ktmoffitt/iStock via Getty Images

The travel industry is a mixed bag right now. Total travel spending in the U.S. is down only slightly from 2019. A recession hasn’t materialized (yet), and air travel is strong. For instance, Las Vegas recorded its third-highest passenger total ever this summer.

Consumers continue to spend, and Airbnb’s (NASDAQ:ABNB) Q3 report was spectacular, even though its forecast warned of slackening demand.

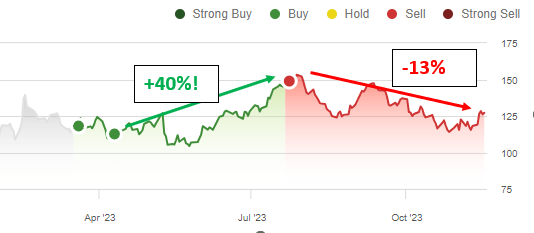

In my latest Airbnb article in July, I downgraded the stock from Buy to Sell after it ran up 40%, as shown below.

Seeking Alpha ratings history page

It is down 13% since, while the S&P 500 is flat. The stock price is more attractive now, so I am upgrading to Hold and watching closely for a great entry point.

Let’s start with the positive.

How were Airbnb’s Q3 earnings?

Airbnb’s business model is fantastic. The company’s stellar free cash flow separates it from the pack. This is why Airbnb and Booking Holdings (BKNG) are the only travel stocks I will touch in this economy.

I always look at free cash flow before net income. The ultimate measure of any business’s financial success is the cash it puts in the owners’ pockets. Two businesses could have the same GAAP net income, but if one has to spend tons of capital on factories, equipment, etc., it is less attractive.

Airbnb’s platform requires very few capital expenditures (CapEx) – less than 1% of

Cash from operations ((CFO)) over the trailing twelve months. Marriott International (MAR) spent 16%, and Booking Holdings (BKNG) 4% (also a great model).

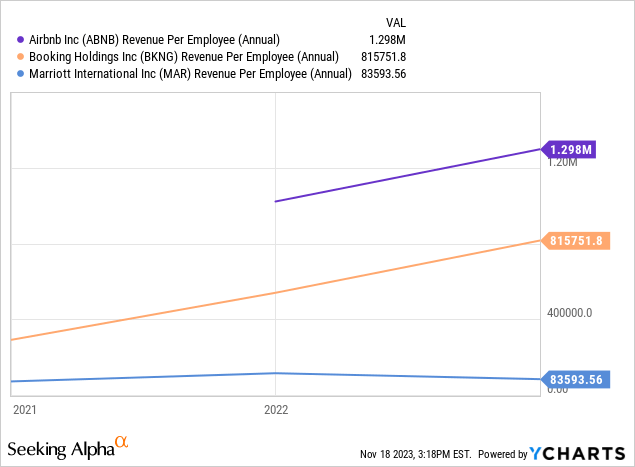

Management pivoted to a lean business model when COVID-19 crushed travel and hasn’t looked back. Airbnb brings in more revenue per employee than its peers, as shown below.

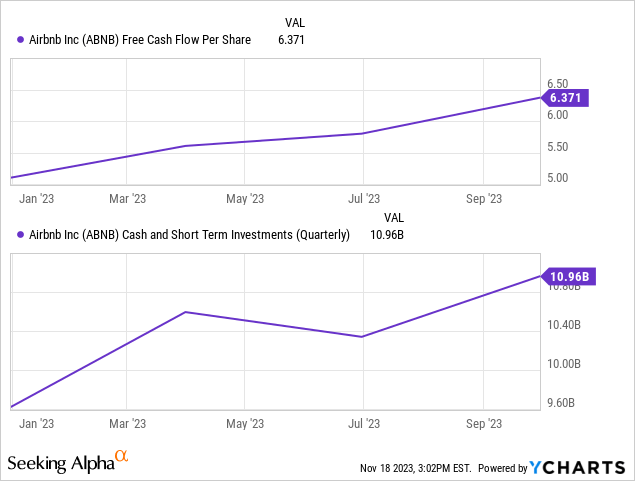

Airbnb reported $1.3 billion FCF in Q3, reaching $4.2 billion over the TTMs on a ridiculous 44% margin.

As shown below, TTM free cash flow per share leaped over $6, and Airbnb reported nearly $11 billion in cash and investments.

Cash and investments on hand are over $16 per share, and the company has repurchased $3 billion worth of shares since starting the buyback program last year. The total diluted share count is down 2.5%. With little need for CapEx, shareholders should expect share repurchases to continue in earnest.

It sounds terrific, but here’s why I am not buying yet.

Is Airbnb stock a buy?

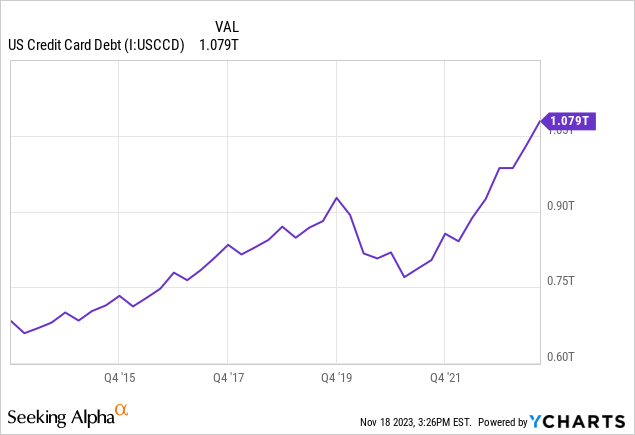

Consumers are the engine of our economy, but many are running low on fuel. The Federal Reserve’s war against inflation has yet to produce a recession, thanks largely to government spending, but high interest rates and prices are taking a toll. Remember when stimulus checks were issued and Americans paid off a lot of debt? Well, we have charged those credit cards back to record levels, as depicted below.

No wonder consumer sentiment is lower now than during the Covid crash and nearly as bad as the Great Recession. Interest rate hikes also take some time to fully take hold. For example, many people own cars with less than 3% interest and mortgages under 4%. This makes buying a new car or house unattractive, which slows the economy. It also means that their spending power will drop when they do need a new vehicle or home, further dampening economic activity. This is just one simple example of many the economy faces.

Let’s face it. We know that consumers can’t keep up this frenetic pace forever. Something will give. This was evident in management’s tepid tone after Q3.

Is Airbnb stock overvalued?

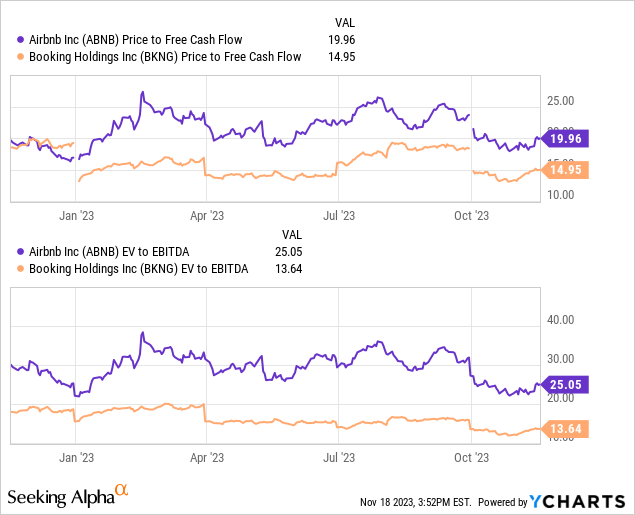

Airbnb often draws the “overvalued” tag. It is, and it isn’t in my view. Its price-to-free cash flow and EV-to-EBITDA valuations aren’t outlandish compared to many companies (for instance, Microsoft (MSFT) has a price-to-free cash flow ratio over 40); however, they are significantly higher than Booking Holdings.

Given the economic situation, I need a significant discount to take the plunge back into a long position.

I said I would buy shares once the stock got close to $100 per share during the summer, and that remains my target. However, combining a desired price with dollar-cost averaging is a strategy I use to buy shares slowly as the price closes in on the target.

Selling cash-secured put options is another great way to get in at an attractive price; however, please be aware that this is a higher risk. For instance, the stock never did get below $100, but I was lucky enough to get in with an average cost of $108 and sold a $100 put option for $10.65 per share before exiting the stock entirely after it eclipsed $140 per share.

Airbnb stock looks much more attractive than just a few weeks ago, but the discount isn’t substantial enough for my money just yet. Stay tuned.