designer491

Macro:

In the 1970s Fed Chairman Arthur Burns, under pressure from President Nixon who was trying to get re-elected, cut interest rates. With the US off the gold standard, the result was a reignition of US Dollar inflation that plagued the rest of that decade.

History may not repeat itself, but as Mark Twain said, “it often rhymes”. In fact, so far it appears to be doing so.

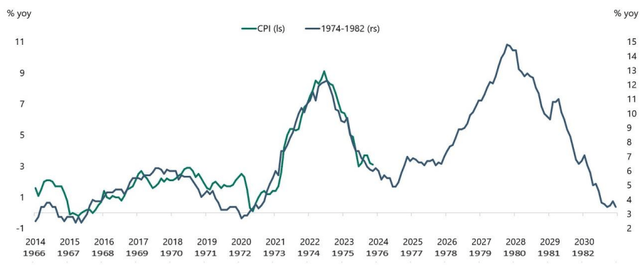

CPI history repeats (apolloacademy.com)

The 2014 – 2024 inflation rate seems to be highly correlated with the 1966 – 1976 pattern. Now, the Fed’s latest dot plots imply 75 basis points in rate cuts in 2024 similar to the ill-advised interest rate cuts Burns did in the early 70s. This is even as the US debt is at an incomprehensible $33+ Trillion dollars. If rates are cut, will it reignite a 70’s like inflation?

I think it would, except personally I also suspect the Fed is not going to make the same mistake. They aren’t going to cut too early. There are multiple reasons for this. For one the Fed Chairman isn’t up for renomination until 2026, so the Biden Administration doesn’t have the sway over him that Nixon had over Burns (nor that they had when Powell delayed raising rates during the midterm elections). Also, I note the Fed should be painfully aware of Burn’s 1970s error and want to continue to resist repeating it. Thus, despite likely pressure from the Biden Administration and what the dot plots currently say, I don’t think it will make significant cuts in 2024. That is unless some serious Black Swan/extraneous event forces his hand. Unless that happens, they will want to keep his powder dry and will not want to go down in history as a repeat of the failed Arthur Burns Fed.

Additionally, while not directly part of their charter, the Fed will be quite aware the World Reserve status of the US dollar is under threat. BRICS+ members still hold over $1 Trillion of US Debt and yet have displayed a trend over the last few years of decreasing those US Treasury holdings and increasing their gold holdings instead. They have also been setting up alternate trade systems to bypass the US Dollar. If these actions eventually cause the international community to lose faith in the US Dollar as a store of value, that too would be inherently inflationary.

Finally, I reason even if I’m wrong and the Fed does cut 75 basis points this year, the most likely result is in fact the reignition of inflation the chart above portends. In that case, eventually, rates will once again have to be raised to fight this reignited inflation. Thus, the result will be the same, my timing will just be off.

So, my analysis differs from what most of the Market thinks. When that happens, it behooves me to ask how to benefit. Who is underpriced and likely to outperform if I am right?

Fixed-to-Floating Preferred:

One answer to that question is fixed-to-floating preferred stock. Specifically, I reason if rates don’t decline much, some of these preferred are going to switch to floating over the next couple of years at rates that are highly undesirable for those firms. As a result, management is going to want to pay-off or refinance that high cost preferred if they can. That in turn may lead to them calling it, a yield-to-call ‘YTC’ situation which I can potentially benefit from.

Furthermore, even if I’m wrong about interest rates, as long as the firms I choose stay solvent, I continue to collect a reasonable yield. Hence, it’s only in situations of default, or where rates go down and stay down, that I am likely to earn an unacceptable return.

In order to achieve the optimal outcome however rates become onerous to the firm during our investment period. So, we need to choose firms whose preferred dividend rates are likely to go up significantly when they start to float in the next year or two. Another obvious key is these firms need to not only remain solvent but preferably to also be able to pay off or refinance those floating rates that have become onerous. Thus, forward-looking debt and cash flow analysis of the underlying firm remains essential. In particular, we need to avoid the firms where the resetting of rates to a much higher level will be the final straw that propels them into bankruptcy.

Specific Fixed-to-Floating Opportunities:

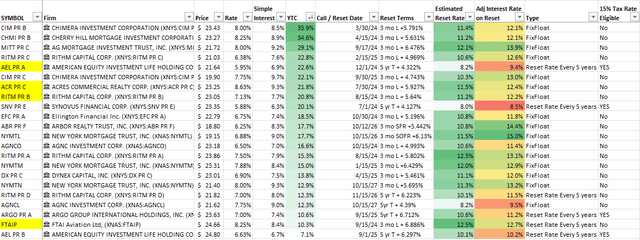

Here’s a list of fixed-to-floating Preferred YTC opportunities along with their key attributes. You may find some of them attractive. The highlighted equities are those I did and have invested in recently.

YTC Preferred Opportunities (Quantumonline.com)

The first fixed-to-floating opportunity I found attractive enough to cover for Seeking Alpha was FTAI Aviation Preferred (FTAIP). You can find out more about it in the original public analysis, but I warn Mr. Market has since repriced these preferred. As a result, they are not as attractive as when we first covered them.

Similarly, at Cash Flow Club we’ve also already provided articles covering three more opportunities, each of which would generate a >20% YTC if called. These are ACRES Commercial Realty Preferred (ACR.PR.C), Rithm Capital Preferred (RITM.PR.B) and American Equity Investment Life Preferred (NYSE:AEL.PR.A). I own all three, but will cover the last one here.

American Equity Life Preferred

AEL is an insurance company being bought by Brookfield Reinsurance (BNRE), an affiliate of Brookfield (BN).

As part of the AEL merger, BNRE is assuming AEL’s non-cumulative preferred A and B which it indicates it plans to keep listed.

Upon the closing of the proposed transaction, AEL Shares will be delisted from the New York Stock Exchange and shares of AEL’s series A noncumulative preferred stock (NYSE:AELPRA) and series B preferred stock (NYSE:AELPRB) will remain listed on the New York Stock Exchange.”

That merger is expected to close in the first half of this year.

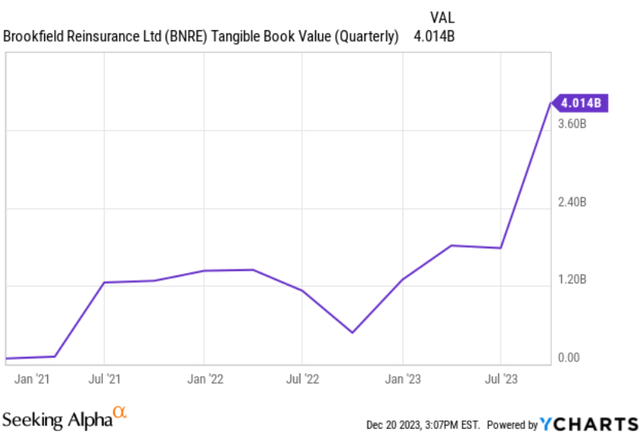

BNRE has also been buying other insurance firms in a bid to gain size and book value.

BNRE Tangible Book Value (YCharts)

For instance, BNRE recently bought the insurance firm Argo Group and assumed Argo’s preferred in the process. Once that deal closed, the preferred, ARGO.PR.A, rose from $22.85 to about $24.50, a 7% yield. This made sense as BNRE is rated A- (Excellent) by AM Best and the preferred similarly rated insurance firms like Allstate (ALL) trade at 6-7% yields (e.g. ALL.PR.H).

However, I think our return maybe even better than that because AEL.PR.A could also be called towards the end of this year.

Currently AEL.PR.A ‘s yield is similar to other insurance firms at 6.8%. However, that floats at 5yr T + 4.322% on 12/1/24 (8.2% coupon and 9.3% simple interest at today’s price). An 8.2% coupon is likely to seem a bit expensive compared to the 6-7% other A- rated insurance firms pay on their preferred. Thus BNRE could potentially save a few bucks by refinancing these preferred into either a fixed rate instrument or something with a smaller spread.

Alternatively, BNRE could just pay them off with cash on hand. BRNE has about $7 billion in cash and short-term securities. Much of that is earning a rate equivalent to about that of a 5-year Treasury. So paying off preferred costing 5 yr T + 4.3% with cash earning about 5 yr T generates positive net cash flow and may be the best choice.

Regardless, if BNRE calls the preferred at the end of this year our potential YTC is 21.5%. However, even if they don’t, we will start to collect an acceptable 9.3% dividend yield on cost from a firm with a low risk of default.

Furthermore, I don’t see Brookfield delisting or otherwise playing games with their Preferred. If they did it could raise concerns with insurance regulators and potential future merger candidates. Some customers may also question how safe and trustworthy such a firm would be. Hence a healthy insurance company seeking to grow is unlikely to play games with its financial obligations. GNRE has not delisted the preferred they have assumed so far, nor do I think they will be the AEL preferred.

Instead, if they don’t find the new AEL.PR.A floating rate acceptable on reset, the most likely outcome is for Brookfield to simply refinance it, or use some of its ample cash to pay it off.

Conclusion:

My expectation of interest rate changes differs from the markets expectation. Thus, it behooves me to figure out what opportunities may exist if I am correct. One such potential opportunity is fixed-to-floating rate preferred. In particular, I’m looking for fixed-to-floating preferred whose rates will climb significantly in the next couple years to a level likely to be unacceptable to management, and whose firms can afford to either refinance or pay them off.

I suspect ACR.PR.C, RITM.PR.B and AEL.PR.A are such opportunities, all of which offer >20% YTC. The latter, AEL.PR.A, is in the process of merging with and becoming part of A- rated, large cap insurance firm, Brookfield Re-insurance. This opens up the possibility of it being called towards the end of this year for a 21.5% yield-to-call.

Potential investors will of course need to conduct their own further due diligence. However, the risk to reward ratio here seems good. Ultimately, the appeal of investing in these preferred lies not in the lack of all-risk, but rather in the potential for an above average return vs. the risk actually being taken. Each investor will therefore need to assess their own tolerance and set an appropriate allocation level prior to making any investment.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.