Pixelbizz/iStock Editorial through Getty Photographs

Introduction

Akzo Nobel (OTCQX:AKZOF) (OTCQX:AKZOY) is among the largest and greatest identified paint producers and coatings producers on the planet. The corporate has been engaged on boosting its EBITDA margins and is definitely doing job in growing them. This was once more noticeable within the first quarter of the present monetary yr, and this bodes properly for Akzo’s steerage to extend adjusted EBITDA to 1.5-1.65B EUR this yr.

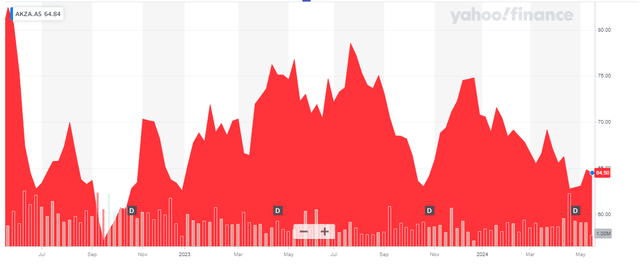

Yahoo Finance

Akzo Nobel’s major itemizing is on Euronext Amsterdam, the place the corporate is buying and selling with AKZA as its ticker image. Because it clearly is probably the most liquid itemizing with a median day by day quantity of roughly 445,000 shares I would strongly suggest to make use of the Amsterdam itemizing to commerce in Akzo’s shares. There are also choices out there. There are presently slightly below 171M shares excellent, leading to a market cap of just about precisely 11B EUR.

A great begin of the yr with a pointy EBITDA enhance

Whereas the corporate’s income decreased within the first quarter of the present monetary yr in comparison with the identical interval final yr, the margins improved relatively dramatically. As you may see under, the reported income decreased by roughly 1% (though the natural income elevated by roughly 2%), however the COGS decreased by in extra of seven% to roughly 1.55B EUR.

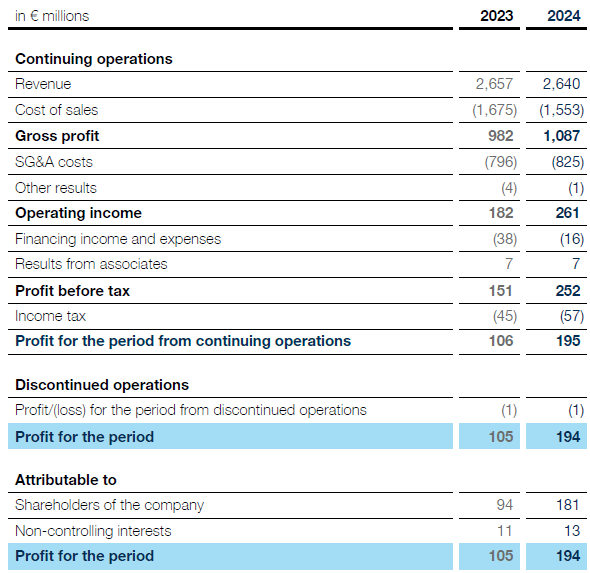

Akzo Nobel Investor Relations

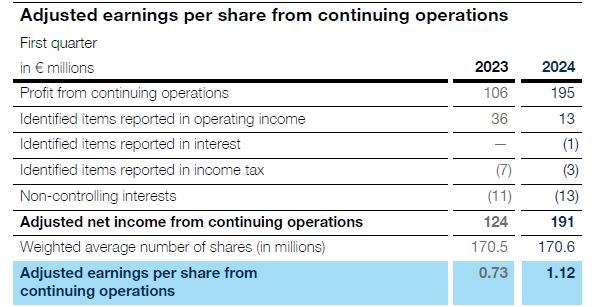

This boosted the gross revenue by in extra of 10% to 1.08B EUR, and though the SG&A bills elevated by slightly below 4%, the working revenue jumped by nearly 50% as the rise from 182M EUR to 261M EUR is fairly noticeable. On the similar time, the online finance bills decreased as properly, resulting in a two-thirds enhance of the pre-tax revenue and a rise of just about 90% of the online revenue from persevering with operations, which got here in at 195M EUR. After deducting the 13M EUR in web revenue attributable to non-controlling pursuits and the 1M EUR loss from discontinued operations, the online revenue attributable to the widespread shareholders of Akzo Nobel was 181M EUR or 1.06 EUR per share. The corporate additionally offered the adjusted earnings per share which got here in at 1.12 EUR per share.

Akzo Nobel Investor Relations

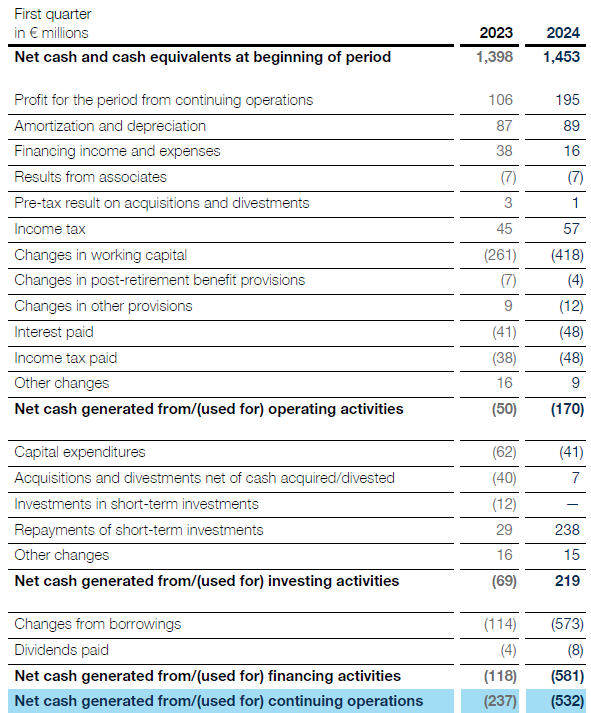

As Akzo Nobel additionally has a fairly low capex requirement, the corporate is an actual money cow. Whereas the reported working money circulation within the first quarter was a unfavorable 170M EUR, this was influenced by the 418M EUR funding within the working capital place. After including that again to the equation and after deducting the roughly 22M EUR in lease funds, the adjusted working money circulation generated within the first quarter was roughly 226M EUR.

Akzo Nobel Investor Relations

The whole capex was simply 41M EUR, which implies the underlying free money circulation was roughly 185M EUR and simply over 170M EUR after taking the minority pursuits into consideration. That’s decrease than the reported web revenue because of some short-term discrepancies because the low finance bills reported within the revenue assertion possible contained some non-recurring FX advantages as the entire web curiosity funds are barely greater. In the meantime, not all curiosity funds are successfully paid out on a quarterly foundation. As a number of the bonds solely make money curiosity funds on a six-month foundation. A portion of the discrepancy is only a “timing” subject.

On the finish of the primary quarter, the corporate’s web debt elevated to 4.03B EUR primarily as a result of adjustments within the working capital place (which is able to finally be reversed) however with an anticipated adjusted EBITDA of 1.5-1.65B EUR for this yr, the debt ratio will possible are available in under 2.5 occasions EBITDA (and this contains lease liabilities and the lease amortization rhythm).

What can we anticipate later this yr?

Because the yr obtained off to a powerful begin, it isn’t a shock to see Akzo Nobel reiterate its full-year outlook. The corporate is aiming to report an adjusted EBITDA of 1.5-1.65B EUR. Contemplating the adjusted EBITDA was “simply” 363M EUR within the first quarter of the yr, it might want to generate a median of 379M EUR in adjusted EBITDA per quarter to satisfy the decrease finish of the steerage and simply over 400M EUR per quarter to achieve the mid-point of 1.575B EUR in adjusted EBITDA steerage for this yr.

Contemplating the primary quarter tends to be the weakest quarter of the yr for Akzo Nobel, I believe we will undoubtedly begin to have a look at the midpoint of the steerage. The second and third quarters are typically the perfect for Akzo, and it is going to be attention-grabbing to see if the second quarter adjusted EBITDA lives as much as the expectations and if that may result in Akzo Nobel tightening its adjusted EBITDA steerage.

And simply to offer context: Akzo Nobel reported an adjusted EBITDA of 1.43B EUR in FY 2023. This implies the decrease finish of the 2024 steerage anticipates a 4% enhance of the adjusted EBITDA, whereas the midpoint of the steerage signifies a ten% enhance.

As there aren’t any particular different bills (apart from maybe a barely greater curiosity expense), the overwhelming majority of the EBITDA enhance will circulation proper via to the underside line. Making use of a 35% common tax fee would point out a further 94M EUR in earnings and working money circulation on an after-tax foundation.

Readers are cautioned the primary quarter was very capex-light and Akzo’s full-year capex steerage of 350M EUR has been reiterated. This represents a 25% enhance in comparison with the FY 2023 capex and will probably be specializing in manufacturing development.

Utilizing an adjusted EBITDA of 1.575B EUR and realizing the entire depreciation and amortization bills will probably be round 365M EUR, we will anticipate an EBIT of 1.21B EUR. Assuming a 225M EUR web finance expense and a 28% tax fee would end in a web revenue of round 710M EUR of which roughly 650M EUR could be attributable to the widespread shareholders of Akzo Nobel. This might symbolize an EPS of round 3.80 EUR per share.

Funding thesis

Whereas that doesn’t make Akzo Nobel low cost at its present share value, I am shopping for the corporate’s midterm development plans. Akzo plans to extend its adjusted EBITDA margin to in extra of 16% (the margin was lower than 14% within the first quarter of the yr and simply 13% in FY 2023 whereas it additionally goals to develop its volumes by a low single digit proportion). That must also increase the ROI to a really respectable 16%-19%. In the meantime, the normalized tax fee ought to lower to round 28% (ranging from this yr).

If I might apply a 3% annual income development fee and a 15.5% adjusted EBITDA margin on a four-year time-frame utilizing the 2023 outcomes as baseline, the adjusted EBITDA ought to attain a run fee of near 1.9B EUR by the top of 2027. That ought to be enough to spice up the earnings to in extra of 5 EUR per share and sure even nearer to five.5-5.75 EUR per share as I anticipate Akzo Nobel to restart a share buyback program after reaching its desired leverage ratio of two occasions EBITDA.

In the meantime, I anticipate the corporate to extend its dividends once more. The coverage is to pay a “secure to rising” dividend, however shareholders haven’t seen a dividend enhance but for the previous few years because the dividend remained unchanged at 1.98 EUR per share, for a dividend yield of round 3.1%, topic to the 15% customary dividend withholding tax fee for The Netherlands.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.