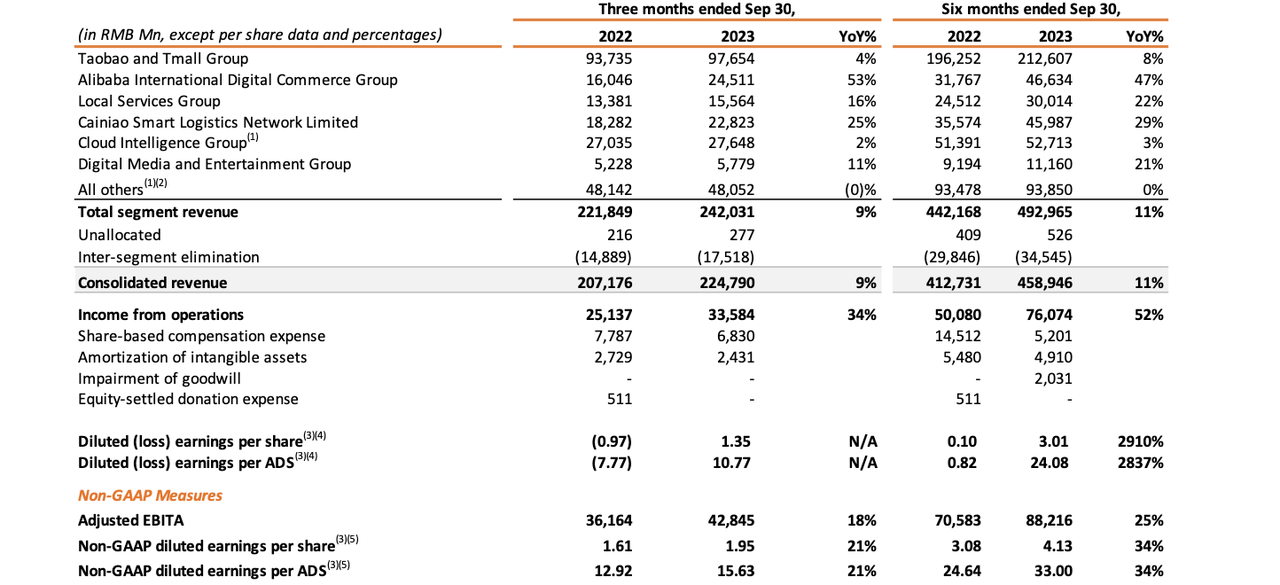

BABA Stock Key Metrics

In its most recent quarter, BABA generated 9% YoY revenue growth, led by 53% growth in international digital commerce. It is notable that competitor PDD Holdings (PDD), formerly Pinduoduo, has been generating triple-digit top-line growth in comparison. Operating income grew even faster at 34% YoY as the company continues to push for operational efficiency.

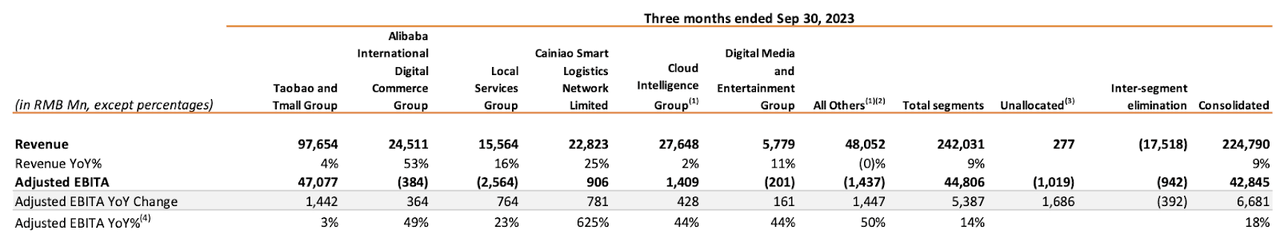

2023 Q3 Presentation

From an adjusted EBITA perspective, we can see below that the company delivered the greatest improvements in its Cainiao logistics segment.

2023 Q3 Presentation

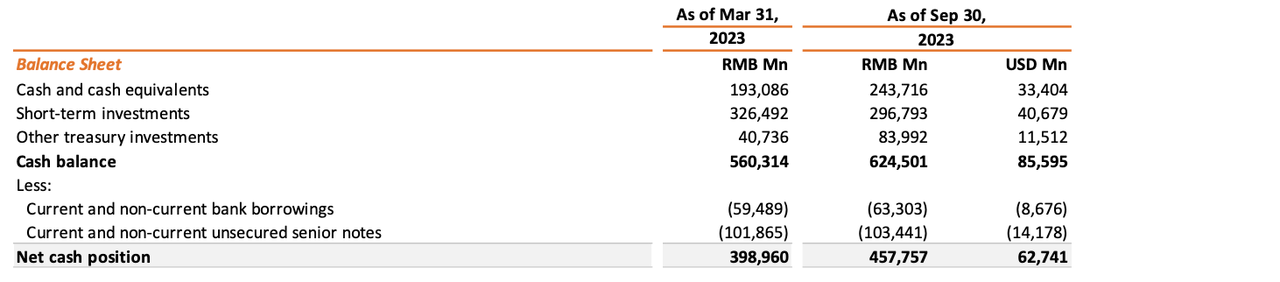

BABA ended the quarter with a typically strong balance sheet, highlighted by $62.7 billion in net cash and $67 billion in equity investments. I note that the market cap recently stood at just around $185 billion.

2023 Q3 Presentation

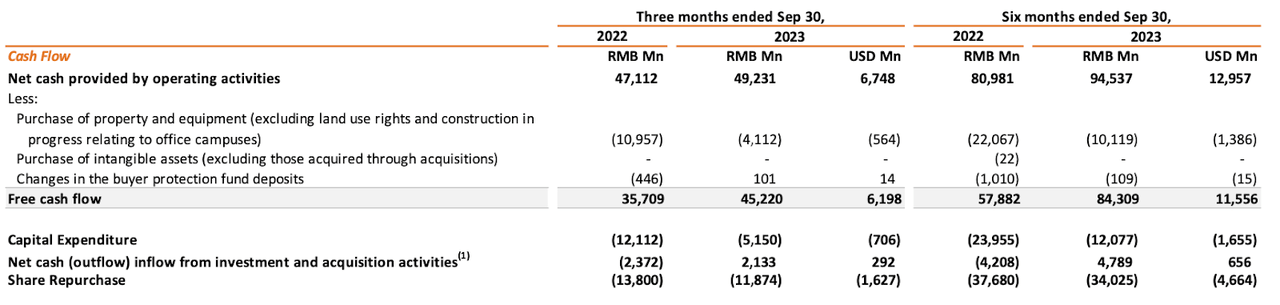

BABA generated $6.2 billion in free cash flow and repurchased $1.6 billion of stock. Given current valuations, investors may have been hoping for the company to be more aggressive with its share repurchase program, but the company’s recent results remain far more constructive than in years past when share repurchases were completely off the table. Management has since issued a press release stating that they had repurchased $2.9 billion of stock in the fourth quarter.

2023 Q3 Presentation

On the conference call, management noted that they will no longer pursue a spin-off of their cloud division due to “uncertainties created by recent U.S. export restrictions on advanced computing chips.” This comes after management paused their plans to IPO the grocery segment due to concerns about valuation. Management stated that they intend to instead develop a “sustainable growth model based on emerging AI-driven demand for networked and highly scaled cloud computing services.”

I view this development as being quite damaging to the bullish thesis, as the cloud division (and others) were and have not been rewarded with premium valuations under the conglomerate structure. As such, I am not of the view that driving increased focus on the cloud division would lead to shareholder returns, that is unless management also increases the aggressiveness of their share repurchase program (of which there is no indication). The company had previously filed for an IPO of their Cainiao Logistics segment in August and has received approval from the exchange, but at this point I need to see results before regaining hope.

Management emphasized their commitment to long term profitability, discussing ambitions to lift their ROIC from the single-digits to the double-digits. Management also noted plans to “monetize the value of non-core assets,” specifically calling out the $67 billion in equity investments. Such a move, if carried out, would be highly bullish for investors given the low valuation of the stock today – but again, after being disappointed on the business segment spinoffs I need to see to believe.

Management approved a quarterly dividend but noted that they are “not going to consider a one-time cash dividend,” stating that “the priority for cash use is to invest for future growth.” That appears to go against the commentary regarding monetizing the equity portfolio, and at the very least crushes any hopes for an aggressive share repurchase program fueled by cash on hand and sales from the equity portfolio.

Is BABA Stock A Buy, Sell, or Hold?

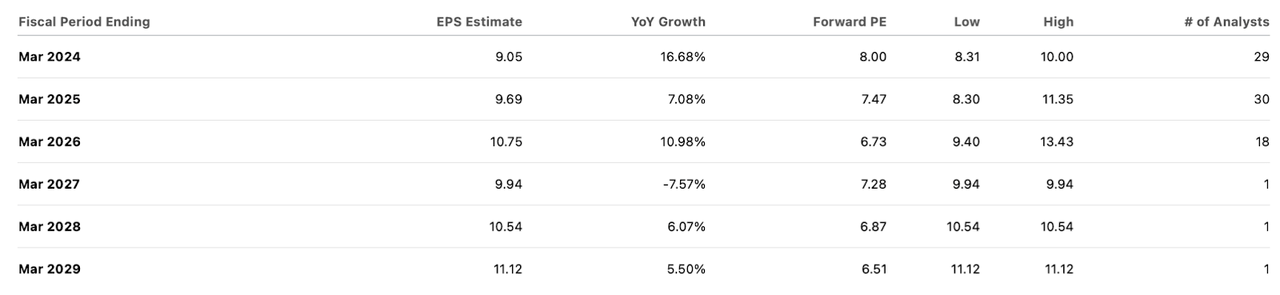

At recent prices, BABA was trading at just around 8x earnings.

Seeking Alpha

The company does have around 70% of its market cap represented by net cash and equity investments, but I caution against calculating upside based on adjusting for net cash given that management has made it clear that an aggressive share repurchase or dividend payout is off the table.

My previous bullish case was based on Alibaba Group Holding Limited creating shareholder value by breaking up the business segments through IPOs and spinoffs. The idea was that many of these businesses are loss-generating or not generating much profits, meaning that they are not contributing much to that current P/E ratio. By separating them out, they would receive non-zero valuations, and that would lead to substantial value creation assuming that the core Taobao business is valued at least the current earnings multiple. However, as it is looking increasingly unlikely that BABA will be able to spin out their cloud or grocery segments, that thesis is falling apart.

In the absence of that thesis, we are left wondering if Alibaba Group Holding Limited stock is cheap enough at current levels. The Chinese government risk is well known, and I’d argue that management is not repurchasing enough stock nor paying generous enough dividends to offset that risk through shareholder return of capital. But there are other risks that are more concerning.

As briefly mentioned earlier, PDD and other competitors are potential reasons for concern. The fact that PDD is growing so rapidly relative to BABA appears to indicate that BABA is losing market share to the competition. Yes, some may point to PDD spending aggressively on advertising, but it is notable that PDD remains highly profitable on a consolidated basis with a stunning 22% net margin in the latest quarter. If it turns out that BABA’s core businesses are in slow-growth or even terminal decline, then 8x earnings no longer looks so cheap. If anything, one could argue that 8x earnings would be too expensive, given that we must also factor in the Chinese risk.

But in my view, the more concerning risk is that of the macro situation in China. It appears inevitable for a real estate crisis to emerge, and I am not encouraged by the government’s efforts to support the financial markets. My naive eye sees a lot of similarities between the 2008-2009 Great Financial Crisis and the troubles in China today. I am of the view that we may likely see exceedingly attractive entry points into Chinese stocks including BABA in the medium-term future. It is not clear what role, if any, BABA will play in a Chinese recovery.

Again, I stress that these concerns always existed, but have become more important given the lack of visible catalysts. I am downgrading the stock to “hold” representing a neutral rating, but may upgrade the stock if management shows a committed effort to returning cash to shareholders more aggressively.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.