Pascale Gueret/iStock via Getty Images

Africa Oil Corp. (OTCPK:AOIFF) recently took advantage of Impact Oil and Gas’ upsized new equity offering, investing in just under 40 million shares for $31.4 million, increasing its ownership stake to 31.1%. The discovery is the largest sub-Saharan oil offering ever, and the largest discovery in 2022, with an estimated 3 billion barrels.

As we’ll see throughout this article, the Venus discovery is among several sizable catalysts in Africa Oil Corp.’s portfolio.

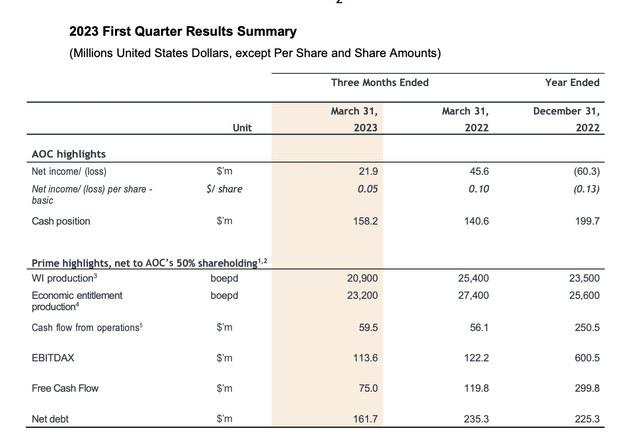

Africa Oil Corp. First Quarter Results

The company had strong first quarter results, although the impact of lower oil prices is clearly visible.

Africa Oil Corp. Investor Presentation

The company had $21.9 million in net income, down 50% YoY. The company’s cash position is $158.2 million, representing ~17.5% of the company’s $910 million market capitalization. That’s up $18 million QoQ, although it is down YoY. Still, it’s a strong improvement from the company’s $0 cash position post its POGBV acquisition.

The company’s WI production from Prime Oil and Gas is just under 21 thousand barrels / day, down ~20% YoY, as the asset continues to mature. Still, the strength of Prime Oil and Gas is visible as the net debt position drops to an incredibly low $161 million net to the company’s shareholders. We expect cash flow from operations to remain strong.

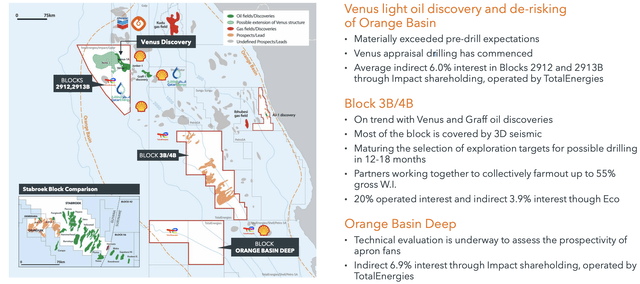

Africa Oil Corp. Southern Africa

Among the company’s most exciting positions is its positioning in the Orange Basin.

Africa Oil Corp. Investor Presentation

The Venus discovery, as discussed above, was the largest discovery of 2022. The multi-billion barrel discovery passed pre-drilling expectations, and the company is the only publicly listed E&P with exposure. A four-well drilling program has begun, which will include investigating a potential westerly extension for the block.

Current forecasts are for a rapid FPSO development to lead to first oil in 2028 at roughly 250 thousand barrels / day, meaning just under 20 thousand barrels / day attributable to Africa Oil Corp. These recent FPSO developments have had strong margins. Additionally, the company has the Orange Basin Deep and Black 3B/4B assets.

Block 3B/4B has un-risked resources assessed at roughly 4 billion barrels, with a roughly 25% chance of success. The assets are being investigated for possible drilling with farm out operations. We expect cash flow and success from the Venus discoveries, could lead to substantial and rapid development in the company’s other assets.

Overall, the company has exciting operations here.

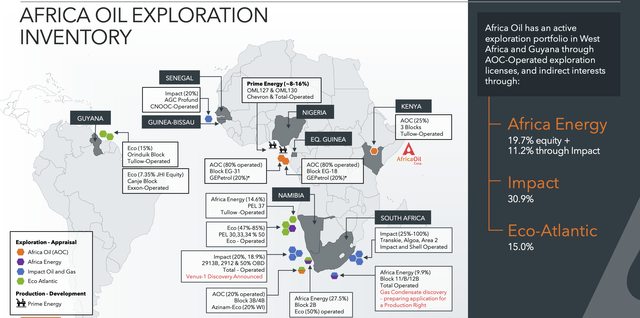

Africa Oil Corp. Other Catalysts

The company has a number of other catalysts.

Africa Oil Corp. Investor Presentation

The company has built up a diversified portfolio across the world, partially through different equity holdings that it’s built up. We’d like to see the company’s production continue increasing from current levels, with high margin offshore production generating the cash flow for the company to provide strong shareholder returns.

It’s a bit of a long-term wait, but the largest catalyst for us is whether the company can grow production going into the end of the decade.

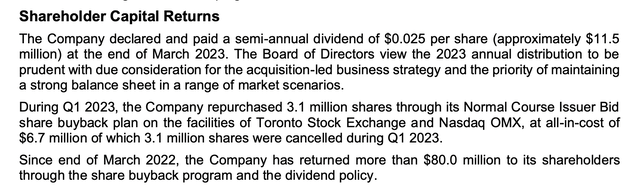

Africa Oil Corp. Shareholder Returns

Africa Oil Corp. has the cash and cash flow to provide substantial shareholder returns.

Africa Oil Corp. Investor Presentation

The company’s annualized dividend is $0.05 / share, or roughly 2.5%. That’s a strong dividend that it can comfortably afford, and it plans to continue those buybacks. The company repurchased 3.1 million shares during the quarter for $6.7 million, slightly above current prices, and ~0.7% of its outstanding shares during the quarter.

That puts the company’s annualized shareholder returns at ~5.5% based on the quarter’s results. We’ve seen a tendency for the company to cut buyback rates during a downturn, and we’d like to see it reverse that trend and aggressively repurchase shares during the downturn to the tune of at least ~$15 million / quarter.

Thesis Risk

The largest risk to our thesis is crude oil prices, which have had a difficult time over the last several months, with fears of a recession. Brent Crude has dropped below $75 / barrel. While Africa Oil Corp. is highly profitable, that profitability drops substantially as oil prices drop, hurting the company’s ability to drive future returns.

Conclusion

Given its valuation of less than $1 billion, Africa Oil Corp. has one of the most exciting portfolios in the industry. The company has strong core production from its Prime Oil and Gas acquisition, which has already exceeded its acquisition price. As net debt for Prime Oil and Gas goes down, the company will be able to drive more cash to Africa Oil Corp.

At the same time, the Venus discovery that the company has a respectable stake in was the largest discovery of 2022. An accelerated and forecast development timetable could result in production starting up in 2028. That’s high margin production that could expand heavily from there. Altogether, the company’s portfolio could lead to substantial returns.

Let us know your thoughts in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.