Athitat Shinagowin

In September 2017, I received slightly over $100K from my former employer, representing the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of June 2nd, 2023 (before the bell):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $2116,948.61

- Dividends paid: $4,639 (TTM)

- Average yield: 2.14%

- 2022 performance: -12.08%

- SPY= -18.17%, XIU.TO = -6.36%

- Dividend growth: +10.83%

Total return since inception (Sep 2017-June 2023): 99.47%

Annualized return (since September 2017 – 69 months): 12.76%

SPDR S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 11.43% (total return 86.31%)

iShares S&P/TSX 60 ETF (XIU:CA) annualized return (since Sept 2017): 8.19% (total return 57.26%)

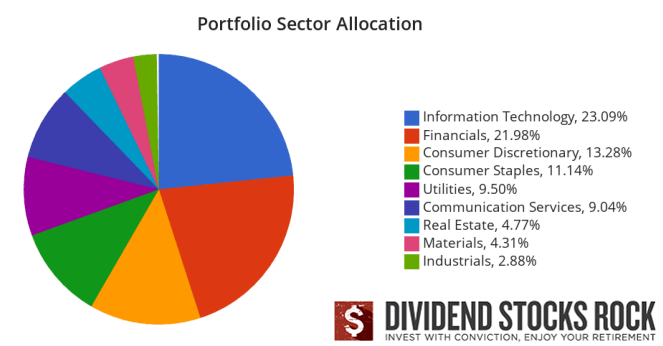

Dynamic sector allocation calculated by DSR PRO as of April 6th.

Smith Manoeuvre Update

The SM strategy is back. When you attempt any kind of leveraged strategy, you must be certain to follow these rules:

#1 Have a long-term horizon (minimum 10 years) to benefit from a full stock market cycle.

#2 Be comfortable with market fluctuations (your portfolio could go down 20% as it’s part of the game).

#3 Be comfortable financially (have an emergency fund + the ability to pay off the debt without liquidating the assets).

I followed my rules and took a break after spending a bit too much in creating lifetime memories with my family in Africa. I’m now back with a new $500 per month since March 1,2023.

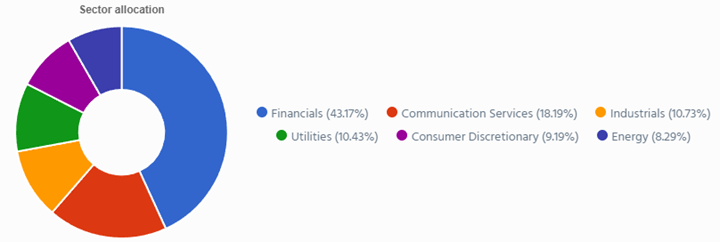

Slowly but surely, the portfolio is taking shape with 8 companies spread across 6 sectors. My goal is to build a portfolio generating 4-5% in yield across 15 positions. I will continue to add new stock monthly until I reach that goal. My current yield is at 4.81%.

Adding more of Telus

I couldn’t find any new or interesting stocks to add this month and Telus (TU) has recently dropped to $25. I saw a good opportunity to add another ~$500 of this telecom giant. The stock is currently trading at its 2021 levels as debt continues to be a source of concern. Telus reaffirmed its confidence in its business model by raising its dividend earlier this year on top of confirming its ability to maintain its dividend growth policy through 2025. We can see the gap between CAPEX ($2.6B projected for 2023) and free cash flow ($2B) getting smaller. This means the company won’t need to secure additional debt to finance its projects eventually as the business generates more cash flow each year.

Here’s my SM portfolio as of June 2nd, 2023 (before the bell):

| Company Name | Ticker | Sector | Market Value |

| Brookfield Infrastructure | BIPC:CA | Utilities | $559.08 |

| Canadian National Resources | CNQ:CA | Energy | $442.92 |

| Canadian Tire | CTA.A:CA | Consumer Disc. | $492.45 |

| Exchange Income | EIF:CA | Industrials | $572.99 |

| Great-West Lifeco | GWO:CA | Financials | $654.67 |

| National Bank | NA:CA | Financials | $571.68 |

| Telus | T:CA | Communications | $972.04 |

| TD Bank* | TD:CA | Financials | $1,081.92 |

| Cash (Margin) | -$643.17 | ||

| Total | $4,704.58 | ||

| Amount borrowed | -$4,500.00 |

Let’s look at my CDN portfolio. Numbers are as of May 8th, 2023 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Alimentation Couche-Tard | ATD:CA | Cons. Staples | $23,920.17 |

| Brookfield Renewable | BEPC:CA | Utilities | $10,459.28 |

| CAE | CAE:CA | Industrials | $5,550.00 |

| CCL Industries | CCL.B:CA | Materials | $8,778.00 |

| Fortis | FTS:CA | Utilities | $9,711.09 |

| Granite REIT | GRT.UN:CA | Real Estate | $10,310.40 |

| Magna International | MG:CA | Cons. Discre. | $4,591.30 |

| National Bank | NA:CA | Financials | $11,528.88 |

| Royal Bank | RY:CA | Financial | $7,903.35 |

| Cash | $238.38 | ||

| Total | $92,990.85 |

My account shows a variation of -$3,340.22 (-3.47%) since the last income report on May 8th. Besides Alimentation Couche-Tard, my other holdings have all reported their earnings for this quarter.

CAE: Strong quarter, but no signs of a dividend reinstatement.

CAE reported a solid quarter with revenue up 32% and EPS up 20.7%. It’s interesting to think that the dividend before Covid was $0.11/share ($0.44/share) whereas the past 12 months brought an adjusted EPS of $0.88 for a hypothetical payout ratio of 50%. Unfortunately, CAE didn’t talk about reinstating the dividend this quarter.

Civil aviation revenue was up 53% as Civil training center utilization was 78% and 17 full-flight simulators (FFSs) were delivered to customers. The Defense revenue was up 14% as CAE booked orders for $564.7M, bringing the full-year total to a record $2B. I just wish for a dividend announcement soon.

CCL Industries: diversification pays well!

CCL reported a strong quarter with revenue up 9% and EPS up 12%. CCL reported organic growth of 1.4%, acquisition-related growth of 3.0%, and 4.2% positive impact from foreign currency translation. There is sometimes an advantage to doing business across the world! By segment, CCL sales were up 7.5%, Avery was up 44% (14.5% organic and 25% via acquisitions), Checkpoint was up 3.6% and Innovia was down 14%. Foreign currency translation had a positive $0.05 impact on EPS. In constant currency, the company reported high single-digit growth for revenue and earnings. This company is looking good for the rest of the year.

Granite REIT grows organically and by acquisitions.

While the stock price remains volatile, Granite continues to report robust quarters. This time, GRT reported revenue growth of 19% and AFFO per unit growth of 18%. The strong results were supported by net acquisition activities, the completion of developments and expansions beginning in the first quarter of 2022, and contractual rent adjustments. In other words, GRT grows organically (via rent increases) and by acquisitions. I like how AFFO per unit grows at a similar pace to revenue. It means the REIT can generate more cash flow as it grows. The AFFO payout ratio was 68% for the quarter.

National Bank offered the highest dividend increase this quarter.

National Bank’s quarter is like the other big 5: net income was driven by higher interest rates, but higher provisions for credit losses offset the gain. PCLs were up to $85M, from $3M last year. EPS was down 6% this quarter, but management came in strong with a 5.2% dividend increase, which was the most generous dividend announcement amongst all the Canadian banks this quarter. Personal and commercial net income was up 14%, driven by higher revenue and a strong net interest margin. Wealth Management was up by 9%, but financial markets were down 7%, mostly affected by higher expenses and compensations. US & Intl reported weaker results too (-17%) on higher expenses and PCLs.

Royal Bank reported a mixed quarter.

Royal Bank reported a mixed quarter as revenue jumped by 21%, but EPS was down 11%. Results this quarter reflected higher provisions for credit losses, with a PCL of $600M compared to a PCL recovery of $342M last year. Personal & Commercial Banking was down 14% and Wealth Management was down 8%, mostly driven by higher PCLs. Insurance was down 33%, primarily due to higher capital funding costs. At least Capital Markets was up 10%, driven by a lower effective tax rate reflecting changes in earnings mix, and higher revenue in Corporate & Investment Banking. The Bank increased its dividend by 2.3%.

Here’s my US portfolio now. Numbers are as of June 2nd, 2023 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Activision Blizzard | ATVI | Communications | $9,303.20 |

| Apple | AAPL | Inf. Technology | $13,506.75 |

| BlackRock | BLK | Financials | $9,363.76 |

| Disney | DIS | Communications | $3,986.55 |

| Home Depot | HD | Cons. Discret. | $8,651.70 |

| Microsoft | MSFT | Inf. Technology | $18,291.90 |

| Starbucks | SBUX | Cons. Discret. | $8,289.20 |

| Texas Instruments | TXN | Inf. Technology | $8,790.50 |

| Visa | V | Inf. Technology | $11,325.00 |

| Cash | $646.49 | ||

| Total | $92,155.05 |

The US total value account shows a variation of +$1,486.54 (+1.64%) since the last income report on May 8th. I only had two companies that hadn’t reported last month.

Disney

This quarter reminds us of the bumpy ride ahead for Disney. The company disappointed the market with revenue up 13%, but EPS down 14%. Revenue growth was supported by 17% sales growth at Disney Parks (operating income was up 23%). The problem remains the massive investment in the streaming business which has hurt the Media & Entertainment segment (income down 42%). Disney reported improvement in its streaming losses despite another subscriber decline. Disney+ subscribers fell for the second straight quarter (-2%) but average revenue per user gained across Disney+ (to $4.44 from $3.93) and ESPN+ (to $5.64 from $5.53).

Home Depot

Home Depot didn’t impress anyone with revenue down 4% and EPS down 7%. Comparable sales decreased by 4.5%, and comparable sales in the U.S. decreased by 4.6%. HD pointed to extreme weather in California that disproportionately impacted results and lumber deflation as negative factors. Overall economic weakness also put pressure on HD’s results. Management had to revise their guidance due to the recent slowdown. HD now expects comparable sales to be down 2% to 5% and EPS down 7% to 13% vs. a prior expectation of down at a mid-single-digit rate. We expected a bad year for HD, and we are getting it. That’s good news if you are looking to grab some shares!

Actually, I believe HD is among the best stock ideas for 2023.

My Entire Portfolio Updated for Q1 2023

Each quarter we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of April 6, 2023.

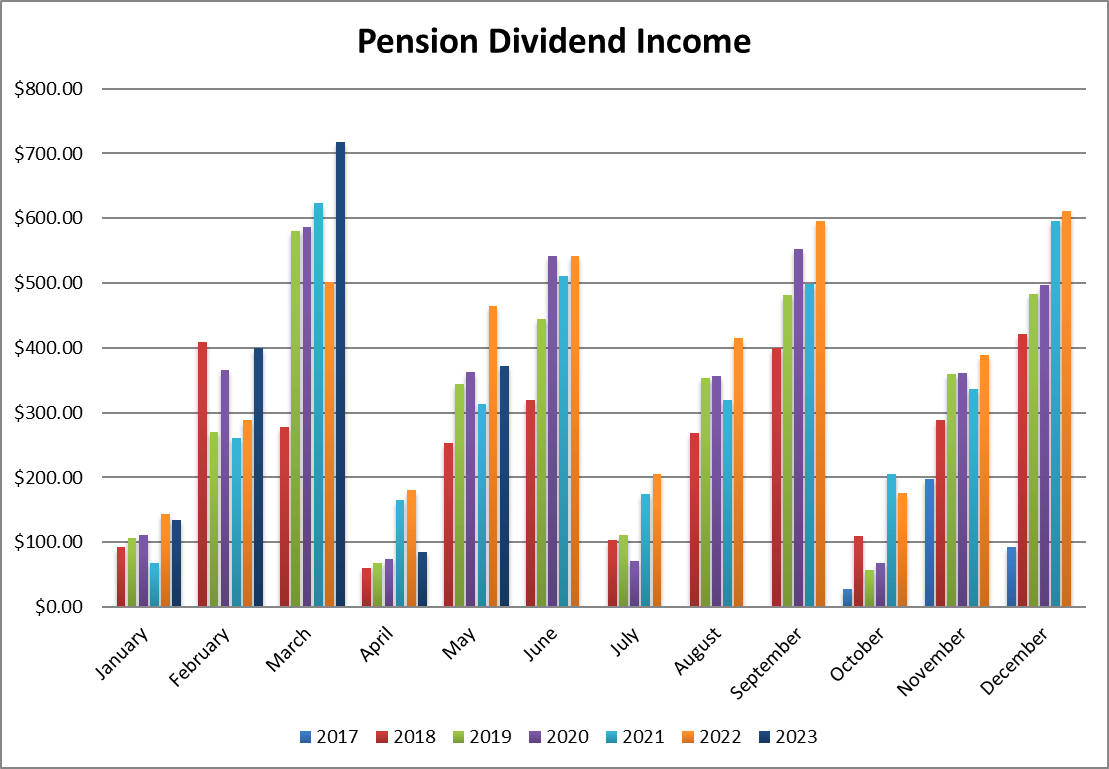

Dividend Income: $371.37 CAD (-20% vs May 2022)

All my holdings show better dividends than last year:

- National Bank: +11.50%

- Royal Bank: +19%

- Granite REIT: +3.3%

- Texas Instruments: +7.8%

- Apple: +4.3%

- Starbucks: +8.2%

I also enjoyed a currency boost of nearly 9% vs. last year. Unfortunately, my monthly dividend income is lower as the Magna dividend was not paid in May (it will be paid in June) and I’m still missing the dividend from Activision Blizzard which has been suspended while the deal with Microsoft is still in limbo.

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- National Bank: +11.50%

- Royal Bank: +19%

- Granite REIT: +3.3%

- Texas Instruments: +7.8%

- Apple: +4.3%

- Starbucks: +8.2%

- Currency: +8.83%

Canadian Holding payouts: $203.17 CAD.

- National Bank: $117.37

- Royal Bank: $85.80

- Granite REIT: $34.14

U.S. Holding payouts: $125.05 USD.

- Texas Instruments: $62.00

- Apple: $18.00

- Starbucks: $45.05

Total payouts: $371.37 CAD.

*I used a USD/CAD conversion rate of 1.3451

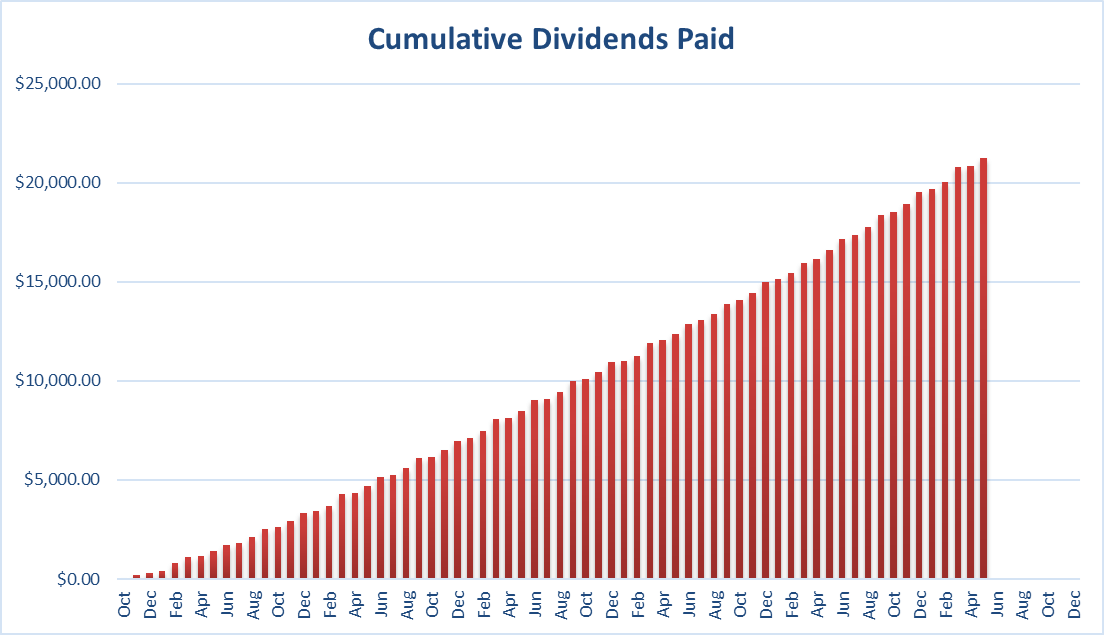

Since I started this portfolio in September 2017, I have received a total of $21,229.03 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

As summer is taking off shortly, I’m satisfied with my portfolio. I plan to hold most of my holdings for more than 25 years, but I monitor them quarterly to ensure each business continues to meet my investment thesis. After the spring cleaning I did earlier this year, the only two stocks on my watch list are Disney and CAE. I expect them to resume their dividends by the end of 2023 (especially Disney). If it doesn’t happen, they will likely be part of my spring cleaning in 2024.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.