Las Vegas Review-Journal/Tribune News Service via Getty Images

I wrote an article covering Albemarle (NYSE:ALB) a few months back. In this article, I explained why I think the company has a durable competitive advantage in the lithium space. However, I am temporarily downgrading the stock. In this article, I will explain why.

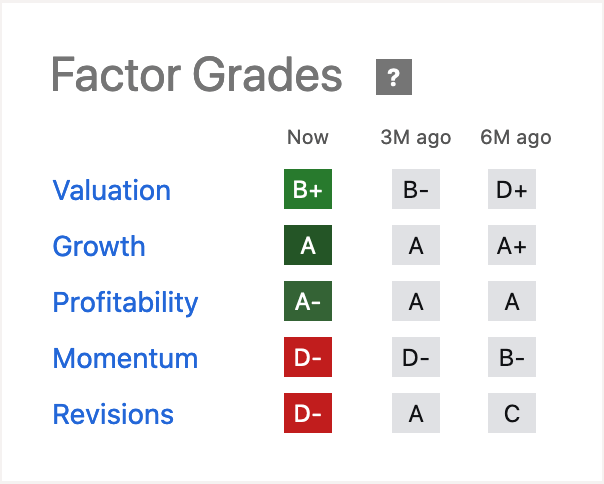

Seeking Alpha Quant Ratings (Seeking Alpha)

You can see that the Seeking Alpha Quant rating gives this a deep value kind of rating. The company has great growth and profitability, but poor momentum and revision ratings. The stock has fallen 65% from a high of $325 to $112. The questions are, “Will this stock turn around?” and “When?” I am firmly convinced that the company will turn around, but not within the next 3-4 months. Here’s why.

Lithium Prices and Albemarle’s Earnings Forecast

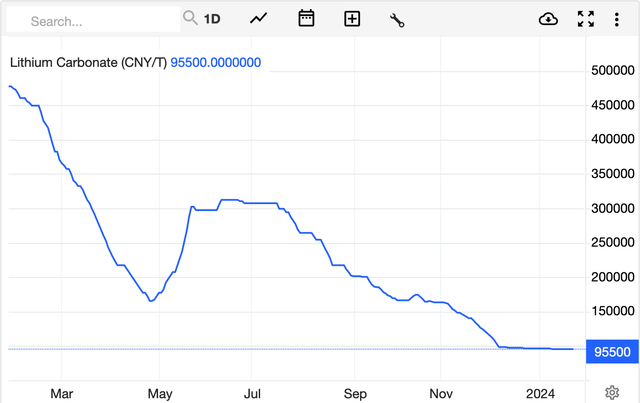

Since my last article, the price of lithium has continued to plummet. At that time, the China Spot price of lithium carbonate was ~$25/kg. Today it is as low as $13/kg.

China Lithium Carbonate Sport Price (Trading Economics)

The price of spodumene concentrate was reported to be between $1000 and $1200 in December. While I believe in the long-term lithium bull case, there are major factors that have pushed down the price, including the destocking of inventories and marginal supply sources. I explain some of this in my article on Pilbara Minerals (OTCPK:PILBF).

What makes this worse for the stock of Albemarle is how the company does its earnings forecast. Instead of taking their best guest at prices, the company takes the current market prices and projects that forward. CEO Kent Masters explained this on an earnings call.

We decided to do our guidance by not forecasting lithium prices, but by basically take the — whatever the market is today and we forecast it for the balance of the year. And that’s the methodology that we’re going to use for the foreseeable future, the near term.

What this means is that most likely in their next earnings call they will downgrade their price forecast, meaning they will downgrade their top line and bottom line forecast for 2024.

Some Defensive Actions

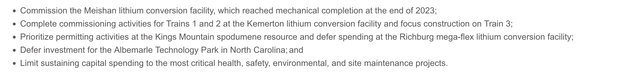

Albemarle have recently taken several cost-cutting actions, ahead of their next earnings call. The company recently announced that it is taking action to, “Preserve Growth, Reduce Costs, and Optimize Cash Flow.” They are reducing their growth CAPEX: “Albemarle expects its 2024 capital expenditures to be in the range of $1.6 billion to $1.8 billion, down from approximately $2.1 billion in 2023.” There are five bullet points:

Cash Saving Actions (Albemarle Announcement)

What is interesting is that they are continuing their Chinese expansion, but slowing their Western expansions. Kemerton lithium trains are the only commercial-scale spodumene to lithium hydroxide facility in the world. This facility converts the feedstock from the Greenbushes mine. They currently have two trains and were planning four. Now they are planning three.

They are also holding off on their American conversion facilities, which is the facility the US government was hoping for.

The other action of note is that Albemarle has sold its stake in Liontown Resources (OTCPK:LINRF). After their failed bid to acquire the spodumene developer Albemarle has decided to sell their shares in Liontown. Albemarle received “roughly $120 million” for the shares which, “sold between $1.26 and $1.32 each, representing a 7.4 percent to 2.9 percent discount to the last close.”

While these defensive moves are great, it means that their short-term prospects are more about surviving than thriving. I worry that the market will greet these actions with fear.

Earnings Call

On Feb 14, 2024 the company will host their next earnings call. Here are a few things to look out for. First, they will make an earnings revision. The analysts will ask about their thoughts about the possibility of a price recovery. If the company seems to think it will be a while, then it’s best to hold off.

Second, on the last earnings call Albemarle released data about lithium stocks in the upstream. If these are getting lower that’s a good sign.

Third, look out for any stoppage of lithium sales. The Greenbushes mine is owned in a JV. Albemarle’s JV partner have stopped selling their lithium and are now stockpiling.

Forth, look to see how their upgrades are going. The are expanding their lithium chemical capacity in China and Australia. These being completed will increase their capacity.

Finally, look out for information on the Kings Mountain Mine.

The Bottom Line

Fundamentally, I believe that this is a great company that will do well over the long term. The current low lithium prices are forcing low-quality resources to turn off which will create the next spike in price. But for now, we are in for more pain as the price of lithium stays low. I guess that Albemarle could trade even lower, representing a fantastic buying opportunity in the not-too-distant future. If the company trades down below $100 I would consider it a steal.