SHansche

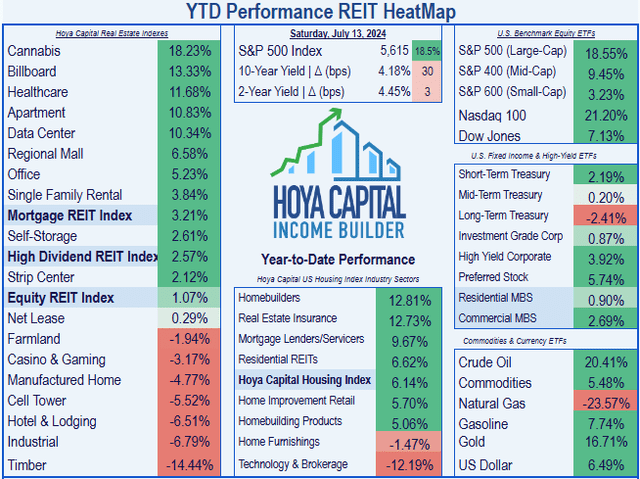

So far this yr, Workplace REITs have gained modestly, returning a mean of 5.23% (most of that coming final week), in comparison with the REIT common of 1.07%. This stands in sharp distinction to the +18.55% return posted by the S&P 500, and even sharper distinction to the +21.20% earned by the Nasdaq 100.

Hoya Capital Revenue Builder

The WFH (work at home) pattern kickstarted by the pandemic has had, and can proceed to have, lasting results on business workplace house owners, as demand has slackened, kind of completely. In the meantime, mounting defaults in business actual property loans, and office-related loans specifically, provides strain to an already sketchy banking system. As Looking for Alpha Contributor Avi Gilburt wrote in April:

[according to] a examine revealed by researchers from USC, Columbia, Stanford, and Northwestern, . . . 14% of all CRE loans and 44% of office-related loans look like in “damaging fairness.” In different phrases, the present values of properties, which function collateral for these loans, are lower than the excellent mortgage balances. As well as, the paper stated that round one third of all CRE loans and nearly all of office-related loans could encounter substantial money move issues and refinancing challenges. The examine concluded that U.S. banks are more likely to face a 20% default ratio on their CRE loans.

So the longer term would not look good for Workplace REITs.

www.alx-inc.com

Alexanders, Inc. (NYSE:ALX) is a small-cap REIT ($1.14 billion), externally managed by Vornado Realty Belief (VNO) since 1995. Based in 1928, the corporate went public in 1968.

Alexander’s has simply 5 properties, all in larger New York Metropolis:

- 731 Lexington Avenue (workplace and retail, together with Bloomberg’s world headquarters),

- the Rego Middle complicated in Rego Park, Queens (together with the Rego Park I & II retail properties),

- The Alexander condo tower, and

- a retail property in Flushing.

The portfolio totals 2.455 million sq. toes. The corporate reviews a wholesome 92.5% occupancy of its workplace and retail house, and 96.8% occupancy of its residential properties, as of March 31.

VNO costs ALX the next yearly for its administration companies:

- A flat charge of $2.8 million, plus

- 2% of gross income on Rego Park II, plus

- 50 cents per sq. foot on the occupied workplace house at 731 Lexington Ave., plus

- $376,000, escalating at 3% every year, plus

- 6% of improvement prices, if relevant, plus

- 3% of lease for the primary 10 years of every lease, 2% for the following 10 years, and 1% thereafter, plus

- 33% of any third-party lease commissions, plus

- charges for cleansing, parking, and safety. Such charges paid to VNO for Q1 2024 alone totaled $2.4 million.

Though it owns workplace, retail, and multifamily properties, ALX is often categorized as an workplace REIT as a result of nearly all of its rental income comes from its Lexington Avenue property.

One tenant (Bloomberg L.P.) accounts for 49% of ALX rental revenues, and that firm’s 947,000 sq. foot lease runs by February 2040, having just lately been prolonged for 11 years. No different tenant accounts for even 10%.

After I first wrote about Alexander’s final August, I rated it a Promote over a 2 – 5 yr investing horizon, due to its excessive indebtedness, damaging income progress, over-reliance on a single tenant, and unsafe dividend. Nevertheless, I famous that attributable to its excessive yield,

Courageous buyers could come out forward by holding within the shorter time period.

And certainly they’ve. After the article was revealed, ALX shares did unload by (-11.4)% over the following two months, from $192.84 on August 3 to $170.80 on October 5. Nevertheless, buoyed by the expectation of decrease rates of interest, all of REITdom rallied into early 2024, carrying ALX high-yield shares to a excessive of $234.29 on Might 9, a surge of +21.5% in comparison with the August 3 value.

Nonetheless, on the 5-year and 10-year time frames,

Looking for Alpha Premium

the general pattern in share value has been relentlessly bearish.

Looking for Alpha Premium

ALX shares are value a whopping 41.27% much less at this time than 10 years in the past. Thus, buyers’ whole return has been significantly lower than the dividend yield.

There was a variety of water over the dam since that article revealed final August. The query now’s: which means are shares headed over the following 2 – 5 years? Has the corporate meaningfully addressed any of its weaknesses?

Quarterly Outcomes

ALX reported the next on its 10-Q for Q1 2024:

| Metric | Q1 2024 | Q1 2023 | % Change YoY |

| Rental Income | $61.4 m | $52.9 m | 16.1% |

| Bills | $36.3 m | $33.8 m | 7.4% |

| Shares Excellent | 5.13 m | 5.13 m | 0.0% |

| Web Revenue | $16.1 m | $11.2 m | 43.8% |

| Web Money from Operations | $16.8 m | $20.7 m | (-18.8)% |

| Money from Financing | $0.7 m | $164.8 m | (-99.6)% |

| Money and Money Equivalents | $536.4 m | $356.5 m | 50.5% |

| Revenue per share | $3.14 | $2.19 | 43.4% |

| FFO (Funds From Operation) | $25.5 m | $18.6 | 37.1% |

| FFO per share | $4.98 | $3.63 | 37.2% |

Though most of those figures look fantastic, they’re a little bit of an phantasm. As of April 1, IKEA terminated its 112,000 sq. foot lease at Rego Park I, greater than 6 years early. IKEA paid a $10 million lease termination charge for this privilege, together with all their rental obligations by March 2026, and this greater than accounts for the obvious year-over-year bounce in ALX revenues.

The money from financing drop of almost 100% can be anomalous. In Q1 of 2023, the corporate offered $166.8 million value of treasuries, which is extremely uncommon, making the year-over-year comparability very difficult.

Progress metrics

Listed below are the 3-year progress figures for FFO (funds from operations), and TCFO (whole money from operations).

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 | 4-year CAGR |

| FFO (hundreds of thousands) | $99.7 | $82.5 | $89.8 | $87.1 | $81.1 | — |

| FFO Progress % | — | (-17.3) | 8.8 | (-3.0) | (-6.9) | (-5.03)% |

| FFO per share | $19.47 | $16.11 | $17.52 | $16.99 | $15.80 | — |

| FFO per share progress % | — | (-17.3) | 8.8 | (-3.0) | (-7.0) | (-5.09)% |

| TCFO (hundreds of thousands) | $126.1 | $78.1 | $118.5 | $102.5 | $109.1 | — |

| TCFO Progress % | — | (-38.1) | 51.7 | (-13.5) | 6.4 | (-3.56)% |

Supply: Schwab.com, Hoya Capital Revenue Builder, and writer calculations

ALX revenues have fallen in 3 of the previous 4 years, at a CAGR of about (-5)%, and money move has suffered solely rather less. The outstanding similarity between the gross FFO and the FFO per share figures displays the truth that the corporate not often points new shares.

In the meantime, right here is how the inventory value has carried out over the previous 3 twelve-month durations, in comparison with the REIT common as represented by the Vanguard Actual Property ETF (VNQ).

| Metric | 2021 | 2022 | 2023 | 2024 | 3-yr CAGR |

| ALX share value July 12 | $273.78 | $232.48 | $184.28 | $224.62 | — |

| ALX share value Achieve % | — | (-15.1) | (-20.7) | 21.9 | (-4.83) |

| VNQ share value July 12 | $105.96 | $91.52 | $85.75 | $87.46 | — |

| VNQ share value Achieve % | — | (-13.7) | (-6.3) | 2.0 | (-4.68) |

Supply: MarketWatch.com and writer calculations

ALX fared worse than the common REIT within the selloff years of 2022 and 2023, however a lot better than common over the previous 12 months. It finally ends up being a wash. ALX buyers have seen the (-4.83)% CAGR in share value erode the yield by greater than half, whereas the common REIT has seen its yield swallowed completely.

Steadiness sheet metrics

Listed below are the important thing steadiness sheet metrics.

| Firm | Liquidity Ratio | Debt Ratio | Debt/EBITDA | % Variable | Bond Score |

| ALX | 1.20 | 50% | 10.0 | 32.3% | — |

Supply: Hoya Capital Revenue Builder, Looking for Alpha Premium, and writer calculations

ALX carries a load of liabilities nearly equal to their belongings, and a weak Debt/EBITDA of 10.0. The corporate reviews money and money equivalents of $536 million as of March 31, over towards money owed totaling $1.093 billion. The corporate lays out just a little over $23 million per quarter to pay dividends.

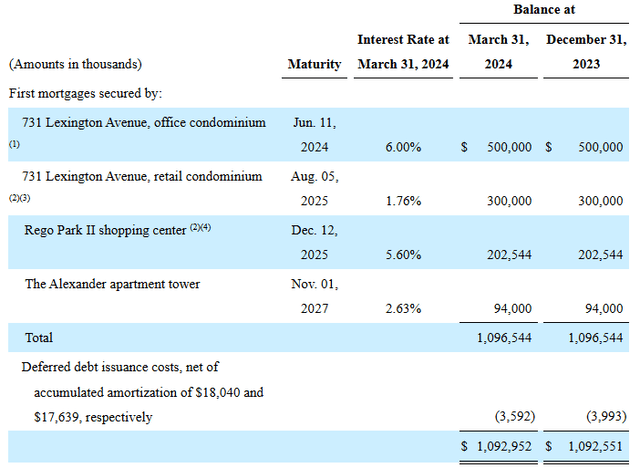

The maturity image shouldn’t be fairly, as seen beneath.

Alexanders’ Inc. 10-Q for Q1 2024

Utilizing the figures above, we are able to compute the corporate’s weighted common rate of interest at 4.47%, and weighted common time period to maturity of simply 1.2 years. The rate of interest is excessive, and the payments come due comparatively quickly.

In accordance with the corporate’s 10-Q for Q1 2024, they’d simply sufficient money readily available to cowl the June 11 cost of $500,000 and nonetheless pay an unchanged dividend. After that time, they are going to be strapped for money, besides as earnings replenish the stockpile. Debt/EBITDA ought to enhance markedly. Nevertheless, ALX additionally has letters of credit score summing to $900,000, so liquidity can nonetheless be had, at a value.

In any other case, the one solution to elevate money can be to situation new shares, which might dilute share worth and put downward strain on the share value.

Dividend metrics

Because the desk beneath reveals, ALX has been an distinctive dividend payer. The corporate’s dividend has remained at precisely $4.50 per quarter, ever since Q1 2018. Even through the pandemic, the corporate didn’t minimize the divvy. Nevertheless, the payout ratio of 114% is unsustainable, and Looking for Alpha Premium assigns the corporate a Dividend Security grade of D (a slight improve from the D- it was carrying 3 months in the past).

| Firm | Div. Yield | 5-yr Div. Progress | Div. Rating | Payout | Div. Security |

| ALX | 8.01% | 0.00% | 8.01 | 114% | D |

Supply: Hoya Capital Revenue Builder, Looking for Alpha Premium, and writer calculations

Dividend Rating tasks the Yield three years from now, on shares purchased at this time, assuming the Dividend Progress fee stays unchanged.

Nevertheless, the corporate did supply this reassurance of their quarterly submitting:

Latest will increase in rates of interest and inflation may adversely have an effect on our money move from persevering with operations however we anticipate that money move from persevering with operations over the following twelve months, along with present money balances, might be enough to fund our enterprise operations, money dividends to stockholders, debt service and capital expenditures.

Valuation metrics

ALX gives a excessive yield at a barely beneath common value, however is presently priced 9.6% above its estimated NAV, based on Hoya Capital Revenue Builder.

| Firm | Div. Rating | Value/FFO ’24 | Premium to NAV |

| ALX | 8.01 | 17.5 | +9.6% |

Supply: Hoya Capital Revenue Builder, and writer calculations

What may go improper?

All ALX belongings are concentrated in a single geographic area. Thus, any macroeconomic change affecting New York Metropolis and neighborhood would probably have an outsized impact on ALX operations.

There’s a clear and current hazard of continued slippage in FFO, resulting in a probable dividend minimize. Dividend security is of paramount significance, as a result of a minimize within the dividend is sort of at all times adopted by a pointy sell-off within the share value.

ALX faces a scarcity of money, main both to extra high-interest debt, a dilution of share worth by new share issuance, or each.

ALX depends excessively on a single tenant: Bloomberg, L.P. Any setbacks in Bloomberg’s enterprise would probably trigger main issues for ALX.

ALX is externally managed by Vornado, whose incentives could not at all times line up with these of ALX.

Investor’s backside line

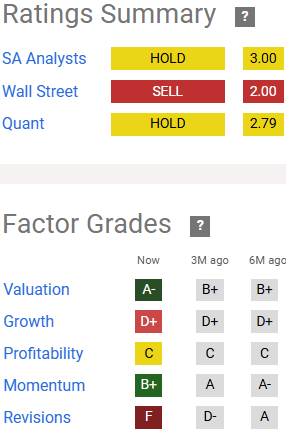

Given the corporate’s acknowledged expectation to maintain the dividend unchanged for one more yr, it’s tempting to fee ALX a Maintain. Nevertheless, the chance components listed above are compelling over the long term. Subsequently, for a 2 – 5 yr investing horizon, I’ve to fee this firm a Promote. ALX has made little or no progress on the problems I recognized almost a yr in the past. Within the meantime, the corporate supplies buyers with treasured little info, past what the federal government requires, and thus the corporate’s relative opacity does nothing to encourage confidence in my thoughts as an investor.

Looking for Alpha Premium

ALX is roofed by exactly one Wall Avenue analyst, at Piper Sandler. That analyst charges ALX a Promote, with a value goal of $145, and has stored that concentrate on primarily unchanged for a yr. That concentrate on implies a draw back of (-34.5)%.

In the meantime, Zack’s charges ALX a Maintain, as does Refinitiv, whereas CFRA charges it a Sturdy Purchase.

As at all times, nonetheless, the opinion that issues most is yours. As a result of it is your cash.