David Peperkamp

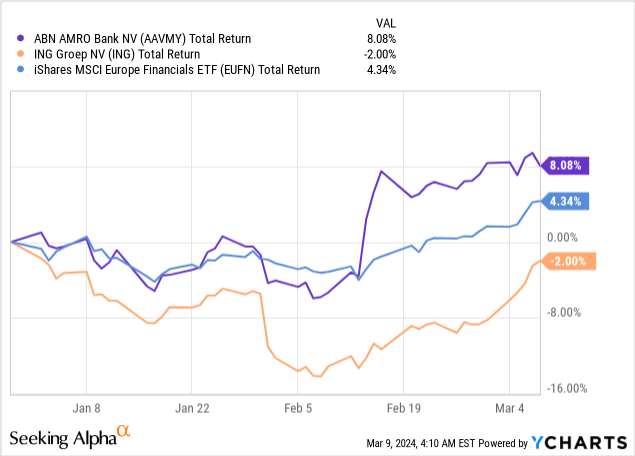

Shares of Dutch bank ABN AMRO (OTCPK:AAVMY)(OTC:ABMRF) have got off to a solid start in 2024, returning around 8% year-to-date in USD terms and outperforming both national peer ING Groep (ING) as well as the wider European financial space (EUFN).

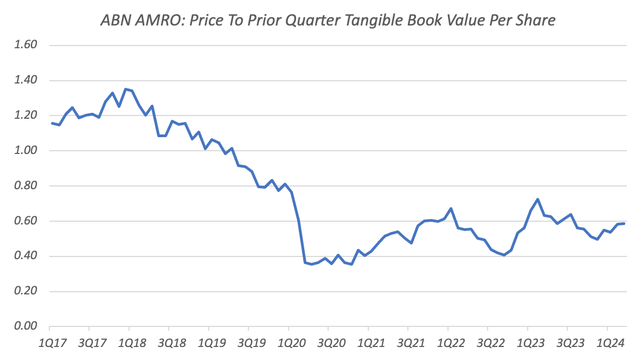

Covering the bank at the start of the year, I said that a lack of clarity regarding capital return plans and operating expenses was perhaps holding the stock back, with a then-valuation of just 0.55x tangible book value per share (“TBVPS”) looking too cheap relative to the bank’s earnings power.

Though arguably a drag on the stock, management was at least due to update the market on both points following Q4 results released a few weeks ago, providing a potential catalyst should the outlook become a bit clearer for investors. That has indeed come to pass, with the market reacting well to more detail on capital returns, as well as reasonable Q4 results and forward guidance. With the stock still cheap and some concerns from last time addressed, I keep my Strong Buy rating in place.

Reasonable Results And Guidance

In contrast to recently-covered peer ING, ABN AMRO delivered a slightly more upbeat set of Q4 results and guidance, with net interest income (“NII”) landing a little higher than consensus on both counts. As NII accounts for around 70% of the bank’s revenue, developments on this line are key for overall earnings.

With that, Q4 NII of €1.504 billion was down around 2% sequentially but marginally ahead of consensus, better than at ING which missed consensus with a circa 4% quarter-on-quarter fall. Similarly, Q4 net interest margin of 152bps was a couple of points ahead of estimates. While deposit migration from cheaper current and savings accounts to more expensive time accounts continues to be a headwind, this has slowed down significantly, according to management.

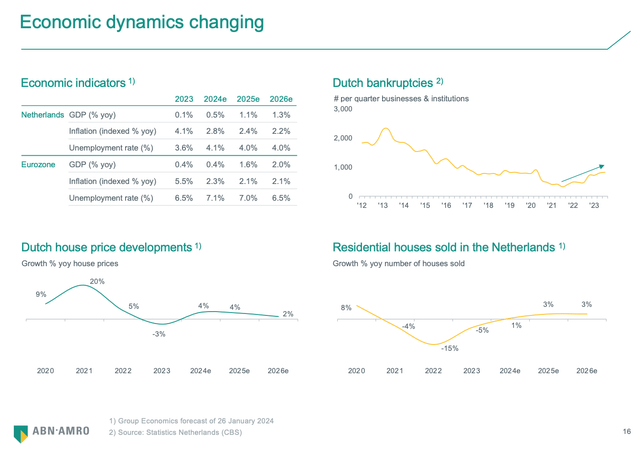

Loan growth also remains a challenge, with client loans down a little over 1% sequentially to €240 billion as higher interest rates continue to sap demand for credit. Mortgage loans (~64% of the book) were basically flat quarter-on-quarter at €151 billion, with some tentative positive signs looking forward as house price growth and transaction numbers are tentatively rebounding.

Source: ABN AMRO Q4 2023 Results Presentation

Positively, management guidance for flat NII was better than expected, with pre-results guidance pointing to a low single-digit year-on-year decline in 2024. This is also more upbeat than at ING, where management expects NII to fall around 5% this year.

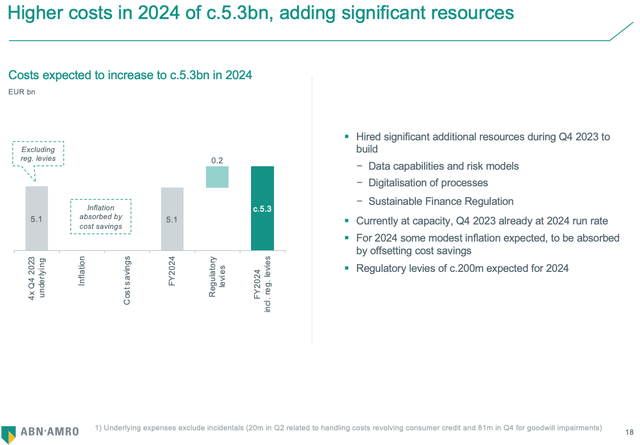

Expenses were a bit of a mixed bag. At €1.46 billion, operating costs in Q4 were around 6% higher than consensus, while 2024 guidance of €5.3 billion was likewise heavier than expected pre-results. Still, clarity on OpEx is welcome even if it does land on the higher side, as this was uncertain in previous coverage given that management had ditched prior targets due to inflation.

Source: ABN AMRO Q4 2023 Results Presentation

More positively, credit costs continued to be a boon for the bottom line last quarter, with the bank booking an €83 million release versus expectations of a ~€100 million charge. That ultimately drove a large beat on net income, which at €523 million was around 30% ahead of consensus. While this isn’t a sustainable source of earnings growth, management did slightly lower through-the-cycle credit cost guidance, with this now seen at 15-20bps versus 20bps previously. This seems reasonable given the now-completed wind down of non-core loans in its corporate book (~32% of total loans). Credit quality generally remains excellent, with the past due ratio improving sequentially and still below levels seen pre-COVID despite the significantly higher interest rate environment.

More Color On Capital Returns Welcome

Looking ahead, management provided most of the moving parts necessary to produce a rough earnings estimate for 2024. NII and OpEx guidance have already been mentioned above, while fee income is seen up 3-5% and credit costs seen “at the lower end” of management’s 15-20bps through-the-cycle range. All told, that should get us to 2024 net income of around €2 billion after non-controlling interests and capital securities (i.e. AT1), which would map to a return on tangible equity of roughly 9%.

Now, this is by-and-large in line with pre-results consensus, with better than expected lines like NII and credit cost offsetting higher than expected operating costs. The more welcome development is that management also provided more color on capital returns, partially removing a key overhang from previous coverage.

Previously, ABN AMRO was fairly consistent on this front, delivering €500 million in annual buybacks over the past three years alongside a hard dividend payout ratio equating to 50% of net income. However, with this equating to a ~75% shareholder payout ratio overall, it was unclear what was preventing management from going even harder on capital returns given the bank’s high capital ratio and relatively minimal reinvestment needs.

Management has now provided more detail on its intention to return surplus capital to shareholders, guiding for a 2026% CET1 ratio of 13.5% versus around 15% at the end of 2023. Given 2024 buybacks have already been set at €500 million, this implies a significant step-up in 2025 and 2026. Perhaps more importantly, this move also de-links capital returns potential from earnings to an extent, and as such, I view it is a welcome development for investors.

Valuation Only Marginally More Expensive

At €14.95 in Amsterdam trading ($16.39 per ADS), ABN AMRO has gained around 8% in share price appreciation since previous coverage. However, this only makes the stock marginally more expensive, as TBVPS has also increased in that time, ending 2023 at approximately €25.50 per share (~$27.90 per ADS).

This multiple continues to look much too cheap relative to the bank’s earnings power. At just under 0.6x TBVPS, ABN AMRO could theoretically return 13-15% to shareholders, assuming an 8-9% return on tangible equity as per above. Because management also intends to return excess capital to shareholders, investors can be reasonably confident that the payout ratio here will indeed be fairly close to 100% of net income over the next few years. Or said differently, at the current share price investors could see greater than 10% per annum returned via dividends and share buybacks.

Data Source: Yahoo Finance, ABN AMRO Quarterly Results, Author Calculation

With the stock’s P/TBVPS multiple still below its recent historical average and offering upside to around the 0.8-0.9x area, ABN AMRO shares remain attractive, and I retain my Strong Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.