Sean Gallup/Getty Images News

Introduction

Acerinox (OTC:ACRXF) (OTCPK:ANIOY) recently reported on the results of its third quarter performance. As widely expected, the second half of the year will be substantially weaker than the first half of the year and fortunately Acerinox (and peer Aperam, which I discussed in a previous article) hasn’t done anything crazy with the cash inflow in the first half of the year, so the balance sheet is strong enough to deal with the current headwinds.

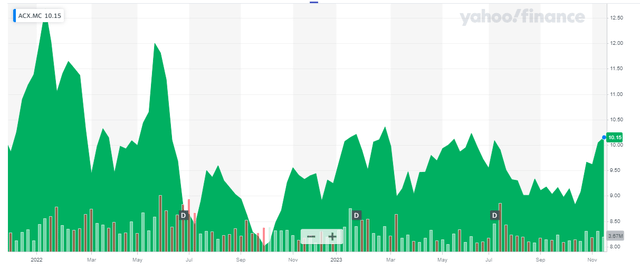

Yahoo Finance

Acerinox has a primary listing on the Madrid Stock Exchange where it’s trading with ACX as ticker symbol. The average daily volume exceeds half a million shares which means the Madrid listing is clearly superior to any of the secondary listings so I would strongly recommend using the Madrid Stock Exchange to trade in Acerinox. The current market capitalization is approximately 2.5B EUR as the net share count has decreased to approximately 250M shares and the share price is just over 10 EUR.

The alloys division was stronger than I had expected

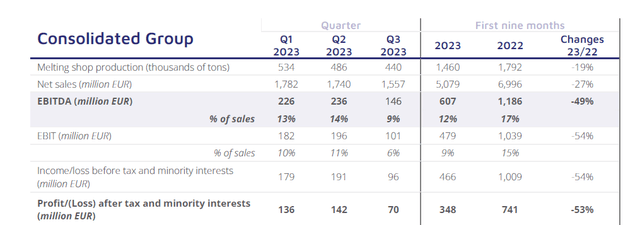

Looking at the Q3 results, you immediately see how the lower revenue and lower utilization rate of the plants has an impact on the profitability. Although the revenue decreased by less than 15% on a QoQ basis, the EBITDA fell by 40% due to a substantially lower EBITDA margin of just 9% compared to the 13%-14% level in the first semester.

Acerinox Investor Relations

Fortunately the company remained profitable: It reported a pre-tax income of 96M EUR and a net profit of 70M EUR which still represents an EPS of 0.28 EUR per share. So even if you would annualize the Q3 results, the stock would still be trading at less than 10 times earnings, which is OK for an industrial company in a downcycle. Looking at the 9M 2023 results (which are somewhat irrelevant as the next few quarters will likely be more in line with the third quarter than with the first half of the year), the EBITDA was a strong 607M EUR. Of course that is much lower than the almost 1.2B EUR in the first nine months of 2022 but that was a very exceptional year.

Acerinox now expects its fourth quarter EBITDA to be slightly lower than the Q3 EBITDA of 146M EUR, so I’ll just use 135M EUR in my assumptions. In that case, the full-year EBITDA will come in at just under 750M EUR while the full-year EPS will be roughly 1.64 EUR (assuming a Q4 EPS of 0.25 EUR).

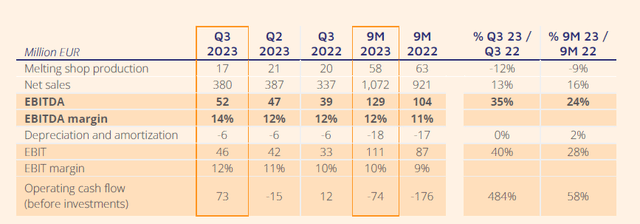

I am however quite pleased with the results of the high-performance alloys. The EBITDA result continues to gain pace there and the division generated 52M EUR in EBITDA during the third quarter. That is a QoQ increase of approximately 10% and this brings the 9M 2023 EBITDA to 129M EUR and a full-year EBITDA of 175M EUR for this division doesn’t appear unlikely.

Acerinox Investor Relations

That being said, I am hoping the alloys division will come close to a 200M EUR EBITDA result in 2024 and applying a multiple of 10 to that EBITDA result (as it is a specialty division which does not seem to be impacted by an economic slowdown, I think that multiple is realistic) would make this division worth 2B EUR.

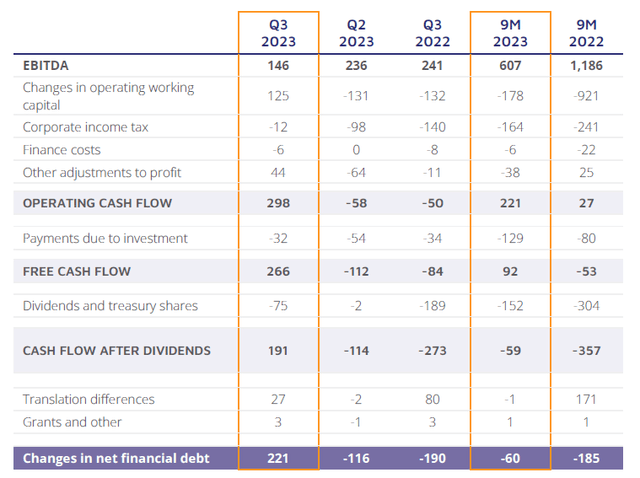

The company’s cash flow performance also remained strong. As you can see below, there was a total operating cash flow of 298M EUR but after deducting the 125M EUR release from working capital elements as well as the 44M EUR in ‘other adjustments’ (the company has not provided any details on these other adjustments so I am ignoring this benefit at this time to err on the side of caution), the underlying operating cash flow was 129M EUR.

Acerinox Investor Relations

The total capex was just 32M EUR resulting in a net free cash flow of 97M EUR and 83M EUR if you would use the correct amount of taxes based on the Q3 pre-tax income. That still represents about 0.33 EUR per share and is higher than the reported net income as Acerinox’ sustaining capex is relatively low and most large scale expansion projects have been completed.

As mentioned before, given the current performance, Acerinox should be able to maintain an EPS of 1.00 EUR per share. As Acerinox is actively managing its working capital position and is making cash available from those working capital elements, the interest expenses should at least stabilize and will likely decrease. At the end of September, the company had 1.75B EUR in cash on hand while it had 1.34B EUR in short-term borrowings and 900M EUR in long-term debt for a total net debt of just 500M EUR. And even if we would assume the annualized EBITDA will be just 500-550M EUR from here on, this indicates the net debt will remain at or below 1x EBITDA. Good enough to get through the current downcycle. Additionally, the company should start to make some serious interest income on its 1.75B EUR cash pile. Acerinox disclosed it has invested in term deposits and I assume interest income will only show up in the financial statements when it has actually been received. Although the net finance expenses were just 5M EUR in the past few quarters, I think Acerinox has a chance to further improve this.

I am somewhat surprised the company’s share price is hanging in there so well. While the share price never reacted positively during the exceptionally strong times (and I would even count the first half of this year as exceptionally strong), the share price is pretty flat now too. The company is hosting a capital markets day next week, and I hope to see a multi-year plan to grow the business without relying too much on just stainless steel.

Investment thesis

It’s not easy to value an industrial player in a downcycle, but I do think the alloys division deserves a premium valuation. If I would assume a 2025 EBITDA of 200M EUR (hopefully this result will already be reached in 2024 though) and assuming a run-rate EBITDA of 350M EUR in the conservative scenario for the stainless steel division, an EBITDA multiple of respectively 10 and 5.5 (I think an EBITDA multiple of 5-6 based on the EBITDA generated in the downcycle is very reasonable) would result in fair value of 3.95B EUR and about 3.45B EUR for the equity. Considering there are 249M shares outstanding, this represents a fair value of almost 14 EUR per share.

Right now, the stock is trading at just over 5 times EBITDA (based on an anticipated consolidated EBITDA of 560M per year) and I think that’s pretty attractive for a company in a clear downcycle. The strong balance sheet means Acerinox should have no financial issues as its term debt has gradual maturities all the way to the end of this decade while its existing cash pile is sufficient to cover pretty much all maturities until close to the very end. These aren’t easy times but I think Acerinox has what it takes to survive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.