JHVEPhoto

Alcoa Corporation (NYSE:AA) is active in all aspects of the upstream aluminum industry with bauxite mining, alumina refining, and aluminum smelting and casting. AA’s operations comprised two reportable business segments starting 2023: Alumina and Aluminum. The Company has direct and indirect ownership of 27 locations across nine countries on six continents.

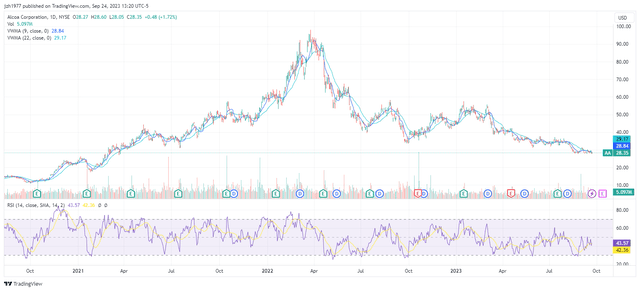

The stock price has declined significantly

AA’s stock price has declined by more than 70 percent since the peak in March 2022, right after the start of the Ukrainian war. Is the current price level attractive enough for investors to take another look at this stock?

TradingView.com

The market conditions for AA have not improved

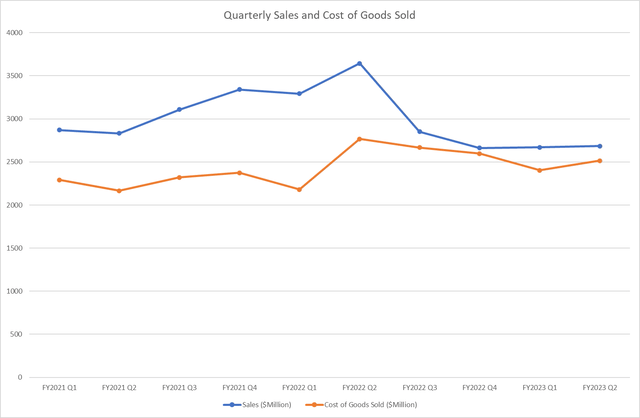

AA’s revenue in the second quarter had declined by 26.4 percent compared to the same quarter last year. Its non-GAAP EPS was -$0.35. The direct reason of the deteriorating operating outcome is that the prices of AA’s main products remained low and its producing costs increased.

SEC Filings (10-Q, 10-K)

In fact, the positive price shock right after the start of the Ukrainian war was reversed quickly in a few months last year, AA’s quarterly revenue even dropped below the pre-war periods.

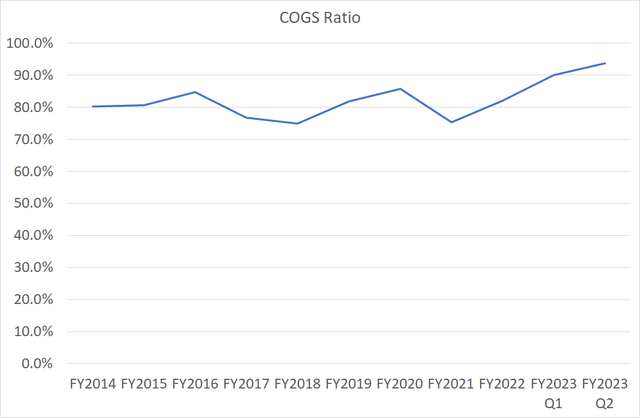

The cost of goods sold also experienced a similar price shock at the same time and declined after that. However, the cost decline was very gradual and the difference between the revenue and the cost of goods sold was narrowed significantly.

There are future uncertainties on both demand and supply

Aluminum is the second most used material in the auto industry next to steel. Near-term demand for AA’s aluminum products is now under pressure with the threat of the UAW strikes.

The UAW so far only started strikes in a few facilities. A full-scale strike is still possible since the UAW and the big three carmakers are still far apart in their contract negotiation. It is unclear if the president’s visit will speed up the negotiation. If the strike continues and spreads to more facilities, AA’s revenue will take more hits.

Even if the negotiation somehow reaches conclusions quickly, there are reasons to be cautious on demand for aluminum from the automotive industry. The highly cyclical nature of aluminum commodity suggests that economic slowdown engineered by the Fed’s monetary policy would take its toll on AA’s revenue.

On the supply side, the production cost could prove to be stickier than AA’s management expected. Crude oil prices have risen since the end of the second quarter which was a surprise to many market participants. The increase in energy costs will likely sustain the level of AA’s cost of goods sold in the next few quarters as well. The prices of key materials used in the Aluminum segment, including calcined petroleum coke and coal tar pitch, were also stabilizing.

TradingView.com

Valuation is not that cheap

Morningstar Morningstar Morningstar

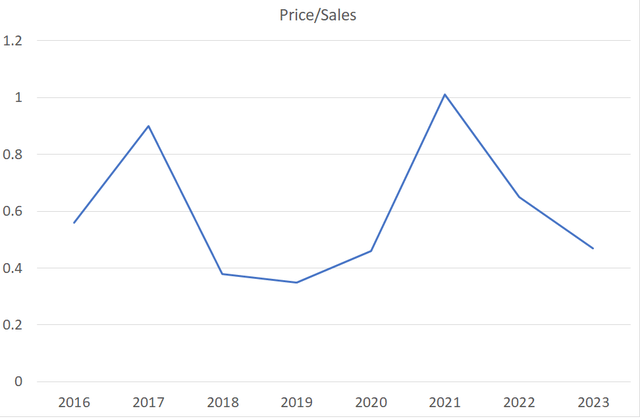

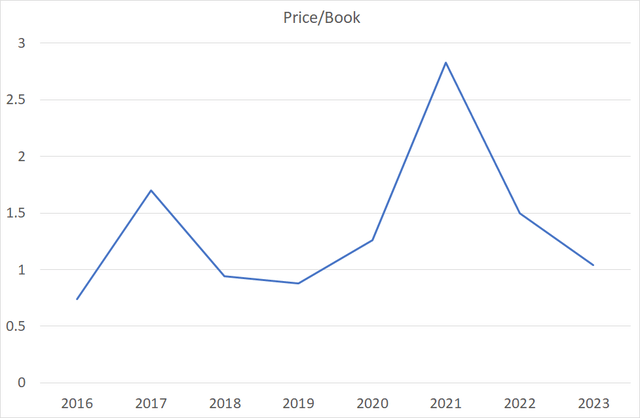

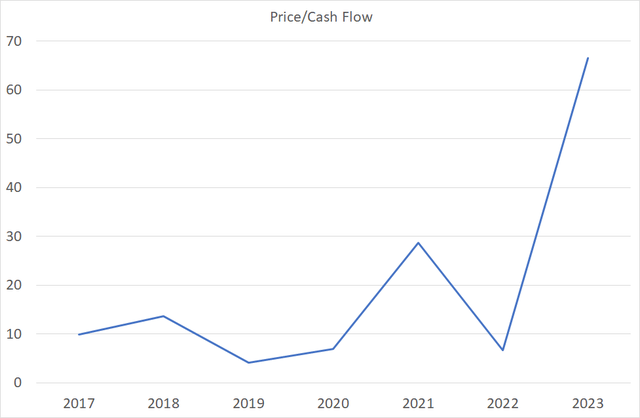

Currently, AA’s price/sales ratio and price/book ratio are both near the lower end of the historical range. Based on these indicators alone, it looks like AA is cheap. However, the ratio of price/cash flow is actually at the highest level since 2017. Thus, the signal is mixed at this point.

Also, AA’s peers have even lower valuations. For example, Century Aluminum Co (CENX) has a Price/Sales ratio of 0.27 and a Price/Cash flow ratio of 26.82. Kaiser Aluminum Corp (KALU) has a Price/Sales ratio of 0.38 and a Price/Cash flow ratio of 15.69. Both of them are “cheaper” than AA in this sense.

Conclusion

The main positive argument for AA is that its price has really come down a lot, which means that much news had been priced in. The management also emphasized at the Morgan Stanley 11th Annual Laguna Conference that “Our proportional net debt is over $2 billion lower than it was in 2020. We have no significant debt maturities until 2027.” In this case, the low price of AA right now is the main selling point.

However, there are too many uncertainties in AA’s operations in the near future. I do not see its COGS ratio coming down meaningfully in the next few quarters. If there is another leg down in the current business cycle, I am afraid that AA’s price still has more room to drop. To a long-term value investor, the margin of safety in AA’s price is still not good enough in my view.

SEC Filings (10-Q, 10-K)

Risk Factors

The biggest risk of my thesis is missing a good entry point in AA stock. Several events would potentially change my conclusion:

- A much stronger and restrictive sanction regime on Russian aluminum. AA’s management had mentioned in the earning call that the sanction loophole enjoyed by Russian producers contributed to the over-supply of aluminum in the global market. If a new sanction policy can remove Russian aluminum from the market, the reduced supply would support the aluminum prices and benefit AA stock.

- An agreement on the UAW-Big Three labor contract negotiations and a quick end of the strike will reduce uncertainties and inject more confidence in the market.

- The Fed successfully avoids recession in this cycle. So far the Fed has done a good job to keep the economy going and combat the inflation. It is still possible that recession would come later this cycle. But if the Fed succeeds in controlling the inflation without causing a recession, then AA would also benefit from this success.