Koki Nagahama

Shares of Alibaba (NYSE:BABA) lost a combined $12B in market value yesterday after it was reported that anchor shareholder SoftBank Group, a Japanese investment conglomerate run by Masayoshi Son, is selling down its stake in the Chinese e-commerce start-up. The report created new selling pressure for Alibaba just after the e-Commerce company announced that it would split itself up in order to create value for shareholders. The return of Jack Ma to China recently also indicates that crackdown fears are easing. I believe yesterday’s price drop is another opportunity to buy shares of Alibaba before the company is going to present its full-year results next month!

Why the SoftBank share sale shouldn’t affect Alibaba’s valuation for long

According to an analysis of regulatory filings by the Financial Times (Source), SoftBank Group sold $7.2B worth of Alibaba shares through prepaid forward contracts which is set to reduce the company’s shareholding in Alibaba to just 3.8%. SoftBank has been an earlier investor in Alibaba and owned almost a quarter of the company’s outstanding stock at some point. SoftBank became been an investor in Alibaba in 2000 which is when Masayoshi Son invested $20M into the obscure internet start-up.

What is the reason for the share sale?

SoftBank itself has come under pressure after the pandemic as many high-priced investments in technology companies — many of which were made at the peak of the last pandemic — failed and triggered massive losses for the investment company and its flagship investment fund. In August 2022, SoftBank reported a record-shattering $23.4B loss which was mostly due to technology valuations correcting to the downside in FY 2022. Some high-risk bets like WeWork turned out to be complete disasters and resulted in billion dollar losses for early investors.

However, I believe the share sale is not as big a deal as investors think it is. This is because Alibaba is a large-cap Chinese technology company with significant liquidity and a change in shareholder structure should not affect Alibaba’s valuation for a long time. SoftBank closed out a very profitable investment in Alibaba, but the share sale alone should not have a lasting negative impact on Alibaba’s P/E ratio as SoftBank was merely a passive investor in the e-Commerce company. With earnings coming into focus again next month, I believe the market will quickly return to an evaluation of Alibaba’s fundamentals.

Alibaba’s e-Commerce business is ripe for a recovery

Instead of obsessing over Alibaba’s shareholder structure, investors should look towards the future which I believe is bright for Alibaba. The company recently announced that it was splitting itself up into 6 separate business units which at some point could result in an IPO of Alibaba’s pure-play Cloud business… which I estimated could be worth between $48B and 60B. Alibaba’s e-Commerce business especially is ripe for a rebound after the segment suffered a severe growth slowdown in the last two years.

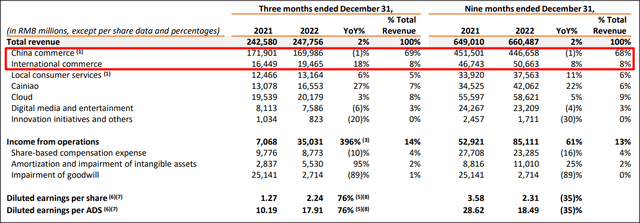

In the December-quarter, Alibaba’s China commerce business continued to suffer from COVID-19 lockdown measures that weighed heavily on consumer spending. But with China’s economy reopening in January, there is a strong chance that Alibaba will see a gradual recovery in e-Commerce spending and higher transaction volumes in the first half of 2023. Despite investments in AI, Cloud and other growth sectors, e-Commerce remains Alibaba’s bread and butter and will likely continue to account for an approximate 70% revenue share this year.

Source: Alibaba

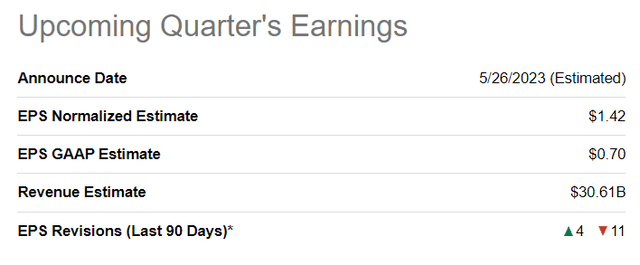

EPS estimate trend is improving

Alibaba’s estimates are low, but they are no longer in freefall like they were in 2022. With China’s economy going through a post-pandemic reset right now, I believe we could see significant EPS outperformance in the next few quarters. For the March-quarter, analysts expect $1.42 per-share in earnings, showing 20% year over year growth.

Source: Seeking Alpha

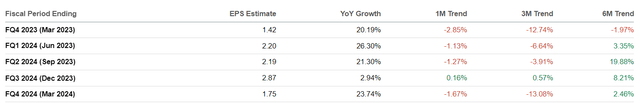

The estimate trend is also getting more positive, with analyst expecting three straight quarter of 20%+ year over year EPS growth, compared to their respective year-earlier periods.

Source: Seeking Alpha

Alibaba’s valuation

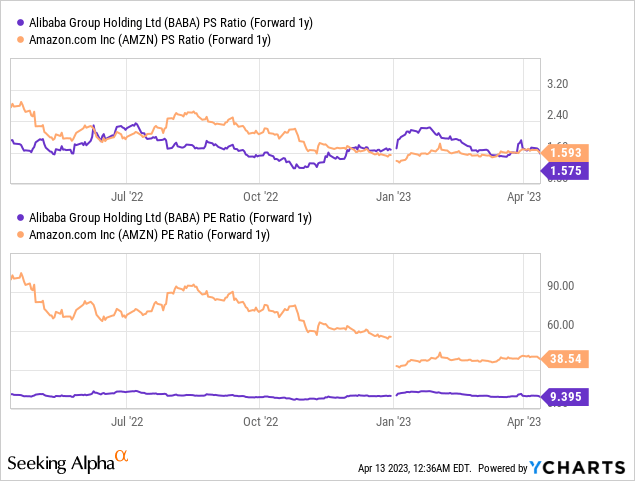

I continue to believe that Alibaba shares are extremely attractively valued after the price drop on Wednesday. The reason for this is that Alibaba is trading at a P/E ratio of only 9.4X while estimates call for impressive EPS growth in the next two years: the consensus indicates that Alibaba could see ~13% EPS growth in FY 2024 and FY 2025.

I also consider Alibaba to be much better e-Commerce value than Amazon (AMZN), for example… which has deep problems, especially in the e-Commerce business. Additionally, Alibaba faces a potent catalyst in 2023: the reopening of China’s economy.

While Alibaba is valued at a P/E ratio of 9.4X, Amazon is valued at 38.5X earnings, which makes the American company almost four times more expensive than Alibaba.

Alibaba revenues are expected to grow 10% annually in the next two years, while Amazon is projected to grow 13% next year and 12% in the following year, so there really isn’t that big of a growth difference between those companies. I am not sure that this minor difference in growth justifies such a large divergence of Alibaba’s and Amazon’s P/E ratio.

Risks with Alibaba

The biggest risk for Alibaba, from commercial point of view, is that the reopening of the Chinese economy is not going to unleash as much pent-up demand as expected which in turn could delay the recovery of Alibaba’s e-Commerce business. What would change my mind about Alibaba is if the company saw a serious decline in its free cash flow and if its e-Commerce operations continued to slow down despite a general reopening of China’s economy.

Final thoughts

I believe the drop in Alibaba shares is a temporary phenomenon that investors can take advantage of before the company is going to report earnings for FQ4’23 next month. As I have indicated, Alibaba’s earnings expectations are low… and the company has significant earnings surprise potential since results for FQ4’23 should include the positive effects resulting from China’s economic reopening.

For this reason, I am moderately optimistic that Alibaba could beat low earnings projections for its full-year and the ecommerce company still has the option to increase its stock buyback program in order to return a larger percentage of its free cash flow to shareholders. Since the company recently also announced a major organizational transformation as well, investors should focus on Alibaba’s recovery potential and not on an inconsequential change in shareholder structure!