Pekic/E+ via Getty Images

Introduction

If you’re like the woman in the picture above and wondering where to invest your money, then look no further than Agree Realty (NYSE:ADC). Since first starting my investment journey and focusing on REITs, Agree Realty was one that really stood out to me. Although their big brother Realty Income (O) gets all the attention, ADC is simply the better REIT in my opinion. And in this article, I list several reasons why they are one of the best REITs your money can buy currently.

Previous Thesis

I last covered Agree Realty back in January. During that time, ADC along with many of its peers experienced a short rally after coming off the October lows. The stock was trading at $63 at the time of that article but has since retracted to less than $57 a share at the time of writing.

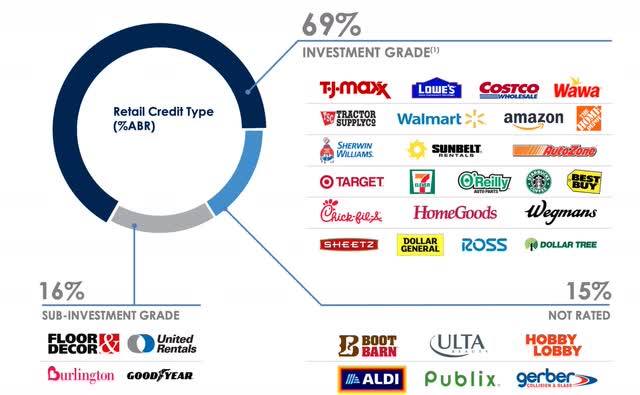

I touched on the company further strengthening its portfolio by focusing on investment-grade tenants, which is important during the challenging economic backdrop. I also discussed the growing monthly dividend and how it was well-covered by growing FFO & AFFO. Since then, the REIT has reported its Q4 earnings to close out the year, which proved to be another strong one for the books.

Management Matters

Probably the biggest key to running a successful company or business is management. And Joey Agree runs a tight ship. No pun intended. Those who follow me probably know I’m a huge fan of the company, one reason being their CEO. It’s one thing to know a company’s management from afar, but I’ve gotten to know Mr. Agree more personally as we’ve talked.

And knowing the management of any company on a more personal level definitely helps your investment decision in my opinion. And what I like about Agree Realty is that they don’t tend to waiver or deviate from what makes the business successful.

In short, Agree Realty keeps it simple. And sometimes keeping it simple is all that needs to happen. Furthermore, I like that they stay within their circle of competence. If something doesn’t fit, Agree Realty doesn’t try to make it.

Unlike its peer Realty Income, ADC prefers to stay inside the retail circle and not go outside for the sake of growth. During their Q4 earnings posted back on February 14th their CEO stated:

We will not grow the denominator without driving meaningful AFFO per share growth, nor will we move up the risk curve to create short-term opportunities & growth.

This stood out to me as I took this as although the environment remains challenging, we will not go outside of what we do just to show shareholders we’re growing for the sake of growing.

With high interest rates placing pressure on the economy and businesses, ADC remains planted like a tree and will continue to find ways of growing its portfolio without making acquisitions outside of its wheelhouse for short-term gains. This is something to look for when investing in a company, especially if you plan to hold them for the long term.

Meaningful Growth

Net income for the quarter grew roughly 11% while core FFO was up 3.4% to $0.99. For the full-year, it was up 1.6% to $3.93. AFFO for the quarter was up 5.2% to $1.00 and up 3.1% to $3.95. Furthermore, they invested more than $1.3 billion for the fourth consecutive year, acquiring 319 retail net lease properties for the year.

They also increased their exposure to investment-grade tenants to 69.1%, up from 68% year-over-year. They also added additional ground leases to their portfolio bringing the total to 224, up from 206 a year prior.

ADC February investor presentation

In 2023, Agree Realty crossed the 2,000-property count and the portfolio currently stands at 2,135. This grew 16% year-over-year from 1,839. Furthermore, they acquired these properties at an attractive spread, with a weighted average cap rate of 7.2%. This is in comparison to another favorite in my sector of mine, NNN REIT (NNN), which acquired additional properties at a weighted average cap rate of 7.4%.

The weighted average cap rate of dispositions was 6.1%. Occupancy for the full year also ticked up to 99.8% from 99.7% which is impressive considering the challenging environment. To put this into perspective, both Realty Income and NNN REIT had an occupancy of 98.6% & 99.5%, respectively. While NNN saw their occupancy tick up similar to ADC’s by 0.1%, Realty Income’s occupancy declined from 98.8% over the same period.

So, despite electing not to go up the risk curve, ADC still managed to grow core FFO & AFFO and increased occupancy for the year, showing why they are one of the best net lease REITs right now.

Monthly Dividend With Room For Growth

Another reason why I think Agree Realty is one of the best REITs your money can buy is that shareholders get paid a monthly, growing dividend that’s well-covered by AFFO. For the full year, ADC’s dividend of $2.92 was well-covered by their AFFO of $3.95 giving them a payout ratio of 73.9%, below management’s target range of 75% to 85%.

Additionally, the REIT reached nearly $100 million in free cash flow on an annualized basis after paying the dividend. They also managed to grow the dividend by 4.1% year-over-year. And, seeing by their conservatism, Agree Realty has plenty of room to sustain its growing dividend for the foreseeable future.

Operating Like An A-Rated Company

The way Agree Realty operates its business, you’d think they were the REIT with the A-rated balance sheet. In a few years’ time, I see them being upgraded to an A-rated company if they can continue growing the business the way they have been doing.

They also were put on positive outlook by the S&P earlier in the month. They also managed to lower their Proforma net-debt-to recurring EBIDTA to just 4.3x, down from 4.5x. They also maintained a healthy fixed-coverage charge ratio of 5.0x.

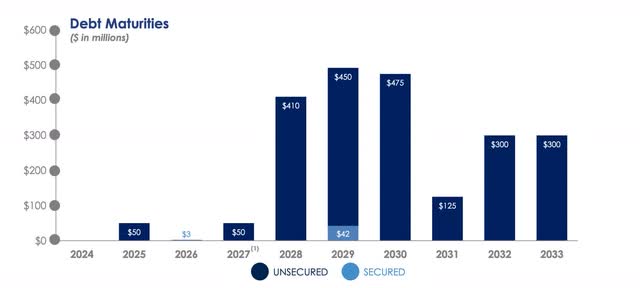

ADC February investor presentation

If investors were worried about the higher longer rate environment, ADC has no debt maturing for the next four years and ample liquidity of $1 billion. They also had $15 million in cash on hand and $773 million of availability on the revolver.

So, even if the Fed decides to keep rates here to 2024, ADC remains in a strong financial position with no debt to refinance at a higher rate. This is important because unlike some of its peers like W. P. Carey (WPC) or Realty Income, who both have more than $1 billion due this year, ADC can focus on making acquisitions instead of using available liquidity to pay down debt.

Continued Growth

To close out 2023, Agree Realty had a record year with 37 projects either completed or under construction. During Q4 they commenced 4 new projects with anticipated costs of approximately $13 million. Two of these are being leased to coffee giant Starbucks (SBUX).

They also completed 4 projects in the quarter alone and executed new leases to recession-resistant retailers like Walmart (WMT) and T.J. Maxx (TJX). Additionally, only 28 leases are expiring this year or 110 basis points of annualized base rents. So, Agree Realty is in a strong position financially and from a portfolio standpoint. Another reason why the REIT is one of (the best), if not the best, in the sector.

Undervalued

At the time of writing, ADC is trading less than $57 a share, giving them a P/AFFO ratio of 14.39x. Although this is slightly above the sector median, it’s below their 10-year average of nearly 18x. This means the stock’s fair value is around $70 a share, so investors are getting a bargain currently. And even though no one knows if and when rates will be cut, when they are, I think Agree Realty will be one of the first REITs to see massive upside.

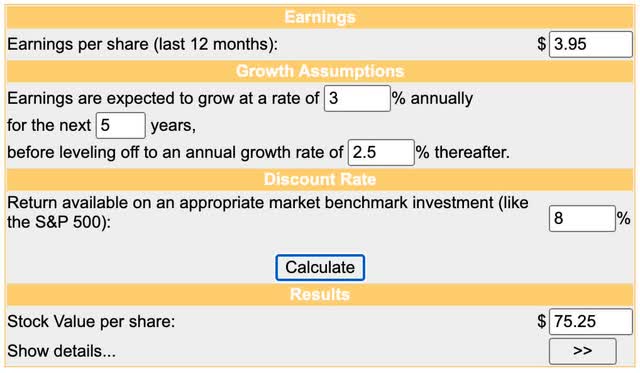

Wall Street also agrees with me that ADC is a strong buy right now at current levels. Investing in ADC gives investors 3% growth and a 5% dividend yield for more than 8% growth while you wait for a price recovery. Not to mention double-digit upside to the average price target.

The current analyst price target is roughly $67. But I suspect the share price could rise even further when rates are cut, which I expect sometime this year. Using a WACC of 8% and the Discounted Cash Flow Method, I have a price target of roughly $75 a share. This gives investors near 30% upside. You also get a monthly dividend while you wait.

moneychimp

Risks To Thesis

While Agree Realty doesn’t have any debt to worry about for the next few years, higher rates will still have an impact on the business, more so as operating expenses increase. Year-over-year, these increased for several businesses as interest rates continue to place downward pressures on companies.

Furthermore, as seen by the latest CPI data, some are saying we can see a potential rate hike in March instead of a cut. During their latest earnings, their CEO was cognizant as he mentioned it’s likely we get a rate hike this year rather than a cut. If so, portfolio companies will likely face more stress than they have already been. And even though ADC’s portfolio occupancy ticked up slightly and has remained resilient, another hike can cause further stress for businesses within the portfolio.

If so, they can see their occupancy decline in the coming quarters, which will then likely impact financials. Another risk is a decline in share price if rates experience a hike. All eyes will be on the upcoming meeting, but if a hike occurs, REIT prices will likely experience volatility, potentially making new 52-week lows. If you’re a long-term investor, I think that will be a perfect opportunity to average down.

Bottom Line

Despite the volatile year and headwinds ADC and many of its peers have experienced over the past 2 years, fundamentals remain strong, and investors should use this opportunity to build their positions so that when rates are cut, they lock in the potential for some nice upside.

Especially, if you have a long-term outlook on your investments. Additionally, ADC’s monthly dividend is well-covered, and the REIT has no debt to worry about refinancing like some peers. Because of their strong balance sheet and commitment to growth, I expect ADC to continue making attractive acquisitions and growing their dividend while the share price remains volatile due to interest rate uncertainty.

The company continues to drive meaningful growth for its shareholders, which will continue for the foreseeable future. Due to their commitment to growth, strong balance sheet, and share price well below fair value, I am upgrading Agree Realty to a strong buy.