blackred

Affirm Holdings, Inc. (NASDAQ:AFRM) is an organization within the monetary sector of the economic system working within the transaction and fee processing companies trade. It’s in the identical trade as PayPal Holdings (PYPL) which I wrote about final week. Just like the PYPL article, AFRM seems bullish to me. On this article, I’ll define my funding thesis utilizing the technical evaluation components of value motion, momentum, quantity, and relative energy. I additionally supply a value goal and two cease losses in case my evaluation is defective.

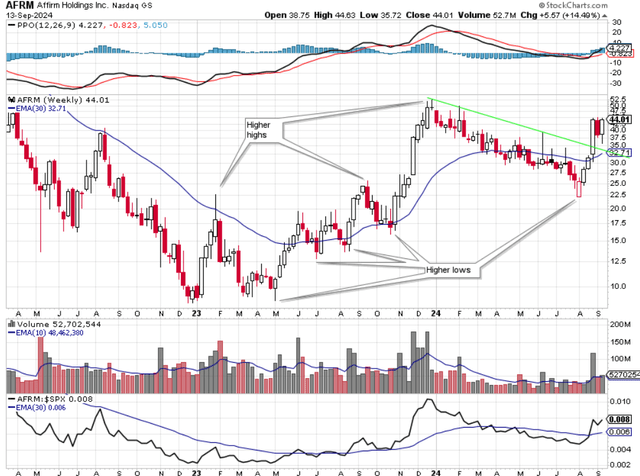

Chart 1 – AFRM Weekly with Momentum, Quantity, and Relative Power

StockCharts.com

The value motion is the very first thing I take a look at once I think about shopping for a inventory. I need to purchase shares which can be in uptrend. These are shares which can be making a collection of upper highs and better lows. One other value motion function I search for is an upward sloping 30-week exponential transferring common (EMA). The 30-week EMA permits me to seek out the medium to long-term development of the inventory. Chart 1 reveals that AFRM has made a collection of upper lows and better highs since its backside in late 2022 at $8.62. From that low, AFRM rallied as much as $22.50 after which gave up virtually all of that achieve when it fell again to $8.80 in Could 2023. Discover that AFRM wasn’t capable of keep above the downward sloping 30-week EMA throughout that advance and decline. From there, AFRM started its upward ascent in earnest. It rallied once more over the following eight months, making a collection of upper highs and better lows, reaching a excessive of over $52 late in 2023. Then AFRM gave again a portion of these features whereas dropping the 30-week EMA. Whereas AFRM did handle to lose the 30-week EMA throughout this pullback, it did handle to rally again above the 30-week EMA. That was a bullish signal. Then AFRM had the massive bullish candle that coincided with its earnings launch on August twenty eighth. This massive bullish candle cleared the down trendline proven in inexperienced. The next week, AFRM gave up a few of the earlier week’s advance, which isn’t uncommon after such a big advance. Final week, AFRM closed greater after initially heading decrease. AFRM is buying and selling above its upward sloping 30-week EMA and its weekly candles have been giant bullish candles. I like the value motion I see in AFRM.

The subsequent factor I need to see value do is commerce above the highs of $52.48 registered in late 2023. If value can clear that top, then AFRM can proceed its advance towards $96 per share. This potential value goal is predicated on the distinction between the value low of $8.62 in late 2022 and the excessive of $52.48 in late 2023. The distinction of $43.88 is added to the excessive value of $52.48 to present a value goal of simply over $96.00. This isn’t a assure or a prediction of the place value will go. It’s merely a value goal primarily based on typically accepted strategies utilized in technical evaluation.

Momentum is the following component I think about when analyzing a inventory. The Proportion Worth Oscillator (PPO) is the indicator I take advantage of to measure momentum. The PPO is straightforward to grasp. When the black PPO line is above the purple sign line, that is a sign of quick time period bullish momentum. Conversely, when the black PPO line is under the purple sign line, then PPO reveals quick time period bearish momentum. Proper now, PPO reveals quick time period bullish momentum. One other method that PPO reveals momentum depends upon the black PPO line being above or under zero. When the black PPO line has a studying above zero, that is a sign of long run bullish momentum. Conversely, if the black PPO line has a detrimental studying, then PPO is exhibiting long run bearish momentum. With a studying of 4.227, PPO is exhibiting long run bullish momentum. I need a inventory that’s long run bullish with momentum. The explanation I say long run is as a result of the black PPO line doesn’t usually oscillate above or under zero. It usually spends a very long time above or under zero earlier than altering. Proper now, AFRM reveals momentum to be each short-term and long run bullish.

Quantity is a think about my evaluation of any inventory. I need a inventory that’s being collected by institutional traders. This may be decided by trying on the massive black quantity bars. This reveals the shares being bought throughout a inventory’s advance for that week. Retail traders don’t purchase tens of millions of shares over a interval of weeks. Trying on the quantity pane in Chart 1, there have been quite a few massive black quantity bars going again for months. This tells me that institutional traders are nonetheless accumulating shares of AFRM. The one purpose they might be accumulating shares is that they suppose AFRM is undervalued at present costs. Quantity is bullish for my part.

Relative energy is the final technical component I think about when evaluating a inventory to purchase. I need to personal shares which can be outperforming the SP 500 index. That’s the solely strategy to beat the key index as an investor. The relative energy value line is straightforward to grasp. The road is a value ratio of AFRM to the SP 500 index. When the black line is rising, that signifies that AFRM is outperforming the key index. When the black line is falling, then AFRM is underperforming the key index. General, AFRM has outperformed the key index since AFRM bottomed out in late 2022. AFRM’s relative energy has underperformed the key index for many of 2024, nevertheless it has lately turned that round. The relative energy line has superior and has even retaken the 30-week EMA. Moreover, the 30-week EMA of relative energy has turned upward which can also be bullish. I like what I see concerning AFRM’s relative energy.

My evaluation could possibly be defective for quite a few causes. Earnings may disappoint, rates of interest may stay greater for longer, or there could possibly be some geopolitical occasion that might trigger a market decline. As a result of this evaluation could possibly be mistaken, you will need to have a cease loss in case you determine to purchase shares of AFRM. My first cease loss can be proper under the low of final week’s candle at $35. If value acquired there, I’d at the least promote a few of my shares, figuring out that I can all the time purchase again in later if value motion improves. One other cease loss could possibly be a detailed under the 30-week EMA. Once more, you possibly can all the time purchase again shares if value motion improves.

In abstract, AFRM is a inventory displaying bullish value motion. It has been making a collection of upper highs and better lows, and now trades above an upward sloping 30-week EMA. Momentum as measured by PPO is each short-term and long-term bullish. It seems that institutional traders have been accumulating shares of AFRM which is bullish. The relative energy of AFRM reveals that it has been outperforming the SP 500 index, and the relative energy line is now above its upward sloping 30-week EMA. There’s a potential value goal of $96, however this evaluation could possibly be mistaken, so it’s best to think about a cease loss in case you select to purchase shares of AFRM.