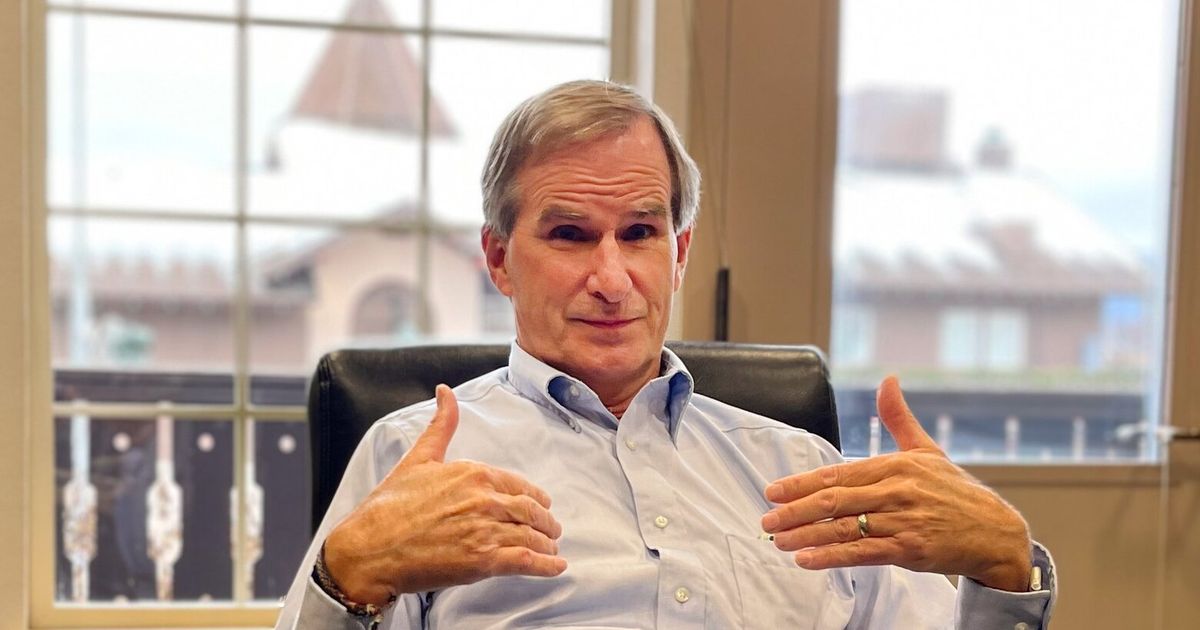

Linka A Odom | Stone | Getty Photos

Firm: Liberty Stay Group (LLYVA)

Enterprise: Liberty Stay Group is a monitoring inventory that represents Liberty Media Group’s possession stake in Stay Nation Leisure. Stay Nation operates as a stay leisure firm worldwide. It operates by the next segments” Concert events, Ticketing, and Sponsorship & Promoting. The Concert events phase promotes stay music occasions in its owned or operated venues, and in rented third-party venues. The Ticketing phase manages the ticketing operations, together with the supply of ticketing software program and companies to shoppers and shoppers with a market for tickets and occasion info by cell apps, different web sites, shops and its major web sites: livenation.com and ticketmaster.com. The Sponsorship & Promoting phase sells worldwide, nationwide and native sponsorships, in addition to the location of promoting and promotional packages.

Inventory Market Worth: ~$7B ($75.85 per share)

Shares of Liberty Stay Group prior to now 12 months

Activist: ValueAct Capital

Possession: 5.51%

Common Price: $51.17

Activist Commentary: ValueAct has been a premier company governance investor for over 20 years. ValueAct principals are usually on the boards of half of the agency’s core portfolio positions and have had 56 public firm board seats over 23 years. Moreover, the agency is a long-term, considerate and diligent investor identified for creating worth behind the scenes. ValueAct has beforehand commenced 105 activist campaigns and has a mean return of 55.02% versus 21.76% for the Russell 2000.

What’s taking place

ValueAct filed a 13D on Feb. 11, reporting a 5.51% place in Liberty Stay Group (LLYVA).

Behind the scenes

Liberty Stay (LLYVA) is a monitoring inventory that represents Liberty Media Group’s 30% possession stake in Stay Nation (LYV), a worldwide stay leisure firm. John Malone’s Liberty Media Group has traditionally used monitoring shares as an enormous a part of the corporate’s toolbox to permit buyers to have a extra targeted publicity to the companies they favored with out having to leap by the authorized and tax hoops of a derivative. He used this prior to now with the Atlanta Braves and Sirius XM, and he presently makes use of it with Stay Nation and F1. ValueAct has taken a 5.51% place in Liberty Stay, however it additionally owns a 0.44% stake in Stay Nation, bringing the agency’s efficient possession of Stay Nation to roughly 2%, which might make it a high shareholder.

There are two traits which can be core to ValueAct’s investing philosophy and that permeate a lot of its investments: First, the agency likes firms that it thinks are considerably misunderstood by the market. Second, it is a long-term investor that may tolerate short-term ache. Each of these facets are current right here. As an lively shareholder of Spotify, ValueAct has seen firsthand how the music trade has remodeled over the past a number of years. It’s a lot simpler in the present day for a proficient artist to construct a worldwide following by streaming companies and the advertising energy of social media, however the monetization that follows is just not as simple. The payouts from streaming companies are comparatively meager and simply get smaller as further artists are added to the platforms. Because of this, stay performances and touring have turn into probably the most profitable methods for artists to earn – and Stay Nation dominates this market. The corporate owns all sides of this ecosystem, which permits Stay Nation to handle an artist’s whole tour with none exterior involvement. Apart from personal peer Anschutz Leisure Group, no firm comes shut in scale, and even Anschutz lacks the complete vertical integration of Stay Nation. Nevertheless, whereas this dominance is actually an asset, it will also be seen as a legal responsibility by some, primarily the U.S. Division of Justice.

In Might 2024, the DOJ sued to interrupt up Stay Nation and Ticketmaster, sending the inventory down about 8% from $101.40 to $93.48. Whereas this improvement might trigger quite a lot of buyers to run in concern, ValueAct noticed it as a shopping for alternative in an ideal firm that was having a market overreaction. The agency invested in Microsoft throughout issues over the PC market, in Spotify when individuals thought streaming was dying and in Disney throughout the writers’ strike, so it’s no shock that the agency noticed a chance in Stay Nation at a time of heightened uncertainty. The worst factor that the DOJ may do is pressure the breakup of Stay Nation and Ticketmaster, a structural treatment that’s not often resorted to by the Justice Division (AT&T’s 1984 breakup being a notable exception). It’s extra probably that Stay Nation agrees to sure modifications like amending its venue reserving insurance policies and shortening the size of Ticketmaster contracts to permit for extra competitors to assuage the DOJ. Nevertheless, even when the worst case occurs and the 2 firms separate, Stay Nation stockholders would personal two nice companies with robust tailwinds and best-in-class market positioning. It might probably even be one other shopping for alternative for buyers like ValueAct.

The ultimate piece of hidden or misunderstood worth on the firm is its venue enlargement. Whereas in main U.S. cities with NBA and NHL groups, there are huge arenas for concert events, in different cities and globally there aren’t practically as many available venues. Seeking to tackle this hole, Stay Nation is pursuing these initiatives, efficiently growing the College of Texas at Austin’s new enviornment and dealing on comparable initiatives all over the world. Because of this, the corporate has been dedicating quite a lot of capex to its venue enlargement targets: Capex has elevated by 48% over the previous two years and complete debt has tripled since 2015 and has virtually doubled since 2019. Furthermore, the corporate’s disclosure round this has been considerably opaque including to extra market confusion and uncertainty. Constructing these venues is dear within the quick time period however ought to repay handsomely in the long run, a dynamic that ValueAct is acquainted with. Contemplate that the agency invested in Adobe when it was changing from a product buy to a subscription, sending short-term income down however creating important long-term worth. Proudly owning these venues will give Stay Nation extra worth to its shoppers and extra income from venues (versus renting venues). As these venues are constructed and utilized, buyers will begin realizing that there might be return on the funding.

Assuming the thesis above is correct, there’s important worth available by shopping for the monitoring inventory or the widespread shares of Stay Nation. So, why purchase the monitoring inventory? The reply is as a result of the monitoring inventory trades at a pointy low cost to Stay Nation, and it may present much more worth above and past the basic undervaluation of the enterprise if this low cost goes away. That might occur if the identical plan have been adopted as with earlier Liberty monitoring shares comparable to Sirius. Liberty Media has already introduced plans to spin off Liberty Stay right into a separate public firm later this 12 months, which is what it did with Sirius. At the moment, the Liberty Stay low cost ought to compress just a little however will solely go away totally if merged into Stay Nation. That’s what finally occurred with Sirius. For a lot of causes, together with the connection between John Malone and Stay Nation CEO Michael Rapino, we expect the spinoff and subsequent merger will take much less time. ValueAct is the form of investor that’s pleased holding for 5 years or extra as worth is being created.

Ken Squire is the founder and president of 13D Monitor, an institutional analysis service on shareholder activism, and the founder and portfolio supervisor of the 13D Activist Fund, a mutual fund that invests in a portfolio of activist 13D investments.