solidcolours/E+ via Getty Images

Aclaris Therapeutics, Inc. (NASDAQ:ACRS) could be among the U.S.-listed healthcare stocks with strong upside potential

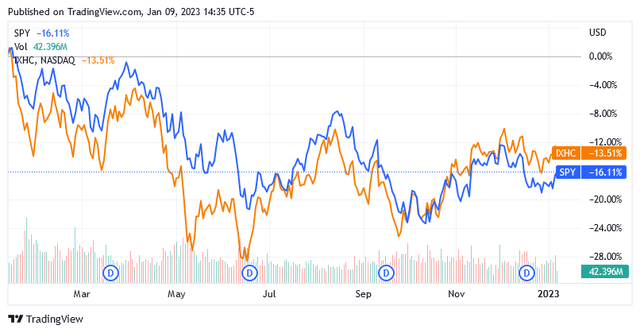

U.S. healthcare stocks, summarized by the performance of the benchmark NASDAQ Health Care Index (IXHC), have outperformed the broader market over the past 12 months but are still down 13.51%.

Source: Seeking Alpha

The downtrend in the U.S. healthcare sector is largely due to the same headwinds that dragged the stock market lower. Additionally, the sector is populated by many stocks with strong upside potential, and Aclaris Therapeutics, Inc. appears to be one of them.

The company develops treatments for specific inflammatory conditions caused by autoimmune diseases. These products in development could become successful treatments and potentially attract the interest of relevant market leaders. This lays the foundation for a significantly higher share price than today.

Aclaris Therapeutics shares are not at their most attractive entry points, but the presence of so many headwinds in the market could soon help create one.

Aclaris Therapeutics, Inc. is in the diagnostics & research industry

Aclaris Therapeutics, Inc. is headquartered in Wayne, Pennsylvania. It is a biopharmaceutical developer of innovative treatments for patients with inflammatory immune diseases who struggle to find appropriate and satisfactory treatment options.

The company currently operates in the diagnostics and research industry through its two segments of Therapeutics and Contract Research.

The Aclaris Therapeutics treatment pipeline is under development

The company’s pipeline of treatments under development includes Zunsemetinib, ATI-1777, ATI-2138 and ATI-2231, against specific conditions as consequences of autoimmune diseases. These treatments all appear to work on the same principle, which is to block or slow down the etiological cause of the condition.

However, this cause is not yet fully known, which leaves a lot of room for different hypotheses, which are the subject of current research in the field of autoimmune diseases and others. Scientists suggest that an organism’s loss of tolerance for its own biochemical processes, which are normal effects of the immune system’s response to certain factors, may be due to genetic causes, infections, or environmental factors such as exposure to radioactive material or air pollution.

An inhibitor is a substance that attempts to block the loss of the organism’s immune tolerance property to its own components.

Zunsemetinib or ATI-450 is the name of an MK2 inhibitor that aims to become a potential treatment for patients suffering from moderate to severe rheumatoid and psoriatic arthritis and hidradenitis suppurativa.

ATI-1777 is the name of a gentle JAK-1/3 inhibitor-based treatment that targets another autoimmune disease, namely moderate to severe atopic dermatitis.

ATI-2138 is the name of an ITK/TXK/JAK3 inhibitor-based drug that aims to become a potential treatment for autoimmune diseases mediated by T cells.

The company is also working on the Gut-Biased program in inflammatory bowel disease; and an MK2 inhibitor-based treatment called ATI-2231, which targets pancreatic cancer and metastatic breast cancer.

Aclaris Therapeutics, Inc. employees working in the company’s contract research division are responsible for the supply of laboratory services.

Several diseases are targeted by Aclaris Therapeutics

Rheumatoid arthritis is a somewhat disabling disease, as it has not only physical consequences, but it has also social consequences, both of which can seriously affect the quality of life.

This autoimmune disease attacks the tissues that line the joints in the body, and the joints are affected symmetrically while other parts can also develop the condition.

Rheumatoid arthritis not only causes pain and affects treatment outcomes, but also poses a significant risk of other diseases, such as chronic cardiovascular disease and the risk of developing diabetes.

Rheumatoid arthritis patients are such for the rest of their lives, which means the disease will never go away. But they may experience periods when symptoms become so mild that they feel the condition is going away. These remissions come and go.

Most often, people develop the autoimmune disease of rheumatoid arthritis when they are between 40 and 60 years old.

Among the autoimmune arthritis family, rheumatoid arthritis is the most common one, and statistics show that over 1.3 million U.S. citizens suffer from the disease. Also, most rheumatoid arthritis patients are women, accounting for 75% of the total affected population.

Psoriatic arthritis usually resembles rheumatoid arthritis symptomatically, although it affects fewer joints and causes swelling and inflammation of the organs.

In addition, patients with psoriatic arthritis develop chronic skin conditions with a red, scaly rash and nails that are thick and scarred.

About 15 to 30% of the approximately 125 million psoriasis patients worldwide (psoriasis patients make up 2 to 3% of the world’s population) can develop psoriatic arthritis.

Hidradenitis suppurativa is a painful and long-lasting autoimmune skin disease that manifests as abscesses and scars. These skin lesions have their onset near hair follicles where sweat glands are located, usually around the groin and buttocks, but breasts and armpits are also affected.

However, recent studies show that hidradenitis suppurativa affects up to 1% of the general population, including milder cases, with women being the most commonly affected.

Atopic dermatitis, which is commonly called eczema, is a chronic condition characterized by inflammation in addition to redness and irritation of the skin. Although people can develop this disease at any age, the condition usually makes its onset in childhood.

Among the eczema family, atopic dermatitis is the most common form. Statistics show that over 9.6 million children plus approximately 16.5 million adults are living with this medical condition in the US.

Aclaris Therapeutics has an exciting 2023 outlook for its key treatments in development

On January 6, 2023, Aclaris Therapeutics provided the market with its 2023 outlook and anticipates an exciting year, as several key data reads are expected to be released for Aclaris’ two lead clinical programs evaluating Zunsemetinib and ATI-1777.

The efficacy, safety and tolerability of the treatments are being evaluated.

Key data on Zunsemetinib 20 mg and 50 mg twice per day in combination with methotrexate chemotherapy in patients with moderate to severe rheumatoid arthritis should be released sometime in the second half of 2023.

Key data on a 12-week regimen based on Zunsemetinib 50 mg twice per day in 95 randomized patients with moderate to severe hidradenitis suppurativa should be published around March/April 2023.

Key data on Zunsemetinib 50 mg twice per day in patients with moderate to severe psoriatic arthritis is expected to be released later this year.

Topline data for ATI-1777, which is being studied in multiple doses in patients with moderate to severe atopic dermatitis, will be released between June and July 2023.

The company made progress in the development of ATI-2138 for autoimmune diseases in patients with T-cell defects, and in the development of ATI-2231, which aims to become a potential treatment for certain oncology indications. The first one is in a clinical study while the second one is in a preclinical study.

As an oral covalent inhibitor, ATI-2138 will initially be evaluated in ulcerative colitis, with key data expected to be released sometime in the second half of 2023.

ATI-2231 aims to become a potential treatment not only for pancreatic cancer patients but also for metastatic breast cancer patients. The treatment aims to prevent patients with metastatic breast cancer from developing a condition of bone loss.

This year, Aclaris is expected to file an investigational new drug application seeking approval from the Food and Drug Administration to study ATI-2231 in humans.

Analyst Ratings

Last month, The Goldman Sachs Group, Inc. (GS) commenced coverage of shares of Aclaris Therapeutics with a buy rating.

The analyst sees good prospects for Aclaris Therapeutics’ lead candidate, Zunsemetinib, in rheumatoid arthritis and other autoimmune diseases, while also setting a target of $25 per share, which reflects an upside potential of 51.8% from the current share price.

If, as the analyst believes, the next top-line data expected in the first half of this year shows Zunsemetinib true potential, the stock price could rise sharply as a result.

The market for treatments for autoimmune diseases, which cause various inflammatory diseases, is not easy, as many companies are present with their generics and biosimilars, the analyst notes.

If Aclaris Therapeutics’ lead candidate Zunsemetinib succeeds in breaking into the hidradenitis suppurativa and psoriatic arthritis market, the treatment has the potential for a sales boost of well over $5 billion, according to analysts group Goldman Sachs.

Ahead of Goldman Sachs ratings, BTIG analysts began coverage of Aclaris Therapeutics stock with a Buy rating and a price target of $32 (up 94.% from current levels) issued on October 6, 2022, citing that Zunsemetinib is just as effective as other inhibitors of this kind, but this is less of a concern from a safety point of view. BTIG believes Zunsemetinib has the potential to become a successful treatment.

On top of what the analysts forecast, it is possible that the stock is already in the crosshairs of a major drugmaker. In this case, the prospective buyer could be willing to bid a multiple of current levels to buy Aclaris Therapeutics, Inc. and its key assets.

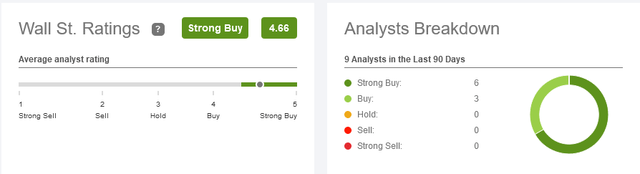

As of writing, Aclaris Therapeutics, Inc. has 6 Strong Buys and 3 Buys, resulting in a medium Strong Buy rating

Source: Seeking Alpha

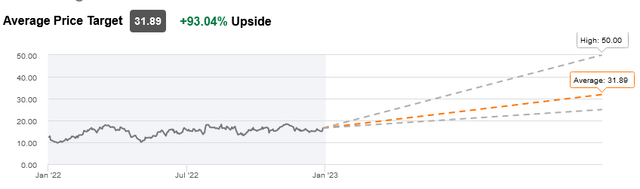

Aclaris Therapeutics, Inc. has an average price target of $31.89, which represents a 92.81% upside potential as of this writing.

Source: Seeking Alpha

Aclaris Therapeutics’ financial condition

Aclaris Therapeutics is not generating a net profit because none of its treatments are yet on the market.

Total revenue for the first three quarters of 2022 was $22 million (compared to $5.3 million for the corresponding period of 2021), which came from contract research and certain licenses.

Research and development expenses increased 91% year-over-year to $56.7 million for the first three quarters of 2022, driven by higher costs related to clinical and preclinical activities and an increase in headcount.

Other expenses also increased, such as an 8% year-over-year increase in general and administrative expenses to $18 million.

Net loss for the first three quarters of 2022 was $59.3 million, or a net loss of $0.92 per share.

As of September 30, 2022, Aclaris’ balance sheet reported $248.1 million in cash and cash equivalents, which the company believes is sufficient to fund research and development activities and to pay employees for approximately two years.

The Stock Valuation

Shares of Aclaris Therapeutics traded at $16.47 for a market cap of $1.10 billion as of this writing.

Source: Seeking Alpha

Shares are not at their lowest, as can be seen from the stock price action chart over the past year. The current levels are above the long-term trend of the 200-day simple moving average of $15.37.

Furthermore, the current share price is above the middle point of $14.11 of the 52-week range of $9.26 to $18.96.

There is strong potential for higher share prices in the pipeline of products under development. Top-line data about the state-of-the-art efficacy, safety and tolerability of Aclaris Therapeutics’ flagship drug for curbing autoimmune disease symptoms could provide a strong boost to the company’s stock price as early as 2023.

However, since the stock price also moves through downturns while there are factors that could cause the stock price to eventually return to lower levels than the long-term trendline, it would be wise to wait for that significant drop before buying shares.

These factors are elevated inflation, the resurgence of the COVID-19 virus in China, and the impact of the war in Ukraine on commodity prices, as these could create strong headwinds in the stock market.

In addition, the next interest rate decision by the U.S. Federal Reserve, which is expected on February 1, could again trigger strong headwinds that will weigh heavily on the share price of U.S.-listed stocks and Aclaris Therapeutics. If the Fed decides to further raise interest rates, which is likely given the high inflation, it will fuel fears of a recession, which could further discourage investors from buying U.S. stocks.

Higher interest rates will correspond to lower present values of future cash flows because higher discount rates must be applied in the model to determine the intrinsic value of U.S. stocks.

Headwinds will probably also impact Aclaris Therapeutics. After that, it would probably be a good time to add to this healthcare stock, with its promising pipeline of drugs in development.

It may also be that the market does not present another opportunity for a share price significantly below the current level. But objectively, the likelihood that Aclaris Therapeutics won’t offer a more convenient entry point than current levels is very slim when so many issues of a macroeconomic and geopolitical nature are converging to create an unprecedented level of uncertainty in the stock market.

Conclusion

Aclaris Therapeutics, Inc. is developing inhibitors of inflammatory diseases that arise because of an autoimmune disease.

According to some analysts, the treatments appear to show great promise, and they also forecast sales of over $5 billion.

If Aclaris Therapeutics, Inc. stock doesn’t disappoint expectations, it could attract the attention of some big names in the healthcare industry.

Aclaris Therapeutics, Inc. shares could become much more attractive after the market faces headwinds.