We Are

Energizer Holdings, Inc. (NYSE:ENR) promised lower net leverage in 2024, and appears interesting with dividend yield of close to 4%. Besides, I would also expect further operating efficiency increases in battery manufacturing, and distribution thanks to the ongoing Project Momentum profit recovery program. In addition, if recent acquisition efforts are successful, I believe that Energizer will most likely deliver net income growth in the coming years. There are some risks coming from the evolving retail landscape, or competition, as well as goodwill impairments. With that all being said, I believe that the company remains undervalued.

Energizer

Energizer offers a wide range of home and automotive products, as well as lighting. Its batteries encompass technologies such as lithium, alkaline, zinc air and silver oxide, under major brands such as Energizer, Eveready and Rayovac.

Additionally, they provide automotive care products, from appearance and fragrance to performance and air conditioning recharging. Besides, in the automotive performance space, they offer fuel and oil additives under the iconic STP brand. Its lighting line includes portable flashlights and area products under well-known brands such as Hard Case, Dolphin and WeatherReady.

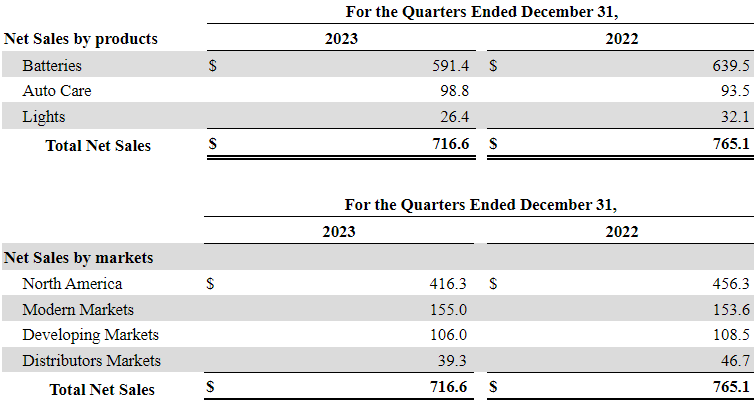

As shown in the image below, most of the revenue comes from the sale of batteries, and Energizer sells both in North America, and overseas. I believe that diversification is one of the assets that Energizer may not be reporting in the balance sheet.

Source: 10-Q

The company owns thousands of trademarks globally, including Energizer, Rayovac and Eveready, along with other associated brands. They distribute products through an extensive retail network ranging from large chains to specialty stores and e-commerce.

Its marketing strategy covers both modern trade, such as large retailers, and traditional trade, which is more common in developing markets. I think that this diversified model allows them to reach a broad consumer base.

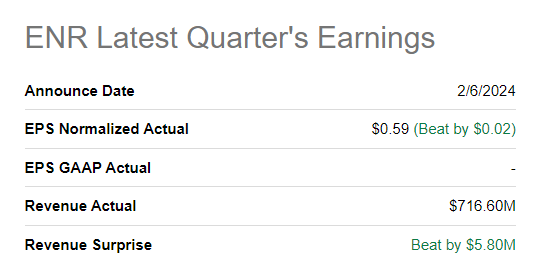

With that about the business model, I believe that it is worth having a look at the most recent earnings, which came in better than expected. Both EPS Normalized Actual, and quarterly revenue was better than anticipated by analysts.

Source: Seeking Alpha

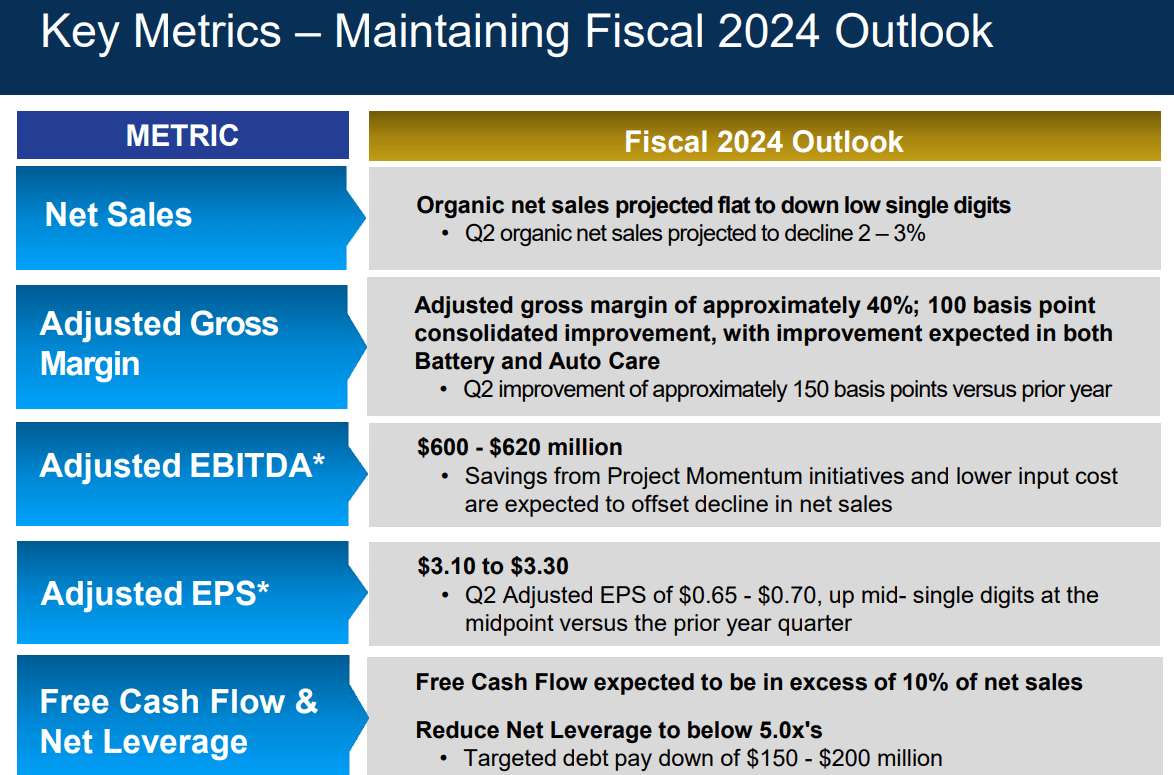

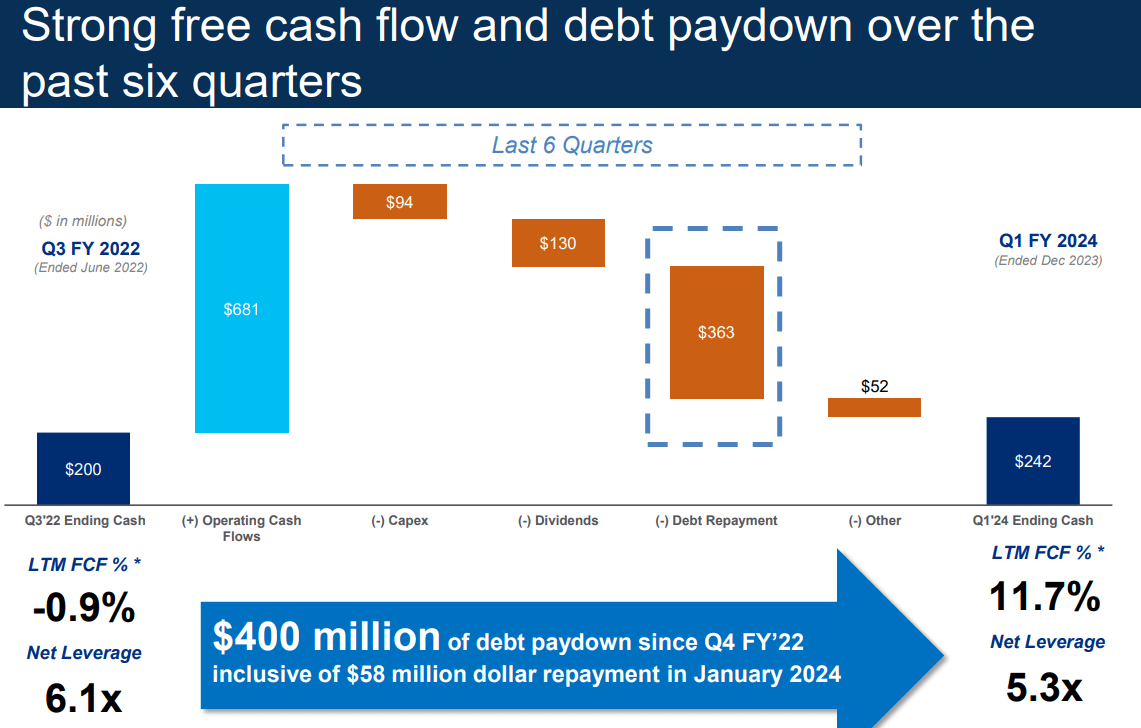

Energizer also noted guidance including 2024 Adjusted EBITDA between $600 million, and $620 million, and adjusted EPS close to $3.10 and $3.3. In addition, Energizer noted that net leverage will most likely fall below 5x soon thanks to debt repayments.

We also expect Adjusted EBITDA to be in the range of $600 million to $620 million and Adjusted earnings per share to be in the range of $3.10 to $3.30. Source: First Quarter FY 24 Press Release

Source: First Quarter Earnings Slides

Assets: Recent Acquisitions May Bring Business Growth

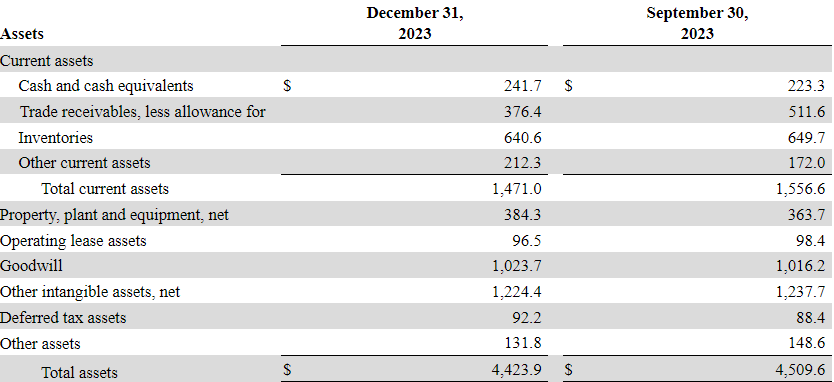

Given the total amount of cash, and with the current ratio being more than 1x, I think that Energizer reports a significant amount of liquidity to finance future acquisitions, or to develop new products. As of December 31, 2023, the company reported $241 million in cash, inventories worth $640 million, and total current assets close to $1.47 billion.

Source: 10-Q

Energizer reported goodwill close to $1 billion, and other intangibles of $1.2 billion. These assets are derived from previous acquisitions. With this in mind, I believe that Energizer has expertise in the M&A markets, and could announce new acquisitions in the coming years. Readers may want to have a look at previous merger agreements, and acquisitions agreements signed by the company.

Among the most recent acquisitions there is for example battery manufacturing assets in Belgium, and raw materials from APS. In this article, under my most optimistic case scenario, I assumed that Energizer’s recent acquisitions could accelerate net sales growth in the future. I assumed median net sales growth of close to 1.9% from now to 2034.

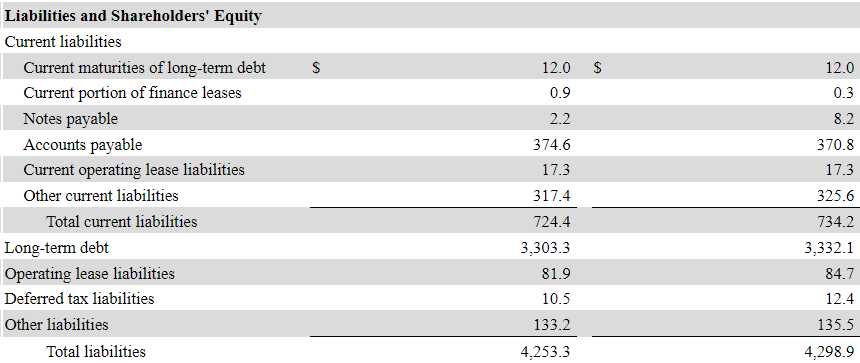

Liabilities: The Total Amount Of Debt Is Not Small

Energizer receives financing from business providers as the total amount of accounts payable stand at $374 million. However, the company also receives financing from banks. The total amount of debt is not small. In the last report, the company noted debt of $3.3 billion.

Source: 10-Q

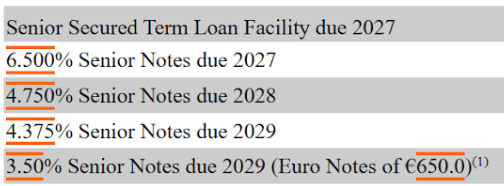

Given the total amount of financial debt, I did study carefully the interest rate being paid. The company structured its debt through a credit agreement, which includes a $400 million revolving credit facility and a $550 million secured term loan, maturing in 2027. Besides, they seemed to have made adjustments to the agreement to obtain additional financing and have refinanced certain senior notes. The interest rate being paid stands at close to 3.5% and 6.5%. With these numbers in mind, I assumed a valuation of close to 7% and 8% in my two case scenarios.

Source: 10-k

Net Revenue Catalyst: The Battery Market Size Growth Will Most Likely Push Organic Net Revenue Growth

Under my best case scenario, I assumed that Energizer will most likely deliver net sales growth thanks to the growth of the battery market. It is not easy coming up with precise expectations about the growth of Energizer’s target market. The company offers different types of batteries and solutions. With that, for instance, the alkaline battery market is expected to grow at close to 5% CAGR.

The alkaline battery market size surpassed USD 8.84 billion in 2023 and is predicted to hit around USD 14.43 billion by 2033 with a CAGR of 5.03% from 2024 to 2033. Source: Precedence Research

Net Sales Catalyst: Innovation, New Brands, And New Technology

Energizer’s business strategy focuses on global expansion, constant innovation and adaptation to market trends. Likewise, it seeks to strengthen existing brands, develop new products and explore growth opportunities in emerging areas. Operational efficiency, sustainability and excellence in the customer experience are prioritized.

In my view, in this industry, it is considered crucial to invest in technology and human talent to maintain competitiveness. Under my most optimistic case scenario, I assumed that these initiatives will most likely lead to net income growth, and net sales growth.

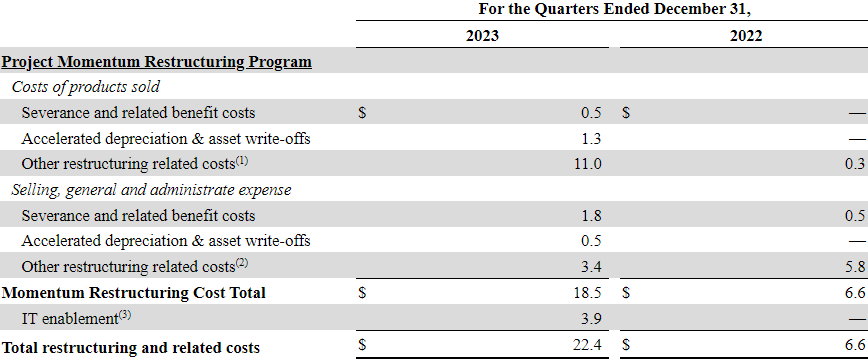

Net Income Growth Catalyst: Optimization, And Streamline Of The Organization

In the most recent quarter, Energizer noted an expansion to the Project Momentum profit recovery program, which is expected to accelerate optimization in manufacturing, distribution and global supply chain networks. Under my most optimistic case scenario I assumed that these efforts will lead to net income growth.

The Company’s Board of Directors approved an expansion to the Project Momentum profit recovery program and delegated authority to the Company’s management to determine the final actions with respect to the plan. The expansion of this program included an additional year, which will allow for additional optimization of our battery manufacturing. Source: 10-Q

In this regard, in the last quarter, the company noted total restructuring and related costs of about $22 million, which is significantly higher than that in 2022.

Source: 10-Q

Under My Best Case Scenario, The WACC May Be Lower Thanks To Debt Repayment.

In the last presentation given to investors, the company noted a significant decrease in the total amount of debt. Net leverage decreased from 6.1x to less than 5.3x. Under my most optimistic case scenario, recent debt reduction, and potential new debt reductions could lead to net income enhancement, and small WACC reduction. Note that I assumed a cost of capital close to 6.9%-7% under my best case scenario.

Source: First Quarter Earnings Slides

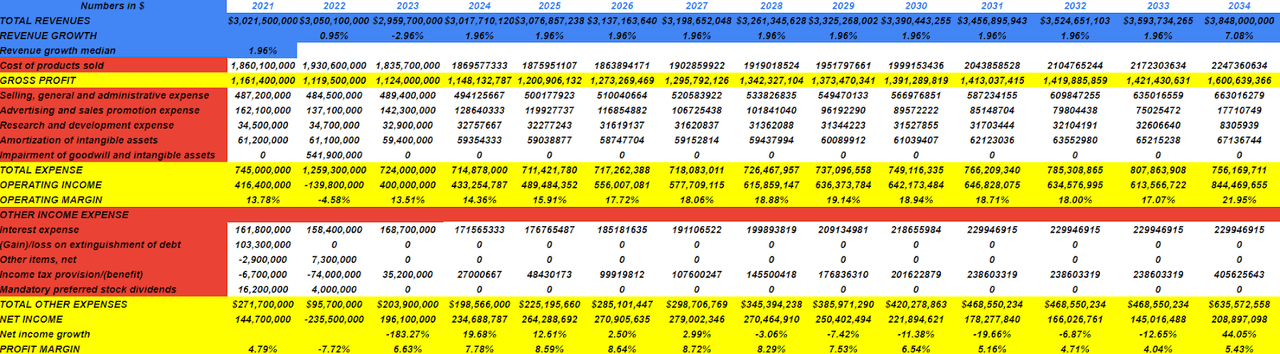

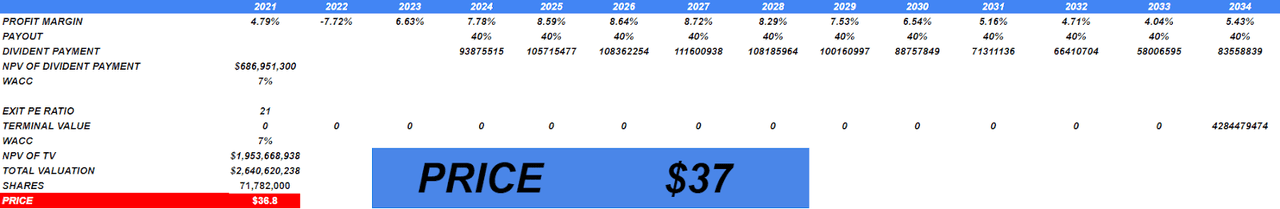

My Optimistic Case Scenario Implied A Valuation Of $37 Per Share

Under my most optimistic case scenario, I assumed that recent restructuring efforts, the growth of the battery market, and reduction of debt could lead to net income growth, and operating margin growth.

It is also worth noting that I keep into account previous income statements reported by Energizer. I really believe that my figures are quite conservative.

Under my estimates for the company in the future, I used 2034 total revenues of $3848 million, cost of products sold of close to $2247 million, leaving us a gross profit of $1600 million.

In addition, adding selling, general and administrative expenses of close to $17 million, and advertising and sales promotion expenses of $257.148 million, I also included 2034 research and development expenses of $8 million.

The total expense would be close to $756 million, and operating income would be $844 million. Finally, I also obtained a net income of $208 million, which translates into a profit margin of 5.43%.

Source: My Expectations

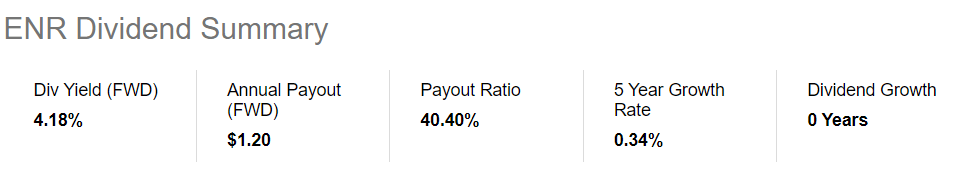

With payout ratio close to 40%, I obtained a 2034 dividend payment of $83 million. I also assume a WACC of 7%, which implies a net present value of dividend payments close to $686 million.

Source: Seeking Alpha

Besides, with an exit PE ratio of 21x points the total valuation would be close to $2.6 billion, leaving us with a price per share of $37.

Source: My Expectations

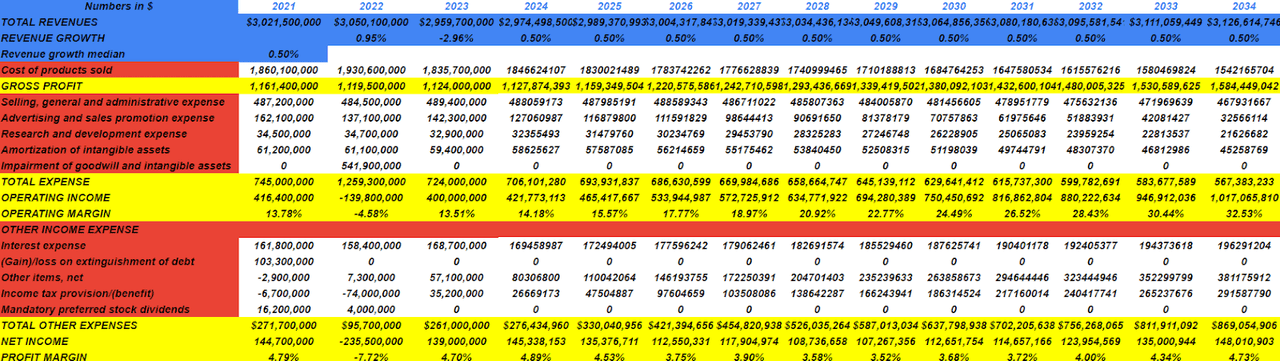

My Pessimistic Case Scenario Implied A Valuation Of $23 Per Share

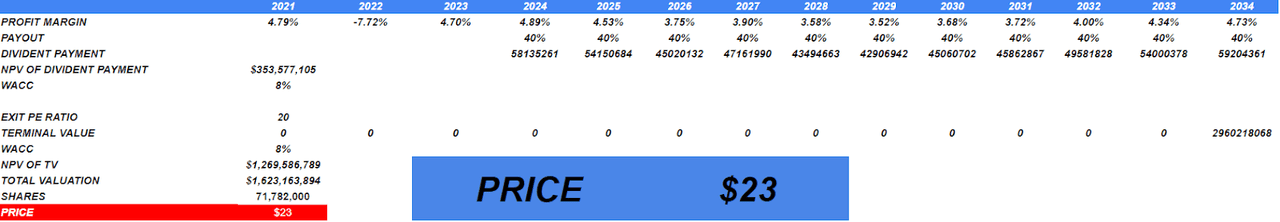

Under my pessimistic case scenario, I assumed that some of the initiatives of Energizer including restructuring efforts, debt reduction, or M&A efforts are not successful. As a result, net sales growth, and net income growth is a bit smaller than in the previous case scenario.

In a less optimistic case, 2034 total revenues would be $3.709 billion, accompanied by a median revenue growth of 0.5%. As for the cost of products sold, I assumed $455 million, which will give us a gross profit of $1542 million.

Additionally, the selling, general and administrative expense may be around $467 million, with advertising and sales promotion expense close to $32 million, and research and development expenses of $21 million.

2034 Total expense would be close to $567 million, generating an operating income of around $1017 million. Finally, 2034 net income may be close to $148 million.

Source: My Expectations

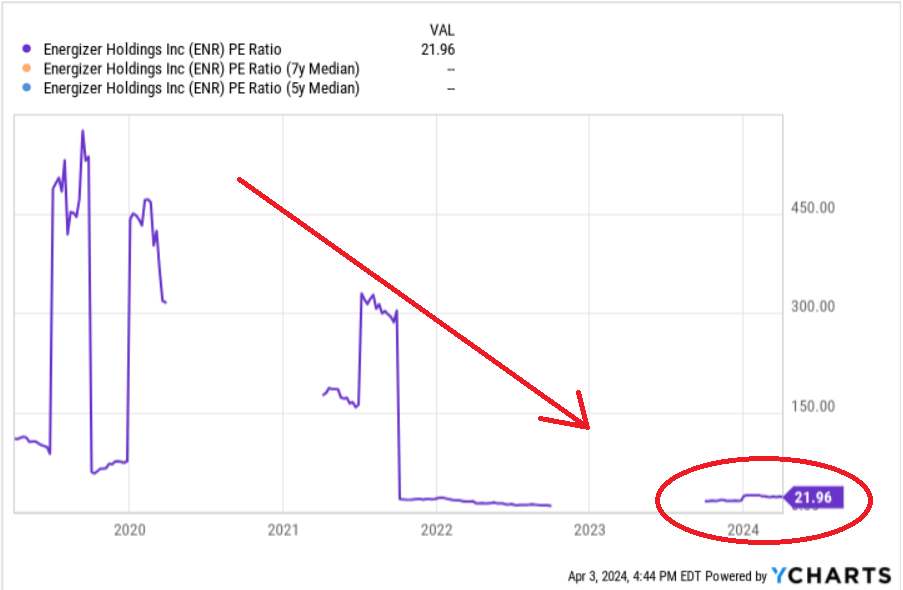

Also assuming a payout close to 40%, 2034 dividend payment would be very close to $59 million. In addition, taking into account a WACC 8%, and exit PE ratio of 20x points, the total valuation would stand at about $1623 million, and the stock price would be of about $23.

Note that I believe that my PE ratio is close to the current PE multiple, which is also the lowest in the last four years.

Source: Ycharts Source: My Expectations

Risks, And Competition

I believe Energizer poses risks with respect to the reputation and continued success of the brands, as they are vital in a competitive and constantly evolving environment. Besides, the arrival of new sales channels, such as e-commerce and mass markdowns, as well as changes in business models, such as private labels and direct-to-consumer sales, pose challenges.

Potential risks range from damage to brand image to quality or safety issues, litigation over misleading advertising, and product recalls. These elements could have adverse consequences on the company and its financial condition.

In addition, considering the total amount of goodwill, I believe that Energizer could suffer from goodwill impairment risks, or intangible impairments. As a result, I believe that the book value per share could decrease, and net income expectations may also decline.

In my opinion, the company faces intense competition at a national and global level. The main drivers for the battery business are device usage, consumer demographics and disasters, while for automotive care they are the size and age of the vehicle fleet, and kilometers driven.

My Opinion

Energizer Holdings displays a strong focus on brand protection, innovation, and geographic and product diversification. Besides, I believe that the Project Momentum profit recovery program, and recent restructuring efforts could lead to net income growth in the coming years. In addition, Energizer managed to lower their debt very effectively and maintain compliance with their debt agreements. Energizer faces significant challenges due to intense competition, the evolving retail landscape, and even brand image deterioration risks. With that all being said, I believe that Energizer is trading undervalued.