John Kevin/iStock via Getty Images

Dear Partners & Friends,

For the Second quarter 2023, Ace River Capital Partners, L.P. (the “Fund”) returned 3.73%. Over the same period, the S&P 500 (SPX) and Russel 2000 (RTY) Indexes returned 8.74% and 5.2%, respectively.

Strategy

My goal is to maintain a concentrated portfolio of small and micro-cap companies with unique advantages and growth potential within their respective industries. The aim is to hold them for the long term. Finding such companies requires significant time and effort. Due to the scarcity of suitable opportunities, constraints on time and resources, and opportunity costs, I will take substantial positions in the companies that meet my criteria and pass my risk/reward assessment. I do not subscribe to wide diversification and only research and follow a limited number of companies deeply. I will not spend much time on a company if I am unwilling to take a substantial position and have the conviction to add to that position on weakness. This approach requires a lot of research and patience. There will be long periods of inactivity with few trades, and I will rarely hold more than 5 companies at a time. I will normally aim to have one short position. The short position will usually target a much larger company than the small and micro-cap companies held as long positions. This strategy accepts short-term volatility in pursuit of higher, long-term, tax-efficient returns.

Top Position

The fund’s top position is RCI Hospitality (RICK). RICK is the only publicly traded owner of adult nightclubs in the US. Currently, they own 54 clubs across 13 states and an additional 13 sports-bar restaurants with the “Bombshells” concept that has recently began franchising. With few municipalities issuing new adult entertainment licenses, these businesses function as local monopolies with excellent unit economics.

RICK has recently become positioned to open a Club/Casino/Steakhouse in Central City Colorado. I believe that investment will perform well and have a high ROI for the company, in addition to opening a new path to allocate capital.

Please see Q1 letter for more information on this position.

Latest Moves & Second-Largest Position

Drive Shack (OTCQX:DSHK) is a unique and innovative leisure and entertainment company that offers guests an immersive experience through its state-of-the-art driving ranges, golf courses, and now, its latest offering – The Puttery mini-golf venues. The company has come a long way since its inception in 2016, evolving from a Real Estate Investment Trust (REIT) focused on golf courses to a multifaceted leisure and entertainment company that is committed to creating unforgettable experiences for its customers.

Originally known as Newcastle Investment Corp., the company went through a significant transformation in 2016, changing its name to Drive Shack and divesting its assets in traditional golf courses to focus on creating modernized golf entertainment venues. Since then, the company has opened several top-of-the-line driving ranges across the United States, offering guests an unparalleled experience that merges technology, entertainment, and sports.

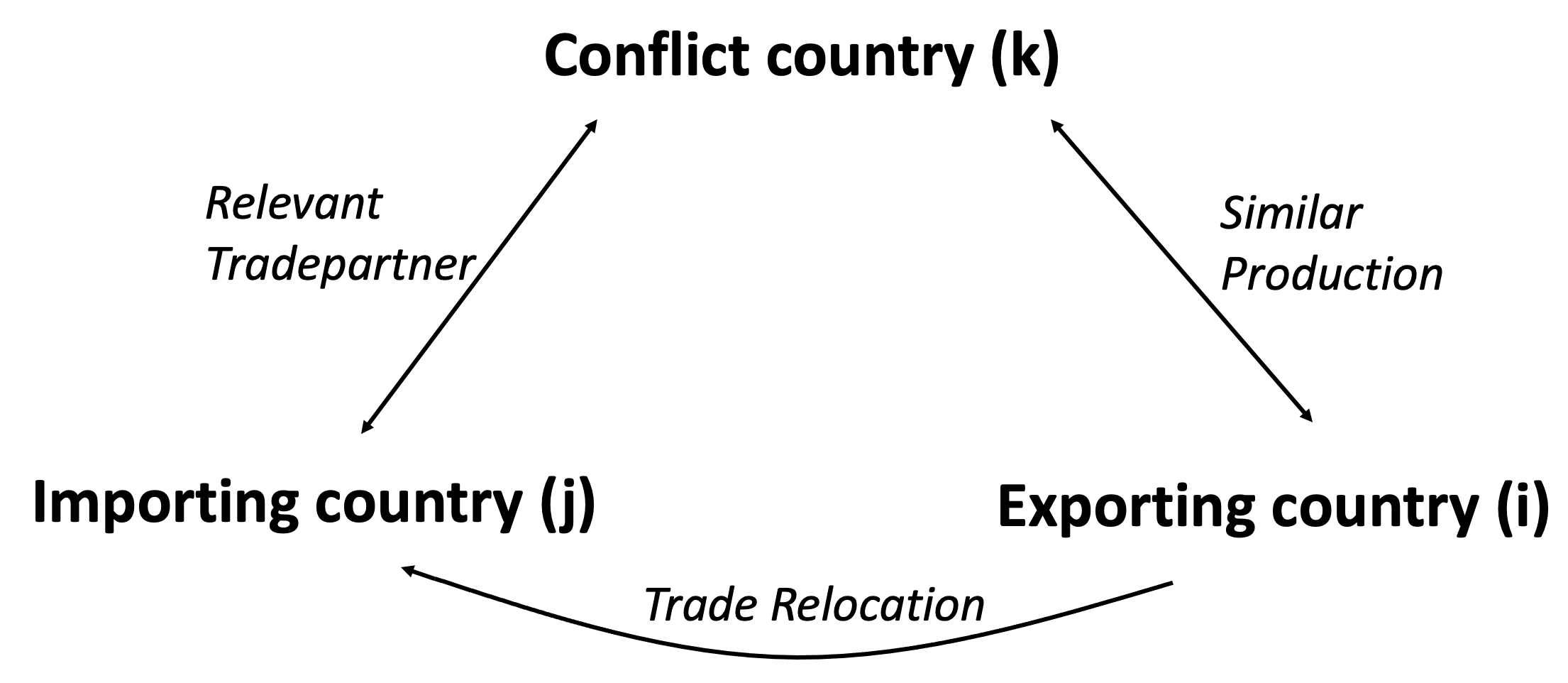

Drive Shack Portfolio of Venues (Drive Shack Investor Presentation)

Investor Presentation – Company Timeline

In 2018 the first Drive Shack was opened in Orlando, followed by 3 more the following year. These venues are technology driven, driving ranges with food and beverage options similar to Top Golf. The venues are expensive to build at around $20MM and the ROIC was in the 15%-20% range vs. the improved Puttery concept which has proven to have a lower cost per venue and a higher return in addition to shorter construction timeline.

In 2020, Drive Shack expanded its portfolio to include The Puttery, a concept that brings a new level of fun and excitement to the traditional game of mini golf. With cutting-edge technology, chic design, and a range of food and beverage options, The Puttery venues are quickly becoming the go-to destination for friend outings, corporate events, and social gatherings.

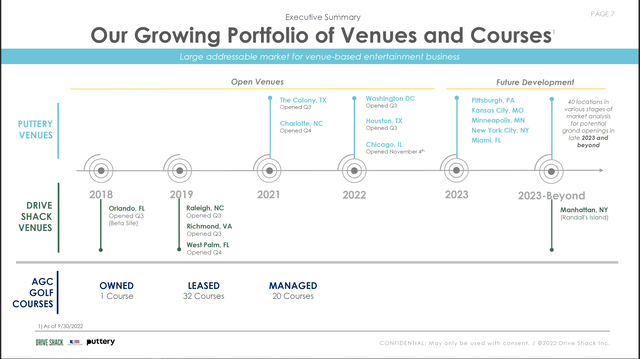

Puttery Venues Performance Chart (Drive Shack Investor Presentation)

Investor Presentation – Puttery Venues Performance

The Q3 2022 earnings report (11/21/22) showed a loss of -$0.09/share before the voluntary delisting from the NYSE on 12/13/22. At this time, the company was in trouble and needed to raise capital to continue construction commitments for new Puttery venues. Bankruptcy looked to be a serious risk. The Chicago Puttery was recently opened before this report and since then Pittsburgh is now open. With each Puttery venue adding roughly $2MM in EBIT based on the current 92.3MM shares outstanding, each will contribute $.02/EPS, so we can expect the most recent loss per share to be cut in half by those openings alone.

The company announced a term loan facility of $26.5MM on 3/8/23 which should be able to cover the opening of 3-4 more venues as last estimates had each venue costing $7MM. With the additional income from those venues, we should be at or approaching break even based on the latest loss/share number. The most recent earnings report showed some progress, with a loss of -$0.07/share. With the stock currently trading around 0.38/share, I can see the market having a strong reaction to the upside after the next earnings update if the company can communicate a plan forward that eliminates any bankruptcy risk. It seems operating the current venues and planning to only open 1 or two venues per year based on cashflow in the near term may be the correct play in this high interest rate environment and with the current depressed share price.

With the very attractive unit economics of The Puttery venues providing 25%-33% ROIC, I am happy to add shares at these levels because if leverage is managed correctly, I see a long runway for growth and countrywide expansion of the concept over the next decade or more. The recent change in CEO and CFO gives me more optimism and I have increased the position.

Thank you for reading. Please reach out for any reason.

Nicholas D’Agnillo

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.