bjdlzx

The final article on Africa Oil Corp. (OTCPK:AOIFF) mentioned the consolidation of prime possession beneath the corporate umbrella in trade for firm inventory. Since that point, administration has continued to streamline its investments whereas additionally lowering future money wants. The end result of that is carried pursuits in key areas whereas the corporate’s financials shall be a bit simpler to grasp sooner or later. There’s additionally a deal with areas that shall be progress areas whereas perhaps some extra speculative (or unsure) initiatives go by the wayside as this course of continues. Africa Oil was, for a very long time, a narrative firm that is one of many uncommon corporations transitioning to an precise working entity with a really brilliant future and a few spectacular companions.

What made the transition potential was the affiliation on the time with the Lundin Vitality Group of corporations. That sizable group is effectively revered for its document with traders. However that affiliation has now ended. The proposed mixture not solely simplifies the entire construction, but in addition locations one other main (well-respected) shareholder behind the corporate to assist this firm proceed to develop. It is arduous to understate the need of that sort of relationship in the case of rising a small firm within the offshore enterprise.

Second Quarter

One other announcement made beforehand was a drilling marketing campaign so as to add to manufacturing for the corporate’s main producing asset off the coast of Nigeria. That was going to interrupt ongoing manufacturing to a sure extent and the present outcomes present that. Nevertheless, the breakeven outcomes have been overshadowed by a distribution from Prime and a discount within the internet debt.

A mix of a distinct tax construction and the important thing transactions proven under have affected each comparisons and reported outcomes. The main points are proven within the quarterly report. A mix of points might proceed to have an effect on quarterly outcomes till all of this accomplished, which makes quarterly comparisons an actual problem.

Africa Oil itself is debt-free. Nevertheless, Prime does have debt that is being paid down and subsequently reveals on the consolidated stability sheet of Africa Oil.

Most likely crucial consideration is the construction and well being of the corporate after all of the anticipated transactions are full. The identical goes for the drilling marketing campaign.

Key Transactions

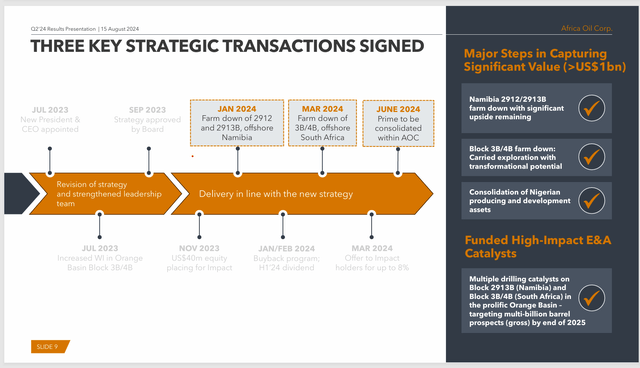

This can be a abstract of what was introduced through the fiscal quarter. After the quarter ended, the corporate introduced a suggestion to minority shareholders of the subsidiary Impression to purchase out their shares.

Africa Oil Rationalization Technique (Africa Oil Company Presentation Second Quarter 2024)

All of this exercise kind of makes the second quarter earnings announcement largely irrelevant. As soon as the drilling marketing campaign is accomplished, manufacturing interruptions are now not a priority and the steps proven above are likewise full, this shall be a really totally different firm going ahead.

Administration additionally introduced an settlement to commerce its almost 15% curiosity in Eco (Atlantic) Oil & Gasoline Ltd. (OTCPK:ECAOF) for a 1% curiosity that Eco held in 3B/4B. This was a part of the earnings announcement and additional rationalizes the corporate holdings. In consequence, this firm now solely has pursuits within the African Continent.

All through all of this Africa Oil itself will stay debt-free. The one situation could be the drilling marketing campaign and the way manufacturing points on account of that marketing campaign have an effect on money circulate and debt repayments sooner or later.

The Enterprise Going Ahead

The transaction with Eco Atlantic will, in impact, finish the enterprise relationship with that firm.

Any comparatively small participant within the offshore enterprise may have down years and up years fairly than a easy “straight-line” up.

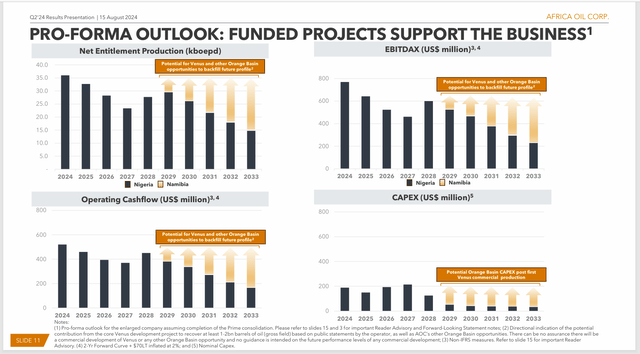

Africa Oil Professional-Forma Future Steerage (Africa Oil Company Presentation Second Quarter 2024)

On this case, the newest drilling marketing campaign will present a right away manufacturing (and money circulate) enhance till the subsequent marketing campaign. Later, one other undertaking will come on-line and supply one other supply of money circulate. That diversification will present the beginning of the corporate’s effort to easy earnings.

It is tougher to inform the consequences on the inventory value as a result of the trade has been within the doghouse for a while. In consequence, it could be well worth the await the higher years forward as a result of the trade may return to extra regular historic valuations that would offer some upside potential even when manufacturing declines between drilling campaigns. There’s additionally some potential for one more accretive acquisition utilizing some money circulate.

The important thing a part of the slide is the low capex required to get to that second manufacturing supply proven on the decrease right-hand nook of the slide.

Abstract Of The Future Enterprise

Africa Oil is a Canadian firm that reviews in United States {dollars}.

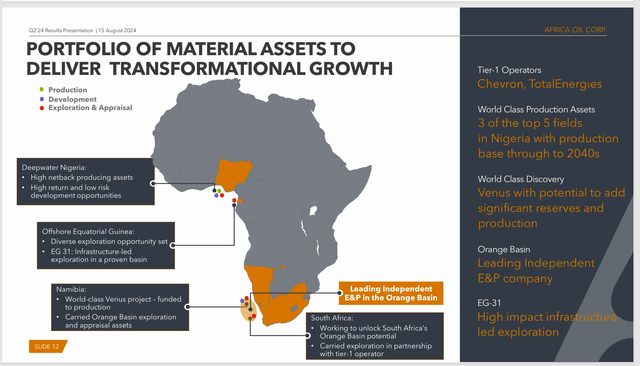

Africa Oil Enterprise Abstract (Africa Oil Company Presentation Second Quarter 2024)

One of many issues that offers this firm credibility over lots of its dimension is the companions proven above. Each Chevron Company (CVX) and TotalEnergies SE (TTE) are well-regarded operators that very a lot elevate this offshore operator significantly above many offshore operators of the identical dimension.

This might effectively make the seek for a “title” companion for the Equatorial Guinea undertaking a lot simpler than it in any other case could be.

The top of the technique of minimizing money out in trade for some working curiosity in a undertaking is lastly inside the view of the longer term.

The approaching on-line of initiatives in South Africa and Namibia is bringing earnings positioned in two of essentially the most superior international locations in Africa. They’re additionally two of essentially the most steady international locations on the continent. This represents a better valuation location than the placement of the supply of the present money circulate.

It’ll take a while for that future to reach and start to diversify money circulate. Subsequently, this inventory could also be appreciated when the newest drilling marketing campaign is accomplished. However there’s much more appreciation potential that is just a few years away.

Valuation of the inventory will depend on market situations on the time one other undertaking begins to contribute to complete firm manufacturing and earnings. Total, although, this can be a small participant with decent-sized pursuits in some comparatively giant initiatives.

Abstract

Between the drilling marketing campaign that has effects on the money circulate from the one money supply, and all of the introduced simplification methods, the corporate’s monetary statements are very prone to bear a serious (optimistic) transition that can finish with the consolidation of Prime inside the firm. Total, each step seems to be a serious plus for the corporate.

Africa Oil, as a smaller offshore operator, naturally has an elevated danger to the purpose it is thought-about speculative at this level. Nevertheless, for many who can deal with the chance of a problem like this, it is in all probability a robust purchase thought. This firm is prone to be a materially totally different and way more helpful firm by the tip of a decade (and certain earlier than that). That is that uncommon firm that is making the transition from a “story firm” to an working mannequin.

Africa Oil itself is debt-free. Nevertheless, Prime does have debt that it is paying down and is consolidated on the stability sheet. That debt is at conservative ranges. The low necessities of money wanted to carry the subsequent initiatives on-line (as a result of a carry has been negotiated) signifies that the corporate will proceed to have a robust stability sheet.

Dangers

Any upstream firm is uncovered to the volatility and low visibility of future oil costs. A sustained and extreme downturn in commodity costs may change the outlook for this firm and a few of its promising initiatives.

The drilling marketing campaign underway has thus far been profitable. However success for the remainder of the marketing campaign just isn’t assured.

Equally, all of the simplification steps have mandatory approvals and administrative steps that must be profitable. A overview of all of this might discover some unexpected challenges to get all of the anticipated steps finished. It is unlikely. But it surely’s a danger.

A lack of key personnel may materially set again the corporate’s future prospects.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.