mi-viri

I covered Albireo Pharma (NASDAQ:ALBO) nearly four years ago. At that time, Albireo was a little known liver disease company with a promising pipeline. Odevixibat, also known as A4250, was then running a phase 3 trial in PFIC or Progressive Familial Intrahepatic Cholestasis. This is a cholestasis mediated liver disease where bile formation becomes disrupted, leading to hepatic collapse. I covered the science in my previous article, and that is still relevant. What is important is to understand is odevixibat’s mechanism of action, which is agnostic to which specific cholestasis-mediated disease it is targeting. There are many of these, and since odevixibat modulates IBAT or ileal bile acid transporter, which is responsible for bile’s circulation back to the liver, it can address a number of related diseases.

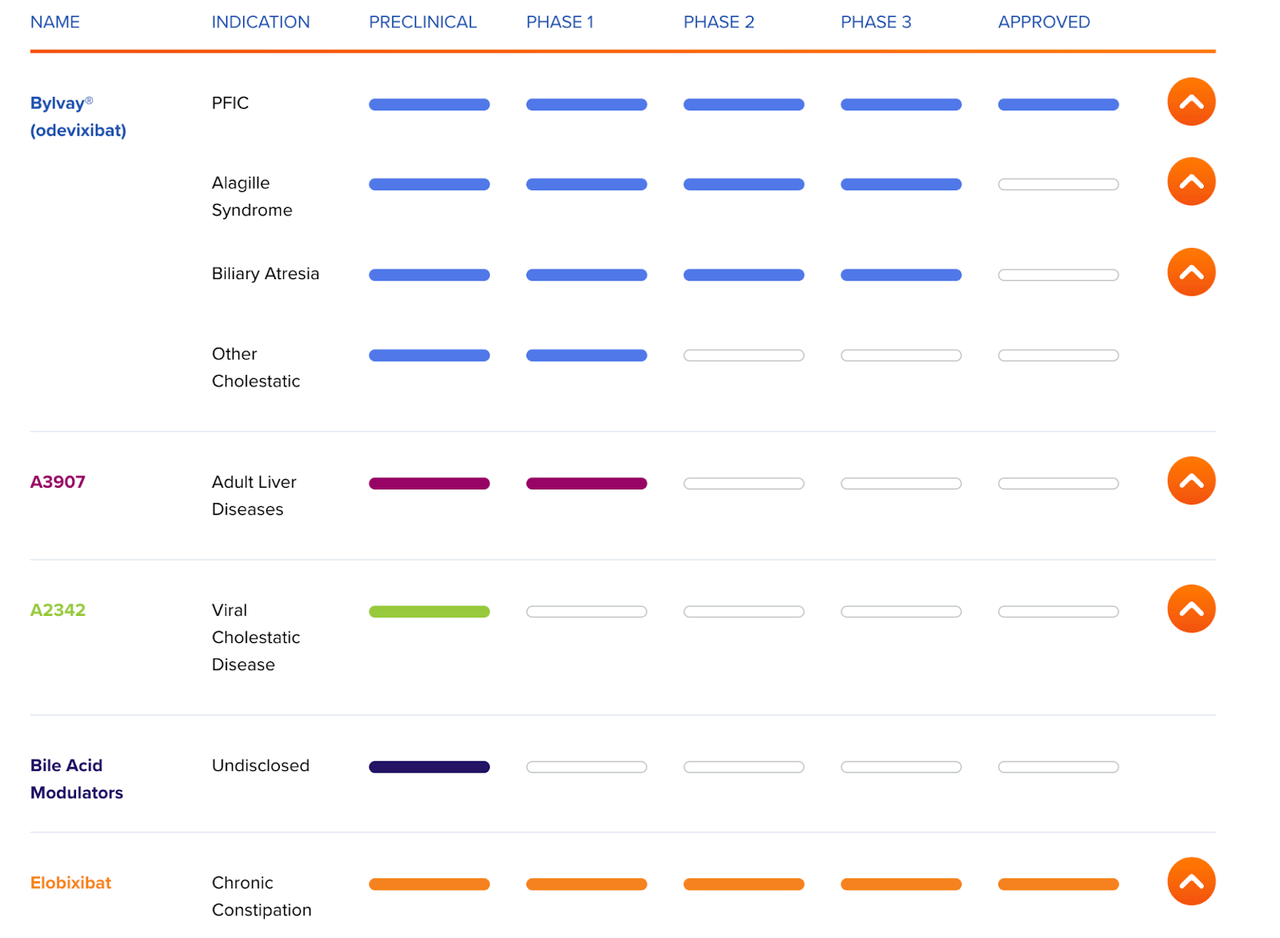

Some of these diseases are now in the pipeline of Albireo. Odevixibat is now approved for PFIC and known as Bylvay. My interest in Albireo now lies with the rest of the pipeline, which looks thus:

ALBO Pipeline (ALBIREO website)

Phase 3 indications are Alagille syndrome and Biliary Atresia, which are also cholestasis-mediated diseases. Thus, the PFIC approval works as a big proof of concept for these other indications, derisking the asset.

Albireo has done phase 1/2 work in Alagille syndrome. This was a basket trial along with other diseases, including the one where odevixibat was approved. ALGS is actually a larger market than PFIC, with 1/30 000 to 1/50 000 live births compared to the latter’s 1/50 000 to 1/100 000 live births. There are currently no approved treatments for ALGS and “may include off-label use of ursodeoxycholic acid (UDCA) to increase bile flow and reduce liver damage.” Besides surgery for biliary diversion and liver transplant, other drug options, although not always effective, include:

Other medications are used to manage pruritus37 including cholestyramine, which sequesters bile acids in a resin complex for excretion38; rifampin, which activates the nuclear pregnane X receptor and is thought to increase the elimination of bilirubin and enhance enzymatic reactions that make bile acids more hydrophilic and less toxic39-41; naltrexone, an opioid antagonist used to decrease opioid-mediated neurotransmission associated with pruritus and/or cholestasis42; or antihistamines. In addition, a high-calorie diet with vitamin/mineral supplementation (eg calcium, zinc and vitamins A, D, E and K) to provide nutritional support is frequently prescribed.43 However, these approaches may not be entirely effective, and many patients either do not respond at all or require combination therapy.

Recently, Mirum Pharma’s (MIRM) IBAT inhibitor maralixibat was approved (Sept 2021) for cholestatic pruritus in people with Alagille Syndrome 1 year or older.

In odevixibat’s phase 2 open label trial that included ALGS patients, the following data were seen:

No serious adverse events occurred and all participants finished the trial per protocol. At the end of the multiple-ascending-dose study, plasma total bile acids and FGF19 decreased by 47% and 76%, respectively, at 3 mg/day (P < 0.01), and by 15% and 16%, respectively, at 1.5 mg twice daily (P < 0.05). Plasma C4 and faecal bile acids increased at all dose regimens, by 555%, 664%, 292% and 338%, 421%, 420%, respectively (P < 0.01-0.05). The primary bile acids cholic and chenodeoxycholic acids constituted the majority of faecal bile acids in the A4250-treated groups.

The company recently (in Oct 2022) released topline data from the phase 3 ASSERT study of odevixibat in ALGS. This was a 52-patient, 24 week study comparing odevixibat versus placebo in 35 and 17 patients, respectively. There were no treatment discontinuations. Primary measure was pruritus, where the drug arm saw a 1.69 point reduction in pruritus versus 0.8 point between the drug and placebo arm, respectively. On a key secondary measure, serum bile acid, there was a 90 point reduction in the drug arm versus a 22 point increase in the placebo arm. Improvements in both outcome measures were highly statistically significant. These results were actually slightly better than those seen in the approved indication’s study.

The company planned to complete regulatory filing in Q1 2023. On December 19, the company announced that they had already filed an sNDA in both the US and EU. Expect approval in the first half of 2024 at the latest. They are also running the phase 3 BOLD study in biliary atresia, which is now fully enrolled. Expect approval in late 2024 if data is good, which it is likely to be, given the similarities in the disease and drug mechanisms for each of the three indications.

Financials

ALBO has a market cap of $408mn, a cash balance of $275mn, and the company earned revenues of $10mn this quarter. Research and development expenses were $23.3 million for the three months ended September 30, 2022, while selling, general and administrative expenses were $20.6 million. At that rate, the company has a cash runway of 6-7 quarters, which will be enough to cover the BOLD trial topline data readout timeline.

Bottom line

ALBO has one approved indication and a stack of label expansions in the next two years. It has two other assets (that I have not covered) also in liver diseases. The approved product is earning revenues slowly but steadily. Their cash balance is decent. The stock, despite all this, is trading near 52-week lows. This may present an opportunity, although in small proportions.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.