photoman

Airbnb (NASDAQ:ABNB) has seen its business boom following a pandemic reopening. Yet in spite of the strong fundamental results, the stock has crashed along with the rest of the tech sector as valuations quickly reset. Unlike many tech peers, ABNB is highly profitable, posting 42% GAAP net margins in the latest quarter. That margin profile places ABNB among the most profitable names in the sector. For those looking to invest in the tech sector, ABNB offers secular growth without having to sacrifice on profitability.

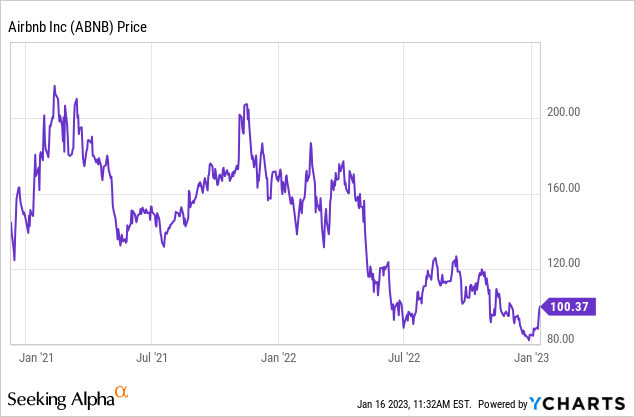

ABNB Stock Price

ABNB has crashed from all-time highs, but not as much as many tech peers. Much of that may be due to the fact that business remains red-hot in the current economy.

I last covered ABNB in August where I rated the stock a buy on account of the 10% net cash position and share repurchase program. The stock has since declined by 15%, helping to further improve the value proposition.

ABNB Stock Key Metrics

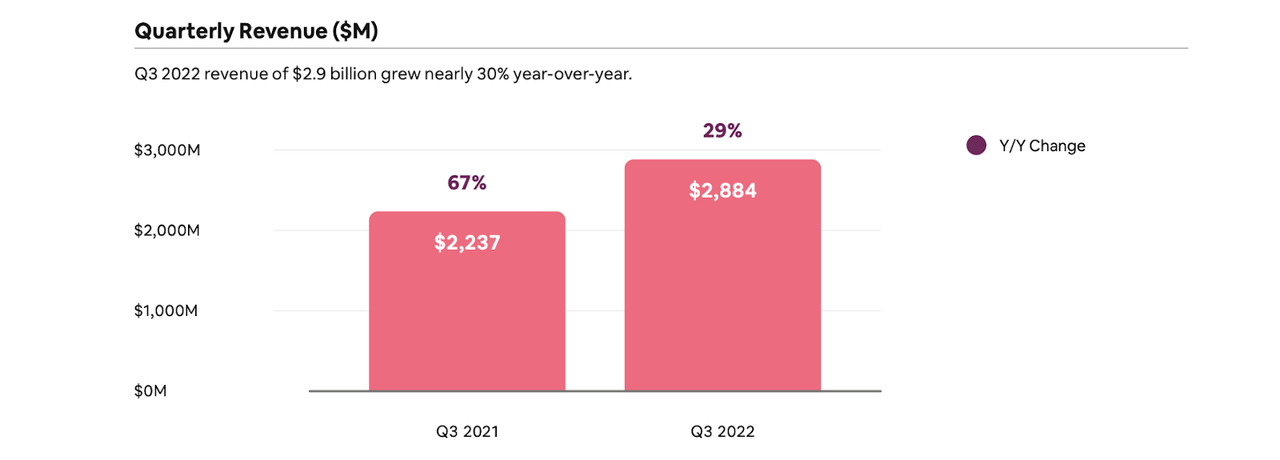

In its most recent quarter, ABNB managed to show 29% YOY revenue growth. That is an impressive result considering that the company was lapping tough comparables and the macro picture remains tough. Yet that growth rate may be understating the strength as growth was actually 36% on a constant currency basis.

2022 Q3 Shareholder Letter

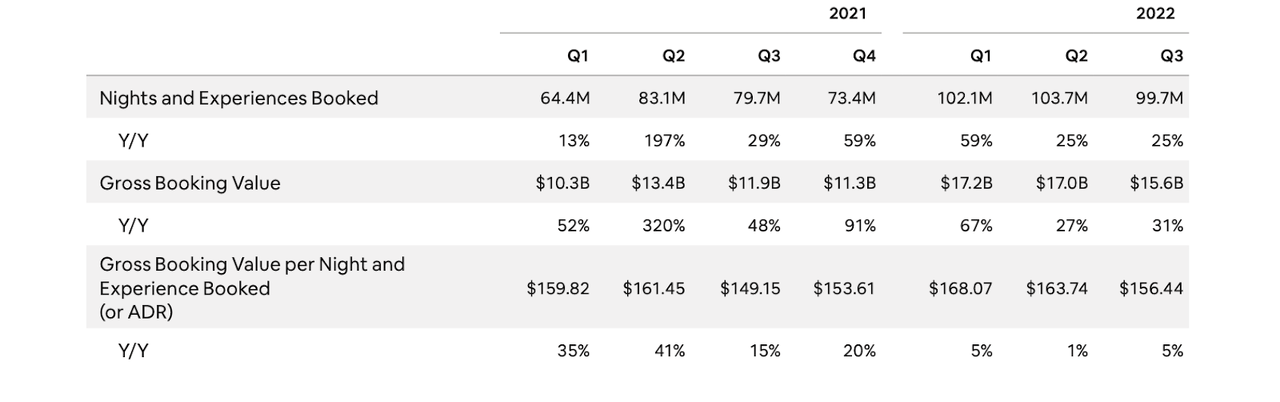

Last year’s results were in part driven by solid growth in the average daily rate (‘ADR’). In 2022, ADR growth has been minimal with the bulk of the growth coming from an increase in nights booked.

2022 Q3 Shareholder Letter

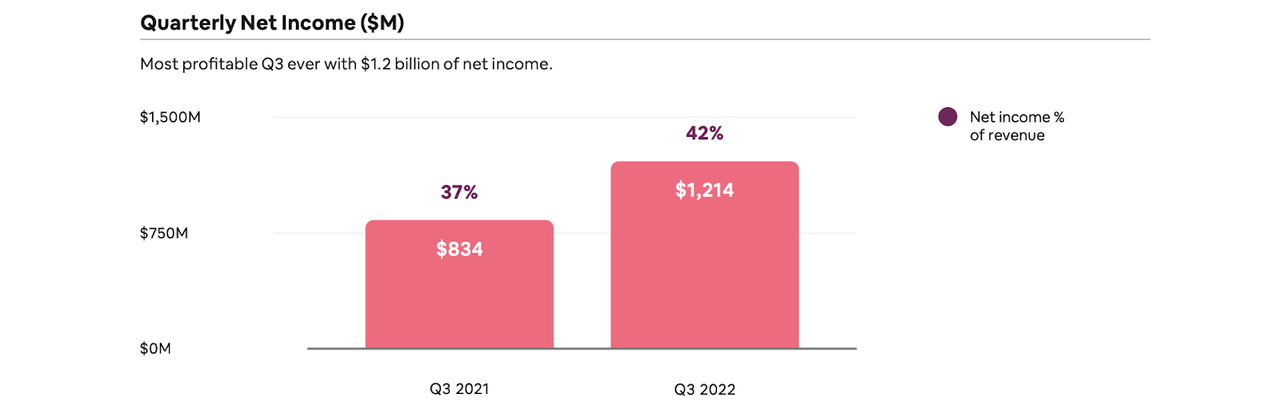

It’s not just about revenue. ABNB delivered $1.2 billion in quarterly net income and I note that this is a GAAP metric. That represented an astounding 42% net margin.

2022 Q3 Shareholder Letter

How is ABNB able to deliver strong results amidst a tough macro backdrop? Management noted that while consumers are pulling back on spending, travel is one area where there hasn’t been as much pullback. On the conference call, management stated their possible explanation as follows:

And I think the reason why is just because many people are now working from home, the mall is now Amazon. The movie theater is now Netflix, people still want to get out of their house. They still want to have memories. They still want to have meaningful experiences. And I think that’s why they continue to turn to Airbnb.

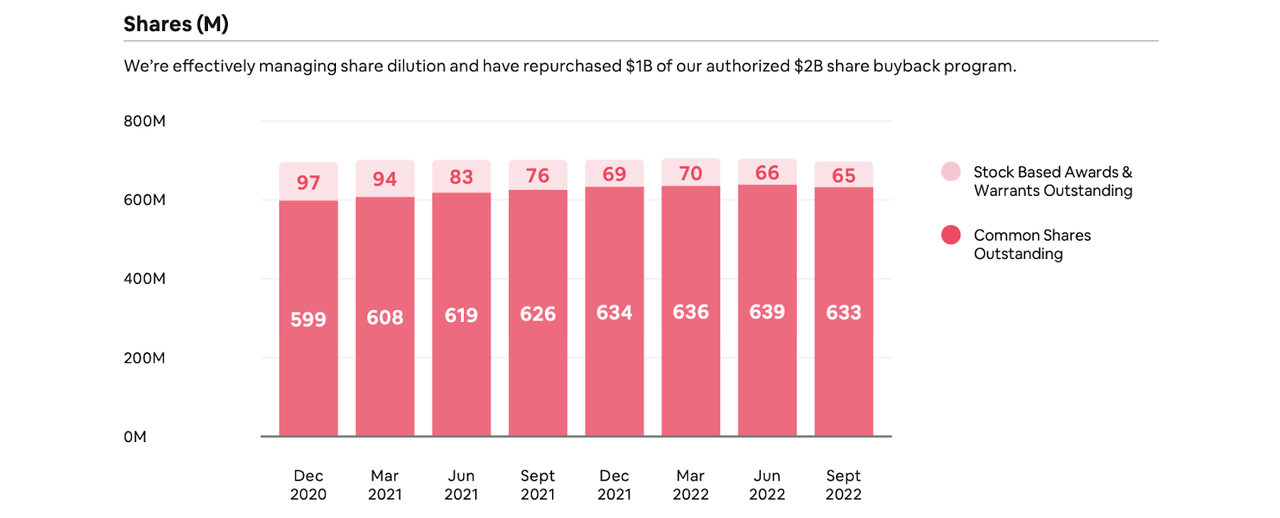

In the first quarter, the company had authorized a $2 billion share repurchase program. ABNB has already repurchased $1 billion of that program, leading to shares outstanding to decline sequentially.

2022 Q3 Shareholder Letter

ABNB ended the quarter with $9.6 billion of cash, $4.8 billion in funds held on behalf of guests, versus $2 billion of debt. Even excluding funds held on behalf of guests, that net cash position represented 12% of the current market cap.

Looking ahead, ABNB expects revenue to grow up to 23% YOY to $1.88 billion. On a constant currency basis, YOY growth is expected to be up to 29%. Management noted that the projected deceleration in growth rates is attributable due to a tough comparable as the fourth quarter of 2021 was an inflection point after Delta and before the Omicron variant.

Is ABNB Stock A Buy, Sell, or Hold

At first glance, ABNB may seem just like any other travel website like Expedia (EXPE). But ABNB may be different. In my view, ABNB represents a thesis on the gig economy for everything housing. Right now ABNB mainly caters to short term stays, but management notes that long-term stays (as defined by longer than a month) represent 20% of total gross nights booked. Over time, I can see ABNB taking a cut of the longer term rental market. ABNB was started amidst the Great Financial Crisis and offered homeowners a way to earn extra income. That may prove to be a relevant incentive once again in the current macro environment.

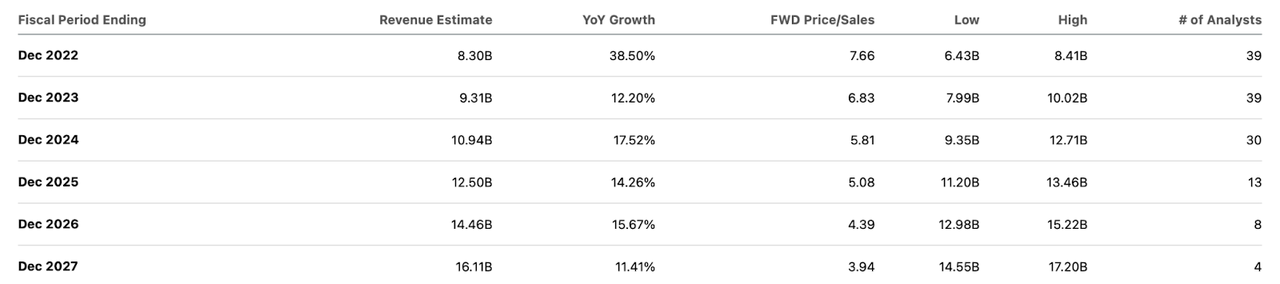

At recent prices, ABNB was trading at 39x earnings and 7.6x sales. ABNB is expected to sustain double-digit top-line growth over the coming years. That expectation is reasonable considering the above thesis.

Seeking Alpha

I could see ABNB sustaining 40% net margins over the long term. Based on 15% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see ABNB trading at 9x sales, or a stock price of $132 per share over the next 12 months.

What are key risks? The near term risk may be that of peak earnings. Just like how many e-commerce operators are showing minimal growth this year, ABNB might see a similar deceleration next year. The stocks of e-commerce operators were hit hard once that deceleration became evident – ABNB stock might also get hit as well. The profitability at ABNB might not be enough to shield itself from such volatility as names like PayPal (PYPL) were also highly profitable prior to their crashes. The longer term risk is if ABNB ends up being no different than EXPE. ABNB has generated such strong margins in part due to sales & marketing making up only 17% of revenue year to date. In contrast, sales & marketing made up 50% of revenue at EXPE. In short, EXPE seems to have lost value in uniqueness as many travelers first search on Google (GOOGL) for lodging needs. ABNB does not yet suffer from the same issue and thus has not had to invest so heavily in advertising, but as competitors bring on more inventory, I expect competition to force ABNB to spend more on sales & marketing. I have discussed with subscribers that a basket of undervalued tech stocks can be the best way to take advantage of the tech stock crash. ABNB fits right in with such a basket as it offers an attractive combination of secular growth and profitability.