Growing stacks of coins that demonstrate the power of investment compounding. J Studios

It’s no secret that Warren Buffett is arguably the greatest investor of our generation and probably of all time. But as you can imagine from a man of his experience and wisdom, he isn’t just known for his knack for stock picking, but his deeply insightful quotes.

One of the Oracle of Omaha’s most memorable quotes that you probably have come across at some point is as follows: “If you don’t find a way to make money while you sleep, you will work until you die.” As an unchanging fact of life, this is a timeless argument.

Even if you enjoy your job, there’s a good chance you may not be able to do it forever for various reasons (i.e., age, health, or layoffs). That is why it is necessary to have a fallback plan, which is what makes investing in world-class dividend payers so appealing.

It’s said that money never sleeps. This is because when you own a well-diversified portfolio of businesses, they operate 24/7 for 365 days each year (or 366 days on a leap year). Well, Air Products and Chemicals (NYSE:APD) is one such business that I believe every dividend growth investor should own for their portfolio. Let’s discuss why that’s the case.

The Cream Of The Crop Among Dividend Stocks

How do you know that a particular company can fit in as a trusted staple of your portfolio? The answer is probably a little different for everybody. But the general gist is a business with a proven track record of rewarding shareholders that looks like it can persist.

Well, Air Products and Chemicals has hiked its dividend for 40-plus years. That checks off the consistency prerequisite that we have as dividend growth investors. Having hiked that dividend at a 10% clip annually since 2014, APD also isn’t just handing out token dividend increases to retain its status as a Dividend Aristocrat. This wasn’t all just frontloaded at the beginning of that period, either: The most recent dividend increase was 8%. My prediction is that the company can deliver 7.75% annual dividend growth over the long haul to shareholders.

Thanks to growth in both its core industrial gases business and hydrogen business, analysts expect 9.7% annual adjusted diluted EPS growth for the next five years from APD.

The company’s dividend payout ratio is also sustainable. APD won’t be funding its dividend from free cash flow in the near term as it prioritizes heavy investments in hydrogen projects to set itself up for the future. But as these projects come online in the next few years, free cash flow should again adequately cover the payout.

In the meantime, APD’s dividend is well-supported by adjusted diluted EPS. In fiscal year 2022, the company logged $10.41 in adjusted diluted EPS. Alongside the $6.24 in dividends per share paid in the fiscal year, this is equivalent to a 59.9% adjusted diluted EPS payout ratio.

Adjusted diluted EPS is set to grow a bit faster than the dividend in the fiscal year 2023 ending later this month to an analyst consensus of $11.48. Compared to the $6.74 in dividends per share that have been paid this year, this is how the adjusted diluted EPS payout ratio could improve to 58.7% in fiscal year 2023.

Fundamentals And Trends Are On The Side of APD

Unless you are a stakeholder in some way of APD (e.g., a shareholder, employee, or direct customer), you probably aren’t even aware of the tremendous impact that it has on our daily lives. Industrial gases are regularly used as inputs in numerous industries, such as electronics, food and beverage, and manufacturing. Simply put, just about everything you take for granted is made possible by APD’s contributions to the world.

Selling its industrial gases and equipment to more than 200,000 customers in over 50 countries, APD is one of the biggest industrial gas suppliers on the planet.

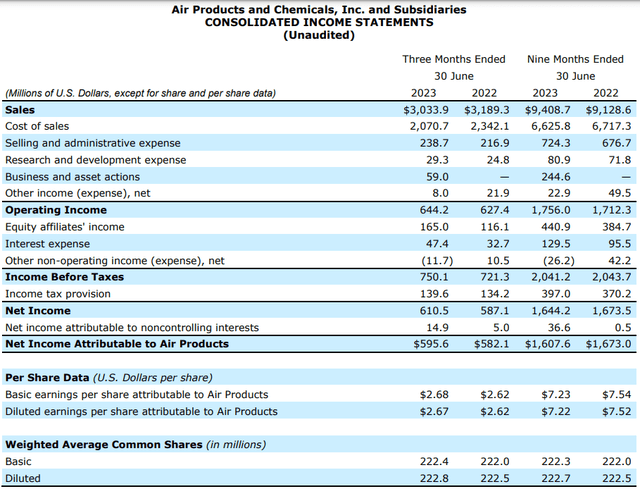

APD Q3 2023 Earnings Press Release

As the global population grows in both numbers and wealth, it’s not hard to see how global demand for industrial gases continues climbing from here. This is precisely what drove growth for APD through the first nine months of its current fiscal year and what should continue to serve as a growth catalyst.

APD’s sales increased 3.1% year over year to $9.4 billion for the nine months ended June 30. This topline growth was fueled by a few different factors. For one, the mission-critical nature of APD’s industrial gases makes it indispensable to customers. That explains how the company was able to pass price increases on to its customers. Strong demand for industrial gases was the other contributor to these decent results, with the third quarter marking the ninth consecutive quarter that volume has improved. In the past year, APD has brought 30-plus new assets online to support this rising demand, according to Chairman and CEO Seifi Ghasemi’s opening remarks during the company’s earnings call.

APD’s adjusted diluted EPS surged 11.1% higher over the year-ago period to $8.36 during the nine months concluded June 30. Topline growth and tight cost controls helped the company to produce these results.

Looking toward the future, APD estimates that it will be deploying over $30 billion in capital to projects over the next 10 years. The company expects that a bit more than half of this capital will be generated from cash flow, with the other half coming from debt issuances.

Fortunately, APD should have no problem taking on this additional debt load to further grow its earnings capacity. That is because as of June 30, the company’s year-to-date interest coverage ratio was a respectable 16.8. That leaves a big enough buffer to protect against any uncharacteristic and temporary downturn in profits (all info in this subhead sourced from APD Q3 2023 earnings press release and APD Q3 2023 Investor Presentation and APD Q3 2023 earnings call transcript).

Risks To Consider

Based on what we’ve already discussed, it’s evident that APD is an incredible business. But because every business has potential issues, it’s important to at least be aware of some of the risks facing your investments.

APD invests in projects that often take at least several years to bring online. This is important to remember because while the company often completes projects on time and on or under budget, that may not always be true. Any delays or budget overruns could harm APD’s results for a time, especially if it is for multi-billion-dollar projects.

The Stock Is Almost Fully Valued, And Deservedly So

When thinking of deeply discounted stocks, APD may be one of the last stocks to come to mind. But the stock still does look to be a decent value at its current $303.05 share price (as of September 13, 2023). Please allow me to further explain my assumptions into two valuation models to provide a better understanding of why.

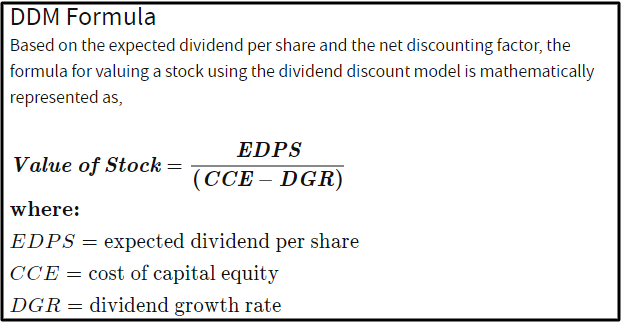

Investopedia

The first valuation model that I will utilize to value APD’s shares is the dividend discount model or DDM. This valuation model consists of three inputs.

The first input into the DDM is a stock’s expected dividend per share. APD’s annualized dividend per share is currently $7.

The next input for the DDM is the cost of capital equity. Since I require 10% annual total returns, I will use 10% for this input.

The last input into the DDM is the annual dividend growth rate over the long haul. As I already noted, I will use 7.75% for this input.

Using these inputs for the DDM, I arrive at a fair value of $311.11 a share. This points to shares of APD trading at a 2.6% discount to fair value and can provide a 2.7% capital appreciation from the current share price.

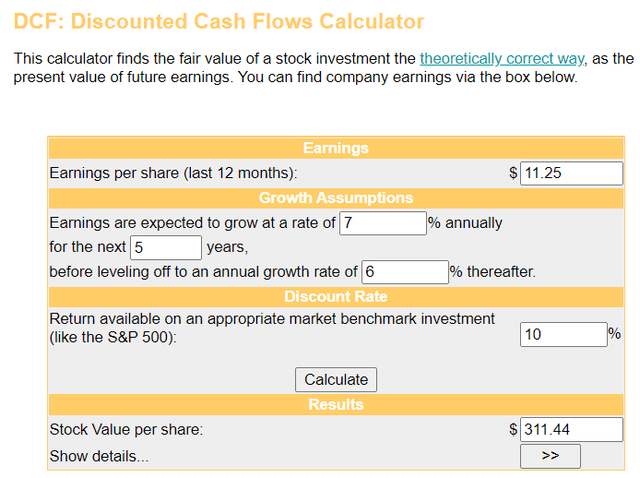

Money Chimp

The other valuation model that I’ll use to estimate the fair value of APD’s shares is the discounted cash flows model or DCF model. Just like the DDM, the DCF model has three inputs.

The first input into the DCF model is trailing 12 months of adjusted diluted EPS. That amount is $11.25 for APD.

The second input for the DCF model requires an investor to make predictions about adjusted diluted EPS growth potential. I believe that a five-year annual adjusted diluted EPS growth rate of 7% and a slowdown to a 6% growth rate thereafter is perfectly reasonable for a company of APD’s quality.

The third input into the DCF model is referred to as the discount rate. I’ll use 10% for this as well.

Factoring these inputs in for the DCF model, I came out to a fair value of $311.44. That signals shares of APD are priced 2.7% below fair value and could have a 2.8% upside from the current share price.

Averaging these two fair values together, I am left with a fair value of $311.28 a share. This means that APD’s shares are trading at a 2.6% discount to fair value and could appreciate by 2.7% from the current share price.

Summary: An Intriguing Pick For Growing Passive Income

APD has convincingly established itself as a Dividend Aristocrat in recent years. An examination of its dividend payout ratio and business fundamentals inspires confidence that dividend growth is far from over.

The cherry on top for dividend growth investors is that the stock looks like it is trading at a small discount currently. APD’s 2.3% dividend yield and high- single-digit annual adjusted diluted EPS growth prospects make it a clear buy for investors looking to balance dividend growth with capital appreciation.