josefkubes/iStock Editorial via Getty Images

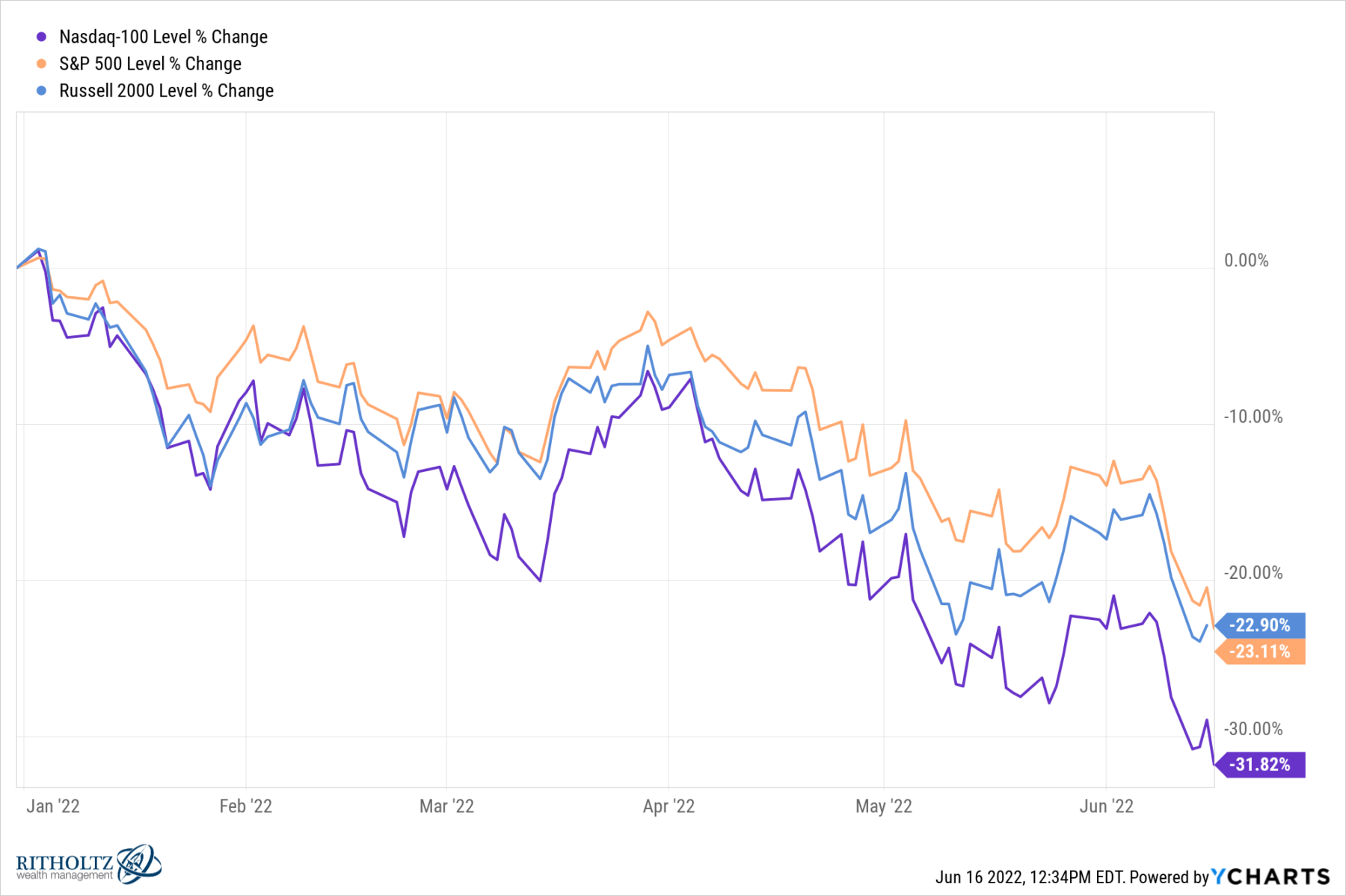

The last three articles we wrote on ABB (OTCPK:ABBNY) were bullish on the company, seeing a potential profitability turnaround combined with a reasonable valuation. In the last article we wrote: “given the operational improvements and the still relatively low valuation, we believe shares continue to offer value at current prices”. We wrote that in October 2022, more than year ago, and shares are now significantly higher. It looks as if a lot of investors have now become convinced that the company has structurally changed. While we see the company has made further progress in its turnaround improvement efforts, we do believe the excitement might have gone too far. There is certainly still a lot to like about the company, but we believe shares have gone from undervalued to overvalued.

Seeking Alpha

New Strategy

The new strategy that ABB’s management put in place a couple of years ago appears to be working. It calls for stability and profitability before growth, and empowering the different business segments. These brought transparency and accountability within divisions, and improved the speed of decision-making.

One concrete example of this new strategy is that now each division has a pricing officer, responsible for implementing a clear pricing strategy for their products and services. At the same time, ABB has been divesting certain lower growth businesses, and instead focusing on small to mid-sized bolt-on acquisitions, to strengthen certain business units.

Growth

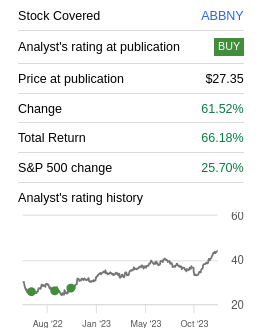

ABB has become much smaller in terms of revenue than it was a decade ago. A large part of this is the result of selling divisions to refocus the company. One of the largest transactions was the sale of the power grid division to Hitachi (OTCPK:HTHIY) for roughly $8 billion. The company also spun off its turbocharger division to shareholders in a new company called Accelleron (OTCPK:ACLLY), and plans to IPO the E-Mobility business soon.

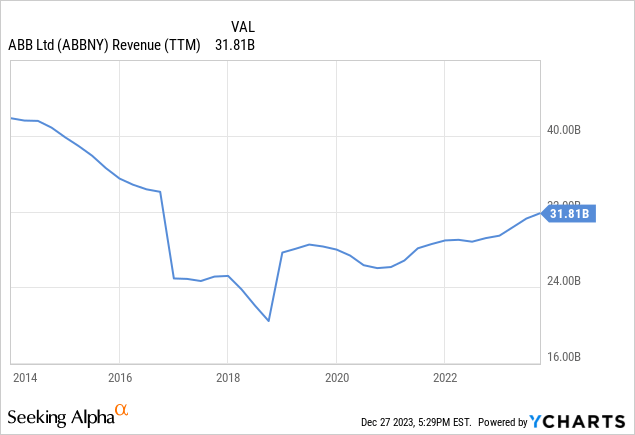

It has also made some acquisitions, like the purchase from General Electric (GE) of GE Industrial Solutions for about $2.6 billion. The M&A activity makes it harder to evaluate organic growth. In any case, the last three years it has not impressed, growing at a quarterly year-over-year average of ~7.5%.

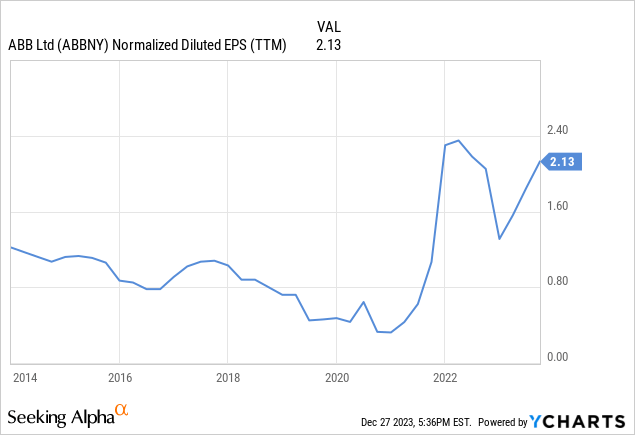

The results of the turnaround are more clearly seen in earnings per share, which have significantly increased in the last couple of years after a long period trending down.

Financials

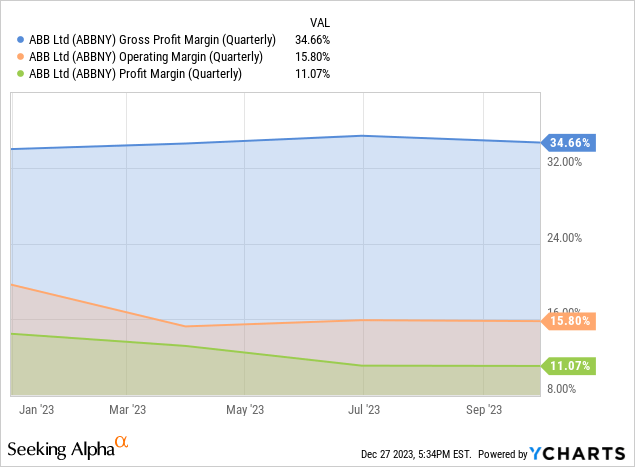

One of the key elements that have helped improve the profitability of the business is increasing embedded software content and services. Together with better pricing strategies, more control and accountability at the division level. This has resulted in gross profit margins of close to 35%, and the company believes it can still improve them further.

Semi-Ambitious Targets

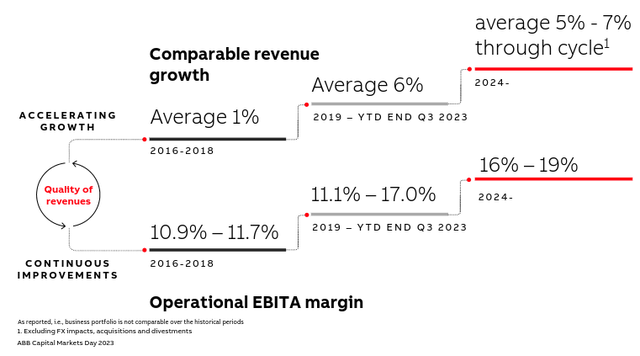

We see the margin improvement targets as ambitious but achievable, and are less impressed with the comparable revenue growth target of between 5% and 7% through the cycle. The net acquired revenue is expected to average between 1% and 2% annually. This is particularly disappointing given the number of structural tailwinds that are benefiting the company. It also has the liquidity to step-up the bolt-on acquisition strategy to further accelerate revenue growth.

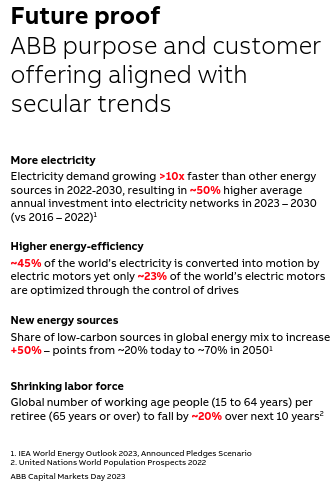

ABB Investor Presentation

Structural Tailwinds

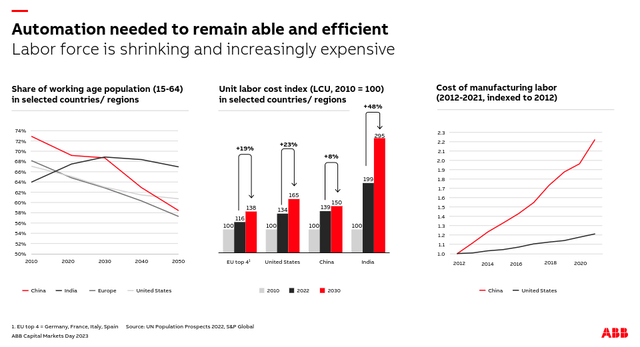

A lot of investors are attracted to the company because of the structural tailwinds it has, including many of its products aligned with a more sustainable and resource-efficient future, and the company having technology leadership in many areas of the electrification and automation sectors.

ABB Investor Presentation

Many of its products reduce carbon intensity, increase labor productivity, increase energy, efficiency, reduce downtime, etc. The company should therefore benefit from the megatrends of electrification and decarbonization of the economy. Roughly 45% of the world’s electricity is converted into motion by electric motors, and ABB is #1 in this ~$59 billion market, where only ~23% of motors are optimized though the use of control drivers.

ABB Investor Presentation

ABB is also benefiting from the re-shoring and energy security trends, which are motivating many Western economies to modernize their industrial assets. The company also benefits from AI advancements, as these technologies enhance the capabilities of its robots.

ABB Investor Presentation

ESG

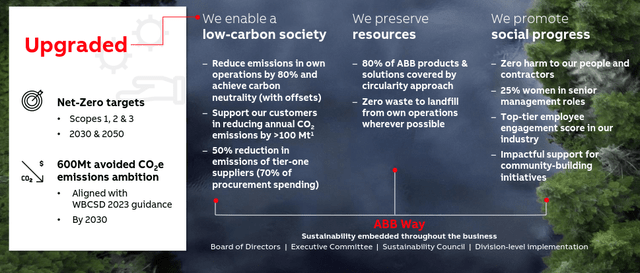

We have to give credit to the company for stepping up its ESG efforts. For example, it is using circular economy principles with its robot refurbishment centers, which repairs around 1,200 robots per year. Most of these are then reused, with most of the remaining sent to their recycling partners.

The company is also improving its designs, for example, some large robots now use regenerative braking and are about 10% lighter, resulting in energy savings of up to 20%. As the slide below shows, the company has upgraded its ESG targets.

ABB Investor Presentation

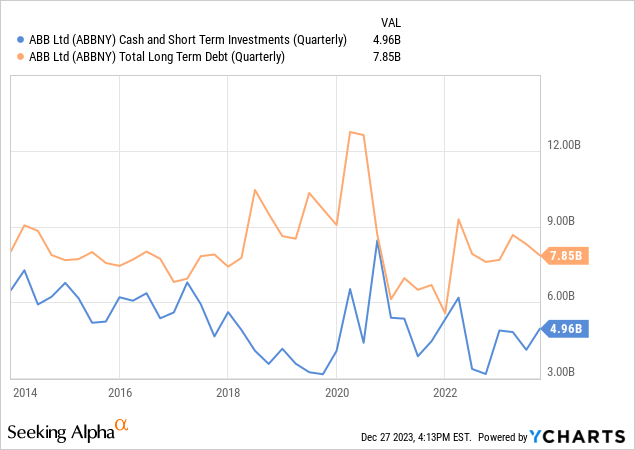

Balance Sheet

While ABB carries almost $8 billion in total long-term debt, much of it is offset by the close to $5 billion in cash and short-term investments. Leverage is quite low, with financial debt to EBITDA at ~1.4x.

Outlook

Moving forward, we expect moderate revenue growth from the company, probably in the mid to high single digits, with continued margin improvement. We do not see a catalyst for a stock price correction, other than a potential recession.

Still, it looks like the odds of a recession in the US have come down in recent months. We are downgrading shares to ‘Hold’, as we would not buy them at current prices. It is possible that the company will grow into its valuation in a couple of years. We will continue to monitor the company and its results, as we believe it is an interesting company that will play an important role in the electrification and decarbonization of the economy.

Valuation

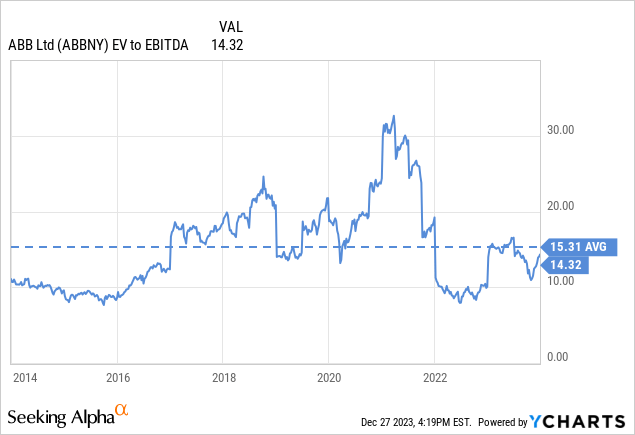

In some ways shares do not look terribly expensive, for example, its EV/EBITDA multiple is close to the ten-year average. The problem we see is that we might be close to peak earnings for the cycle, and that a lot of the “low-hanging fruit” with regard to improving efficiency and increasing margins has been implemented.

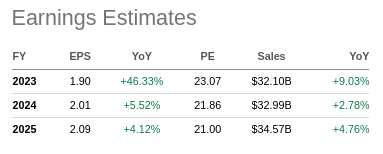

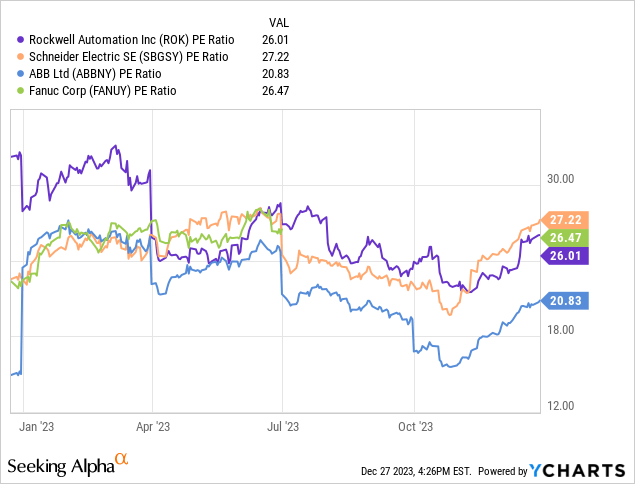

Compared to similar companies that should also benefit from the megatrends we have discussed, ABB looks relatively cheap. Part of the reason is that analysts expect very low earnings growth for ABB in the next two years, for FY24 EPS growth is estimated at ~5.5%, and for FY2025 at ~4%.

Seeking Alpha

More than ABB being undervalued, we see it as the other companies, including Rockwell (ROK), Schneider Electric (OTCPK:SBGSY), and Fanuc (OTCPK:FANUY), being considerably overvalued.

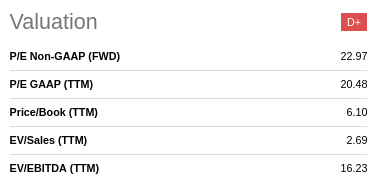

For its part, Seeking Alpha gives ABB a ‘D+’ grade to its current valuation, which we think it’s fair. As we also see the company as somewhat overvalued, but not to an extreme.

Seeking Alpha

Based on our estimated net present value of future earnings, we calculate a fair value per share of ~$37. We therefore believe shares are about 20% overvalued, or priced to deliver mid to high single-digits returns.

| EPS | Discounted @ 10% | |

| FY 24E | 1.90 | 1.73 |

| FY 25E | 2.01 | 1.66 |

| FY 26E | 2.17 | 1.63 |

| FY 27E | 2.34 | 1.60 |

| FY 28E | 2.53 | 1.57 |

| FY 29E | 2.73 | 1.54 |

| FY 30E | 2.95 | 1.52 |

| FY 31E | 3.19 | 1.49 |

| FY 32E | 3.44 | 1.46 |

| FY 33E | 3.72 | 1.43 |

| FY 34E | 4.02 | 1.41 |

| Terminal Value @ 4% terminal growth | 62.01 | 19.76 |

| NPV | $36.80 |

Risks

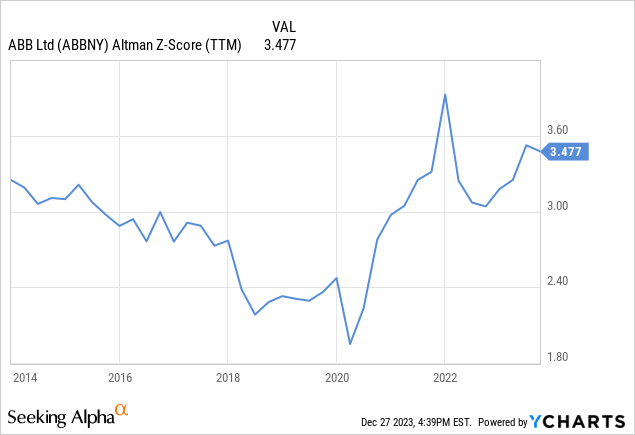

The main risk we currently see with ABB shares is their high valuation. The company has a solid balance sheet, good liquidity, and improved profit margins. It has also sold or divested some of the more cyclical businesses, as with the sale of power grids, or with higher risk of long-term obsolescence as was the case with Accelleron. The company currently has an Altman Z-score above the 3.0 threshold, reflecting its financial strength.

Conclusion

ABB’s turnaround seems to continue in the right direction, and there are still many things to like about the company. These include exposure to some of the most relevant megatrends affecting the world economy, including re-shoring, electrification, automation, and decarbonization. While the company has improved margins, revenue growth remains somewhat disappointing, especially given the structural tailwinds. We are downgrading the company to ‘Hold’, mostly because now we see shares as somewhat overvalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.