D. Lentz

Acushnet Holdings Corp. (NYSE:GOLF) may not be a household name, although anyone who has even casually been around the game of golf will be familiar with the company’s flagship “Titleist” brand. Indeed, the company is a giant in the sport with its portfolio of sticks, balls, and accessories often favored by elite players and weekend warriors alike.

The attraction here is that the game of golf has seen a sort of renaissance in recent years, with data showing a growing number of players, leading to a boom in the industry. Acushnet has capitalized on the momentum, generating record sales and earnings.

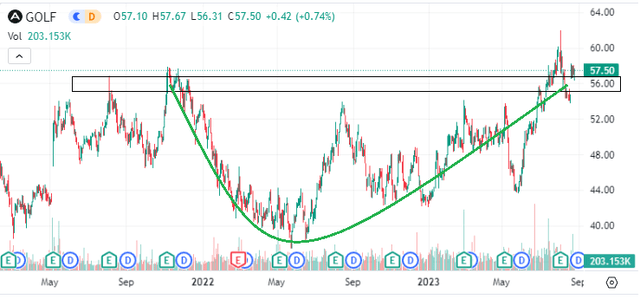

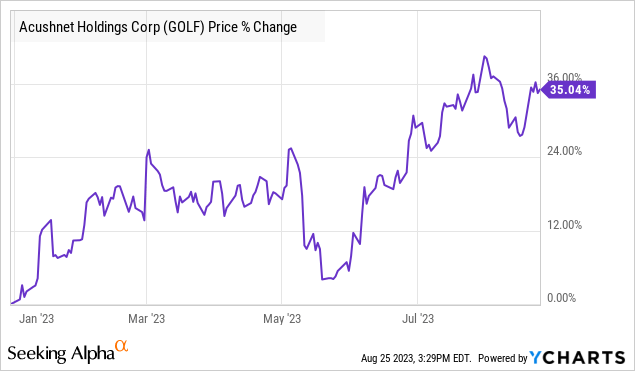

The stock is up 35% year-to-date, supported by a combination of impressive operating and financial execution. We are bullish on GOLF, which is well-positioned to climb higher, benefiting from a combination of solid fundamentals and a positive long-term outlook.

GOLF Q2 Earnings Recap

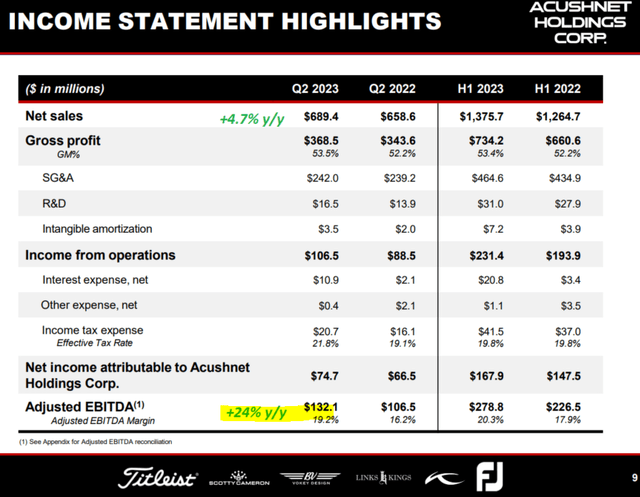

The company reported Q2 GAAP EPS of $1.09, up 20% year-over-year, and also $0.16 ahead of consensus. Revenue this quarter reached $689 million, an increase of 5% from the period last year and also ahead of estimates.

A major financial theme is the trend in firming margins. The gross margin at 53.5% climbed from 52.2% in Q2 2022, reflecting both higher average selling prices along a strong response by customers to new products.

Lower cost pressures and easing supply chain disruptions that defined 2022 are also part of the story. SG&A is down as a percentage of revenue, which follows an effort at cost savings and efficiency measures implemented over the past year.

The result here is that income the benchmark adjusted EBITDA is up 24% y/y, with the adjusted EBITDA margin of 19.2% rebounding sharply from, 16.2% in Q2 2022.

source: company IR

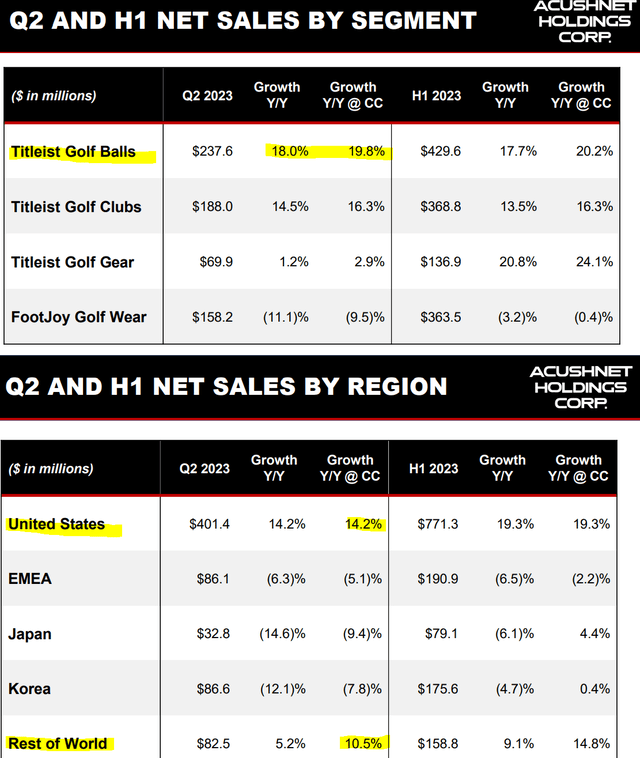

Operationally, some of the metrics that stand out include the strength in sales of Titleist golf balls, up 19.8% y/y globally on a constant currency basis. Titleist golf clubs, as the second-largest segment for the group, also posted a strong 16.3% sales gain. These areas balanced some weaknesses in the “FootJoy” golf wear brand, with a 9.5% decline in sales, with management citing an end-of-product cycle ahead of the launch of new styles set for Q3.

By region, the U.S. has been the growth driver with 14.2% higher sales. While traditionally important markets for the company like Korea, Japan, and EMEA have seen some softer trends this year, momentum in the “rest of the world” has accelerated, responding to an ongoing international expansion strategy.

source: company IR

In terms of guidance, Acushnet revised higher its outlook for both revenue and earnings. Management now sees full-year constant currency net sales growth between 5% and 7.2% compared to 2022. An adjusted EBITDA target midpoint of $365 million, represents an increase of 8% y/y. The tone during the earnings conference call projected optimism toward second-half trends, looking ahead to new product launches.

Finally, we’ll note that the company ended the quarter with $61 million in cash against a total debt position of $682 million. Considering the trends in adjusted EBITDA, a net leverage ratio is around 1.7x is a stable level in our opinion and represents a strong point in the company’s investment profile.

Acushnet pays a $0.195 per share quarterly dividend, which we view as well-supported by underlying cash flows at an earnings payout ratio around 25%. While the dividend yields a modest 1.4%, the company has also been active with share repurchases, buying back $140 in stock this year with a remaining $267 million in the existing authorization.

GOLF Stock Price Forecast

We mentioned the level of interest in golfing has been climbing in recent years. The trend likely began during the pandemic, with people seeking outdoor activities to stay active.

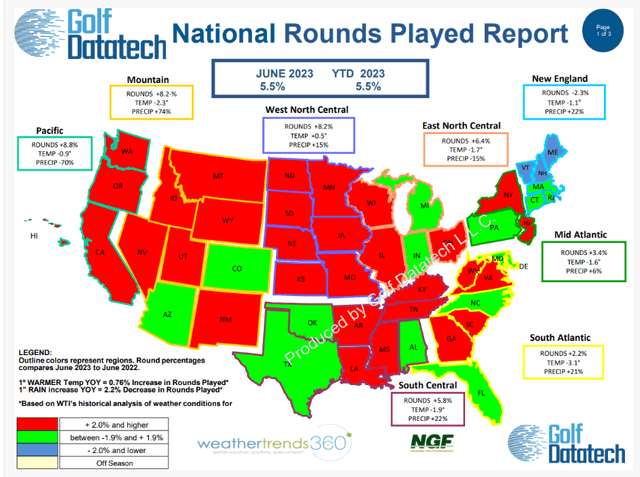

The good news here is that the trends are still positive. Data from the independent “National Golf Foundation”, the number of rounds played as a measure of participants tracked by a national network of golf clubs, shows an increase of 5.5% year-to-date in June.

The setup represents a strong tailwind for Acushnet with an expanding addressable market of golfers in the United States with trends carrying over internationally. Simply put, more people playing golf drive demand for related equipment, and the Titleist brand will be a good option for many consumers.

source: National Golf Foundation

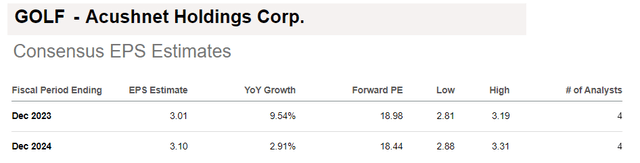

According to consensus estimates, GOLF is expected to reach EPS of $3.01 this year, up 10% from 2022. The market currently sees that pace slowing to 3% in 2024, although we believe that estimate is too low, with the bullish case for he stock that the company exceeds expectations.

Seeking Alpha

Wall Street analysts from Jefferies Financial Group (JEF) recently upgraded the stock, citing some of these same trends and Acushnet’s growing market share. The same note made a good point that the aging demographic dynamics in the U.S. should be a long-term runway for the sport as players age and find time for more rounds. We agree, and see GOLF as a big winner in the industry.

Is GOLF Undervalued?

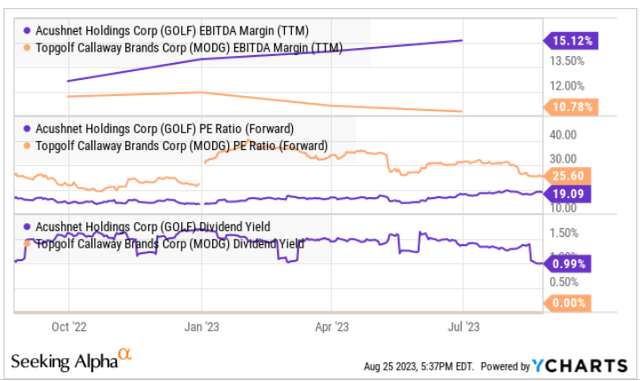

The insight we offer is that GOLF stands out among other “golf stocks” like Topgolf Callaway Brands Corp (MODG) and even Nike, Inc. (NKE), which sells golf equipment, as more of a pure-play into the segment. MODG. for example, maintains a portfolio of non-golf apparel brands and has invested in some experimental concepts like “Top Golf” entertainment, which has a separate business model and distinct economics outside of sporting goods.

In our view, Acushnet is more targeted in the traditional sport, with the flexibility to better respond to potentially shifting industry trends. We bring this up because while GOLF is generating higher current margins, shares trading at a 19x forward P/E multiple are at a discount to MODG closer to 26x. GOLF also has the advantage of offering a dividend yield. Overall, GOLF is undervalued in our opinion.

source: yCharts

GOLF Stock Price Forecast

We rate GOLF as a buy with a price target for the year ahead at $74, implying a 25x multiple on the current consensus 2023 EPS. The way we see it, the company justifies a higher valuation premium given its position as a high-end brand that sets the standard in several product categories. Continued growth in the sport of golf worldwide can open the door for earnings to trend higher as the company consolidates its market share.

In terms of risks, despite the positive backdrop, Acushnet remains exposed to global macro conditions. A potential deterioration of global growth with a significant slowdown in consumer spending would likely pressure demand for the company’s products and drive a new round of volatility. Monitoring points for the stock over the next few quarters include the evolution of the EBITDA margin, along with sales trends in its key regions.

Seeking Alpha