xavierarnau

Adtalem Global Education (NYSE:ATGE) offers workforce solutions. Recently, Safkhet Capital published a report against ATGE, due to which its share price fell more than 19% in just one week. However, the management has denied all the allegations and states that the report is false and is aimed towards making money through short selling. I don’t know if the allegations are true or not, but I know one thing for sure: we will see volatility in the share price. So investing in it can be risky at the moment. Hence, I would advise you to avoid investing in it. I assign a hold rating on ATGE.

Financial Analysis

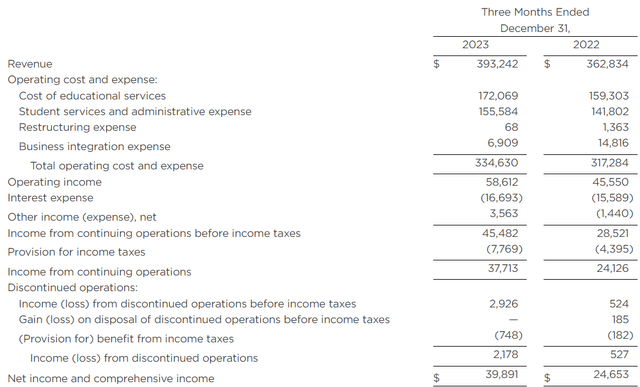

ATGE recently posted its Q2 FY24 results. The revenue for Q2 FY24 was $393.2 million, a rise of 8.4% compared to Q2 FY23. Its Chamberlain and Walden segments performed well, which was the major reason behind the revenue rise. The revenue from its chamberlain segment grew by 8.6% in Q2 FY24 compared to Q2 FY23. Strong growth in the pre and post-licensure nursing programs resulted in increased student enrolment by 6%, which was the reason behind the revenue rise in the Chamberlain segment. The revenue from the Walden segment grew by 11.3% in Q2 FY24 compared to Q2 FY23. The student enrollment in this segment grew by 7.9%, which was due to growth in healthcare programs. The operating income grew 28.6% in Q2 FY24 compared to Q2 FY23.

ATGE’s Investor Relations

The net income for Q2 FY24 was $39.89 million, a rise of 61.8% compared to Q2 FY23. The growth in student enrolments across all programs is a positive sign. Its initiatives, such as the Believe & Achieve Scholarship, seem to benefit them. The management has raised its FY24 revenue and EPS guidance. The FY24 revenue guidance is now around $1.54 billion, which is 2.6% higher than the previous guidance, and the FY24 EPS guidance is around $4.65, which is 6.9% higher than the previous guidance. Considering the strong demand they are experiencing and the various initiatives like Believe & Achieve Scholarship and Growth with Purpose, which are aimed to attract more students and increase operational efficiency, I believe they might achieve the revenue and EPS targets.

Technical Analysis

Trading View

ATGE is trading at $48.4. In October 2023, the stock broke the $45.5 level, which it had been trying to break since 2021, and after the breakout, the stock moved up around 35% in less than three months. It looked like the stock was headed towards its all-time high of $75. However, the stock fell down around 20% in just one week, and I believe the Safkhet report was the main reason behind the stock falling. Currently, the stock price is near a crucial level of $45.5. The $45.5 is a support for the stock, and if the price falls below the $45.5 level, then the stock might go into a consolidation phase, and no one can predict for how long the consolidation will last. Before the breakout happened in October 2023, the stock was consolidating between the range of $33.5-$45.5 for about 20 months. Hence, the price must sustain above $45.5, and if it doesn’t, then it might go into a consolidation phase. So considering the current conditions, I think it would be best to stay away from it for some time.

Should One Invest In ATGE?

Its financial results were impressive, and the increased guidance is also positive. In addition, it looks attractive valuation-wise. It is now trading at a PEG [FWD] ratio of 0.06x compared to the sector median of 0.60x and is now trading at a P/E [FWD] ratio of 10.05x, which is lower than its five-year average of 11.52x. So, ATGE is now trading lower than its historical averages. It was also looking technically strong just three weeks back. However, despite all these positives, I think staying away from it might be a better option, at least in the short term. The reason I am saying this is because of the Safkhet report. They have published a short report on ATGE with several allegations. One thing that is positive is that the company has quickly responded to the allegations and has a strong stance amidst them. ATGE is denying all the allegations and has countered the report. To be honest, I don’t know if the allegations are true or not. We will get to know about it with time, but one thing that I am sure of is that we will see volatility in the stock price. Its stock price can be quite volatile in the short term, and investing in it can be quite risky. Hence, despite cheap valuation and solid results, I think one should avoid it. So, I assign a hold rating on ATGE.

Risk

The price of their common stock, their reputation, student enrollment rates, revenue, profit, and/or other aspects of their business could all be adversely impacted by unfavorable publicity about any past, ongoing, or future investigations, claims, settlements, and/or actions against them or other proprietary postsecondary education institutions. Unresolved inquiries and actions, or unfavorable resolutions or settlements thereof, may also give rise to further inquiries, administrative actions or lawsuits, heightened scrutiny, the withholding of authorizations, and/or the imposition of other sanctions by state authorities in charge of professional licensing and education, taxing authorities, their accreditors, and other regulatory agencies that oversee them. Taken individually or collectively, these events could substantially impact their business and impose major limitations on them and their capacity to operate.

Bottom Line

ATGE has announced strong results, and its future guidance is strong. In addition, it looks attractive valuation-wise. However, I am expecting extreme volatility in its share price fluctuations due to the Safkhet report. So, investing in it right now can be quite risky. Hence, I would advise you to avoid it.