Kativ

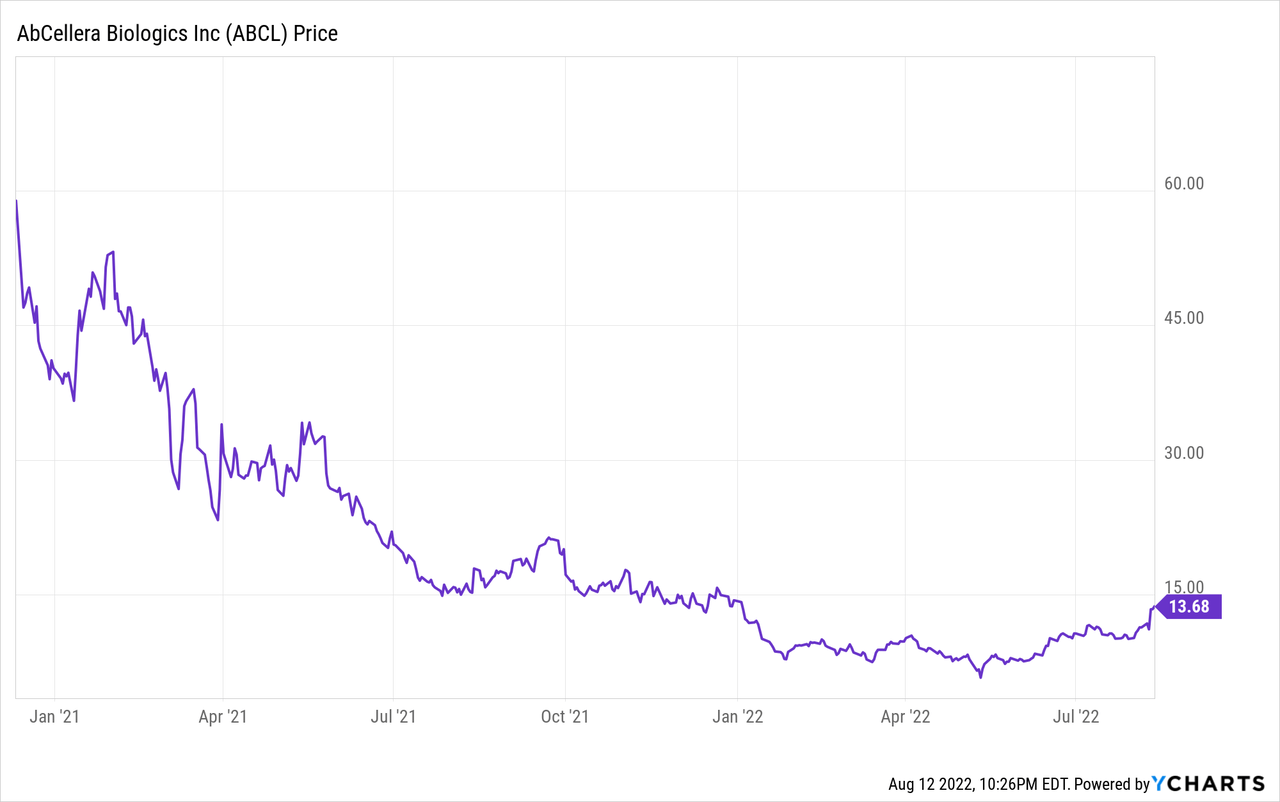

Properly, the final 3 months have been fairly darn satisfying if you’re a holder of AbCellera Biologics (NASDAQ:ABCL). Shares have rocketed from the lows of $5.44 reached in mid-Might, up over 250% to the present $13.68 degree.

To be clear, the inventory nonetheless stays down a whopping 72% from the IPO opening commerce of $49.22, nonetheless progress is progress. With AbCellera now dominating almost 40% of my speculative portfolio at a median price foundation of $10.57, I need to admit to feeling a sure sense of satisfaction holding a paper acquire of 30% with a chart that appears like this.

So, what occurred? Properly, Q2 outcomes had been launched on Tuesday August ninth, and whereas the numbers reported weren’t precisely “fridge door” high quality, it seems that the convention name, and specifically, feedback by the CFO Andrew Sales space, left buyers giddy for the close to time period future regarding the potential for continued COVID antibody royalties through Lilly’s (LLY) commercialization plan.

Mr. Sales space said the next on the convention name (Writer corrected spelling for context in transcript)

We proceed to report six molecules within the clinic for our molecules at a industrial stage, a us authorities buy order for 150,000 doses of bebtelovimab was acquired and partially fulfilled by our companion, Eli Lilly throughout June of 2022. This contributed meaningfully to our Q2 outcomes. As well as, Lilly just lately introduced that they are going to start industrial gross sales of bebtelovimab to states, hospitals and different healthcare suppliers beginning this month. We might anticipate this association to allow the usage of bebtelovimab sooner or later.

Based on US, HHS information bebtelovimab has just lately been administered at a median charge of roughly 4,000 doses per day inside the US.

Waiting for the rest of 2022, we anticipate continued power in analysis charges and nearly all of whole 2022 income to be derived from royalties on COVID antibodies, Lilly offered and shipped over 670,000 doses of bebtelovimab to the us authorities.

Within the first half of 2022, we anticipate this to achieve 750,000 doses cumulatively in Q3, given the present confirmed orders by the US authorities, the brand new association of economic gross sales by Lilly of bebtelovimab to state’s hospitals and different healthcare suppliers beginning this month is anticipated to lead to further royalties to speed up. And we can be watching that carefully as utilization normalizes within the coming months and quarters.

As a reminder, below our settlement with Lilly, we’re entitled to obtain royalties within the mid-teens to mid-twenties on gross sales of bebtelovimab.

As we, I believe have mentioned fairly constantly on the pricing beforehand, the federal government buy orders had been at about $1,800 a dose for bebtelovimab, we observed within the current launch that the brand new pricing is at $2,100 a dose for, for a way doses are going out below this new industrial association by way of with Eli Lilly promoting on to states. In order that’s simply one other information level that we have additionally seen within the publicly obtainable data.

The important thing gadgets of be aware within the above are the next:

- 80,000 doses of bebtelovimab as a part of the US authorities order are more likely to be booked in Q3.

- A median of 4,000 doses of bebtelovimab per day are at the moment getting used to deal with COVID-19.

- Mid-teens to mid-twenties royalty charges are earned for bebtelovimab.

- Pricing has been set at $2,100 per dose of bebtelovimab by Lilly.

So what can we glean from all of this? It definitely seems that the COVID antibodies will proceed to pay dividends for the corporate for a while to come back so long as it stays efficient.

For example this level, let’s play out the remainder of 2022 utilizing the above data and by making some assumptions.

The corporate has clearly indicated that 80,000 doses of bebtelovimab remained to be delivered to the US authorities at quarters finish, which means at $1,800 per dose, that is $144 million in income to Lilly and $28.8 million on account of AbCellera utilizing a 20% royalty charge.

As well as, if utilization stays at 4,000 doses per day within the US at a $2,100 worth level and starting non-government contract commercialization on August fifteenth, that leaves 138 days left within the yr, or probably 552,000 doses to promote.

552,000 doses at $2,100 every equal $1,159,200,000 in income to Lilly and $231,840,000 on account of AbCellera. This places a possible whole of over $260 million extra in COVID royalties inside attain of the corporate, this yr. This calculation could be extrapolated out over 2023 to achieve a further $613 million if comparable utilization (unlikely) holds into the next yr.

I do know that personally, I didn’t have almost any COVID royalties baked into my considering after this quarter as I had assumed, wrongly, that the antibodies weren’t used a lot within the scientific setting because the creation of Paxlovid from Pfizer (PFE), but it surely does seem that the potent antibody does nonetheless have a spot within the toolshed for medical professionals.

AbCellera is definitely within the driver seat relating to COVID antibodies as it’s really the final one standing. Based on AbCellera, bebtelovimab is the one antibody remedy that continues to be efficient to all at the moment circulating variants.

I don’t need to overstate the potential royalties that may be earned by the corporate; nonetheless, this pandemic has confirmed to be fairly adept at sticking round and remaining harmful, which bodes nicely for AbCellera within the close to time period given the effectiveness of its therapy.

CD3 potential

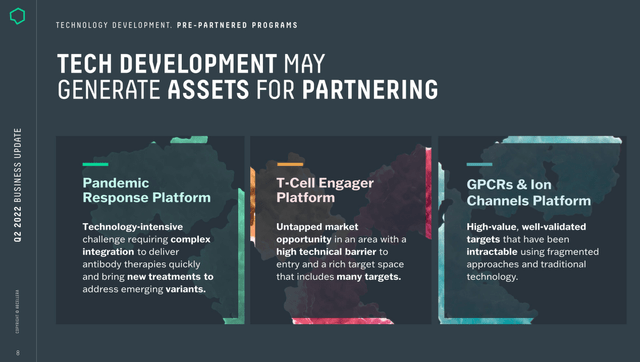

Along with the excellent news relating to future COVID royalties, the corporate appears to lastly be getting some recognition for its implausible work on the internally developed CD3 panel of antibodies.

In November of 2021, AbCellera determined to tackle the problem of creating, in home, an entire panel of CD3 antibodies, which is broadly thought-about a promising new avenue within the growth of T-cell engagers for most cancers therapies.

In a interval of solely 6 months, the corporate introduced to the world that it had created and validated what the corporate believes is the world’s largest panel of over 200 distinctive antibodies that bind broadly throughout a number of websites on the CD3 complicated.

Importantly, the corporate said that it sees properties within the lab that point out its panel successfully kills tumor cells with no, or very low cytokine launch, suggesting that these molecules may overcome a key hurdle within the clinic right now. The corporate is now actively creating this panel in opposition to two identified tumor antigens in stable tumors, with additional information to be shared over the subsequent 12 months.

This playbook must be very acquainted to buyers within the firm as it’s almost an identical to the COVID antibody growth, solely on a extra normal drug growth timeline. The corporate will look to companion these antibodies at a extra superior discovery stage, thus garnering probably a a lot greater royalty charge than the usual 5% they earn from conventional partnerships.

AbCellera

This particular program will play out over time, nonetheless, it is rather encouraging that the corporate is selecting to give attention to extremely differentiated packages, the place it believes it’s best at school, to extract further worth. GPCR’s and ION channels look like subsequent up on the checklist for the corporate to develop in home.

Valuation

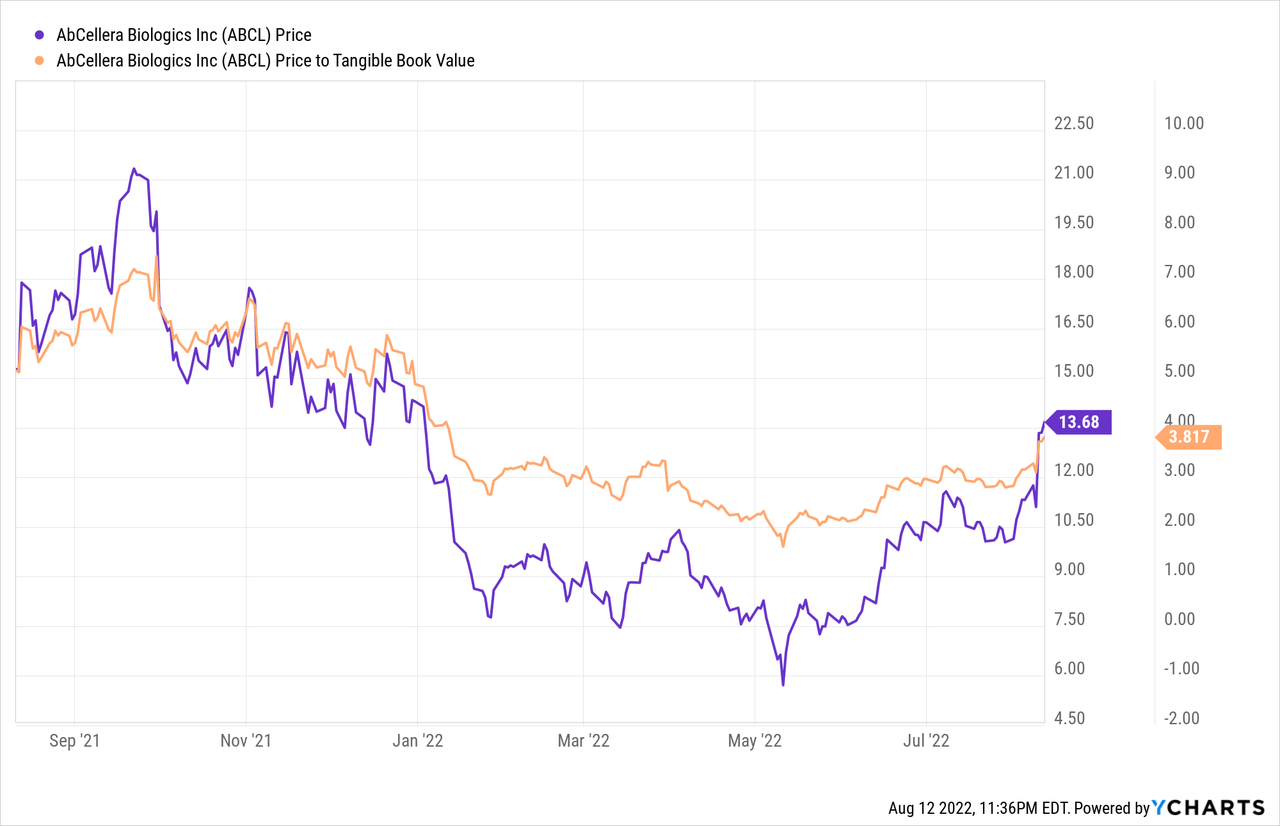

AbCellera is definitely extraordinarily arduous to worth from a conventional technique given it has such a protracted fuse from program initiation to recognizing worth within the type of royalties, nonetheless, with over $1 billion in money readily available, with no debt, together with the prospect of continued COVID royalties for a while to come back, shares had been due for a bounce.

Presently, the corporate has a $3.9 billion market cap and an enterprise worth of $2.9 billion netting off the money on the stability sheet. I can see the rationale for the inventory to proceed to climb, however I may also see a robust argument that it could have risen too quick provided that the COVID royalties do seemingly have an expiration date and are more likely to stay lumpy quarter to quarter.

The corporate’s shares are likely to commerce totally on sentiment, making close to time period worth predictions virtually nugatory. I’m not a dealer so I can’t predict what might occur within the subsequent 12 months however as a long-term investor, I proceed to view the corporate extraordinarily favorably in the long run.

Backside Line

I need to admit to being shocked that COVID royalties look set to proceed to pour in and will actually improve close to time period, this was an surprising however welcomed piece of reports.

I have a look at each greenback banked right now from COVID as future dilution proofing and an avenue to additional fund the corporate’s main tech stack. The corporate once more indicated that they’re absolutely funded for the foreseeable future, a real rarity in biotech right now, together with confirming plans to open the CMC/GMP facility in 2024-25, which has the potential to supply non-COVID associated revenues and earnings.

Buyers should proceed to remember the fact that vital non-COVID associated royalties are nonetheless seemingly a few years away, making the inventory relatively harmful if you’re not keen to play the lengthy recreation.

Let me know your ideas within the remark part beneath. Thanks for studying and good luck to all!