What ought to in the end be the enterprise of companies? To what extent ought to firm efficiency be judged by issues past the slim focus of the returns on their operations? These questions, continuously debated on Vox (e.g. Krekel et al. 2019, Edmans 2021, Tonin and Vlassopoulos 2012), date again to lengthy earlier than Milton Friedman’s well-known competition that the social duty of enterprise is to make income (Friedman 1970). Till not too long ago, there was a view – dominant because the mid-Nineteen Eighties – that maximising shareholder worth could be tantamount to serving an organization’s social function (Easterbrook and Fischel 1991).

Critics of this proposition have identified its shortcomings, together with an excessively short-term viewpoint, implying a scarcity of incentives for R&D and funding (Hayes and Abernathy 1980, Barton and Wiseman, 2014). Tutorial critique has additionally grown in response to intensified debates round local weather change and company efficiency (Mayer 2013).

In our analysis (Manyika et al. 2021), we got down to devise a means of accounting for who advantages from an organization’s worth creation and why. In doing so, slightly than treating financials and environmental, social, and governance (ESG) or different societal metrics to explain firm impacts individually, we contemplate all attainable impacts on households, particularly monetary flows, in a single built-in framework. We draw on two units of novel analyses. The primary maps the pathways via which company worth flows each immediately and not directly to households. The second teams firms and defines archetypes, based mostly on the hyperlink between what they do, how they do it, and the way they’re positioned relative to every of the pathways we mapped.

Pathways of worth flows from corporations to households

Our analysis primarily focuses on firms with greater than $1 billion in income that have been headquartered within the 37 OECD international locations in 2018 (about 5,000 in complete). We examine two time intervals: from 1994 to 1996 and from 2016 to 2018. One of many findings is the extent to which the combo of worth creation throughout archetypes has modified over time.

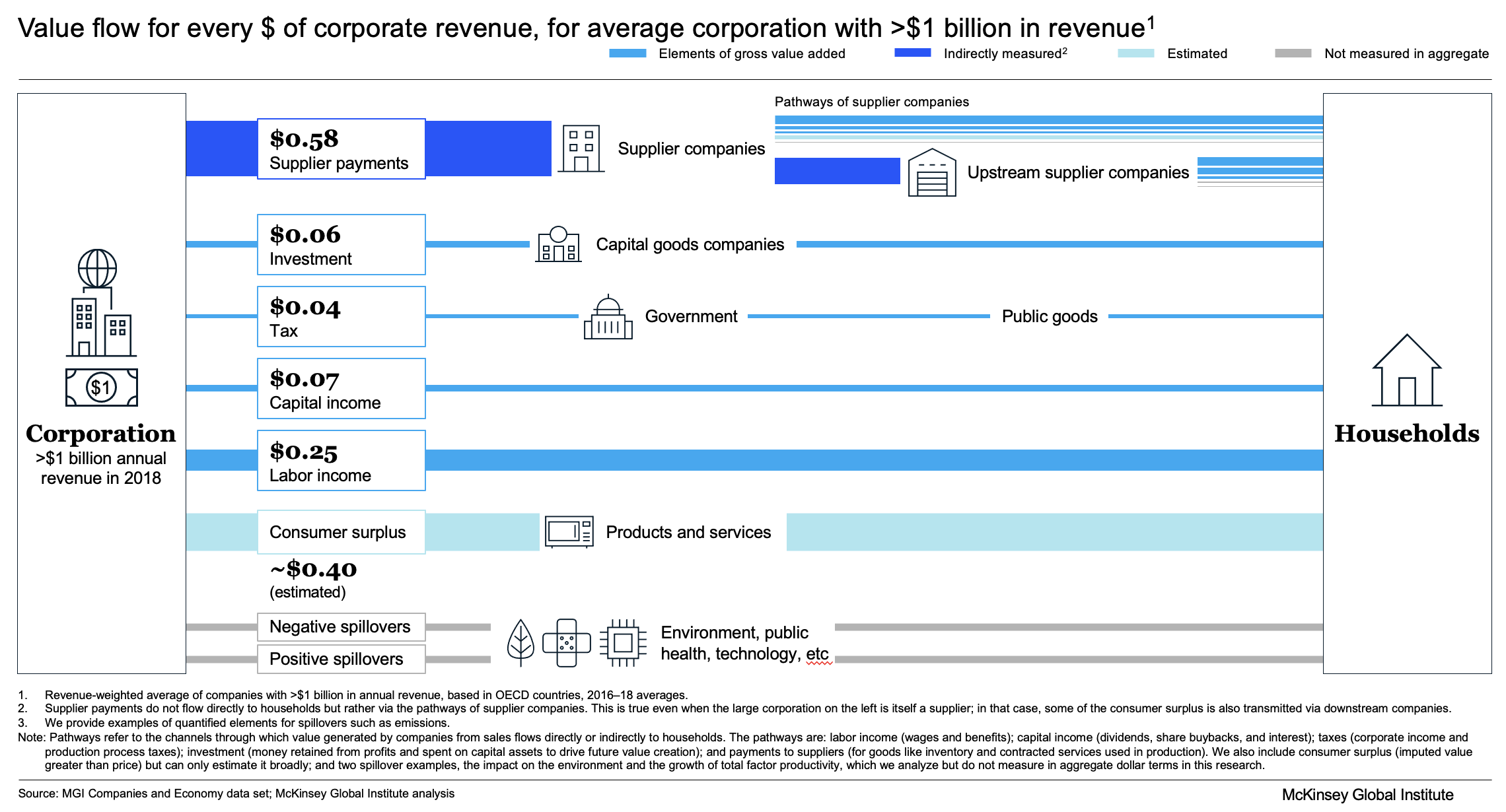

We determine eight pathways via which financial worth from firms flows to households and the financial system (Determine 1). In doing this, we combine an organization view, as mirrored in monetary statements, with a family view, as mirrored in nationwide earnings and product accounts. Given the stronger emphasis placed on corporations’ societal function within the public discourse, an integration of those two views can assist immediate extra constructive debates.

5 of those pathways are immediately measurable financial flows: labour earnings, capital earnings, taxes, funding in capital belongings, and funds to suppliers. Importantly, a narrower GDP view wouldn’t embody funds to suppliers. In that view, solely closing items rely. Intermediate items are netted out, since in any other case that may imply double counting; these funds simply go to the opposite 4 pathways of the provider firms. Nevertheless, to indicate an entire image from the attitude of all events concerned, we additionally embody these earnings flows. Thus, we account for a way a mean giant firm impacts all stakeholders, together with intermediate ones, via its worth flows to households.

Determine 1 Company financial good points movement to households by way of eight pathways

Supply: McKinsey World Institute.

The sixth pathway via which worth is channelled is shopper surplus, that’s, the realm between market value and the demand curve (the latter capturing willingness to pay). Whereas this surplus is unobservable, information on shopper behaviour enable for imputing demand curves, and therefore additionally for backing out the scale of the realm above value (Cohen et al. 2016). We use two approaches. First, we estimate shopper surplus for all the businesses in our information set on a per-dollar-of-revenue foundation. We take a deductive strategy by assuming that, in the long term, in aggressive markets worth is cut up equally between the numerous patrons and sellers. We take a look at the value-added portion and regulate based mostly on proof of markups above issue prices. Within the second strategy, we begin by observing relative value modifications over time: we decompose the change in income between 1994-6 and 2016-18 into value and quantity elements.

The ultimate two pathways we account for are unfavourable and optimistic spillovers, which we don’t assess comprehensively past the examples of environmental influence and contributions to complete issue productiveness progress (the residual, unaccounted for in extra labour or capital enter).

Fundamental sources of worth flows and their change over time

Listed to company income, we discover that labour earnings is the biggest direct-to-households pathway, with wages and advantages accounting for $0.25 for every greenback of income. An extra $0.58 goes to suppliers, reflecting the function they play in enabling firms to create and ship their services to customers or downstream companies. The remainder, totalling $0.17 of every greenback of an organization’s income, goes to firm belongings, shareholders, and taxes. We estimate the patron surplus pathway with much less precision to be about $0.40 per greenback of income. This represents the worth on the opposite aspect of the transaction from the corporate and so represents worth past the $1 of firm income.1

The scale of the pathways has modified over the previous 25 years. Our findings quantify for big firms the expansion of capital earnings and the corresponding decline of labour earnings and provider funds that’s extensively famous for the broader financial system within the literature (Autor et al. 2020, Barkai 2020, Karabarbounis and Neimann 2014, Mischke et al. 2019). Between 1994 and 1996 and 2016 and 2018, we discover that the capital earnings pathway elevated from $0.04 to $0.07 per income greenback. Utilized to the $40 trillion in income represented by our pattern of 5,000 giant firms, this quantities in absolute phrases to a rise in capital earnings of simply over $1 trillion. The labour earnings pathway shrank by $0.02, or 6%, and provider funds fell by $0.02, or 4%. The autumn was particularly steep for small and midsize enterprises. The share going to home suppliers in every nation additionally fell, reflecting cross-border outsourcing and shifts within the worth chain (Baldwin 2016). The tax pathway held regular total in our per income view.

Clustering of firms: Eight archetypes and their various financial and social influence

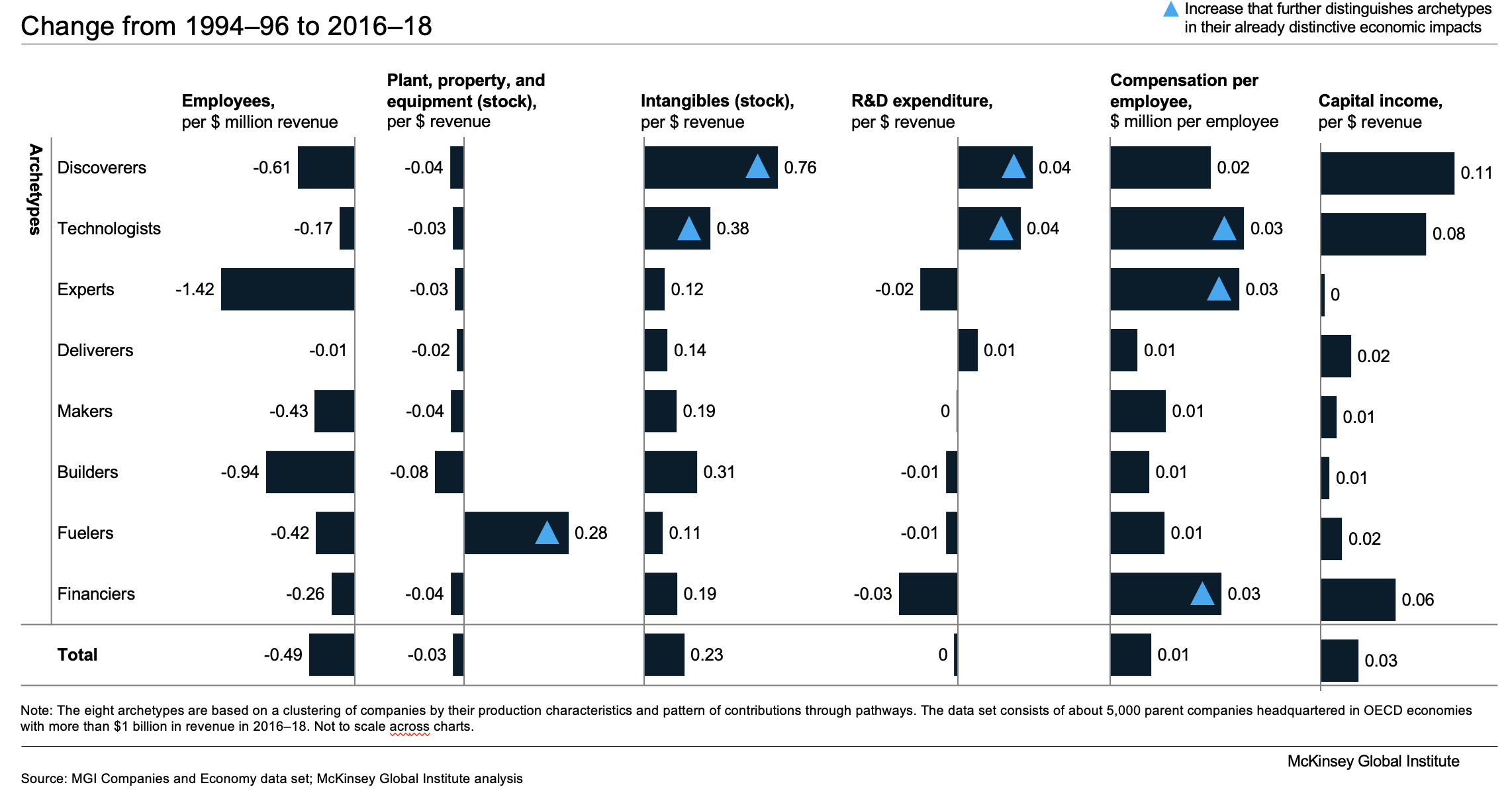

In our second evaluation, we clustered giant firms into eight archetypes based mostly on the issue inputs they use (for instance, labour and each bodily and intangible capital), how they create financial worth (for instance, price construction and R&D spending), and the way they have an effect on the financial system by way of the eight pathways famous above. Our evaluation suggests a rising disparity between varieties of firms by way of their impacts on the eight pathways. For instance, one among our archetypes, which we name ‘Discoverers’, is notable for prime expenditures on R&D, substantial mental property, and robust capital earnings. It contains pharmaceutical and biotechnology firms in addition to some family product firms that rely closely on scientific discovery and mental property to distinguish their merchandise. One other archetype is ‘Technologists’, which vary throughout {hardware}, software program, digital retailers, and media and which even have excessive R&D spend, supporting steady productiveness progress. The place they differ from discoverers is that the tech corporations additionally contributed considerably to shopper surplus via steep value reductions over time. ‘Deliverers’ are notable for prime employment ranges and huge provider prices, typical of retail and distribution, and embody some ostensible producers corresponding to footwear and luxurious attire firms that even have excessive advertising and marketing prices and, in lots of instances, outsource the making itself. ‘Specialists’ embody for-profit hospitals, well being companies, enterprise companies firms, and personal universities that significantly depend on high-skill staff and commit the best share of their value-added to worker compensation.2 ‘Builders’ embody utility, telecommunications, and transportation firms that assemble, use, and function bodily infrastructure, in addition to producers of supplies and chemical compounds. They’ve double the bodily belongings of the common and, together with vitality firms, the best scope one emissions (direct from owned or managed sources) and scope two emissions (oblique emissions from the era of bought electrical energy, steam, heating and cooling).

Different producers that stability average capital depth and expert labour at scale are within the ‘Makers’ class, which is the biggest archetype, accounting for about 25% of the income of all firms and 27% of employment. Lastly, ‘Fuelers’ and ‘Financiers’ align extra intently with conventional sectors as they play elementary enabling – intermediating – roles within the financial system.

Structural adjustment: Altering the relative measurement of archetypes

Makers and Builders have been lengthy the predominant archetypes and mainstays of business economies, as giant firms captured the benefits of scale, significantly in bodily capital. Certainly, on the time of Berle and Means’ seminal research of US enterprise in 1932, these two classes accounted for greater than 85% of the whole income of non-banking firms. That share amongst giant firms has dropped sharply as firms have develop into extra distributed among the many archetypes, reflecting larger differentiation within the companies and information financial system. These shifts within the relative measurement of the archetypes have in flip affected the pathways. For instance, the archetypes whose income has grown in share have decrease labour earnings contributions on common than these shrinking in share, particularly Makers. This composition impact (arithmetically) accounts for two-thirds of the general labour earnings decline throughout firms. The smaller share of the labour earnings pathway additionally stems from a 30% to 40% drop in workers per greenback of income prior to now 25 years (in fixed greenback phrases) for Specialists, Fuelers, and Builders as productiveness elevated.

Some traits are widespread to all archetypes, significantly the expansion in capital earnings, intangible investments, and productiveness progress (declining labour depth).

One of many greatest optimistic impacts for all households has been the expansion in shopper surplus, primarily emanating from Technologists and Makers. Their costs dropped by 50% and 20% over the past quarter-century, respectively, whereas output volumes grew essentially the most in absolute phrases.

The extra various distribution of firms throughout the archetypes – and the sharpened distinctions amongst them – point out larger company specialisation over the previous quarter-century (Determine 2). For instance, Technologists and Discoverers elevated their inventory of intangibles, R&D expenditures, and capital earnings greater than different archetypes. Deliverers elevated their employment share by 9 share factors, the biggest by far. Fuelers added bodily capital belongings, whereas most others decreased them. Specialists elevated wages by nearly 40%, the most important rise, additionally reflecting a abilities premium.

Determine 2 Most archetypes turned extra pronounced of their core options prior to now 25 years

Supply: McKinsy World Institute.

Conclusion: A extra complete perspective on firms’ stakeholder footprint

The aim of our twin evaluation is to supply enterprise leaders and policymakers with a nuanced technique to assess how modifications within the company panorama have an effect on households. Particularly, this evaluation permits for brand spanking new views on a number of the largest shifts within the societal influence of enormous firms and the way that varies based mostly on the kind of firm and the way they produce their financial worth. Additional analysis is required to broaden the pattern of firms past the OECD, together with China and India, and small and medium-sized enterprises. Furthermore, extra of the non-monetary spillovers ought to be accounted for, and the labour-supplier cut up ought to be measured with extra precision. However already, our first findings recommend {that a} micro-to-macro view can assist higher quantify an organization’s stakeholder ‘footprint’, linked to its core belongings and operations, and thus add worth to the present debate concerning the company influence on society.

References

Autor, D, D Dorn, L F Katz, C Patterson, and J V Reenen (2020), “The Fall of the Labor Share and the Rise of Famous person Corporations”, The Quarterly Journal of Economics 135(2): 645-709.

Baldwin, R (2019), The Globotics Upheaval. Globalization, Robotics and the Way forward for Work, London: Weidenfeld & Nicolson.

Baldwin, R (2016), The Nice Convergence. Data Expertise and the New Globalization, Cambridge, MA: Belknap.

Banerjee, A and E Duflo (2019), Good Economics for Laborious Instances. Higher Solutions to Our Largest Issues, London, UK: Penguin.

Barkai, S (2020), “Declining Labor and Capital Shares”, The Journal of Finance 75(5): 2421-2463.

Berle, A and G Means (1932), The Fashionable Company and Non-public Property, Commerce Clearing Home, New York.

Barton, D and M Wiseman (2014), “Focusing Capital on the Lengthy Time period”, Harvard Enterprise Assessment.

Blair, M M (2003), “Shareholder Worth, Company Governance, and Company Efficiency: A Submit-Enron Reassessment of the Standard Knowledge”, in: Cornelius/Kogut (eds., 2003): 53-82.

Catherine M C, M Sawyer and J L Levin (2020), “The rise of standardized ESG disclosure frameworks in the US”, Harvard Regulation Faculty Discussion board on Company Governance, 22 June.

Easterbrook, F H and D R Fischel (1991), The Financial Construction of Company Regulation, Cambridge, MA: Harvard College Press.

Edmans, A (2021), “Why shareholder capitalism advantages wider society”, VoxEU,.org 26 Could.

Friedman, M (1970) “A Friedman doctrine ‐- The social duty of enterprise Is to extend its income,” New York Instances, 13 September.

Hayes R H and W J Abernathy (1980), “Managing our Technique to Financial Decline”, Harvard Enterprise Assessment.

Karabarbounis, L and B Neiman (2014), “Labour shares, inequality, and the relative value of capital”, VoxEU.org, 25 November.

Krekel, C, G Ward and J-E De Neve (2019), “Worker wellbeing, productiveness, and agency efficiency: Proof from 1.8 million workers”, VoxEU.org, 21 April.

Manyika, J, M Birshan, S Smit, J Woetzel, Okay Russell, and L Purcell (2021), “A brand new take a look at how firms influence the financial system and households”, McKinsey World Institute.

Mayer, C (2013), Agency Dedication: Why the company is failing us and tips on how to restore belief in it. Oxford: Oxford College Press.

Tonin M and M Vlassopoulos (2012), “Do social incentives matter? Proof from an internet actual effort experiment”, VoxEU.org, 26 July.

Tirole, J (2000), “Company governance”, Econometrica 69(1): 1-35.

Tirole, J (2016), Économie du bien commun (1er édition ed.) , Paris: Presses Universitaires de France.

Endnotes

1 The estimate of $0.17 flowing to capital, funding, and tax pathways is predicated on well-reported agency stage information; compensation information is much less full and so we anchor estimates of the cut up between labor and provider pathways utilizing granular home sector information and regulate for big corporations.

2 We don’t embody public sector hospitals and universities due to a scarcity of knowledge.