AmyKerk/iStock via Getty Images

Introduction

Agenus (NASDAQ:AGEN), a clinical-stage firm, specializes in therapies utilizing the body’s immune response to tackle cancer and infections. Through its subsidiaries, MiNK Therapeutics and SaponiQx, Agenus diversifies into adoptive cell therapies and vaccine adjuvants, respectively. Their strategy in Immuno-oncology (I-O) hinges on swift, innovative combinations. Agenus boasts a comprehensive lineup, ranging from immune-modulatory antibodies to their notable botensilimab/balstilimab combination, which demonstrated promising results in colorectal cancer [CRC] treatment and earned Fast Track recognition from the FDA. Their end-to-end capabilities, from antibody discovery to clinical manufacturing, set them apart, and strategic collaborations amplify their advancements in the domain.

Recent developments: Agenus cuts 25% of staff to focus on botensilimab/balstilimab cancer program, expecting ~$40M savings by year end.

The following article discusses Agenus’ financial challenges and botensilimab/balstilimab combination data, culminating in a “Sell” stance for investors.

Q2 2023 Earnings

Looking at Agenus’ most recent earnings report, by the end of Q2 2023, the company held cash and short-term investments amounting to $157.8M, down from $193.4M as of December 31, 2022. Since the close of Q2, they’ve raised an additional $20.3M through the sales of their common stock. In the first half of 2023, Agenus reported revenue of $48.2M, with a net loss of $144.3M. Notably, this net loss included non-cash expenses totaling $53.8M for the six months ended June 30, 2023. Major expenses for the company included research and development costs at $116.4M and general and administrative expenses at $38.7M.

Cash Runway & Liquidity

Turning to Agenus’ balance sheet, as of June 30, 2023, the combined values for ‘Cash and cash equivalents’, ‘Short-term investments’, and ‘Investments’ is $157.8M ($143.2M + $14.6M). Over the first six months of 2023, the “Net cash used in operating activities” stands at $118.6M, implying a monthly cash burn of about $19.8M. Considering this burn rate, if maintained consistently, Agenus has a cash runway of approximately 8 months ($157.8M divided by $19.8M per month). However, these estimates are based on past data and may not be indicative of future performance.

The company’s liquidity status seems to be a concern as their cash and equivalents have diminished compared to the end of the previous year and the monthly cash burn is considerable relative to the available assets. On the liabilities front, Agenus has current and long-term debt totalling approximately $13.3M. Further, they have significant liabilities related to future royalties and milestones. Given the company’s financial standing, procuring additional financing might be challenging unless they can leverage assets, present a strong business case or improve their operational efficiency. It is important to note these observations are my own and might vary from other analyses.

Valuation, Growth, & Momentum

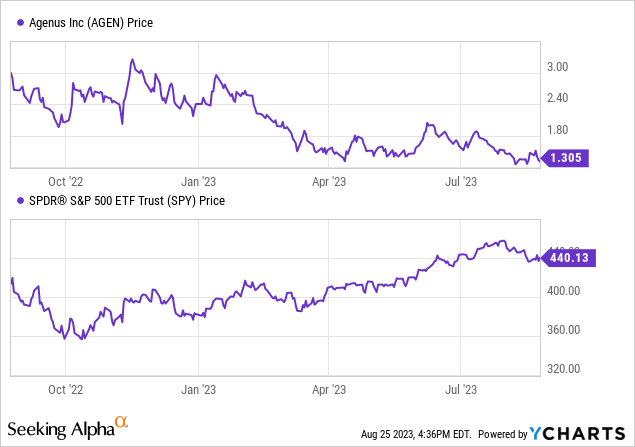

According to Seeking Alpha data: Agenus’ capital structure reveals a relatively small amount of debt compared to its market capitalization, and it holds a cash position which exceeds its debt. The company’s enterprise value stands at $487.91M. Valuation metrics, especially price-to-earnings (P/E), are not meaningful, indicating negative earnings, which is typical of many biotech companies in developmental stages. Agenus’ growth profile suggests modest revenue increases over the coming years, with improving earnings estimates. However, this modest growth is seen in the context of a broader revenue decline year over year. The stock’s momentum is on the downside, with significant underperformance compared to the broader market, as evidenced by the negative returns over varying time horizons.

Promising Outcomes for Non-MSI-H CRC Patients with New Combo Therapy

The combo, presented at the ESMO-GI World Congress in June 2023, heralded substantial advancements for 3L+ non-MSI-H CRC patients lacking active liver metastases. Non-MSI-H, or Microsatellite Stable CRCs, constitute “80% to 85%” of all CRC cases, signaling the significance of this treatment. This combination therapy delivered a median overall survival of 20.9 months, notably exceeding the standard care’s 12.9 months, per Agenus. The overall response rate also reached 23%. In April, the FDA granted this combination a Fast Track designation. The ACTIVATE Phase 2 trial’s enrollment is nearing its end, and a subsequent Phase 3 CRC study is on the horizon. Moreover, a Biologics License Application, or BLA, is slated for 2024.

Assessing the market scope, it’s vital to recognize the prevalence of 3L+ non-MSI-H CRC patients without liver metastases. If this combo consistently demonstrates such impressive outcomes, it might dominate this significant market segment. The remarkable advancement over existing standards hints at its potential as a preferred treatment. This drug’s precision-targeting mirrors the burgeoning preference for personalized medicine in oncology. Given its trajectory, this combo may set a new gold standard for its target patient group.

My Analysis & Recommendation

In light of recent developments, Agenus’ path presents a duality of excitement and concern. The company’s renewed focus on the botensilimab/balstilimab cancer program, demonstrated by their recent staff cuts, is commendable. Such decisive steps, aiming to expedite approvals and to the tune of an estimated $40M in savings, show a targeted approach to solidifying their position in the oncology market. Their capability to streamline processes from antibody discovery to clinical manufacturing remains a differentiation in a hyper-competitive industry.

However, from an investor’s lens, the financial perspective brings unease. Despite recent capital raises, the company’s cash runway of 8 months (plus $20.3M from a recent stock sale), given my estimates, is alarming. The fast burn rate, juxtaposed with the company’s need for continuous R&D spending for potential breakthroughs like the botensilimab/balstilimab combo, suggests that Agenus will require further financing or significant revenue generation in the near future.

It’s pivotal to remember, while the Phase 2 data of the drug combination is undoubtedly promising, it remains just that—promising. The much-anticipated comprehensive Phase 3 data will be the decisive pivot for investors. If this data is affirmative, it could herald Agenus’ combo as the new paradigm in treating a significant fraction of CRC cases. Yet, with so many biotech ventures, hope remains tethered to empirical success; Phase 3 trials have been known to upset earlier projections.

Given the company’s financial health and the looming uncertainties of the Phase 3 trial, I recommend a “Sell” for Agenus. This isn’t a denouncement of the company’s scientific potential, but a cautious approach considering the inherent risks associated with clinical-stage biotech firms. For long-term believers in Agenus’ mission and prospects, the coming months will be telling. For those seeking a more stable position, now might be the time to reassess. As always, investors should remain vigilant, watching for updates on the Phase 3 data and any moves by Agenus to bolster its financial stance.

Risks to Thesis

When the facts change, I change my mind.

Risks that may contradict my final investment recommendation on Agenus:

Overemphasis on Financial Health: I may have placed undue weight on the company’s short-term financial health and not enough on their long-term prospects, especially given the promise shown in their botensilimab/balstilimab combination. Furthermore, with cost reduction efforts, the company could reasonably extend their cash runway over one year.

Underestimation of Strategic Partnerships: Agenus’ collaborations could amplify advancements more than anticipated, leading to unexpected breakthroughs or faster market entry.

Overlooking Market Acceptance: The market might readily accept Agenus’ products more than anticipated, leading to a quicker return on investment.

R&D Progress: While the burn rate is high, it’s common in biotech, and significant R&D investments could yield high returns in the future.

FDA Fast Track Designation: I might have underestimated the advantage this designation provides, which can expedite the review process.

Industry Dynamics: Rapid changes in the biotech industry could make Agenus a potential acquisition target, offering investors a premium.