Veronique D/iStock Editorial through Getty Photographs

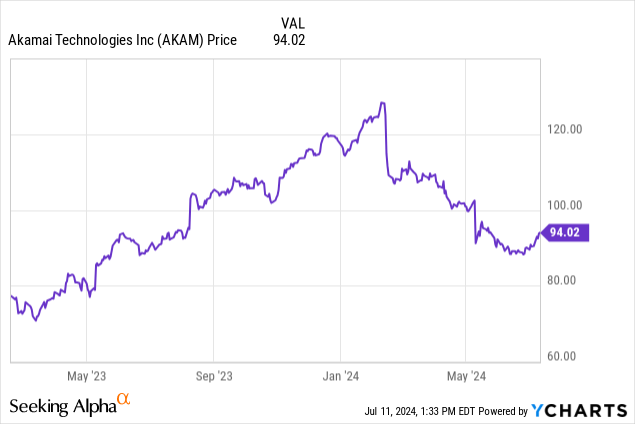

Since I final lined Akamai (NASDAQ:AKAM) in February 2023, it’s up by greater than 20% and at the moment buying and selling round $94 as proven within the chart under. At the moment, my bullish thesis was primarily primarily based on development prospects for its rising Compute phase, which was competing with huge public cloud service suppliers (or hyperscalers) like Amazon (NASDAQ:AMZN) or Microsoft (NASDAQ:MSFT). I used to be additionally optimistic due to diversification away from Supply (content material supply community or CDN).

Now the Compute phase grew by 25% throughout the first quarter of 2024 (Q1) monetary outcomes (which resulted in March) along with Safety which expanded by 21% however Supply noticed an 11% decline. Additionally, after issuing a weaker-than-expected steering the inventory dropped by about 10% as proven above.

Nonetheless, primarily based on the sustained diversification away from CDN by using the momentum of its safety and computing companies as I element under, along with a capability to generate robust money move from operations, this thesis goals to point out that this can be a buy-the-dip, because the inventory may additionally achieve due to its robust monitor document of constantly beating earnings.

I begin with the diversification trajectory.

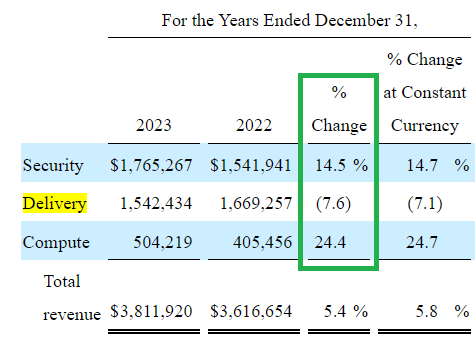

Diversification is Progressing Quickly, however Weak point to Persist within the short-term

Taking a look at annual figures, the Safety and Compute segments grew by 14.5% and 24.4% respectively from FY-2022 to FY-2023 whereas Supply declined by 7.6% as highlighted in inexperienced under. Throughout this time, from constituting 46% of whole gross sales, Supply’s weight declined to solely 30% which exhibits important development in diversifying away from the enterprise. Now, Safety and Compute have been rising at double digits in Q1 as talked about earlier, and are anticipated to maintain development all through this 12 months, whereas Supply has accelerated its decline to 11%. Due to this fact, its weight on general gross sales ought to proceed to say no and will weigh solely round 25% in FY-2025 in accordance with analysts at Scotia Financial institution.

Q1 SEC submitting (seekingalpha.com)

Wanting deeper into the woes of the Supply phase, this was brought on by a big social media buyer optimizing prices. Now, because it makes use of Akamai’s CDN (content material supply community), I consider the client could also be TikTok, the video streaming subsidiary of Chinese language ByteDance (OTCPK:BDNCE) which has been topic to scrutiny from the U.S. Congress as a result of safety menace it represents for America. To this finish, the corporate has confronted loads of stress to separate from ByteDance since 2020, implying that if it doesn’t comply, it is going to be in all probability banned within the U.S.

Now, for a giant video streaming service supplier like TikTok with greater than 1 billion customers cutting down would influence Akamai’s visitors income considerably. For this matter, in accordance with its administration, an influence of $40 million to $60 million is anticipated as a result of social media buyer “optimizing their enterprise to scale back prices”.

Moreover, the corporate has seen weak spot within the gaming and video verticals and this appears to be like more likely to proceed as streaming companies suppliers are monetizing their companies via advertisements and cracking down on password sharing, implying decrease visitors volumes. Thus $20 million to $30 million of extra income shortfalls are anticipated with out forgetting the roughly $40 million of Foreign exchange headwinds to influence the top-line outlook for FY-2024 as a result of robust greenback. It’ll additionally negatively influence non-GAAP EPS by about $0.12.

Consequently, each annual income and EPS estimates for FY-24 have been lowered by analysts, additionally contributing to the inventory’s slide, which may proceed due to uncertainty. Nonetheless, the corporate continues to be anticipated to develop revenues and EPS by 4.72% and 1.79% respectively primarily based on the power of the Safety and Compute segments.

I dive deeper into these two segments.

Power in Safety and Compute

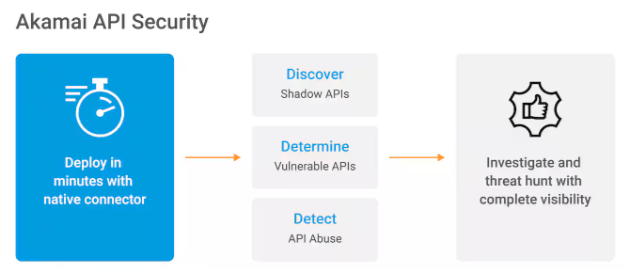

If one takes time to look into the digital transformation secular pattern, is constructed on APIs or utility programming interfaces. On this respect, an API is a means for the app sitting for instance on somebody’s telephone to work together with purposes in a company community positioned miles away. Thus, APIs guarantee that staff or prospects can entry purposes and knowledge seamlessly throughout totally different IT methods.

Nonetheless, the truth that this entry is finished over the web additionally makes APIs engaging targets for hackers ensuing within the variety of associated assaults rising by 30% from 2022 to 2023. This includes faux credentials, account takeover, and breaches simply to call a number of cybercrimes. For 2024, API-related cyberattacks are more likely to enhance as Gen AI may also help hackers develop extra highly effective software program codes to avert detection.

Taking a look at safety, there are alternative ways to supply safety with options like WAFs or net utility firewalls, and secured API gateways with out forgetting utility supply controllers. As for Akamai, its API safety resolution supplies purchasers with full visibility of their infrastructure earlier than the evaluation section to determine threats on a real-time foundation.

www.akamai.com

Wanting throughout the trade, powerful competitors prevails as per Gartner Insights which charges suppliers primarily based on functionality, integration, and help. Thus, whereas Akamai scores higher than Cloudflare (NET), its general score is barely lower than the Cequence API safety platform which is very valued in the way in which it helps purchasers fight bot visitors. Thus, by buying NoName which has an AI-augmented platform and excels in delivering visibility into API enterprise logic abuse, Akamai goals to strengthen its aggressive place to supply its prospects higher evaluation and extra vendor integrations.

As such, the acquisition ought to contribute $20 million for this fiscal 12 months and contribute additional momentum within the fast-growing Safety phase in a market anticipated to develop at a CAGR of 32.5% from 2023 to 2029.

Pursuing additional with Compute, its 24.4% development fee has exceeded the 14.2% CAGR anticipated for the cloud computing trade displaying that in a market dominated by hyperscalers and lots of different smaller suppliers, Akamai stays extremely aggressive. This has been made attainable via its distinctive market positioning achieved by combining its model identify in CDN with edge computing.

Wanting deeper, the primary gross sales argument consists of enabling prospects, largely these working within the video and recreation verticals to course of knowledge nearer to the supply (or the place their prospects are positioned as a substitute of distant metro areas), thereby considerably decreasing the time it takes to transmit knowledge to the cloud. This additionally reduces community utilization prices.

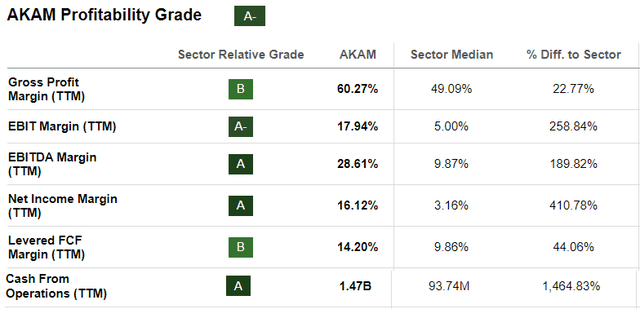

Deserves Higher Due to Profitability and Money Era

Going ahead, the Compute technique is to concentrate on extra profitable markets, consisting of massive media and gaming suppliers whose cloud spend is over $1 billion. This could enhance margins and money move technology for an organization that’s already extremely worthwhile relative to the IT sector as proven under. This in flip signifies that Akamai has the monetary functionality to proceed to diversify its enterprise away from Supply via acquisitions whereas on the similar time driving development in Safety and Compute.

seekingalpha.com

As proven above, one excellent metric is the trailing money move from operations which exceeds the sector by over 1,400%.

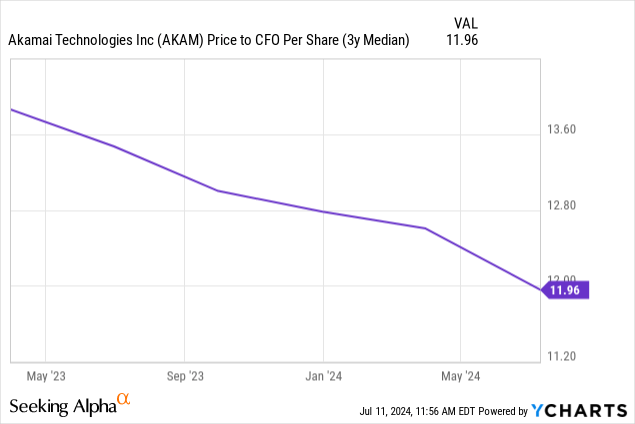

On this respect, whereas the shares have gained 21.6% since February 2023, the price-to-CFO (money move from operations) per share ratio has come down from 13.8x to 11.96x or by 13%. I consider this represents a reduction because the market has not but totally priced within the enhance in money move technology. Thus, on the present share worth of $94, the inventory nonetheless represents a shopping for alternative, and, adjusting for a 13% upside, I receive a goal of $106.

Don’t exclude Volatility Dangers, however the Upside Is Justified

Nonetheless, with the elections approaching, count on volatility, particularly in case the rhetoric round a TikTok ban will get harsher and comes into the limelight throughout the presidential debates. Additionally, with stabilization (or bottoming) but to be seen within the Supply enterprise, visitors quantity may fall additional than anticipated leading to a topline miss throughout the second quarter of 2024’s (Q2) monetary outcomes to be introduced within the second week of August. Noteworthily, such a state of affairs the place there was a topline miss did come up in February when fourth-quarter 2023 outcomes had been introduced and there was round a ten% dip.

Due to this fact, weak spot may persist this 12 months which is the rationale why the 13% upside represents a good goal. On this case, traders will notice that I’ve kept away from valuing the corporate primarily based on the earnings metrics the place it’s undervalued by at the very least 20%. To additional justify the necessity for moderation, whereas it held $1.67 billion of money within the steadiness sheet on the finish of March, whole debt stood at $4.57 billion, which means that it may should borrow cash to proceed rising inorganically in case the double-digit growths in Safety and Compute aren’t sustained.

Ending on an optimistic notice, the corporate expects to achieve $3 million to $4 million of visitors income associated to the Olympic video games for this 12 months whereas the U.S. elections may additionally give rise to extra streaming as was the case in 2016. Due to this fact, whereas there’s a threat of lacking the topline, it might additionally occur that the alternative occurs and there’s a beat. For this function, with a monitor document of getting overwhelmed annual earnings (each EPS and income) estimates by 87.5%, Akamai may produce a optimistic shock ensuing within the inventory surging by 10%, or the proportion by which it has dipped on two earlier events.