Mohammed Haneefa Nizamudeen/iStock via Getty Images

Company Description

Delcath (NASDAQ:DCTH) manufactures Hepzato Kit in the US and Chemosat in Europe. They are the same thing; it’s just a different name. This device enables percutaneous hepatic perfusion which I will call PHP in this article. This is a liver directed cancer treatment. It was approved in Europe in 2012 as a medical device via a CE Mark. However, it needed to be approved as a drug in America which took until August 2023. The different regulatory process is due to this being a drug device combination. The drug part is melphalan (chemotherapy) which the company doesn’t produce itself.

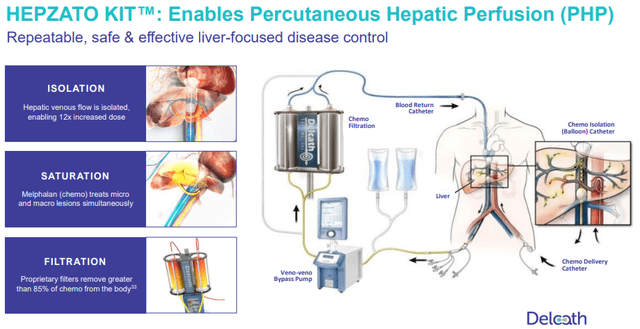

An extremely high dosage of melphalan saturates the liver via a catheter inserted in the groin. The melphalan is kept in the liver via two catheter balloons shown in the image below. After the melphalan isolates the liver, the blood is filtered through the Delcath device. The blood is returned to the body through a catheter inserted in the throat. 86% of the melphalan is filtered from the blood which dramatically limits the effect on the body. Without this filter, this high dosage wouldn’t be possible.

PHP Graphic (Delcath Investor Presentation)

Patients stay in the hospital overnight; the procedure takes 3 hours to complete. Patients go home the next day and can go back to normal activity within a week. The procedure is done every 6 to 8 weeks. It can be done up to 6 times, with the average being 4.1 times in trials. In Europe, PHP has been used to treat several types of liver cancer, but it hasn’t gotten much reimbursement in the past decade because it wasn’t FDA approved. It should start getting reimbursed once the FOCUS trial data is published in Europe early next year. The most prevalent European markets have been the U.K. and Germany.

The recent FDA approval was only for uveal melanoma that metastasizes to the liver. This is an extremely rare form of cancer. Only 3,400 Americans get ocular melanoma per year. About 85% to 90% of ocular melanoma patients have uveal melanoma. 50% of these patients develop metastasis. Liver dominated metastasis occurs in 95% of patients with metastatic uveal melanoma (mUM). Patients need to have cancer affecting less than 50% of the liver to be eligible for PHP. Therefore, slightly greater than 80% of mUM patients can be treated with PHP.

In the FOCUS trial that got PHP FDA approved for the treatment of mUM, PHP had a 36.3% objective response rate (ORR) which beat out the best available alternative treatment which had a 12.5% objective response rate. The objective response rate was the primary endpoint of the trial. The ORR was measured as the percentage of tumors that shrank 30% or more at 2 separate timepoints. Progression free survival was 9.03 months which was much better than the best alternative care which was 3.12 months.

Patients with metastatic ocular melanoma (mOM) had a very grim future without the latest treatments. The survival length is just 9-12 months; metastasis to the liver is the most common cause of death. In a PHP study, survival length increased from 8 months to 20 months for patients that had at least 2 treatments of PHP. This is a non-invasive life extending procedure. PHP is used for unresectable mUM, which means the cancer can’t be surgically removed. The way liver cancer develops, surgical removal a bad idea because of the microscopic disease dispersed in the liver. It’s a miliary disease that dots the liver. It will likely come back after attempted surgical removal. PHP isolates and treats the whole liver; it treats the areas with radiologic evidence of disease and the areas with microscopic disease.

Sales Potential Just From mUM

PHP has been used to treat many forms of cancer that metastasize to the liver in Europe, but since it’s only approved by the FDA for uveal melanoma, we must focus our near term attention to just that. Hepzato Kit will launch in the US in January. The company is focused on training perfusionists, anesthesiologists, and interventional radiologists in hospitals to expand care beyond the Expanded Access Program. This isn’t a drug that can be given simply. However, oncologists at major cancer centers are very excited to adopt this life-extending treatment because there is no other treatment in half of HLA types.

The company started with 3 hospitals in its expanded access program. These hospitals are Moffitt Cancer Center, Duke University, and the University of Tennessee. The firm guided for 5 treatment centers in Q1, 10 in Q2, and 15 by year end. Moffitt Cancer Center treats 4-5 patients per month. On average, centers will treat 1 patient per month in Q1 and 2 by the end of the year. Because this is a rare cancer that only requires 4-6 treatments, Delcath is only targeting up to 35 hospitals. The firm could get to that total by the end of 2025. This will be a slow process that will snowball; as more centers treat patients, more can train oncologists. Right now, we have doctors flying in from Europe to train US doctors.

I think CEO Gerard Michel went into a little too much detail on the Q3 call about this training process which may have spooked investors. In my opinion, investors should only be laser focused on this training process if the launch goes slower than expected. However, some investors are impatient because they come from a biotech background; they follow drugs that don’t need training to administer. Personally, I only follow medical device stocks, so this seems perfectly normal. Either way, this process had been detailed previously; it shouldn’t have shocked anyone.

The market size isn’t easy to deduce with high accuracy because mUM is a rare cancer. If you assume 90% of the 3,400 Americans with ocular melanoma have uveal melanoma, that’s 3,060 patients. Then we look at the 50% with metastasis and the 95% of those who have liver dominant cancer. That brings us to 1,453 patients annually in the U.S. 1 treatment of Hepzato Kit costs $182,500. If the average number of treatments is 4.1, then the addressable market is slightly under $1.1 billion in America.

In Europe, uveal melanoma is much more common in the north. The disease is most common in white people and males. There was an observational cross sectional study from 2012 to 2020 which reviewed the racial/ethnic incidences of uveal melanoma. The results were highly statistically significant. The study stated:

The annual age-adjusted incidence (per million population) of uveal melanoma was 0.31 (black), 0.38 (Asian), 1.67 (Hispanic), and 6.02 (non-Hispanic white).

About 6 people per million in Europe get uveal melanoma; that’s a total of 4,452 people. Since 50% develop metastasis and 95% of metastatic patients have liver dominant cancer, that’s a TAM of 2,115 people. That implies the European addressable market is about 45% larger than in the US. That makes the European TAM about $1.6 billion. Obviously, Delcath needs to get similar reimbursement levels to the US in Europe which could be difficult; therefore, I will knock that down by about 30%. That gives us a $1.1 billion Europe TAM and a total TAM of $2.2 billion.

As I mentioned, precise estimates of the population size of this disease are impossible to get. If 3,060 people in America get mUM per year, that’s about 9 per million. It’s likely that mUM is actually more prevalent per person in Europe due to the demographic differences (higher percentage of white people). The discrepancy in my data is due to the difference in sources. If the European source is correct, the market in the US is smaller. If the US source is correct, the market in Europe is larger. I have no way of knowing which source is the best. Delcath has been conservatively estimating their US TAM to be 800 patients which is below the 1,453 I calculated.

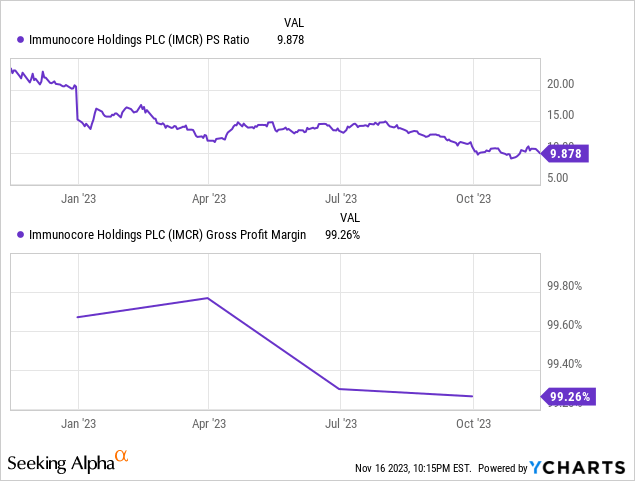

This makes it important to look at the first and only other treatment approved for mUM in 2022 which is KIMMTRAK. I’m going to talk about the competitive landscape later in this article, but it’s illustrative to look at Immunocore’s (IMCR) KIMMTRAK to forecast PHP sales. KIMMTRAK only works on people who are HL-A*02:01–positive which is 45% of mUM patients. KIMMTRAK got to $167 million in annualized sales in 6 quarters. Immunocore got an estimated 40% market share in 1 year. It’s possible that the market is bigger than estimates, which would lower that share.

In its slide deck, Delcath shows what would happen if PHP’s double TAM of KIMMTRAK and PHP’s slower rollout (half the speed) due to oncologist training, cancel each other out. That’s too optimistic because KIMMTRAK had no first line treatment competition, while PHP now competes with it in about half of patients. Plus, initially PHP’s rollout will be slower than half the speed of KIMMTRAK before it starts accelerating due to the availability of experienced oncologists training new ones. Comparing speed to market depends heavily on your timeframe.

I’ll conservatively assume PHP takes 4 times as long to roll out as of Q4 2024 due to training time and a lack of European reimbursement (until the FOCUS trial results are published early next year). Let’s assume 73% HLA positive patients use PHP because patients can use both treatments since this disease usually progresses even with treatment. That assumes 40% of HLA positive patients use PHP first and 55% of KIMMTRAK-first patients eventually use PHP. I’ll get into why I think PHP will often be used first, making that estimate conservative, in the competition section. The main 2 variables that go into the percentage of KIMMTRAK-first patients that will use PHP are the KIMMTRAK success rate and the survival rate.

In year 1 of PHP’s launch, the total amount could be higher than normal because of the patients in prior years who used KIMMTRAK unsuccessfully. KIMMTRAK got to almost $40 million in quarterly sales in its 4th quarter of commercial treatment. Those assumptions I laid out mean Delcath will do $17.3 million in Q4 sales.

Now let’s look at Delcath’s guidance for 2 procedures per month at 15 hospitals by year end. That implies a year end quarterly run rate of $16.425 million. I think that’s very attainable because the year end run rate is higher than Q4 sales due to the expansion in usage and hospitals from the start of Q4 to the end (assume Q4 sales guidance is in the low to mid-teens). The current consensus for Q4 sales according to Bloomberg is $7.6 million; full year sales are expected to be $20.3 million. You can make adjustments to my model to come up with your own assumptions. The takeaway here is $10 million Q4 sales is very achievable and the analyst consensus is too low.

Plenty Of Cash Left To Get To Profitability

In Q3, excluding a non-cash charge of $9.4 million due to a change in the fair value of derivative liabilities, Delcath lost $10.9 million. The company has $40.4 million in cash. The current goal is to get to $10 million in sales per quarter because it unlocks $25 million in cash. This is part of the financing agreement that unlocked $35 million from warrants when Hepzato Kit was approved by the FDA. I think Delcath will get to that $10 million threshold in Q4.

If the company burns $11 million in Q4, $10 million in Q1, and $7 million in Q2, and $2 million in Q3 (total of $30 million), it will get to the $10 million sales threshold with $10.4 million to spare. I view my estimates as very conservative, meaning the cash burn in Q1, Q2, and Q3 will likely be lower than that. The company doesn’t need to hire an extensive sales team to get to 15 hospitals by year end. The burn rate will look bad in Q4 because the firm will have very little sales prior to the Hepzato Kit launch. It will only look slightly better in Q1 due to the slow ramp. However, the burn will quickly start to decline in Q2.

After the company gets access to the $25 million, the balance sheet will be in great shape because of the added money and the minimal cash burn after the business hits the $10 million sales mark. I think the company will reach profitability either in Q4 2024 or Q1 2025. It will have plenty of cash to invest capital in future studies for other cancers in the liver after reaching the $10 million sales threshold.

mUM Competitive Landscape

As I previously mentioned, the only other standard of care for mUM patients is KIMMTRAK which also called Tebentafusp. It has a completely different mechanism of action. PHP is isolated chemotherapy. Tebentafusp is an immunotherapy. It works by mobilizing and activating the body’s T cells in the immune system to fight the uveal melanoma cells. It works in HLA-A*02:01 positive patients which is 45% of the mUM population. It’s a once weekly treatment via an IV infusion that takes 15-20 minutes. The average number of treatments is 41 and the maximum per year is 52. As you can see, it’s a simpler treatment but it’s required much more often. That’s why there are much more treatment centers.

PHP and Tebentafusp aren’t direct competitors because most patients will require both treatments because neither are successful most of the time. Combining therapies has promise because they have different mechanisms of action. In a Tebentafusp study of 378 patients, at the 6 month mark the progression free survival rate was 31% versus 19% in the control group. Once Tebentafusp isn’t working, patients will be put on PHP and vice versa.

It’s somewhat important for investors to figure out which treatment is used first because of the potential for death before patients can get to a 2nd type of treatment. It’s going to be a mix depending on the specifics of each patient, but I’m optimistic PHP will be used first more often than not. That’s why my estimate of 40% of HLA positive patients being treated with PHP first was conservative.

There are 2 reasons to use PHP first. The first explanation comes from Dr. Zager who is currently doing these procedures at Moffitt Cancer Center in Tampa. I’ll summarize his perspective he gave during a Q&A in October. He said PHP doesn’t burn the bridge for Tebentafusp. However, Tebentafusp sometimes burns the bridge for PHP because when a patient is on Tebentafusp, liver disease can rise above 50%, making it impossible for the patient to go on PHP. Ironically, a limiting factor of PHP makes him biased to use it first.

The 2nd explanation comes from Delcath. Keep in mind, management is currently focused on getting PHP to initial patients. Competing with KIMMTRAK to be the first line of treatment will be the focus in 2025. Management believes it makes sense to start with PHP because oncologists will be able to tell if PHP is working after 2 treatments, while Tebentafusp takes a full progression. Remember treatments of PHP occur every 6-8 weeks. Oncologists can determine if the treatment is working after 12 weeks. With Tebentafusp, it’s recommended that the treatment is through progression due to the pseudo progress in immuno-oncology agents. That’s typically after 24 weeks because scans are every 12 weeks and oncologists wait for 2 scans to determine if the treatment is working.

IDEAYA Biosciences (IDYA) is developing a combination therapy for mUM patients of both HLA types. Darovasertib and Crizotinib are combined. The company initiated a Phase 2 expansion trial in October. It’s a small molecule inhibitor immunotherapy with a 60% ORR in HLA positive patients and an ORR of 42% in HLA negative patients. That’s a higher ORR than PHP, but as I’ll get to in the next section, PHP should increase its ORR in a combination therapy. PHP is much different from both immunotherapies (Tebentafusp | Darovasertib & Crizotinib combo). This makes me optimistic it has a long potential runway to be used in addition to immunotherapies as a standard of care. PHP treats the whole liver, making it unique.

The Darovasertib and Crizotinib combination is still likely a few years away from FDA approval. I estimate it will get a decision in 2025-2026. It should get accelerated approval if the Phase 3 data is positive. In the meantime, we will get years of data with HLA positive patients using both Tebentafusp and PHP. Plus, future combination therapy trials (Chopin trial) will inch closer to approval (although the PHP combination the investigator is testing probably will be approved after the IDEAYA Biosciences treatment). Of course, there’s no guarantee any new drug or combination therapy gets approved. It took PHP 10 years to get approved after Delcath was given a CRL (complete response letter) in 2013.

Expanded Use Case Upside

The Chopin trial is an investigative trial in the Netherlands that combines 2 courses of PHP with 4 courses of systemic immune checkpoint inhibitor (OTC:ICI) therapy ipilimumab (IPI) + nivolumab (NIVO). The mUM treatment aims to combine the disease control in the liver that PHP brings with the extrahepatic disease control that IPI + NIVO brings. It makes sense and the early results are promising. In the Phase 1b portion of the study, the ORR was 85.7%, the disease control rate was 100%, and the progression free survival was 29.1 months. All of the 7 people in the study were still alive as of June 2022. The main goal of the Phase 1b study was determining a safe and effective dose.

Now the independent investigator is working to fully enroll the Phase 2 part of the trial. It had about 38 of 76 patients enrolled as of early 2023. As of the latest quarterly report, Delcath stated 55 of the planned 76 patients were enrolled, with full enrollment expected by mid-2024. The interim futility analysis in September led to the independent monitoring committee recommending the study continue. As you can see, this is a bit behind the IDEAYA Biosciences timeline. It’s too early to tell how effective the Phase 2 results will be for the PHP combination study. If the readouts are good, Delcath stock will obviously pop.

The PHP ICI combination could become the first line standard of care. If it has a high rate of progression free survival, the other treatments I’ve noted will become used much less. Right now, we’re in a situation where nothing is extremely successful at treating mUM, so everything is on the table. That’s still way better than where we were 2 years ago when no treatments were on the table.

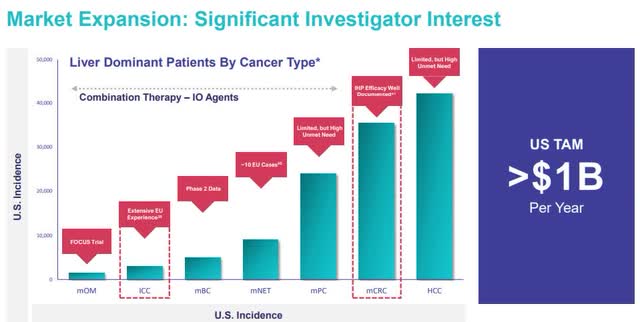

As I mentioned earlier in this article, CHEMOSAT has been used in Europe for 10 years for many types of liver dominated cancer. Unlike some other devices that have hopes of potentially treating new indications, PHP has already done so for years. This de-risks future indications. As you can see from the slide below, Intrahepatic Cholangiocarcinoma (ICC) has extensive EU experience. Metastatic neuroendocrine tumors (mNET) have been treated by PHP in about 10 EU cases.

Potential PHP Markets (Delcath Investor Presentation)

Both Metastatic Colorectal Cancer (mCRC) and mNET along with mUM have been successfully treated with IHP. IHP is Isolated Hepatic Perfusion. It’s an invasive surgical technique that treats the liver with melphalan. PHP is the noninvasive version of IHP. IHP has too high of a mortality and complication rate to be done. In 8 studies, IHP had a complication rate and a 30 day mortality rate of 39.1% and 5.5%. Since PHP has similar effectiveness without the risk, IHP efficacy de-risks PHP’s potential success in those indications. Finally, there is Phase 2 data in metastatic breast cancer. This is an example of a large cancer type with a small percentage of patients with liver dominated cancer.

I think Delcath is going to go after ICC and mCRC first due to success in the EU in the former and success with IHP in the latter. These future indications are most likely where Delcath will spend the $25 million it unlocks from warrants once it gets to $10 million in quarterly sales. The mCRC indication is much more prevalent, increasing PHP’s addressable market drastically. I’m working under the assumption that Hepzato Kit will be covered at a lower price to treat patients with indications that are much larger than mOM. However, these are all rare forms of cancer. An orphan drug in America treats a disease with fewer than 200,000 patients. These are all firmly in that category. Even if PHP for mCRC was covered at less than half the price it is for mUM, it would still be a massive boon for Delcath. This is why the firm deserves a high sales multiple even after it achieves scale treating mUM.

Valuation

I think it makes the most sense to value Delcath based on its 2026 sales because that’s when it will be mostly done rolling out Hepzato Kit in the U.S. and potentially in Europe. Obviously, Delcath needs to get proper insurance coverage in Europe, but the big bottleneck for doing so in the past 10 years was FDA approval which it now has. Delcath is trying to get to 25 to 35 hospitals in the US by the end of 2025. I forecast 30 hospitals will average 2 procedures per month. An average of 4.1 procedures will be done per patient. That adds up to 720 procedures per year which is reasonable when you consider the TAM. I calculated a TAM of 1,453 Americans per year and the company is conservatively stating a TAM of 800 patients. That’s a range of 3,280 to 5,957 procedures per year. That shows 720 procedures is conservative (12% to 22% of TAM).

720 procedures multiplied by $182,500 equals sales of $131.4 million. I think the European market is larger than the US because Europe has more people and the demographics (especially northern Europe) lead to higher prevalence of the disease. I also think it will be easier to find experienced oncologists to train new oncologists in Europe because PHP has been done there for over 10 years. It seems like Delcath is more focused on America than Europe currently because Hepzato Kit is covered in America.

Specifically, Europe’s population is 2.2x as big as America. 76% of America is white compared to 95% in Europe. Therefore, Europe’s white population is 2.7x America’s. I will forecast Europe to have a 30% lower reimbursement price. Therefore, I forecast Delcath’s European sales to be 1.5x America’s even with delayed reimbursement (80% saturation of America) and a lower price. That means Delcath will do $329 million in total sales from mUM in 2026.

Delcath currently has 40.5 million in diluted shares outstanding. I don’t expect a major dilution event, but I do expect more shares to exist from stock-based compensation. Let’s assume there are 51 million shares in 2026. As you can see below, Immunocore trades at 10 times sales and is very profitable on a gross margin basis. Delcath will also have very high gross margins since the business is all disposables. However, it’s a device not a drug, so gross margins won’t be as high. I believe Delcath can trade at 10 times trailing sales in 2026 because by then there should be strong evidence that a launch into the ICC and mCRC indications is probable in the next couple years based on published trial data.

10 times $329 million in sales gives Delcath a $3.29 billion market cap. If 51 million shares are outstanding, the stock price would be $64.5. You can choose to discount that back to today. However, I choose to call this a 3 year price target if the PHP launch mostly goes well and the subsequent trials studying the impact of PHP on ICC and mCRC show a lot of promise. Normally, you should expect an early stage med tech company to have high potential returns prior to a major launch. I think this potential is better than most because sentiment on Delcath is in the toilet. I expected Delcath stock to trade in the high single digits after Hepzato Kit was approved in August, but the stock actually fell a few months later.

Risk

Before I get into the risks Delcath has, I will mention the risks it doesn’t have. While any new healthcare device can have a failed product launch, I think Delcath has the potential to outperform its Phase 3 trial in the commercial treatment setting. In the FOCUS trial, the best available care was given after 2.53 months, while PHP was given after 5.65 months. Getting treated early leads to better outcomes. If real world patients are treated with PHP after 2.53 months, I believe the progression free survival length will improve. Furthermore, oncologists have extensive experience with PHP in Europe. Doctors have been performing PHP procedures for over a decade, unlike most new medical devices.

Hepzato Kit won’t have insurance coverage issues in the US because this is a life extending product and the company has submitted the required applications to get the C-Code, J-Code, and NTAP (new technology add on payment) from CMS. Europe has a large weighting in my 2026 sales forecast. The company needs to hire a modest salesforce and get reimbursement. The most important place to get reimbursement is northern Europe due to mUM’s high incidence there. Therefore, there is execution and reimbursement risk in Europe.

Hepzato Kit’s orphan drug status limits direct competition in the next few years. The fact that it requires training creates a moat future entrants have to surpass. Since it is a medical device, not a drug, it doesn’t have generic risk.

Delcath is a very volatile stock. Personally, I like to look at the long term when everyone else is looking at day to day stock prices. However, this quick trading environment makes it pretty clear investors are the most concerned with 2024. Investors are worried that the Hepzato Kit launch in the US will go slower than the company expects because of training issues which will lead to the company running out of cash before it gets to $10 million in sales per quarter. I already showed how I’m modeling the cash burn next year, so I won’t rehash it here. Analysts are modeling a slower sales ramp and a higher burn rate than me.

I don’t think the competitive threat from either immunotherapy I discussed are enough to stop PHP usage because PHP is the only liver directed treatment. However, I could be wrong. It’s possible Tebentafusp is primarily used as a first line of treatment and that limits PHP’s expansion in HLA positive patients. There’s a reasonable chance the Chopin combination trial doesn’t lead to an eventual approval with a high ORR. It’s possible the Darovasertib and Crizotinib combination gets approved in 2025. It obviously has a strong ORR which could make it the first line of treatment, decreasing PHP usage in both HLA types.

My forecasted sales multiple depends on overall market sentiment, interest rates, and most importantly the early readouts from future trials related to mCRC and ICC. If no data gives investors enough excitement to value Delcath at a premium, the sales multiple could easily be 5x. That results in a 50% lower stock price. However, $32.25 is still way above the current price.

Conclusion

I’m bullish on Delcath and have a large position in the stock because I believe management will guide this unique treatment to becoming the standard of care for liver dominant mUM. Furthermore, I think PHP will become used in mCRC and ICC to treat the liver within the next 5-7 years. If successful, this business could reach $300+ million in high margin sales in a few years.

I think retail investors aren’t seeing the relatively low risk nature of the launch because they wish it was a drug that could be expanded quicker. Institutional funds aren’t in a situation to buy med tech stocks because of the 2-3 year long bear market in biotech/med tech. I think some people are missing that Europe’s market size is much larger than America’s because of its demographics.

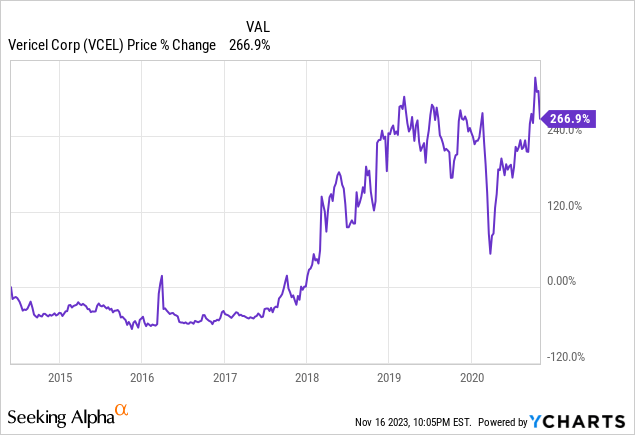

Delcath had a history of dilution and FDA failures before Gerard Michel took over in 2020. He previously drove success at Vericel (VCEL) as the CFO from June 2014 to October 2020. The stock chart shows how well the firm did under his tenure. I think he can do the same for Delcath. Once the company shows it can get to $10 million in quarterly sales without needing more cash, the stock will spike.

Company Response To My Question

As I mentioned, Delcath’s 2026 price to sales multiple depends on PHP working in future indications. Therefore, I asked the company about the regulatory process. My question and their response are shown below.

My question:

What is the process to add new cancer indications to the US label? Does it require a full-blown trial like FOCUS or are simpler studies permitted?

Delcath’s response:

Any label expansion will require a regulatory submission supported by a clinical trial. We do intend to run such trials.

However, additions to NCCN guidelines, which very much drives prescribing behavior, can be achieved with less robust data than the FDA requires. There is a chance that we could get on the ICC guidelines with existing publications or with a modest sized trial.

Lastly, reimbursement can be achieved based on peer review publications. We have existing or planned publications ranging from case studies to single arm basket trials, in multiple tumor types.

While we cannot (and will not) promote off label, I suspect that there is a meaningful amount of interest in the IR community to use this is a select set of patients in other tumor types.

NCCN stands for National Comprehensive Cancer Network. IR stands for interventional radiologist. Investors should be patient with any potential FDA approvals of new PHP indications. However, it’s good to see the company has potential ways to generate revenue from the ICC indication prior to an FDA approval because that will take a few years.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.