Nikada

The iShares Asia 50 ETF (NASDAQ:AIA) has taken a dive lately on the major declines in the Chinese market. We don’t often mention China, but whenever it has come up we always point out the obvious, which is it’s an uninvestable market. Besides increasingly becoming a pariah state, more importantly, the property market there is more systemic than anywhere else and it is undergoing a deleveraging, which is a devastating process that could take years and will destroy trillions more in value. To top it all off there is the demographic issue. AIA has exposure both to China, and also to Taiwan. While we think that the invasion risk is substantially less than in 2022, if China wants to go out with a bang it will try to take Taiwan down with it. It’s not great when one part of your portfolio is trying to subjugate the other, and that’s what’s happening here. Pass.

AIA Breakdown

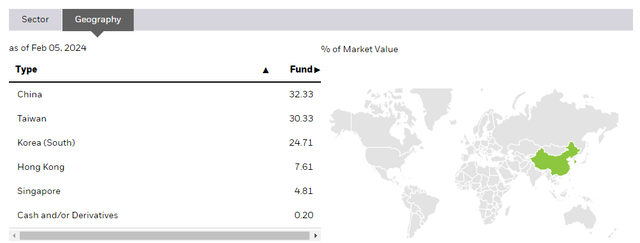

Let’s go straight to geography since that’s most pertinent, particularly given the recent headlines. Exposures are mostly to China and Taiwan.

Geographies (iShares.com)

Beginning with Taiwan, we want to establish first that we believe the invasion risk is very remote, particularly as China’s economy is somewhat at its knees, and prospects for improvement are limited by the fact that, of all major economies, China has been the biggest beneficiary of globalization. Nonetheless, the risk is there – it’s not zero.

More important are China’s internal issues. Their property market has been collapsing. As a post/semi-communist state, property rights and ownership are massively skewed towards real estate. Moreover, a disproportionate amount of their economy is tied to the construction industry, leading to the creation for some years now of Chinese ghost buildings, first signaled by Chanos more than a decade ago. Real estate is around 30% of the Chinese economy. Evergrande is already under insolvency proceedings, and this signals a broader deleveraging that will put this significant part of the Chinese economy in the doldrums for years. Households are affected.

Then there are demographic concerns. Repealing the one-child policy hasn’t done anything, and the rates of urbanization are now hard to keep up. It is a rapidly declining population.

Geopolitically, China is increasingly a pariah state ready to engage in economic nationalism. We have always considered China uninvestable due to the tendency for the government to regulate sometimes thriving industries to death, like tutoring, video games, consumer credit, and other segments of the market. But there are greater issues; for example, capital flow restrictions that we were always worried about, and some similar actions, such as limits on short selling, are being taken now due to the recent flash crash in the Chinese stock market driven by some forced selling, weakening collateral and margin calls. The government coming in an opaque and unsystematic manner to regulate markets may be stopping some more margin calls and forced selling, but it may also remind foreign investors with mandates still open to China that capital control risks are real, and could lead them to reconsider. This could reduce negative reflexivity in a vulnerable China, where weaker markets cause investors’ concern over possible exit limitations which make the market weaker.

Conclusions

There is also substantial Korean exposure, and trade is disintegrating between these nations as well over the chip ban and general influence to eschew each other’s products, particularly Korean products by China.

Being a foreign ETF, expense ratios are quite high at 0.5%. PE ratios aren’t even that low at 13x, implying an earnings yield of less than 10% despite risks and elevated costs of capital, as well as underlying risks to growth in these geographies. If the deterioration of China creates exit issues, that would be game over. We wouldn’t want to risk that in a fractious geopolitical situation where there might be incentives for economic nationalism.